The problem with the current measures being taken by the Reserve Bank to rescue the economy from an economic collapse is that they are directed at rescuing the wealth of the owners of big business not meeting the needs of the big majority of working people.

To a large extent, the same can be said for the economic rescue packages being carried out by the government which have largely involved giving money to businesses just to stay in business. There are no limits imposed on executive salaries, shareholder returns, or keeping on staff long-term so the owners of those businesses just carry on as their normal greedy selves.

There will be problems down the road from the Reserve Bank simply printing the currently planned $128 billion dollars and then loaning it to the government to run budget deficits or giving that money directly to the banks at zero interest to loan on to speculators in the property market.

We are seeing a surge in property prices as one obvious negative that has occurred almost immediately. New Zealand homeownership rates are now at a 70-year low according to a recent report from the Statistics department. Prices are already at world-record levels in terms of average incomes. Renters are also being driven into poverty. “The proportion of renting households that spent more than 30% of income on housing costs rose from below 20% in 1988 to over 40% in 2019.” Widespread homelessness is a direct consequence.

The government could fix this problem by building 10,000 state houses each year for the next decade and renting them to people at no more than25% of their income. They could use the money they are printing to do that. They choose not to do so.

The same argument is true when the government chooses not to implement the Welfare Expert Advisory Group’s report which would genuinely boost the incomes of the most in need and eliminate child poverty.

The cost of the steps needed to genuinely confront the climate crisis – like free and frequent public transport with electric vehicles and cycleways everywhere – could be implemented virtually overnight.

These steps could be made to happen if the money being printed was used for those purposes.

Instead, the Reserve Bank has said it will print up to $100 billion for the government to use and another $28 billion that they will simply give to the banks at no cost and with no restraints on how it should be used. They can choose who to loan it to. And profit is their sole master. That is the nature of a privately-owned banking system. Their greed leads to criminal behavior on a vast scale for which they only ever receive a slap on the wrists if it gets out into the public arena.

The NZ Reserve Bank, and similar banks all over the world lead by the US Federal Reserve, are doing this and similar in almost every country, because their system, the capitalist system, is in the deepest crisis it has faced in 200 years. The US Fed is naturally number one in the international pecking order because the US dollar is at one or both ends of 90% of international financial transactions.

I explained in a blog a few weeks ago headlined A crisis of the system that no amount of spending can fix that this crisis is not just a product of the Covid-19 pandemic. It is part of a cyclical crisis that happens every decade or so under capitalism but they seem to be getting more synchronised internationally and more severe in their consequences for working people.

In part, this has been a consequence of the financialisation of economic activity over the last three decades. This has created a tiny financial oligarchy that controls most economic activity on the globe. Financialisation was also associated with an explosion of all forms of debt – personal, government, and corporate debt. But rather than this debt being used to accelerate growth under capitalism, the greed and predations of the dominant financial oligarchy appear to have become a brake on the system. Growth over each of the last three decade-long cycles has been progressively weaker each cycle despite (or maybe because of) the ever-growing debt.

But this financial oligarchy calls the shots on what type of government policies are considered acceptable. The debt market and interest rates are used to police those governments when necessary. This is especially true when it comes to monetary policy.

After the inflationary 1970s it was an article of faith that no government would be allowed to simply print money and spend it – especially on social programmes that benefited working people. Tax cuts for the rich were OK because that caused the governments to be even less able to spend money on anything useful.

Central Banks were removed from government control and made “independent” to prevent inflation beyond 2-3%. Many governments turned the need to always run budget surpluses into a religious dogma.

All those dogmas have now been abandoned without explanation. Pushing back against complaints about their policies, the Reserve Bank Governor Adrian Orr simply asserted that booming house prices were a “first-class problem” and that the alternative is “recession or depression”. That may be true but we have a right to discuss alternatives to how the money being created should be sued.

Essentially the world has gone through two crises over the last few decades where it became necessary to print money on a vast scale and simply hand it to the 1% who control the banks and other financial institutions to use to facilitate payments between themselves.

In 2007-08 we had a crisis that had its origins in the US sub-prime mortgage market and swept the globe because much of the debt that had been created over the previous decade proved to be worthless. When a huge player in the market like AIG insurance could collapse overnight no one was safe. No one trusted each other anymore. Credit froze.

To stop the system from collapsing at that time trillions of dollars were printed by the US Fed, along with European, UK and Japanese central banks. This was simply handed to the financial oligarchy that controlled the banks, pension funds and insurance companies so they could rescue themselves from their self-inflicted disaster. The Reserve Banks essentially used the accounts these institutions have at the respective Reserve Banks for settling transactions between them and credited them with tens of billions of dollars each in their balances so there was no risk of default by any one of them in the short term. This is explained well in The History and Significance of QE in the UK.

In the UK and the rest of Europe austerity policies were imposed on working people to bring the budget deficits required back from deficit to surplus. But the US Fed which led this process hasn’t been able to unwind the quantitative easing policies without threatening a new recession since the 2008 crisis.

A little over a decade later the unthinkable happened and financial markets began freezing up again despite the huge balances held at the relevant Reserve Banks. Stress appeared in the Repo markets first. Brooking explains:

“In September (2019), a disruption in the market in which banks and others lend and borrow for very short periods of time, the repo market, led to a sharp spike in short-term interest rates and prompted the Federal Reserve to inject tens of billions of dollars of reserves into the markets.”

This was a signal that a new crisis was on the way. The Covid-19 pandemic unfolded and the Rep market froze again. Liberty Street Economics explains:

“The repo market faced extraordinary liquidity strains in March amid broader financial market volatility related to the coronavirus pandemic and uncertainty regarding the path of policy. The strains were particularly severe in the term repo market, in which borrowing and lending arrangements are for longer than one business day. In this post, we discuss the causes of the liquidity disruptions that arose in the repo market as well as the Federal Reserve’s actions to address those disruptions.

It was obvious from the unfolding Covid-19 crisis that a major economic downturn was happening and it would hit some sectors of the economy very harshly. Bankruptcies would be inevitable and a broader debt crisis provoked that could take down major banks and finance companies.

The US Fed led a coordinated response across to globe to print deliver even greater amounts of dollars than they did in 2008 and encouraged other central banks to do likewise. The US Federal Reserve admitted in its latest report on financial stability in the US that there has been $7 trillion increase in G7 central bank assets in just eight months in contrast to the $3 trillion increase in the year following the collapse of Lehman Brothers in 2008. The US Fed began buying any form of debt held by their banks and other financial institutions that came under pressure including corporate “junk” bonds. One measure of the US money supply US M1 has increased by 55% since February. What that means is that 35% of all US dollars in existence have been printed in just the last 10 months. Take a minute to think about that fact and how scared you should be as to why that is happening.

One echo of the 2008 crisis is that BlackRock, the world’s largest asset manager, and other financial wizards in the US had started to group together non-investment grade corporate bonds together and relabel as investment-grade because grouping them together allegedly reduced risk. The same argument was used with US mortgages which were repackaged and resold as investment-grade Credit Default Swaps with allegedly low risk in 2008.

And in true US-style one of the companies responsible for creating the new bonds is put in charge of buying them. “BlackRock…. will earn relatively modest fees for helping the Federal Reserve run a bond-buying program to steady markets unsettled by the pandemic.” It is no surprise that two former BlackRock executives are on Joe Biden’s transition team to continue to manage economic policy for the 1%.

The direct consequence of handing the financial oligarchy trillions of dollars in the midst of a crisis is that they use it to advance their own wealth and power. That is the background to the fact that despite one of the worst economic crises in human history the 1% has expanded their wealth and power. Michael Roberts reports:

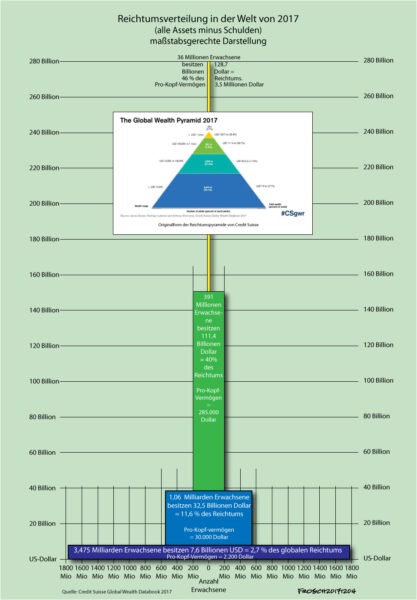

“The top 1% of households globally own 43% of all personal wealth while the bottom 50% have only 1%. The 1% are all millionaires in net wealth (after debt) and there are 52m of them. Within this 1%, there are 175,000 ultra-wealthy people with over $50m in net wealth – that’s a minuscule number of people (less than 0.1%) owning 25% of the world’s wealth!”

Working people across the globe are caught in a dilemma. We don’t want an economic collapse because we know we will be the worst affected. So actions by governments to “rescue’ the entire capitalist system of finance and production and trade are needed. But if we are going to do that why don’t we place the commanding heights of the economy, especially in the area of finance and money creation, into the hands of a publicly-owned and democratically controlled entity rather than simply hand the 1% our cash as if they have some god-given right to it. We have socialised all risk associated with private banking so why not socialise banking itself.

“The top 1% of households globally own 43% of all personal wealth while the bottom 50% have only 1%. The 1% are all millionaires in net wealth (after debt) and there are 52m of them. Within this 1%, there are 175,000 ultra-wealthy people with over $50m in net wealth – that’s a minuscule number of people (less than 0.1%) owning 25% of the world’s wealth!”

That I don’t dispute. The 2020 Credit Suisse Global Wealth report however is, as the title suggests, a global analysis. One can argue that the same shift of wealth is also happening in AO/NZ (which is in global terms quite insignificant), but here’s the rub. It is not the 1%ers that RBNZ measures serve, but the petite bourgeois, the modern day middle class.

Well said, Mike. You have covered a lot of very pertinent points.

What you have not covered is the fact that money is created out of thin air but interest is charged on that fraudulently-created money. Where does the money to pay the interest come from? Yet more fraudulent money-creation!

And the poor sods at the bottom of the financial pyramid see the little money they have, or earn, whittled away by ‘inflation’, which is really just devaluation of money already in the system. A house that was constructed and sold for less than $30,000 in the 1970s is now sells for $300,000+ in a provincial city and $1 million+ in Auckland! And a bag of potatoes that cost $1.50 in the 1970s now costs the best part of $15.

Another aspect worth highlighting is the matter of taxation. Those at the bottom and middle of the financial pyramid are forced to pay a substantial portion of their income back into the system by way of tax, whilst those at the top pay no tax or a relatively small portion of their [unearned] income back into the system.

The other aspect you have not highlighted is that all this money-creation and burgeoning debt is orchestrated on the [false] assumption the economy will grow (to cover the interest and administration costs etc.)

The fact is, the entire system is predicated on converting fossil fuels into waste, and once it becomes impossible to acquire more fossil fuel (particularly oil) every month, the whole system goes into terminal decline.

The most recent report I have seen on that matter indicates peak everything (conventional extraction plus [more expensive] unconventional extraction) peaked in 2019. Since then, demand destruction associated with Covid-19 has muddied the waters immensely. However, if by some remote possibility it were possible to ‘kick start’ the global economy -haven’t heard that worn out cliche for a while- the effect would be to increase the rate of overheating of the planet….a self-defeating strategy if ever there was one.

That said, practically everything governments do is ultimately self-defeating in the long run.

There are only two sources of wealth: growing plants or animals; raiding the wealth already created by nature. Everything else is deception or delusion.

And since we are in the process of gobbling up the last remnants of the natural world and converting them into trash (civilisation), it is a simple logical step -that no politician or economist or banker I know of is willing to concede- to understand that the entire system is self-defeating and in terminal decline.

It’s not as though there haven’t been plenty of warnings. Albert Bartlett, amongst thousands of others, highlighted “the greatest failing of humanity is the failure to understand exponential growth” decades ago.

https://www.youtube.com/watch?v=sI1C9DyIi_8

Of course, politicians and bankers have to not understand exponential growth in order to do what they do.

“It is difficult for a man to understand something when his salary is dependent on not understanding it.” -Upton Sinclair

Timely post.

“This has created a tiny financial oligarchy that controls most economic activity on the globe. Financialisation was also associated with an explosion of all forms of debt – personal, government, and corporate debt. But rather than this debt being used to accelerate growth under capitalism, the greed and predations of the dominant financial oligarchy appear to have become a brake on the system. Growth over each of the last three decade-long cycles has been progressively weaker each cycle despite (or maybe because of) the ever-growing debt.”

Sadly the easiest thing would be to put in more constraints and taxes on the ‘John Key’s’ of the world aka “Within this 1%, there are 175,000 ultra-wealthy people with over $50m in net wealth – that’s a minuscule number of people (less than 0.1%) owning 25% of the world’s wealth!”

But instead the tax targets for many in NZ seem to be anyone who is not in poverty, rather than a tax on the 0.1% worth over 50million. Even something like stamp duty on property which has the ability to make someone buying a commercial building worth $100 million pay their taxes as well as those who buy a house worth $500,000 but instead the default capital gains on income, is proposed a mechanism already easily manipulated by the super rich is proposed by the media, lefties and majority not something that actually is almost fool proof in collecting taxes and related to the actual worth of the asset, not through a manipulated process of income tax.

Likewise a financial micro tax on electronic payments could make NZ wealthy (the trick is to not be greedy and keep in small and simple) and once accountants can not manipulate it, the super rich will just pay it as long as it is not too arduous.

I remember when we got our weekly pay in a little brown envelope, it was cash with a small pay slip, now we have been forced to use banks and everything must go into your bank account. This was one of the worst privacy intrusions controlling us with our own income and many of us being taxed to death. Now many critical services like insurance have gone online to cut their cost but in the meantime their services costs are going up and up. It doesn’t seem right that we are charged more for everything but are receiving less, our local councils are also guilty of doing this.

The Wage Protection Act still allows for wages to be paid in cash by right for private sector employers or cheque for public sector employers.

Look…?

What do we have? We have hungry kids yet we have empty roadsides, parks and ‘recreation areas’ devoid of fruit and vegetable allotments. Who the fuck in their right mind would complain if hungry people started growing food along the road sides?

We have retired people living in cold dank poorly lit houses because they can’t afford the electricity bill to say nothing of most of everything else that costs a fortune in Gods Own Mate. BTW? The winter power bill top up is simply a windfall for the electricity retailers, what ever the fuck they do…? The Gold Card !? You can get discounts at the fucking Warehouse. Whoop De fucking Do! 10% off crap !

We have able bodied people living in cars at best who are more than willing to have a go at building a house/hut/shelter/shack/shanty/dwelling/ etc but they’re not allowed to drive so much as a nail in without a filling out a folder full of bureaucratic bullshit paper wankery which must be signed off by the ball cuppers to the neoliberal fascist regime whom we think we know of as Local Councils and their bi-laws drawn up, they lie to you, to protect we, the citizens. Bull fucking shit they are. They’re drawn up to protect fucking fletchers, placemakers etc.

fletcher challenge has been fucking us without the kissing for generations and they can find their way to our parliament in storms, darkness and plague to ‘lobby’ OUR politicians to ensure their ( our) money keeps rolling in.

I have an ex girlfriend living in AU who delights in sending me photographs of their cheap super market produce. I.e. Capsicums @ .40 c while ours are $4.99 EACH! .79 c for Cauliflower when ours were $8.00 each.

My point?

We’re far more fucked than we think we are and I think most of us would agree that we are, in fact, quite fucked.

Now here’s the kicker, as they yanks like to say.

IT IS OUR FAULT. NOT THEIRS.

We let them away with what they can get away with. Basically, we’re being bullied. All of us. You, me, everybody.

Well not me actually. I got into a literal fight with a senior council employee in a supermarket because he took a $45 K rate payer 4×4 to do his personal shopping in. I found him and I told him and he assaulted me so I defended myself.

My point is; if another’s being an arse hole, one must defend one’s self against the tyranny of the arse-hole.

We must come to terms with fronting up and saying ” No more of this shit. We’ve had enough. Fuck off ! ”

Our politicians are abysmal. They’re greedy arrogant fuckers, the lot of them. They waste our time, steal our money, sell our stuff, make life miserable and enduring for the unlucky, the unlovely and the unloved. Clearly, coming here to write angry comments seems to many is all we can do.

That’s not quite correct. Is it ?

We need to reform the unions of AO/NZ’s workers. Nothing else politically matters but for that. While AO/NZ’s work force is without unions we’re all fucked and the greedy rich scum who continually bite our hands that feeds them our money then we get UNIONISED.

And this must be the attitude: ” If you’re not going to sign up to the union, you’d better fucking not try to come to work.”

The funny thing about fascists is that they bring about their own undoing.

People who are arrogant enough to actually believe they’re better, smarter and are more able to manipulate and exploit others for their own personal gain are always the authors of their own demise.

” All your strength is in your union All your danger is in discord; Therefore be at peace henceforward, And as brothers live together.”

Henry Wadsworth Longfellow (1807–1882)

” Or, you are fucked !” Is something Henry might have wanted to add.

People? Baby steps first.

Remind yourselves daily. Your politicians are there because you voted for them and now you pay them to be there and you pay them far too much for what little they do. Work with that for while.

Sure, they’ll wail and moan and meander on about how hard they work for you but all I can say is where’s the evidence of that? Because look around? We’re fucked! When there’s one homeless person or one hungry kid we may as well all be hungry and homeless if the law of empathy is what it claims to be.

Otherwise we become accustomed to seeing hunger and homelessness and so what does that make us then?

Yep. The same as our oppressors. The fascist’s job’s done. They’ve molded us in to their image.

That, is why I reckon we’re fucked.

Here’s one for you, C.B.

Just replace Old England with New Zealand.

Johnny Collins – What Will Become of England

https://youtu.be/h_qfPE-pe6A?t=3

And the rest of you should take it to heart. This is what is happening in our fair land. A once egalitarian country who prided herself as such. Now those values are like dry bones in a tomb. Celebrating what once was yet turning a blind eye to curry favour to the wealthy overlords.

What have we become?

Why people are poor in NZ? With wages going down with big business like supermarkets benefiting from low wage labour while stiffing consumers for everyday products.

In spite of investigations from the Commerce commission, big business in NZ like supermarkets selling every day items, are not prosecuted in a way to make their prices go down for consumers.

“A one-litre pump bottle of sunscreen selling in Australian supermarkets for A$8.50 (NZ$9), currently sells in New Zealand supermarkets for $18.

The sunscreen in question is the Woolworths Everyday 1 litre SPF50+. The supermarket in New Zealand is Countdown. The supermarket in Australia is Woolworths, which owns Countdown.

This is a necessary product for many families, yet it’s priced as a luxury one.”

https://www.stuff.co.nz/business/123625273/are-kiwis-getting-a-raw-deal-on-sunscreen

Kiwifruit is now $9 per kilo in supermarkets…

Countdown – Green Kiwifruit $9 per kilo, Gold Kiwifruit $9.70 per Kilo

https://shop.countdown.co.nz/shop/searchproducts?search=kiwifruit

New world, green Kiwifruit, $8.99 per Kilo, Gold Kiwifruit $8.99 per Kilo

https://www.ishopnewworld.co.nz/Search?q=kiwifruit

Exploited labour is certainly not driving down the prices of Kiwifruit or sunblock here in NZ!

https://www.stuff.co.nz/business/123644402/kiwifruit-company-fined-230000-for-mininum-wage-failure

“Working people across the globe are caught in a dilemma. We don’t want an economic collapse because we know we will be the worst affected.”

The problem with this attitude is we are in an exponential growth curve of money supply. I prefer to look at M2 or M3 as a better representation, but even your M1 curve proves the point.

This money is being used to prop up a failed system, and each time the printing presses are fired up the transfer of wealth to the 0.1% fires up as well.

The poor are the ones who suffer under this system, and it is not going to magically right itself.

So while the task may be daunting, the poor are in a far better position now to take a major stance and force change with the threat of system collapse, than waiting until they are all forced on to the streets, defenceless, and face imminent collapse.

As Countryboy said, sometimes you need to stand up and face the bullies even if it means you may not come out of it too well.

But the bullies have more to lose than the poor, that is to the poor’s advantage.

The Christchurch chief executive bought in from the U.K earns 9,900 dollars a week not including her superannuation part of the package.

And the number of people in the council who are financially raping the people of Christchurch earning six figure salaries has climbed over the last year.

This country is filled with greedy parasites from the top down who exploit this countries people and they always can justify and have an excuse for their greed but watch them run and duck for cover when they should take responsibility.

mosa 100% 🙂 It’s disgusting while we have child poverty, homelessness, a whole generation unable to buy a house in the housing ponzi scheme, and a government that refuses to act to remedy the above. We’re governed by visionless greedy smug career climbers and Blaircinda is one of them. I’ve given up on this once good land.

Comments are closed.