Vision-bereft policies from National include chucking more cash at first home buyers so they can compete with investment property landlords. More of the same policies from National will see more baby boomers walking away with unimaginable wealth at everyone’s expense, increasingly unliveable cities and more homelessness and poverty.

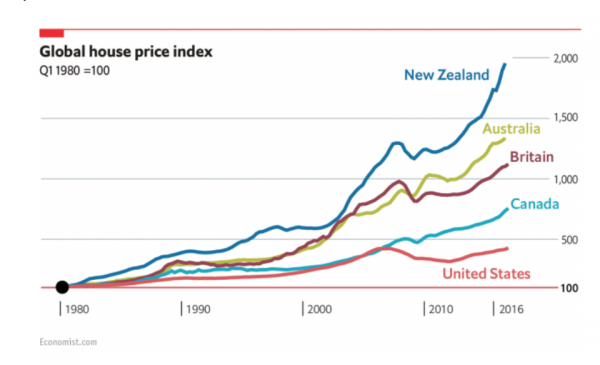

The huge imbalances of the housing bubble won’t be solved just by building more houses no matter how much they are needed. Bryan Bruce new documentary Who owns New Zealand now? points to the property crash in Ireland that left a glut of unsold and half completed houses. New Zealand should take heed especially as we have replaced Ireland at the top of the global house price index

Labour seemed to have a sensible approach to getting expert advice on this controversial issue after the election, so I was shocked and disappointed when Labour resiled from dealing with the taxation of housing with any urgency. While Labour can still immediately extend the bright line test, stop foreign buyers, and improve rental housing quality, etc. to curb speculation, it will not be enough to restore fairness.

But there is always a silver lining. Now there is time for a proper, rational debate on all the alternatives for the sensible taxation of wealth held in housing. In reality any tax working group would struggle to find a magic way to do a capital gains tax quickly post election. Nor would a capital gains tax deliver much in the short term. It could likely only apply to properties purchased after a given date and would have little impact on the excessive, accrued, untaxed capital gain that has been driving inequality.

We are not doing policy development well in New Zealand. Labour now has a real chance here to get it right. There would be time, for example, to investigate the risk-free return method first discussed by the McLeod Tax Review committee in 2001, and more recently by the Gareth Morgan foundation.

In risk-free return method equity in property would be taxed at least as much as if it had been placed on a bank deposit. This immediately levels the playing field and begins to treat income from all sources more equally.

This method taxes a person’s total net equity (real estate value less mortgages) at a rate which would be set each year to reflect interest rates for term deposits on offer at the banks.

Jacinda should take away the limitations of what can be looked at by the tax taskforce. The family home should be included in the tax base otherwise people would over-invest in their own home. We do not need any more over-elaborate homes to gobble up our scarce building resources or people like John Key to make untaxed millions from their own home. The cbest way to protect those who have modest property equity is to have an exempt level of net equity, set high enough that the majority of New Zealanders would be unaffected.

Let’s say Anne and Arthur have a family home worth $2.4 million, a rental property worth $600,000 and a family bach worth $1m. Each has property assets of $2m. With a personal exemption of say $1 million, and a risk- free rate of return of say 4%, they would each be liable for tax on an imputed income of $40,000.

At a personal tax rate of 33 per cent, they each would pay $13,200 in tax but they would not have to include any rents as part of their taxable incomes. There would be an incentive to make sure the rental and bach were generating some rental income and not standing empty. All of the complexity of keeping records of expenses and deciding which are really capital expenditures on the rental property disappear. Negative gearing whereby losses from rentals are offset against other income would be impossible.

By relating the tax to the net equity held, as property prices increase, future capital gains would be captured in the base. The burden of the tax would fall on the older wealthy with large equity while the young with small equity and high mortgages would be protected.

Of course there are fishhooks in any property-related tax. There needs to be an agreed way to assess the capital value for each property, such as the use of CVs as at the beginning of the year. Overseas owners and property-owning trusts would have no exemption.

In principle, even just the prospect of the tax could have the desired depressing impact on house prices while releasing more houses for sale. Importantly it would remove the incentive to over-invest in property and restore some balance and equity to a grossly distorted picture.

Ah, the granny tax that is doomed to fail for the simple reason that those on fixed incomes (pensioners) living in the hard payed for freehold home will have to find an extra income stream to pay the asset tax. Granny and her partner (now deceased) worked hard (payed taxes as well) and is now enjoying the freedom from mortgage payments living in her freehold house on a modest pension and enjoying life.

Along comes the state and says, your million dollar freehold asset must return 4% so you need to earn $40,000 and pay the income tax on that $40,000 (at 30% tax rate that is $12,000).

Where will granny get that $12,000 dollars from when her pension is barely $25,000?

Oh that right under TOP proposal she can take out a reverse mortgage with the IRD to “pay” the taxes.

And Gareth Morgan wonders why he has just 1.5% of the vote.

Note the the TOP asset tax includes ALL assets. Your car, your savings, your investments, etc., etc..

Each must earn a return off 4% on value.

So with interest rates being payed on bank term deposits of less than 3%, a whole lot of savers will be owing more taxes to the IRD.

It all sounds so good till you get to how this asset tax affects ALL the people and you realise it is a rubbish tax method.

I don´t think the TOP proposal includes all assets, so cars etc would not be included. Nor would bank deposits, or shares (in this case the company would be paying the tax if any was due). Also I don´t think that forcing granny to take out a reverse mortgage is unfair given that her million dollar house probably cost probably cost her a mere $100,000 fifty years ago.

It did originally, though I see their web site has removed the previous list of assets to be taxed by a generic “productive assets” that generate income. So who knows what is a “productive asset” (my car is used in the course of my business so is a productive asset). Your savings in the bank for sure are a productive asset. If the interest you receive from the bank is below 4% (and most if not all do pay only that amount or lower) you need to pay extra tax on those savings.

I don´t think the TOP proposal includes all assets, so cars etc would not be included. Nor would bank deposits, or shares (in this case the company would be paying the tax if any was due). Also I don´t think that forcing granny to take out a reverse mortgage is unfair given that her million dollar house probably cost probably cost her a mere $100,000 fifty years ago.

Absolutely right. CGT on all property speculation is essential, but the family home must be absolutely untouchable.

I don´t think a CGT is the best option for stabilising the housing market but, if we must have one, I don´t see why private homes should be ¨untouchable¨.

Gerrit

If she is in a $1 million house she would not pay the tax. Please read how the example works. If she is in a $2 million house, downsizing may be sensible.

Accruing debt against the property if she wants to stay may be fair enough

Problem is you are making up figures. The $1M exemption is not listed on the TOP web site. Your proposal to sweeten the deal? What is the value exemption for a family owned farm? My business get an exemption as well?

Problem is you are just focusing on the family home, not every other asset. Now if the family home is owned by a family trust or charitable trust how will the tax be levied? To the trust beneficiaries?

Downsize means relocation. Granny is settled in a location with friends, family and social interests build up over a generation. Would you force her out of that area?

huh? Trustees are appointed to act on beneficiaries behalf so what are you talking about? If you look at what trusts are actually used for, more times than not its used by the husband to hide assets from his wife.

So what are you talking about?

And yeah. There is a huge fucking difference between residential and commercial farms. Different regulations apply.

Any one who has to ask the questions you’re asking either don’t know anything about what they’re talking about or are fucking time wasters.

https://horizonpoll.co.nz/page/479/labour-best?gtid=3031264578076XWC

Labour best to manage most issues, but not the economy overall

19 Sep 17

What about the $1,000,000 exemption the writer referred to, and besides, would Granny be on a 33% tax rate on a $25 000 income? At least read before charging in to decry alternative ideas for sorting out the disaster of neo-liberal economics that is screwing the country Gerrit.

Thanks CC.

Gerrit please note I am NOT the TOP party nor do I endorse their policies. TOP picked up on an old idea that has been around at least since the McLeod review. There are many ways to implement the principle and all the work that I have done on this has used a high exemption on one’s total equity in all property. It will take a well resourced taskforce and the top brains to iron out all the wrinkles- cant be done on the daily blog comments section. But I think there would be less work involved than trying to design a sensible capital gains tax that actually did anything to either the property market or to reducing inequality

The problem concerning granny´s million dollar home is really a transition problem, and I must admit I don´t really know how best to deal with it. If the policies we have been discussing had been in p[lace a long time I think the problem would have been foreseen and avoided.

There is a high rate of suicide in Nz it can be tied in with homelessness,and loss of self esteem.

Young families are split up and must fit in with anyone who will house them,If young people cant look forward to a home of their own,there is nothing to look forward too,they give up hope.

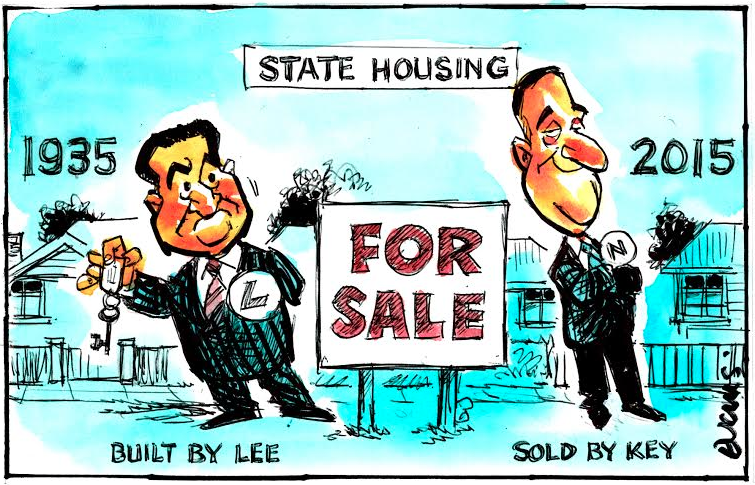

National sold state houses at huge profit, and havnt replaced them.

National sold our assets and prices went up to compensate shareholders(often National party MPs).National is all about profit not people.

John Key was all about his puppet masters in USA,NZ was just a means to make profit for USA,he gave millions of taxpayers money to the Clinton foundation to curry favour,that money could have gone to build some lower cost houses,but even then anyone could buy low cost houses, including profiteers.

National claim they will lower drs bills,drs tell us thats a lie ,National told drs they cant afford to give cheap drs bills,it wont happen ,but we wont hear about that until after the election.

I dont know who i will vote for ,still deciding but it definately wont be National.

The graph on ‘Global house price index’ says it all really!!!!

Now we see that the ‘global investors’ are comming here to NZ for the biggest property return on their money.

Alll while we suffer with the worlds biggest ‘property bubble’ in our time, that has set us up as the next failed state after Greece!!!!!

And we all really knew this was going to happen.

So Finance ministers Joyce and English, you’d better get ready for a big crash and revolt!!!!!

I’m not saying it’s a bad idea. But it sounds complicated to implement, a field day for clever accountants and almost impossible to sell politically. No-one wants to see weeping grannies on the news being forced to sell their house of 50 years because they can’t afford a new tax they hadn’t planned on.

Sing with me: Smarmy smarm smarm smarmidy smarm.

Basic Survival Guarantee! Because the ‘free market’ priced shelter away from you and me~!

Supply and Demand + Location-Location-Location is the rule for housing.

I drive by entire neighborhoods of 2-or-3 bedroom 1 bath houses that is worth $80K to $120K and rent for about $800-ish+, and I often joke that if the same houses were on beach front locations in a city they’d be $million dollar houses. Locally there’s even houses to be found for as low as $20,000 if you don’t mind a damaged house in a poor area. But all these prices are distorted in New Zealand by immigration, land banking or what ever.

We’re also seeing a lot more investors doing 1031 exchanges (tax free property swaps) this last couple of years because of it. That or some of our oldies are really happy theres no estate tax indexed for inflation.

And this whole moving out of the family home so papi can flog it for a million so he can buy the batch, 4WD and fishing boat he saw on an ad in between late night talk shows just needs to be addressed. In Asia and Italy, they live with there parent till they die and inherit the family home untaxed and so the cycle continues. It is quite economical.

Well, first you need to build the homes, and to do that, you need finance, whether bonds the government may issue and back, or whether loans from the banking sector, or whatsoever.

You need workers, materials, land and much will be restricted by capacity constraints, such as the National Party led government has allowed to develop, particularly in places such as in Auckland.

It is not just some overseas investors and speculators that are a problem, high net immigration combined with population growth drives demand, and we cannot keep up with demand as it is.

We face massive capacity challenges to build the homes that are needed, this is not only limited to availability to land, to build on, we do not have the tradespeople that are needed to keep up with demand. Training apprentices takes time, and finance is not as easily available to build more homes, as the banks have already tightened access to credit, putting constraints on what can be built now.

Here are reports on some challenges for construction:

http://www.stuff.co.nz/business/property/92714692/concrete-shortage-another-hurdle-for-constrained-construction-industry

http://www.interest.co.nz/property/84532/rbnz-concerned-range-challenges-facing-construction-industry-will-limit-high-density

https://www.nbr.co.nz/article/capacity-constraints-construction-sector-driving-massive-price-escalation-b-200942

http://www.stuff.co.nz/business/property/92714692/concrete-shortage-another-hurdle-for-constrained-construction-industry

https://www.odt.co.nz/business/capacity-constraints-drag-nz-economic-growth

The present government, apparently together with Auckland Council, have been pushing for the so called East West Link, which is likely to become the most expensive roading or infrastructure project in the world:

https://www.stuff.co.nz/auckland/96652489/East-West-Link-to-cost-an-estimated-327-million-per-kilometre-Infrastructure-New-Zealand-says

Add the Inner City Rail Link already under construction, ballooning in costs:

http://www.stuff.co.nz/business/industries/84233394/auckland-city-rail-link-cost-set-at-up-to-34bn

Add projected costs for Watercare, for new and also replacement water networks, urgently needed in Auckland:

http://www.watercare.co.nz/about-watercare/news/Pages/-How-Watercare-plans-to-stay-ahead-of-Auckland-population-growth.aspx

So where is the bloody money going to come from, when Auckland cannot borrow more, and when the government is according to the PREFU going to be maxxed out with costs to cover for the coming years.

To be honest, we have been screwed up by Key and now English and Joyce, they are leaving us liabilities for decades to pay off, and the more population growth there is, the more costs will be created, as we cannot even ensure safe electricity and now fuel supplies for Auckland, when just one bit of infrastructure gets disrupted.

The next government will face a massive challenge, and will not last for more than one term, I fear, whether it will be led by Jacinda led Labour, or by the Nats, we will be screwed over, and huge debt will be accrued, if projects are pushed ahead. Otherwise we face stagnation and long term shortages and crisis, we are not even prepared for climate change issues, let alone have we addressed sufficiently the leaky homes crisis.

To be honest, I dread the future, no matter who wins the elections.

Good question. One solution apparently is that the tax can be deferred until the property is sold or inherited.

Nice post

I just don’t get what either National or Labour is saying about immigration and housing.

I immigrated in mid1990s. At that time close to 100,000 people/year were immigrating here. The message from government was to move out of the regions to cities for jobs. Government basically closed down regional towns by closing schools, fire/police, post etc.

But they had NO real infrastructure plans. Since then more and more people are coming with absolutely NO plan.

I live now in SE Auckland. There is totally out of control building that will become the future ghettos because the houses are too big and expensive for one family.

There is no effort to make liveable communities. Everything is built around a Mall rather then a Downtown. There’s very little public transport.

Our community is about to more than double the population within 3 years with a rural road, a ferry that holds 49 people! No high school, no playgrounds being built in the massive subdivisions, primary schools can no longer handle the influx, the road has been resurfaced 4 times in 2 years!

And all the plans our community associate worked for was then changed in the RMA with ‘non-notification’ .

Valid points, that is why immigration should have been an honest topic and discussion this election. But it was closed down from the start, as those in government, also in the media, and even in some opposition parties started screaming ‘racist’, racism, xenophobia, so the topic that once was, was buried swiftly.

[…] This will remain a bubbling wound. Economy: There are real dangers of an economic collapse that demand more than more immigration […]

Comments are closed.