Central Banks across the globe are setting course to break inflation by inducing a recession while trying to blame workers for price rises.

The New Zealand Reserve Bank increased the official cash rate 50% to 1.5% April 13.

The return of inflation across the globe has become entrenched. The financial aristocracy who determine Central Bank policies is determined to break inflation because it reduces their wealth.

The Financial Times reported April 6 that: “Consumer prices in the world’s 30 richest countries already rose at an annual rate of 7.7 per cent in February, up from only 1.7 per cent in the same month last year and the highest since December 1990, the latest OECD data showed on Tuesday.”

Agustin Carstens, the general manager of the Bank for International Settlements(BSS) , the umbrella organisation of the world’s central banks, declared war on working people in a recent speech by claiming there was a “dangerous wage-price spiral.”

This was echoed by the New Zealand Reserve Bank statement today “that inflation is above target and employment is above its maximum sustainable level. As such, the Committee confirmed that further increases in the OCR are needed in order to meet their mandate.” Why the current level of 3.2% unemployment is considered too low is never explained. Of course, the bosses hate low unemployment because it increases workers’ bargaining power. But this does not mean it is not “sustainable”.

This is the capitalist economist’s way of blaming workers for price increases deliberately created by the central bank policies over the last few years.

But we all know that the sudden surge in inflation rates over the last few years has had nothing to do with a sudden surge in wages. Prices surged above wages everywhere in the advanced capitalist world. The reason for that is simple – central banks everywhere printed trillions of dollars to rescue their system from collapse when Covid hit.

There is simply no other reason.

Yet Carstens of the BIS, and our own central bank governor Adrian Orr tried to deny any responsibility.

Carsten made the following extraordinary admission: “The shift in the inflationary environment has been remarkable,” he said. “If you had asked me a year ago to lay out the key challenges for the global economy, I could have given you a long list, but high inflation would not have made the cut.”

So the people responsible for monetary policy worldwide have no idea what is happening or why.

Nearly every economist in the capitalist world is either a Keynesian (associated with easy money policies) or a monetarist (associated with tight money policies). Neither understand inflation and its causes properly. That is why governments and central banks simply use one or the other theory to justify whatever policy they are implementing now. So we have seen the monetarists become Keynesians overnight to justify policies they thought necessary to save their system in recent years.

Now the monetarist rhetoric (cut government spending, cut the money supply to kill inflation) will become the new mantra.

In 2008 and 2020 world capitalism faced massive crises. Each time the capitalist system bailed itself out by printing money and creating massive amounts of debt. That extend and pretend policy for the world is coming to an end. Rising interest rates to break inflation means many indebted companies (Evergrande, Softbank) governments and countries (Lebanon, Sri Lanka), and the banks and insurance companies they owe money to will come crashing down.

Working people will be forced to pay the price for the failures of the capitalist system through a surge in unemployment while being told it’s their own fault.

We should demand that money and its creation be turned into a public service under democratic planning and control. We can’t do worse than those in charge at the moment.

Yes their failure to fix the problems exposed in 2008 are coming home to roost. This is all the fault of the USA QE policy for the West since the GFC.

The BRICS nations will adhere to a commodities based monetary system to avoid the mayhem facing the West now, whilst the West will face more major problems from the backlash of the crazy sanctions imposed on their “enemies”.

Everyone who believes the Yanks are wonderful and that neoliberalism is great, just might start to see through their manifest failures financially, economically and politically.

Usually your columns are really good however I am not totally convinced by your logic this time. While I agree that problems with QE exist if it was not used the recession would have been years earlier so really all it did was delay the inevitable & hopefully soften the blow for the vulnerable although the last part never seems to happen. While your solution is probably correct in that it could not do worse I am not convinced that it would be significantly better.

It is rather disturbing when those against benefits say being reliant on government support is not a way to live long term, while at the same time the machinery in the background is apparently rooted if everyone has a job.

They have not quite ruined everyone among the plebs just yet, so here is another round of we want and we will have your house, your car, your valuables and all the rest. The banks, and their enablers the selected empty suits that keep seats warm in parliament – at great cost to the treasury – from the left, the right and the center.

It’s interesting to talk about ‘we’ having your assets etc. I have come to the conclusion the Nazi grab of goods and property was about that in the main. The authorities decided to oppress good citizens who had good standards of living and education, in the main, then they were gradually brought down, their jobs, their businesses were all confiscated, they were refused the ability to use public facilities. They were often refused passports when they might have found a new home, then mostly they were removed themselves.

It was theft on a giant order by the cruel state,with no compensation, just denial of humanity or rights. Is it possible that certain people in NZ will become dispensable, drug payoffs might provide a parallel to part of the Nazi mindset?

part of the reason for the german peoples support of the nazis was that very property/goods theft which was redistributed to ‘deserving’ germans

….nice flat used to belong to some jews but they were resettled, lovely vase where did you get that oh it belonged to a communist who went away…psychological reasons for nazi support are not neccesary when greed works perfectly well

we are seeing the same process with our landlord class..as we speak

Adrian Orr protected and barricaded the rich landlords by boosting house prices letting them sell their 100 house portfolios at 300k tax free capital gain (thanks to Jacinda) per house then once they were out and cashed up he has opened up the Grad rocket launcher and is in the process of annihilating the rest of us, destroying everything, so he can free up lots of houses through mortgagee sales so his rich mates can now buy back in cheaply and ratchet themselves closer to being the new Lords of NZ and get themselves a 200 house portfolio. If Jacinda would start taxing these parasites this new land grab would cease. What is Labour for? How did we get to the point where voting for the enemy Nats was no worse than the voting for the frowning cuckoo?

My views on what I saw/experienced in Ponsonby from when I moved there in 2001.

John Key, the aussie banks and their property speculator mates from 2010 – 2016 were back in the play when the interest rates bottomed out in 2021. The only way to slow them down was to impose the bright line test to selling within 10 years and removing tax subsidies on the interest. The property speculators would acquire large mortgages, compete with the mum and dad investors (like me and many of you) and first home buyers. It is unlikely the latter two would take out large mortgages or the banks would have exercised due diligence to ensure they could manage their mortgage payments. The banks were only thinking of their shareholders at the expense of business owners, first home buyers, new builds, and NZ’s economy. The banks welcomed the speculators in and the result, $6bn profits off to aussie. The winners were banks, shareholders, property speculators and real estates agencies. Losers NZ economy, first home buyers, mum and dad investors.

The strategy must have worked as house prices have leveled out but are still well above their realistic values. I say keep building the infill apartments/homes in the cities/towns/papakainga around NZ and relocate state houses from quarter their acre sections and build social housing.

People down the road in a good little suburb are selling up because of a tenant in a house so abusive and unpleasant that they no longer enjoy living here though been here for years. The nation-wide agents won’t ask him to leave as from their POV he is fine, pays on time $550 weekly, keeps the place tidy, doesn’t hold noisy parties but swears, shouts, abusive if you just look at him.

House valuation rising causes rates to rise for no reason other than other people’s bidding up. The rate needs adjusting but that is an intricate process.The house valuer I think, QV argues for the present system that sees people’s house values shooting up, and they have to sell from where they have lived for decades. The valuer seems haunted by the fear that if the price is too low, then somehow the speculators/investors will get hold of the house and knock it down to rebuild upwards..

We are all twisted every which way. We can understand Maori dissatisfaction over land sales and swamping with new residents, but further, residents are forced to sell by artificial hiking of values in a hothouse climate. It’s blooming well disgraceful so government should pull finger. I often meet immigrants, all I’ve met are lovely people. However climate change brings floods, and people and policy manipulation brings floods of people.

Immigrants hymn to NZ – from all round the world.

Bring me my bow of burning gold!

Bring me my arrows of desire!

Bring me my spear! O clouds, unfold!

Bring me my chariot of fire!

I will not cease from mental fight,

Nor shall my sword sleep in my hand,

Till we have built … go on outbid us……..

In

England’sNew Zealand’s once, green and pleasant land.They failed to adequately address issue back in 2008, leaving the working class people of America to pay the price while they were awarded billions of dollars in bailouts. This was in order to keep the banks and other financial institutions in the US and other advanced countries across the world running, regardless of their respective financial improprieties.

Poor ole me!

Labour. “Having a majority isn’t some ‘grand nirvana’ when there’s a global pandemic at play, says Grant Robertson.

Sounds like LINO are ready to give up again!

Oh! Let’s have an early election instead!

Ah… ( cough-cough) Told you so. So raspberries.

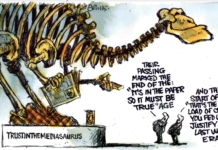

The RBNZ is a money cult which, if left unchecked, will destroy innocent lives. The guilty ones will simply get richer. As I’ve said. Many, many times.

The curative? Know your enemy then kick their arse.

This is also very interesting. In my opinion.

Via Boing-boing.

Why are people still swayed by cults?

https://boingboing.net/2022/04/13/why-are-people-still-swayed-by-cults.html

“Jamie Wheal offers his perspective for the YouTube channel Big Think in the video above. Wheal asserts that “everybody cults” in one way or another and that the desire to join a cult is a vital aspect of being a human- whether we like it or not.”

’employment is above sustainable level’…right so structural unemployment IS an ‘economic lever’ and therefore NOT the fault of the unemployed…can they have benefits above the poverty line and stop with the nat-tard benny bashing please…much obliged

And change the way that stats are drawn up. They are too loose and we will drop out of sight in that maze of figures that measure against the previous figures that no-one remembers what they were actually measuring.

‘We should demand that money and its creation be turned into a public service under democratic planning and control.’

This is the way it should be.

Anyone who tried to implement it would be signing their own…death warrant.

blazer

as kiwis can’t even agree on something simple like masks….good luck with that…best scenario every decision will take 5 yrs and need a judicial inquiry.

I’m not sure they are working to eliminate inflation. Inflation is a tool and it is now being wielded for the benefit of the usual suspects.

Check this out from 1 year back….https://www.ft.com/content/c7ebe679-3373-4f01-94fe-015bf80c4d3b

Choice quotes:

“Most importantly, inflation is now desirable as the way out of the crisis by reducing the value of the debts over time.”

“The return of inflation could help ease the debt burden. But it will be hard to swallow since it arbitrarily transfers wealth from savers to borrowers”

Really!..savers have been getting their heads kicked in ..for the last 15 years.

it effectively been negative intrest rates on bank deposits anything below the rate of inflation is negative

Our reserve bank had already raised interest rates and put the country into recession 6 months before the 2008 GFC. The argument being that too much lending was going to those who would be at risk if interest rates rose. They apparently cannot see the obvious problem with that reasoning. Once again proof that economics is not a science as we wiil soon see again.

giving mortgages to those who cannot afford them in order to inflate a bubble market always ends in tears.

this will be our verson of the sub prime crises i remember the gfc as a warning to get rid of debt and get your personel affairs in order

Do stupid things (MMT/Semi-Keynesian economics/ZIRP/QE/unsustainable deficit spending) win stupid prizes (inflation/recession/depression).

well nitrium the postwar social democrat ‘social contract’ seemed to work better than the current charade….remember when people hark back to ‘the good old days’ that’s what they’re referring to…even if they don’t realise it.

Folks

It wasn’t the reserve bank – it was the previous govt. As always.

“Each time the capitalist system bailed itself out by printing money and creating massive amounts of debt”

Which blew giant asset bubbles due to this easy money being funnelled towards asset speculation rather than anything productive. Rising interest rates will make debt unserviceable for individuals, businesses and countries alike. In addition to asset bubble correction this will dwarf the problems of the GFC.

Combine that with energy, fertilizer and food shortages globally, a reshuffle of geopolitical structures and (IMO) deglobalisation and disruption of supply chains. This decade will be a time of social and political flux and increased conflict.

For a change of economic direction I’d recommend considering the analysis and ideas of Steve Keen.

https://www.goodreads.com/book/show/58153942-the-new-economics

better dig out grannies wartime rationing recipe book

After kicking the can down the road for decades, it’s time to put in the pantry.

interesting I’d always assumed it was an empty rusty can…still as that’s all some NZers will have in the pantry…………………

Big banking business is just high-powered busking tossing balls in the air and skilfully, we hope, catching and placing them correctly. I noted the piece down below. The idea that the financial system is a dream or a nightmare made up in that half-awake state after sleep is something that we might know, but we need it so what can we do.

Agustin Carstens, the general manager of the Bank for International Settlements(BSS) , the umbrella organisation of the world’s central banks, declared war on working people in a recent speech by claiming there was a “dangerous wage-price spiral.”

That bank name recalls a big bank going bust with a lot of the credits of developing countries, easier lost than accumulated. Since I read about this bank bust I have been aware of the intuitive understanding approach to finance and banks.

https://en.wikipedia.org/wiki/Bank_of_Credit_and_Commerce_International

…Police and intelligence experts nicknamed BCCI the “Bank of Crooks and Criminals International” for its penchant for catering to customers who dealt in arms, drugs, and hot money….

William von Raab, a former U.S. Commissioner of Customs, also told the Kerry Committee that the U.S. Central Intelligence Agency held “several” accounts at BCCI. According to a 1991 article in Time magazine, the National Security Council also had accounts at BCCI, which were used for a variety of covert operations, including transfers of money and weapons during the Iran–Contra affair…

BCCI was awaiting final approval for a restructuring plan in which it would have re-emerged as the “Oasis Bank”. However, after the Sandstorm report, regulators concluded BCCI was so fraught with problems that it had to be seized. It had already been ordered to shut down its American operations in March for its illegal control of First American.

On 5 July 1991, regulators persuaded a court in Luxembourg to order BCCI liquidated on the grounds that it was hopelessly insolvent. According to the court order, BCCI had lost more than its entire capital and reserves the year before. At 1 pm London time that day (8 am in New York City), regulators marched into BCCI’s offices and shut them down. Around a million depositors were immediately affected by this action. ..

In 2002, Denis Robert and Ernest Backes, former number three of financial clearing house Clearstream, discovered that BCCI had continued to maintain its activities after its official closure, with microfiches of Clearstream’s illegal unpublished accounts.,,,

The BCCI scandal was one of a number of disasters that influenced thinking leading to the Public Interest Disclosure Act (PIDA) of 1998. The report found that Clifford and his legal/business partner Robert A. Altman had been closely involved with the bank from 1978, when they were introduced to BCCI by Bert Lance, the former director of the Office of Management and Budget, to 1991. Earlier, Pharaon was revealed to have been the puppet owner of National Bank of Georgia, a bank formerly owned by Lance before being sold back to First American (it had previously been an FGB subsidiary before Lance bought it). Clifford and Altman testified that they had never observed any suspicious activity, and had themselves been deceived about BCCI’s control of First American. However, the federal government and Morgenthau contended that the two men knew, or should have known, that BCCI controlled First American. Pharaon also was revealed to be the puppet controlling owner of CenTrust Bank in Miami, Florida.

trouble is the BCCI model is now THE financial model, not just in londongrad but in lil ‘ol NZ too

The inflation is caused by impact on international and domestic production and distribution – this as a result of the pandemic, sanctions and war.

It can be argued that blaming government spending and workers wages for inflation is the market capitalisms way of burning a witch after a bad harvest to bolster confidence in the marketplace.

Yet the fact is, labour shortages in both production and distribution will resolve as borders open and people no longer need to isolate.

So the inflation panic is unwarranted.

Of course the real issue is hidden – it is a deliberate increase in interest rates to bolster returns for debt finance post QE. However that places pressure on government finances (higher debt repayments).

The irony is that the right wing – Prebble dribbling on about government spending – is still keen on tax cuts. Tax cuts, while debt cost is rising, is madness.

If a government cannot manage debt cost, this undermines the public sector and thus the social contract.

And we still have to resolve the GW threat. So it is either a MMT challenge to the status quo, or we face another ruinous round of the post 70’s move further to the right in our economic and political regime. That is where we cling onto our Five Eyes White Mans burden club membership for a generation longer while the rest of the world anticipates the end of the neo-liberal order and makes plans for their place in the world without it.

Try this one…

‘Nugan Hand Bank was an Australian merchant bank that collapsed in 1980 after the suicide of one of its founders, Australian lawyer Francis John Nugan, resulting in a major scandal.[1] News stories suggested that the bank had been involved in illegal activities, including drug smuggling, arranging weapons deals, and providing a front for the United States Central Intelligence Agency. Speculation grew when it became known that the bank had employed a number of retired United States military and intelligence officers, including former CIA director William Colby.’..Wiki.

More young exploited people refusing further exploitation. Let Jacindas favourite rent seeking parasites like Luxon feed on themselves. More leaving every day than arriving and the trend is accelerating. NZ is done. https://www.customs.govt.nz/covid-19/more-information/passenger-arrivals-departures/

Makes sense when the border isn’t fully open to everyone yet. Why don’t you join them and go back to your new adopted country.

Haha, bullshit, and you know it, look at the historical results. Kiwis with a brain and no house are leaving, probably forever. I am in Oz, 5 of my relatives are joining me over here in the next couple months, it’s like a breath of fresh air. No sane kiwi would stay in la la land. It’s just an infestation of parasitic landlords and meth dealing gangs now desperately trying to find new blood to feed on. Lots of maggots hating each other and only caring about how much their house price estimate has gone up on homes.co.nz, how much more rent then can squeeze out of suffering tenants or how much meth they can push to poor struggling people whose future hopes have been lost thanks to the cuckoo. I will only move back to NZ when all the parasites have destroyed themselves through greed and a new breed of humanitarian kiwi is back in control. The boomers greed has wrecked NZ for a generation at least. I miss the old NZ but the place is unrecognisable now. Such a shame. Have fun Nikorima, good luck with your mortgages!!!

see ya see ya, wouldn’t wanna be ya.

Sorry to point out the obvious, but working people can’t raise the price of things.

So who is making inflation?

That is in the hands of those who own the means of production.

Agree that the problem has been fuelled by the governments around the world printing money and in NZ’s case giving it to the banks.

The only thing protecting workers now is a people shortage which has allowed wages to rise. However both the right and left seem to be encouraging more migration to make sure that NZ wages are static and less than Australia and housing is still in demand by more migration.

indeed there is always a choice…increase price, lower wages, better management, reduce margins….

strangely the latter 2 are never mentioned

A smart man says,

Don’t blame the GOVERNMENT , blame those each individual who elected this Government.

You wanted it you got it. Have fun

admittedly it would be much much MUCH less ‘fun’ under the nats…indeed no funnnnnnnn

we had those freedom protester barking on but real freedom comes with that final mortgage payment after that debt slavery ends and your empowered with real freedom

UNTIL YOU FIND MOULD IN YOUR ATTIC OR SUBSIDENCE IN THE FOUNDATIONS…