The window of opportunity is fast closing to get the taxation of housing right.

Government is investigating a tax on vacant land even though there is no support from IRD or Treasury. And after reading the Treasury report it is hard not to agree that a tax on vacant land is the wrong tool.

It is supposed to increase the supply of actual housing by discouraging the holding of empty land. IRD and Treasury conclude that it is far too complicated and highly unlikely to help.

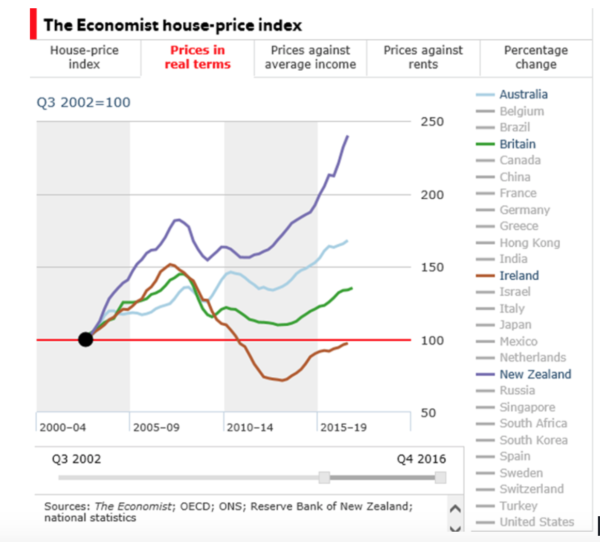

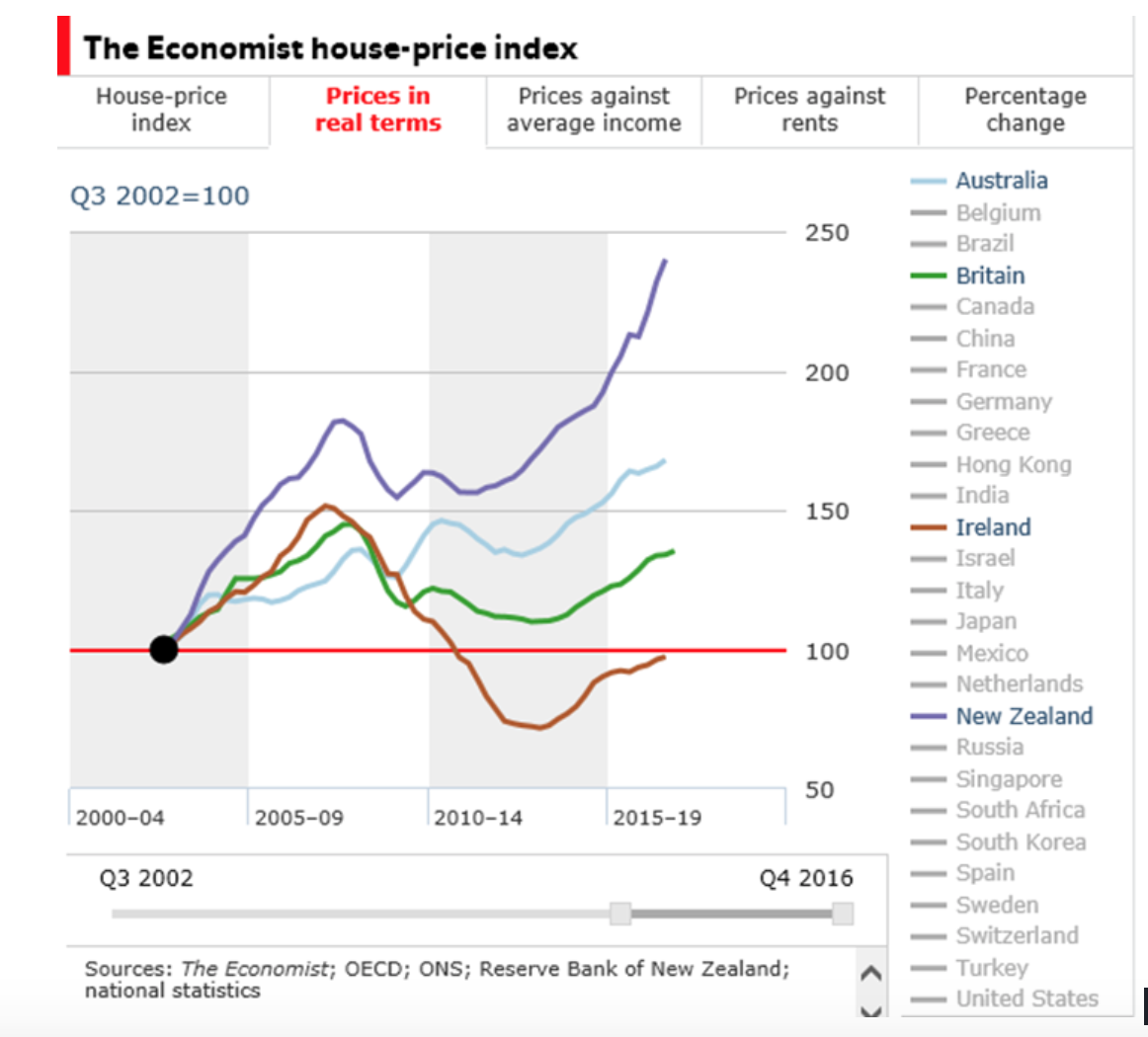

But has the problem been mis-identified? NZ is suffering the effects of a speculative housing bubble that puts us at the top of OECD countries for housing unaffordability, no matter which measure is used. Capital gains have fed the widening wealth divide as fortunes for the top 10% increase exponentially and misery and debt compound for the bottom 50%.

The under-taxation of all residential property including land zoned as residential has caused an unhealthy overinvestment in top-end owner-occupied housing. We have ended up with the wrong kind of housing- too much elaborate housing at the top end and far too few basic homes that give security of tenure at affordable rents. Vacant houses and land are just one symptom of the underlying problem.

Our rampant speculative bubble was given a boost when the Capital Gains Tax idea was abandoned and, while asset price inflation may have appeared to stall at least in Auckland, further rises are predicted on the back of very low interest rates and sustained immigration.

Given the CGT abandonment, and the over-complexity and non-efficacy of a vacant land tax, what do we have left to address the actual problem? The other main approach is to impute income from holding net equity in residential real estate (the Risk Free Rate Method) – in other words, if you own houses or residential land, this method taxes you on how much those net assets could earn for you if they were invested in a bank deposit. This was not investigated adequately by the tax working group.

Protections can be built in. The design can ensure that only the very well-off and speculators are affected, while discouraging rental property as a retirement plan and the holding of under-rented houses and undeveloped land for capital gain. Genuine landlords may even find they are better off and will be freed of the need to hire accountants to produce rental tax returns. At the same time the landlord subsidy, the Accommodation Supplement needs a major reform as outlined in CPAG’s report “The Accommodation Supplement: wrong tool to fix the house.

Time is running out. Boldness is necessary to prevent further concentrations of wealth and misery and the eventual explosive social fall-out.

This will got the conservitves out of bed. Price controls. You wouldn’t even have to emplement price controls on housing. Let’s say the Gini coefficient goes over or under a certain number then Labour or some other major party could hold a sleeper policy that kicks in every time shit hits the fan and instead of bailing out mortgage lenders and home insurers, we punish them. And put them in jail. Sounds simple to me.

People will bang on about housing from now until the general election. Nothing with change.

House prices are driven by the availability of credit. Obviously housing is a necessity and New Zealand is backwards .. best to save up and move countries.

Unfortunately voters in NZ are pretty thick, so u certainly are up the creek without a paddle if you think Phil Twyford is riding in on a white stallion to save the day.

“further rises are predicted on the back of very low interest rates and sustained immigration.”

Time to control immigration as the Ponzi of residency/permanent residency/citizenship here is not working, and our free for all immigration policy is one of the highest per capita in the world seems to have created a housing problem, a health problem, a transport problem, an education problem.

Allowing massive amounts of housing to be consumed by rich and middle class people from overseas (quickly converted to Kiwis so the figures look better) who bring in money and not create it in NZ, which over the last decade in particular, has created the dysfunctional situation of both high property and rental prices and shortages of cheap accomodation, while raising living costs and lowering standards of living like more congestion and lower spend per person on health care.

In short Taxpayers are paying more and getting less.

The commenters seem to have a one track neoliberal mind aka think that somehow taxing property as number one, is going to solve our accomodation dysfunction in NZ when there is little in place to stop the 50,000 at least new people entering into NZ permanently and the approx 4 million tourists here that need accomodation and transport options that are priorities instead of people who live and work here as well as god know how many work visas given out for ‘students’ and other ways to gain residency here.

Dropping wages while increasing living costs creates other issues in a welfare state, such as wages becomes comparable to being on a benefit here.

This further adds to the Ponzi, creating even more dysfunction where locals start choosing to be on benefits because the margin on wages to benefits is slim and the jobs available so poor quality and insecure (those seem to be the ‘new’ jobs being created here not high skilled, high paid ones).

So we are back to the process of exporting skilled people and bringing in unskilled ones. The opposite of what most governments want from immigration.

Also commentators miss the main point about renting, there is a rental SHORTAGE of cheap rentals because people can’t afford to pay more on NZ incomes, therefore the government needs to increase state housing levels, people having rental properties for renting available at lower price points and just as importantly RAISE wages and conditions.

When I looked up plumbers rates for example there were 7 pages of jobs around $20 – $30 p/h and only 0 jobs over $65 p/h… so wages are dropping and little incentive to study for many low paid jobs, as next year another 10,000 plumbers working for $20p/h might be imported in and local construction firms are going under as they compete with firms pulling thousands of low paid workers from bus drivers to trades people.

Taxation ain’t the main issue when people are living in cars or tents and paying laughable amounts like $1200 p/w for a one bedroom hotel which the taxpayers pay for!

Taxation has not worked in places like the UK and many other countries have already tried that apart from Canada that actually targeted the problem https://www.marketwatch.com/story/vancouvers-new-tax-slows-foreign-property-buying-to-a-trickle-2016-09-22

(however since it is so quick and easy to become a NZ citizen or permanent resident) that needs addressing at the same time as taxation for people who don’t pay taxes here from overseas!

NZ and many western countries have become attractive because a large number of the world are looking for ‘gold brick’ investments and have plenty of money to buy them while NZ also offers the bonus of free citizenship for the family on top of that even if you have skills most countries would never consider because they are such low levels of skill.

Therefore we are not attracting the best and brightest migrants but our policy favours those who can buy a cafe or work in a fast food joint at low wages.

Government and commentators also need to grow a brain and focus to stop the Marie Antonoitte council zoning model of using all land and resources in NZ to create McMansion ghettos for new money with no public transport or taking away public transport for existing commuters, luxury apartments for Singapore investors etc.

Kiwibuild fails to work because it is related to the idea that people earn enough to afford a house in NZ. The failure of Kiwibuild shows that that is now a big issue in NZ. Wages are too low to afford a so called affordable house here.

“Kiwibuild fails to work because it is related to the idea that people earn enough to afford a house in NZ. The failure of Kiwibuild shows that that is now a big issue in NZ. Wages are too low to afford a so called affordable house here.”

BANG! Well said, in a nut shell.

I don’t seem much changing in NZ because most commentators from the left are asleep at the wheel and bound up in their own prejudices and not keen to take off the rose tinted glasses and do the maths of incoming people into NZ and cost of housing here and then relate it to the average income here.

You can tax housing to buggery, but if 40% of workers earn minimum wages and the middle classes are made redundant every five minutes here, they can’t afford to buy a house not matter the taxes.

Gold bricks investments don’t actually sell them, therefore capital gains never comes into play. Investors and individuals through trusts and companies hold them as an asset to hedge their bets around the world and often to hide money from other governments.

Then there is all the overseas double taxation agreements and ways of loading up NZ assets with debt to avoid paying taxes here and shipping the profits overseas tax free.

Taxes seem as usual only considered that the Kiwis on one passport are forced to pay and of course we can’t target the problem like Canada, that might annoy our ‘investors’ here, poorly worded trade agreements, or government, advisors and treasury who are glorified sycophants, propping up the order they created.

Tax or rate land not the buildings on the land. It is a simple and effective way of increasing tax on land banking whilst decreasing marginal build costs.

Why the fixation on taxation as THE answer?

Where is the Left’s campaign to free up the supply of land for housing through reform of the local authority planning restrictions and the RMA for urban areas?

Houses are expensive because the land is expensive. Land is expensive because Councils make it so.

Bollocks. Land is expensive because of the highest per capita immigration rate in the OECD. And unrestrained buying by “investors”, until that is reduced we are pushing shit uphill.

Panuku seems to have some land and building bargains for private interests, not available on the open market, (sarcasm) aka the Civic Administration Building (CAB), 22 levels, (19 floors and 3 basement levels), 14,000m2 of office space, and 5300m2 of land in the heart of the Auckland CBD for $3m, with a less than $100,000 deposit… can we really say land in Auckland is expensive when these deals go ahead?

Corruption and incompetence seems to abound over land sales in NZ and those that have so much to say about expensive land or rents are very quiet about about dodgy sales of public land that could be converted to state housing!

https://thedailyblog.co.nz/2019/06/17/guest-blog-mike-lee-civic-administration-building-fire-sale-the-people-ripped-off-again/

Another example of plenty of land available for building in South Auckland that is being sold off by Panuku and the proceeds used among other things for upgrading Milford… ok getting rid of land to just upgrade existing premises does not sound like helping the housing crisis, more like helping the developers and construction industry again.

South Auckland land sale: ‘The poor subsidising the wealthy’

https://www.msn.com/en-nz/news/national/south-auckland-land-sale-the-poor-subsidising-the-wealthy/ar-AAB2saF

And of course the example of Kiwibuild where 2/3 of the land is ‘swapped’ (essentially free) to private developers (with a sale price guaranteed) and the state gets left with 1 state house that is just replacing what they pulled down, with 2/3 of the land privatised…

Free land, not available on the open market for first home buyers to snap up though.

So sounds like people ranting about expensive land and zoning changes are very quiet when it comes to these crony deals.

Aka seems like the argument is more echo chambers for the far right that want to deregulate zoning so all the land they hold, escalate in price , which is exactly what happened when they bought in the unitary plan (aka land prices increased, not decreased because the more houses you can build on land the more it tends to be worth!).

Ada, lands is not expensive because Councils make it so.The Councils have nothing to do with it. So long as there is an acute shortage of houses, the main factor deciding a house’s “affordability” is the cost of the repayments. Low interest rates ultimately enable would- be buyers to pay the mortgages on higher priced houses. The limit is simply how much disposable income does the buyer have at the end of the week. The only solution is to increase dramatically the supply of cheap housing, which the government is not doing. Even rental of upgraded shipping containers would do if it got people out of cars.

With all respect for your constant efforts to provide alternatives to the hopeless status quo, Susan, HELL will freeze over before Grant Robertson and emotionally intelligent, yet soft version neoliberal Princess Jacinda Dear will listen to you and adopt such measures.

They are in any way stuck between a rock and a hard place.

If they make radical changes to taxation, they will face a revolt of business and private residential property owners, the media will lap it up, and Judith Collins and friends will drive a bulldozer up the steps of Parliament, in a well staged protest.

Phil Twyford will be forced into exile and wish he had never been part of this government.

Taxation may need to change, systemically and in regards to progressive income tax rates, and so forth.

But we are so tied into the global financial networks, any sign of more state controls, of higher taxes, of radical changes will scare those having capital, and send the NZ Dollar spinning down, and will send shivers down the spines of bankers and investors.

Look at the anger of firearms owners now, look at the anger of farmers, look at the anger of some country folks now, demanding more motorways for their cars and trucks and tractors.

What this government has done is little, they have backed down from water charging, from royalties for water exports, from addressing climate change issues, from other environmental issues, Kiwi Build is a MESS, and beneficiaries were given the vague hope of indexing benefit rates to wage or income rises will give them a few meagre dollars a week more.

This country is SCREWED, really screwed badly, it is totally unsustainable how people live, we still do primarily live off exporting basic dairy products, of meat, fruit, wines and serving overseas tourists in somewhat expensive hotels and motels, no wonder more prefer freedom camping and back packing.

Every year new invasive species stuff up the environment, nobody does anything effective and serious about the massive challenge of climate change, we still use fossil fuel at high levels for transport, cooking and more, we still use building materials that are crap and will cause toxic and non reusable waste, we have endless sprawl in Auckland and elsewhere, people still want to live a lifestyle, where the infrastructure will cost so much, it is not sustainable by any means.

So this government carries on with the same BS as the last one, using immigration to create growth.

See page 2 of the Westpac report:

https://www.westpac.co.nz/assets/Business/Economic-Updates/2019/Bulletins-2019/Westpac-QEO-May-2019-EMAIL.pdf

‘Population and building continue to support growth’

“But while net migration is off its earlier peak, recent data suggests that there has been a renewed upswing. We’ve been cautious about factoring this into our forecasts, as under the new methodology the most recent figures can be subject to large revisions. Nevertheless, there is some basis for a more positive view on net migration.”

You cannot expect to live in a high standard ‘first world’ country while income remains to be earned mostly from primary and low rate value added products.

Anyway, the shit will soon hit the fan, it will be a life in a jungle like scenario here, people fighting for mere survival, once the Persian Gulf region goes up in flames.

“You cannot expect to live in a high standard ‘first world’ country while income remains to be earned mostly from primary and low rate value added products.”

+1 – especially when increasingly the NZ income is going offshore and NZ individuals no longer own or control many of the assets in NZ and they are at the mercy of bigger countries and multinationals and private offshore investors who will look after themselves and bigger countries interests first…

Our government fails to even act as a regulator, aka massive profits from banking in NZ and even the OZ government did something about it, but our government say’s no need to investigate in spite of one of the highest banking profits in the world!

Look at just what is coming out about the ANZ and their nepotism and property deals to themselves! Turn a blind eye as usual!

https://www.stuff.co.nz/business/113661929/anz-bought-75m-beachside-auckland-property-for-david-hisco

(John Key has even tried to distract from this escalating ANZ property scandals with the flag change again, that’s how much dirt might be beneath ANZ and their questionable conduct).

Re the Accommodation Supplement, yes, it is a subsidy for landlords and employers who pay their workers low wages.

But increasing the minimum wage and increasing benefits will shift the cost burdens, so employers will try and recover extra costs by increasing prices. Benefits at livable rates would force tax increases for higher earners, something this government is scared of doing, see the Tax Working Group’s reports and what the government has so far done in reaction to it. Indeed income tax increases were not even within the scope of the TWG.

I do already see many small businesses feel a pinch as higher costs hit them on various fronts. Be this increased fuel prices, higher minimum wages and higher costs for supplies or whatsoever, even the competitive little Asian run pie shops and lunch bars are now raising their prices as of lately.

The supermarkets are doing the same, we face higher prices for higher wages, as employers will not simply cut their margins and forego profits for themselves.

And due to all such issues, the government will struggle to discourage people from using fossil fuel powered cars by increasing excise levies or what else may come to mind. People will rebel, prepare for at least three degrees warming over the coming decades, we are stuffed, really stuffed.

As for housing, NO easy fixes there, but a massive state housing build is without doubt needed now. Forget KiwiBuild small crappy over priced cottages for the first home buyers.

When more than half of politicians own more than one property and then we find out that a CGT was unpalatable to them do you realise its time we applied the conflict of interest rules to politicians like they are applied to other public servants.

Also the example of Jamie Lee Ross who declared evidence about donation splitting suggests the problem is much larger than the rest of us realise as to the influence big business have on our govt.

We go on about the corruption of other govts but its here right in front of us.

Then another example was on taxation of the richest 150 individuals in this country where half of them claim to only have incomes just below the $70k mark.

We’re screwed!

By my experience this country is a very corrupt little country, full of hypocrisy and BS, especially when it comes to the business sector and vested interest holding property owners. Add the so called public service, that is not so public after all when it comes to showing transparency under OIA and Privacy Act, and add the double speak, self serving politicians, this country should really qualify for easy access to the status of modern day banana republic.

But because it is not a republic, but a constitutional monarchy, and because there are not so many bananas growing here, they do not meet the appearance requirements of a banana republic, hence get away with claiming they are one of the ‘most transparent’ countries on earth.

We know what 100 Percent Pure means by now, due to so many slow learners in the population it takes more than a generation to work out what the true state of affairs here is, as voters show again and again, most are fools that fall for the corrupt and self serving elite and their political servants at each major election.

Just take the Banking Ombudsman, a supposed ‘watchdog’ of the banking sector. I learned that one is INDUSTRY funded. So how ‘independent’ would such a BS ‘Ombudsman’ be after all.

There is a bill before Parliament that would see to it that only the Parliamentary Ombudsman should be allowed to be called such. It is time that this gets written into law, but even the ‘real’ Ombudsman has shown to not have teeth on many occasions also.

If it were not so serious and sad, one could laugh about all this, but I scream and shout often about the rotten state of affairs in Little Sleepy Hobbit Land Down Under.

Forget any hope for the housing disaster to be resolved any time soon. Let us prepare for the first Favelas on the hills around our major cities to grow over coming decades.

Here’s a thought why Kiwibuild does not work…. it is based on failed neoliberalism market driven, profit driven situations that benefit middle men in the process not the government or the public….

Very easy to fix housing.

Get rid of Kiwibuild. Give the money to housing NZ who already are set up for housing and return a profit and build more houses than Kiwibuild, get rid of all the middlemen and administrators and new agencies to run Kiwibuild and the fights among those agencies and go back to the 1970’s state housing model of the state building state houses to rent with HNZ and the habitat to humanity type approach where people help build their own houses aka returned service man style after the 2nd world war.

Forget marketing, forget profits, you can buy a house from Bunnings for under 100k that is built in 3 months, the government already have the land, the SHA designations and a council happy to consent the most fuck up dwellings possible. The services in most cases are already connected, just build the fucking houses and rent them out, and return a profit back to the state as HNZ does, as well as provide lower rents for poorer folks! win, win!

And get back the CAB building and turn it into affordable apartments because there is no point going high rise unless it is in a major city due to congestion issues.

If HNZ do high rises they also need to ensure that they don’t turn into dangerous, drug controlled slums, so make sure that at least 40% are rented very cheaply to police, teachers, nurses, social workers, CYPS caregivers and other people who will help create the social fabric for the community and kids living there, and to drive dysfunction out! Keep the demographics to help aka 20% retired people, 20% families, 20% singles….

And have green spaces and nice spaces for the residents.

Plenty of profit to keep the capital flowing, where tenants are happy to pay $250 p/w to rent a two or three bed place so the rents can fund more housing and people can save to buy their first home…

if you want to know about housing in new Zealand and Australia this is the channel digital finance analytics (walk the world)a big thanks to martin north principle annalist and Joe Wilkes nz based investigator for getting the warning out

https://youtu.be/2D5Q_VwT_L8

there is no shortage of housing its a scam by the banks its a debt bubble and fraudulent lending that’s resulted in this mess

https://www.youtube.com/channel/UCKWDscRjYFTD1KHsmow4-bQ/videos

bomber you should really interviw joe wilkes and martin north there findings are shocking about whats really happening we are heading for a collapse like Ireland please post this interview with eddie hobbs from Ireland people need to know

https://youtu.be/ISvdDCctE64 Joe Wilkes interview

https://youtu.be/1hi7gV9uyK8 this is a very very sobering interview from Ireland

Also the obsession with new construction and ‘supply’ at all costs not lasting quality, while creating a climate of cutting corners with low skilled cheap labour (not to create cheaper buildings but to increase developer profits), endless subcontractors type approaches which means very less and less control over overall projects, and questionable materials that may or not be counterfeit being found in NZ.

There is also very little accountability on developers who can just close down their companies and the liability falls on the bovine councils who fail to understand the liability they are creating for ratepayers and the endless construction which (as seen by the link below) might start to have impacts on stability of existing construction.

First Opal Towers, now Mascot Towers – what’s going on with Sydney’s cracking high rises?

https://www.stuff.co.nz/business/world/113704923/first-opal-towers-now-mascot-towers–whats-going-on-with-sydneys-cracking-high-rises

Comments are closed.