If you ask a member of the public what they know about the NZ Super Fund, it is usually very little. Most believe that somehow it will ensure we can afford pensions in the future.

The New Zealand Superannuation Fund Contribution Rate Model – HYEFU 2022 Spreadsheet model 14 Dec 2022

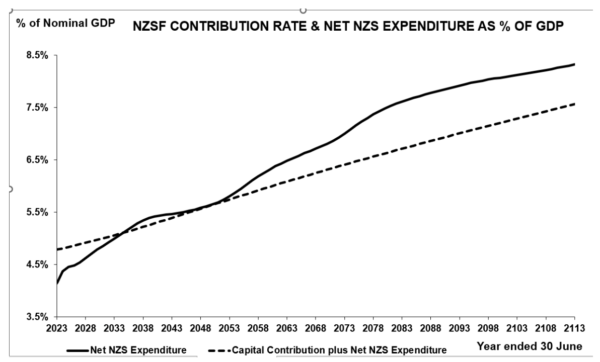

The difference between the dotted and the heavy lines shows we are currently paying into this fund, around $2 billion annually. It is not until 2055 that any significant money emerges and then only slowly. By the early 2070, the fund contributes 0.5% of GDP to NZS which is about only 7% of the total expenditure on the pension. At its best in the 2080s and 2090s the fund provides just 13% of the total net NZS falling away by the beginning of next century to around 10%.

The fund amassed to date from taxpayers or government borrowing is currently a huge $60 billion, and projected to be $409 billion by 2055. By 2100 it will be a very big treasure chest indeed (30% of GDP compared to 14% today). It is invested largely in growth shares to maximise returns, not in the infrastructure we need to prepare for the aging population whose care needs alone will swamp our already overstretched healthcare system.

This is what the fund does not do:

- Make NZ Super any cheaper. The cost of NZS is determined by the numbers of older people who get it, the policy parameters (eg age, indexation and rate) The Budget cost is unchanged by the fund.

- Guarantee of the shape of NZS. Nothing is guaranteed by the fund, not the age at which it is paid, the basic rate, the way it is linked to wages, or whether there is a means test.

- Provide significant help for taxpayers paying for baby boomers pensions. As the graph from the latest Treasury model shows, a trickle starts to come out of the fund around 2055, when nearly the entire baby boom generation will be dead.

A recent report (June 2021) from Treasury: The Golden Years: Understanding the New Zealand Superannuation Fund by analyst Matthew Bell explains the maths behind the legislation that locks us into this perplexing outcome.

When the fund was established two decades ago, (Sir) Dr Cullen claimed “By setting aside some Crown resources toward retirement income now, while we can afford it, we will be able to smooth out the cost over time”

The idea was that workers of the 2000s should pay tax not only to cover the current superannuation payments of the already retired but a bit more to store up for the future when they themselves retired and there would be relatively more older people supported by the working age population.

The policy was based on obscure economic theory about ‘deadweight costs’ that claims a steady tax rate paid over a time period is better for society than a low tax rate today and a high one tomorrow that produces the same average tax rate.

In times of genuine budgetary surpluses, no domestic calamities, no floods, no covid, no poverty, no homelessness it may have made sense to set some cash aside to strengthen the Crown’s balance sheet. There is nothing wrong with fiscal prudence in times of economic good fortune. But why ring fence such a fund and pretend it can be used only to pay for a small fraction of NZ Super?

The NZSF is not like a sovereign wealth fund that holds rental income from a fortunate local natural resource like North Sea gas. In contrast, the ongoing contributions to NZSF are made at the expense of other things that would better prepare us for the fiscal pressures of an ageing population.

Whether there are surpluses or not today, taxpayers currently contribute around $2 billion a year to this fund at a time when the need for substantial investment in the real economy in flood protection, housing, healthcare, hospital beds, nurses and doctors, education infrastructure and poverty alleviation has rarely been more pressing.

A massive fund it wont help us when our brightest and best young skilled workers seek greener pastures overseas where they can at least house themselves and see a future.

The fund won’t stop the spread of the next virus in the fertile ground of poverty, existing ill-health and overcrowding. Imagine the saving on social costs if we had protected the welfare system, taxed housing properly and built social housing so we didn’t have a large number of families ill, and subsisting in overcrowded, badly built slums and motels.

The major challenges we now face include designing enduring redistribution packages, keeping up the supply of basic commodities and essential services, strengthening the public sector especially health and education, and preparing for challenges that private enterprise is clearly incapable of solving. The solution is not to be found in storing up treasure on earth “where rust doth corrupt and moth decay.”

The first step is to remove the straight jacket of the imaginary ring around the NZSF assets on the Crown balance sheet. Then let’s halt contributions and have a clear-sighted debate about the way we can capitalise on our past sacrifices represented by these assets instead of being a captive to a redundant funding formula.

You ring fence these types of funds, because otherwise they are quickly spent on election bribes & pet (pork barrel) projects. You may use the funds for good & ethical outcomes, but I’m pretty sure there’s an incoming government who sees a big pile of money as tax cuts, bribe & “investments” in mate’s businesses. It’s certainly happen before.

Is it appropriate to compare this to what happened when the 1972 Labour government set up a super scheme that Muldoon canceled? As you say there is a high risk that any funds get used on election bribes etc so ring-fencing the funds is necessary.

Ah yes, good old Muldoon. That financial genuis from the 70’s who confused saving for your retirement with socialism. As Brian Gaynor stated, “The worst policy decision in this countries history”.

Why dont we have a fund for education then or health? The fund doesn’t do what most people expect and the $2 billion or so we put in this year has an opportunity cost. And it is not going to deliver much. We have the assets now and yes the fund managers have done very well so the assets contribute to the strong balance sheet and to our very low net debt. We have scope for funding urgent physical and social infrastructure which will better prepare us for the ageing population.

But is it really necessary to kill off the fund? If the economy wasn’t so weak, wouldn’t social programmes AND the sovereign wealth fund be quite affordable?

When the Reaganomics “crazies” were running around shutting down hospitals and selling off public housing, they were also busy implementing unaffordable tax cuts.

It was then claimed that the country deserved worse infrastructure than it had in the 1950s, because there “wasn’t enough money”.

Once this was combined with their extremist ‘globalisation’ trade policy, which destroyed most of the advanced industries, the country entered a death spiral: low value-added production, low wages, and low investment.

Rebuilding the economy so it is diversified and industrialised again is the foundation. The wealth can then be “transmitted” to the social programmes by reversing the tax cuts.

“industrialised again”?

Why would I set up production in New Zealand when China/India/Vietnam can do it for me cheaper? Unless it’s a bespoke or sensitive IP product you want to protect (Team NZ, Fisher & Paykel) I can’t see this happening without “protectionism” or “subsidy”.

Maybe there are industries we do need onshore for National resilience (read: refinery, steel plant, aircraft maintenance) or to process raw products (Saw-mills, food processing), although again – it’s cheaper to ship offshore for processing. Whether this is a good thing depends on your POV I guess.

Sometimes it pays to have your manufacturing onshore, if China invades Taiwan and we have 50-60% of manufacturing done in China, there will be a disruption to our supply channels I am sure of it 100%.

We are very backward thinking as a Nation, the place has been f****d by the Neoliberals in the 1980’s, led by the Bankrupt Pig Farmer.

@billid:

This is the point: ending protectionism was not in the national interest — the economy became less advanced, less diversified, and living standards for working people collapsed. Wealth was sucked out of the economy, and sent abroad.

It only makes sense if your sole concern is the narrow interests of transnational industrialists and financiers, who made a killing by sending all the production to sweatshops.

That could not have happened without a decision by the politicians to completely rewrite trade policy. Now the country is a giant rust belt, with a pathetic economy of cows and tour buses.

Straight to transnational industrialists and financiers. A lot to unpick there but I’ll just say – the 70’s want their production models back. Despite the memes, it isn’t going to happen.

There are plenty of examples of globalisation lifting people out of poverty and hybrid models of production making contributions in both local and remote economies. Icebreaker is a small example. Would not have a global product, let alone provide a sales path for local wool sellers if it was kept and made in New Zealand.

It’s like, when suggesting dairy farmers de-industrialise and change their production methods and them hearing “kill off dairy farming”. This weeks ‘The Working Group’ was a glaring example of one person saying one thing and the others arguing something completely different.

The rational answer is in the middle somewhere.

We were told that a Trump presidency could never happen. That nobody could ever get elected on a platform of bringing back manufacturing. That tarriffs would never come back. They were all wrong.

The idea that protectionism means you cannot export anything is nonsense.

There are barely any complex goods being exported today, because industrial production was deliberately destroyed. All that is left is low value-added exports: primary commodities.

If you prevent foreign dumping using tariffs, the economy becomes more advanced again through industrialisation. You are developing the ability to produce complex goods for export: returning to high value-added production.

The fact that the country can now only produce sweaters is the sign of a weak economy, and a country with no real political independence.

Good article, well researched, well written …but wrong…why? Over 80% of Kiwis need the NZS once they are 65 years old…KiwiSaver, and other retirement schemes are handy, that’s all.

For once I agree Nathan. It’s a necessity for those on low and medium wages in that during their lifetime we will have governments that believe in a low wage economy and by 65 will not have acquired a lot of savings to live on.

I would suggest, without wanting to bring down the wrath of the hard right on this site that super should be means tested.

The problem with means testing is that those with means have often but not always worked for them and paid precisely the taxes that are building up the fund. You don’t have to be hard right to think sod it why should I pay my taxes honestly if I’m not going to benefit from it.

Bert: Thank you for making my day…honest

It has nothing to do with the decision to pay those 80%— The fund protects no-one except to create a false illusion that it has removed the fiscal pressure of a universal scheme so we dont need to talk about the costs of NZSuper any more.

Ask Germany what happened in the 1980s to the pension fund and then think again about ringfencing. The pension fund there was used to fund everything they did not have an official budget for and since then they have conditioned little germans to accept that they must work later to receive less. 🙂

Great piece Susan.

There has of course always been enough money, it is how it is divvied up that is the problem as we all know.

Governments successively shunt it on to the many charitable organisations that we have.

Bert: Thank you for making my day…honest

This article leads readers to believe that a $2billion annual contribution to the New Zealand Superannuation Fund is somewhat excessive because of external factors such as floods and young people migrating overseas. The reality is that the contribution is necessary for the future of the people of this country, and separate issues such as floods can be mitigated by a revamp of the insurance industry, and people migrating overseas in droves is an issue which could mitigated by making slight changes to the tax system or by other means

people paid in under a certain premise, by all means change it for future generations but people who’ve paid in all their lives should get what they paid for

Thanks Michal,

WE give $2 billion a year with zero scrutiny from our precious taxes to this fund but we cant find money to feed and house the worst off.

WE could fix working for families, repay student debt that cripples our nurses and teachers, fix the roads and better support those caught in the floods for $2 billion. Why no discussion?

and how much influence do Morrison & co the fund managers have in wellington. they wouldnt want the amount paid in to fall. how much do they benefit from managing the funds?

Means-test Superannuation! It’s a no Brainer! Can someone please explain to the elderly that Superannuation is a benefit, paid by current tax payers? They all seem to think it’s a tax refund!! IT’S NOT A TAX REFUND. Christ on a bike, the amount of very wealthy boomers collecting other people’s tax via superannuation that I see everyday at my day job is FAARKING SHOCKING!!!! Legal criminals. URRRRG

The costs involved with means testing super, is apparently considerably more than the savings it would make. Still it would create more jobs for sociopaths at WINZ or who would be responsible for managing it. Is that a win?

Dave McCain, superannuation is the largest cost of the transfer payments system. The systems are well in place to means test other beneficiaries so your stance doesn’t make sense. Now that IRD has a implemented it’s online systems, it really only requires minor tweaks to have the wealthy elderly repay the benefits they have received without needing them. It is surprisingly easy, with legislation.

You say that the fund is hardly going to help pay for the baby boom blip retirement costs. I am assuming this is because the disbursements would come from income generated by the invested capital. However the capital in the fund most of which was contributed by the baby boomers in the last two decades could just be used to pay for the baby boom pensions. If the current plan as you say is not going help the baby boomers then the baby boomers have made a massive contribution to help future generations of retirees.

As for the current $2billion contribution is it a rainy day savings scheme or a kind of sovereign wealth fund? If its the latter then may be it should be invested a billion a year into new wealth generating industries in this country.

The extra $2billion that could be spent now on current social programs and education could easily be found from a special bank profits tax.

so sinic you’ll be writing to your mp and the relevant minister demanding your personal pension should not ever be paid out

and you are proposing the theft of pensioners life long contributions…it fucks me off seeing the rich collect pensions but any kind of means testing as a cut off point and that line will disadvantage some of the poor pensioners….lastly check out how many old people are homeless….boomer is a glib and useless generalisation

Means testing is why I cant get supported living payment. It sucks how different rules apply to different people here.

If you don’t need other’s money to survive, why do you even feel entitled?