If you take an economics textbook down from a library shelf the chances are that flipping through it you’ll see lots of charts and graphs and mathematical formula which give the impression that Economics is a science.

Well, that’s arguable. I think the reality is that while economists have some very good tools for predicting what might happen to our economy if you do this thing or that thing – never- the- less what you hear from them are educated guesses…even educated guesses can be wrong.

Back in August for example the Reserve Bank was predicting a 7% fall in house prices by the end of the year whereas the latest information is that house prices , on average are going to up to probably around 9% by the end of December,

That’s a 16% difference.

Why?

Well I don’t pretend to be an economist but one thing I do know is that we humans have survived as a species because we are adaptable. Put a fence around us and one of us will find a hole in it to escape and open up the way for others.

As the interest people can earn on their money in the bank has dropped so they’ve looked to invest in assets such as houses. Result? House prices have gone up.

Now the Reserve Bank is going to have to look at other levers the can put such the Loan to Value lending one because to nothing would be a threat to financial stability.

So .. what to do?

Well, when my working class parents came to New Zealand they worked really hard and after 5 years they had saved enough money for a deposit to build a new house.

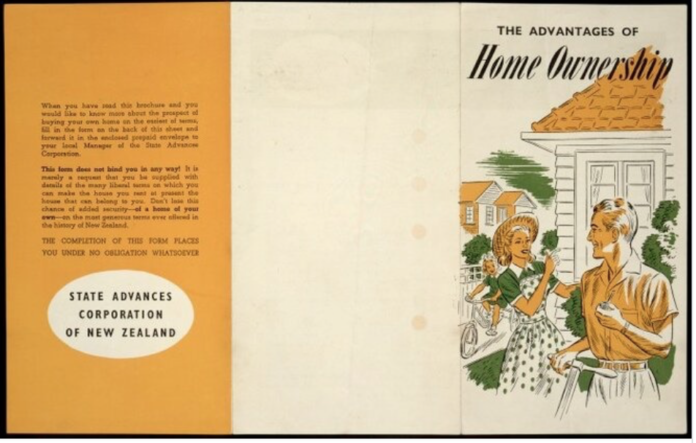

How? Because the government lent them the money through an institution which was called The State Advances Corporation who developed the subdivisions and directly funded builders to build the homes .

In short, the state was once actively involved in the mortgage market.

When we closed down The State Advances Corporation it effectively handed over the mortgage market to the private banks , who are of course driven by the profit motive not a people motive.

It seems to me that was a mistake, but when this government or any future government will fix that mistake – well, that’s anyone’s guess.

Bryan Bruce is one of NZs most respected documentary makers and public intellectuals who has tirelessly exposed NZs neoliberal economic settings as the main cause for social issues.

What is taught as economics and practised as economics in the western world is absolute bollocks. Resources are regarded as infinite; energy inputs are not accounted for, and environmental costs are disregarded altogether!

What is more, GDP is a faux measure insofar as it assigns positive values to negative activities. On the other hand, adoption of the Genuine Progress Index is vehemently resisted by economists because that would expose their gross incompetence over the past 5 decades, during which their reign has brought nothing but trouble. The rorts go on.

The above explains why we are in the predicament we are now in…of living in a post-peak-oil world that is undergoing abrupt climate change, and in which the Ponzi financial system is on the brink of collapse. As is the political system.

If he were alive today, Kuznets would be shocked at how his work was misused by those that followed.

We built our first home with a 5% State Advances loan. Three bedrooms, one bathroom on an empty section. We built our own fences, poured driveways and paths, built a garage and laid lawns and green. All done over about five years with the help of friends, family and neighbours. That’s how it was done by tens of thousands of Kiwi families. It is time to bring it all back!

You are spot on there Nic.

We followed the very same path as you back then, had no carpet for a few years.

We waited until we could afford it.

I often wonder why the same system is not put back in place, for first home buyers it worked a treat.

I was in the same era . No new furniture . 1 reasonable car and one banger .

The problem today is often council regulations health and safety rules and the attitude of the buyers wanting it all now .

+1 Nic181

Gessanomics. I like it.

Do these people really know what they are doing? They are the experts, right? Based on years of study and application of theory to practice. A bit like an engineer. Or medical specialist.

Nah, to call economics an imprecise science is too generous. More askin the the nutters running the nuthouse.

Keith Lockett, a dear friend of mine in the 70s/80s and extremely talented in physics and the classics but long deceased said: “Economics is not a subject and cannot be taught because there is not one principle that can be relied on from one day to the next.”

Nevertheless, millions of students have been subjected to the lunacy taught as economics over many decades since it was invented in the 1960s. And lots of short-term profits have been made from looting and polluting the planet and exploiting the masses.

No, economics [as practiced in the western world] is nothing like engineering or medicine, in which scientific principles of testing and repeatability and abandonment of theories subsequently found to be wrong is the norm. In economics, the worse the result, the more the ‘more leeches’ principle is applied. Got a problem with out-of-control debt: solve it by increasing debt levels! Got a problem with atmospheric CO2 (due to unrestrained emissions? : solve it by setting up financial scams centred on carbon credits and other financial bollocks…and see the atmospheric CO2 level rise inexorably because the source of the problem was never addressed!

Many have described what passes as economics as a total travesty of the Greek root of the world, which meant careful accounting of everything.

We know who is behind the travesty of economics, of course: the bankers, better described as banksters, since they have so much in common with gangsters. Their create-money-out-of-thin-air- and-charge-interest-on-it Ponzi scheme is totally dependent on the faux concepts of fake economics NOT being exposed.

Sadly. the dire state of affairs is not new. And not all economists are nuts :

“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist” is a quote that has been credited in 1973 to English-born American economist Kenneth E. Boulding (1910-1993). It’s not known when Boulding first said the quote.

Governments and the mainstream media dutifully comply with the banksters requirements of silence on the fake nature of economics and the ruinous effects of it -and we all suffer, as do most other species on this planet.

It’s about time economists were treated with the utter contempt they deserve!

But we know that’s not going to happen because they are part of the ‘club’ and are protected by the system. Therefore: “Things are going to get a lot worse before they get worse.” Lily Tomlin

I would personally change that quote slightly:

Things are going to be made a lot worse by economists and politicians before they get made worse by economists and politicians.

The window of opportrunity has closed … but in full agreement AWKTT. And yes, some economists are not fixated by infinite growth and are not captured by measures that ignore wellbeing or environmental costs. Seems though mainstream economics holds the fort, for the reasons you outline: in cahoots with the financial elite.

It goes deeper I feel. I am reminded of a book I read two decades ago (still have it and pick it up occasionally). Its not an easy book to grapple with but the main thesis is that an ideology of pure reason now prevails in many aspects of human life – not least in economics and politics – but ultimately serves no purpose other than to confirm how out of touch and disengaged decision-makers really are. As in line with the title of the book, Voltaire’s bastards offer nothing but illusion.

Putting this in the context of the serious issues we face, the application of pure reason is incapable of offering long-term solutions, just a series of interim measures that don’t address the issue and seem to make things worse. I am thinking of the two examples you give: out-of-control debt solved by increasing debt levels; global warming caused by unrestrained emissions solved by setting up a carbon credits scheme and the use of other ‘tools’. Many more examples. Yes, the source of the issue is never addressed. But it is almost like actors are paralyzed by their own reason.

Or something along these lines. My thoughts are a work in progress …

Please watch.

I think this TED talk by Rutger Bergman is important.

“Poverty isn’t a lack of character; it’s a lack of cash | Rutger Bregman”

https://youtu.be/ydKcaIE6O1k

The reality is nothing like this will happen again for working people. Not when the banks are so openly involved in money laundering for gangs and terrorists. https://www.icij.org/investigations/fincen-files/

I’ve always viewed Economics as the modern equivalent of Haruspicy .

The Haruspex/economist makes predictions on likely outcomes by examining the viscera of live and/or sacrificed animals or humans.

Could be that my chosen discipline of Physical and Social Geography , a complex and catholic scientific profession , was rendered extinct by the sudden and inexplicable rise of Economists ,as the go to public advisors.

Zero intrest for a year, go then grab that, you with your 20% $300.000. deposit in your solid built old State Auckland two bedroom home. Job, how long for your income to remain to service this, not long term debt used to be 30 years, our lending and your deposit will have it paid off in twenty years, is your job going to be that longevity, most these days are casual and without promise of future employment. Question, who are the banks lending to, no job security outside Government control has that promise that after the first year no intrest, will be able to afford the twenty year at least above 10% intrest coming their way.

Some one once said that God created economists to make meteorologists look good.

I suspect the policies achieve exactly what they are privately designed and predicted to achieve. Increased house prices increases the debt burden of normal people and increases the future assets and income of the banks. It also helps reduce the balance of payments problem by increasing the amount of foreign currency overseas buyers must provide to buy property.

We too often let governments of the hook when we say they are stupid and don’t realise the terrible problems their blinkered neo liberal policies will cause. I suspect they know full well what will happen. “Oh no what a terrible mistake’ they say. “Aren’t we stupid.” (and richer)

“Who would have imagined that legalising euthanasia would incentives the state to spend less money on life saving drugs, retirement income and rest-bite care, thus leaving more money to spend on needless luxuries”. “Aren’t we stupid” (and richer)

“Who would have imagined that banning cannabis would drive people to use stronger opiate based pain killers and make the pharmaceutical industry richer”. “Aren’t we stupid” (and richer)

etc etc.

Comments are closed.