The previous Labour Government took Capital Gains Tax (CGT)off the table after the Tax Working Group report, and then in the election promised not to introduce a Net Wealth Tax. While there is not a lot of wriggle room alternatives must be discussed urgently if the COVID recovery is to have any hope for a fairer, flourishing future.

Economists are warning that Inequality and housing affordability are only going to get worse as interest rates drop further. Let’s hope that this new government to not be like stunned possums standing in the glare of impending chaos.

Both CGT and Net Wealth Tax propositions were comprehensive, utopian and, sadly, flawed. An annual CGT doesn’t work in practice. It is game over once it is conceded that only the gains realised on sale can be counted for most assets, and that the family home will be excluded. Mercifully, we were spared agonising months of debate over how assets are to be valued at what start date, who values them, what costs can be deducted, how the family home is treated when it is partially used for business or rental, what exemptions apply, what roll over provisions apply, how inflation and capital losses will be treated, and what tax rate applies, to list but few of the complexities.

The short-term gains under the five years bright-line test is a backstop that needs to be strengthened, extended and properly policed to catch short-term speculation, but a comprehensive CGT is now a pipe dream.

The net wealth tax was doomed as well. Its comprehensive nature to make it fairer made it more complex. It had no sound narrative underpinning it and was easily ridiculed and exaggerated by the Opposition as attacking ‘hard earned’ success. If wealth is amassed from savings out of tax paid income, then a wealth tax looks like a double tax. It certainly managed to scare the horses.

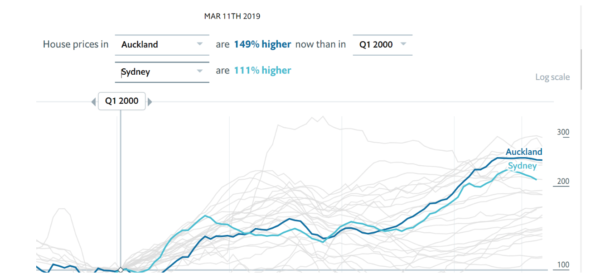

It is time to drop both comprehensive approaches and ask ‘what is the real problem that needs an urgent solution’? New Zealand is not alone seeing low interest rates fuel a housing bubble but the bubble in New Zealand astrides the developed world (see The Economist house price index) and its possible implosion is a grave danger to any fledgling COVID recovery.

Housing unaffordability is at the heart of poverty and the expansion of inequality. A shortage of affordable housing options underpins and reinforces poor outcomes while the wealthy accumulate ever more housing advantage. Market-based reforms in the 1991 “mother of all budgets” set New Zealand on the path of high and persistent levels of after-housing-costs poverty and divisive inequality. Today many families subsist in precarious labour markets or on impossibly low social welfare benefits and face impaired life outcomes with long-term mental and physical health issues. Much more redistribution is needed.

Policies are needed to extract more tax from the undertaxed owners of expensive real estate and residential land, both to restrain price rises and to provide a secure revenue stream. But the government has ruled out introducing any new tax.

One fruitful approach is to revive the narrative of comprehensive income tax. Using our existing tax system we can expand the base of what is captured under an income tax. The persuasive narrative is that income earned from holding assets in whatever form should be treated the same.

Just as we do for the taxation of foreign shares- where they are assumed to earn a 5% fixed rate of return and tax is paid on that, so we could have a tax on the potential income from holding net equity on housing rather than in the bank. Anyone investing in Australia shares/equites understands the mechanism.

Currently someone who has a $100,000 of net equity in housing is treated differently to someone who has $100,000 in a term deposit at the bank. The effect is to make investment in housing very attractive. The $100,000 in the bank will earn an annual interest of say 2%. This will be taxed at the marginal tax rate of the holder of the deposit. Likewise, each person’s total equity in housing and residential land after deducting registered mortgages, could be aggregated and treated as if it were earning interest in the bank. A gross interest of $2000 would generate a tax of between $210 and $666 (or $780 under Labour’s new top rate of 39%.

A wealth tax of 1% on $100,000 of net equity in housing is $1000 regardless of one’s marginal tax rate. Compared to a net wealth tax, treating net equity as earning at least a bank rate of return would be much more progressive.

A personal exemption of, say, $1 million would mean that most home-owners would be unaffected. Unless they have been the beneficiaries of inheritance, younger owners of high-priced homes are likely to have mortgages that reduce their net equity to below the exemption ($2 million for a couple). Older low income people with valuable mortgage-free housing may have significant net equity after the exemption but would pay tax at a low rate: if there is a liquidity problem it can be dealt with using postponement of the debt until sale.

Such a net equity approach has an inherent logic – investment in property should return at least as much as having the same money in the bank. It is fair that taxes are paid on the income for both.

Compared to intractable CGT problems, objections to expand the income tax net this way, such as landlords will “just load up their properties with debt”, or “put their houses in a family trust” or “can’t pay if there is no cashflow” are easily dealt with. Valuation is simple: the rateable values are readily available and regularly updated. No daunting valuation day is needed and over time, if house values increase for whatever reason, the rateable value will increase and with it, the tax base of net equity.

The housing stock would be better used than currently, and the overuse of scarce resources to build larger and more elaborate homes discouraged. Property would stop looking like a sure-fire way to investment riches. Empty houses currently held for capital gains might actually be rented. Houses might be fixed up to keep good tenants. Accountants’ fees to manipulate the profits and loss of renting along with negative gearing would disappear. Good landlords may find in fact, they are rewarded with a simpler system and higher returns than before, meaning there is no justification for rent rises.

The Government must be ready to act decisively and confidently in the first months of the first year of its second term, otherwise the chaos will continue.

Susan St John is Associate Professor of Economics at the University of Auckland Business School and Director of the Retirement Policy and Research Centre.

Surely as interest rates drop, housing becomes more affordable to buy?

Current issues with affordability seem to be demand driven aka OZ and Singapore investors can automatically buy any NZ property and anyone from overseas can often buy NZ new apartments.

https://www.alexanderdorrington.co.nz/buying-residential-nz-land-without-the-need-for-consent/

People do not have to live in NZ to buy NZ property. In Canada there is a 15% tax for overseas buyers to buy property in hotspot areas and it has dulled demand. This should be introduced in NZ.

New apartments in prime areas like NZ waterfronts that take up considerable building resources in NZ (the best builders, council time etc) , don’t seem aimed at the average Kiwi anymore on Kiwi wages…. https://www.thepacifica.co.nz/apartments/

Thats because the NZ property market is over inflated. By some experts as much as 40%. Driven by foreign investment that could have been shut out or watered down as Australia has done.

At the same time you have two main parties pushing a user pays neo liberal agenda that has seen public housing badly neglected leaving no alternative for people on low incomes.

My simplistic suggestion is to flood every corner of the nation with state houses/apartments complete with community gardens.

Add tiny houses for homeless and build relentlessly for a decade till neo rentiers, speculators and other exploiters are incrementally tamed.

New gen state housing could be guaranteed long term, rent to buy, or even transferable between tenants for vacation, study or work reasons.

Plus training, employment, suppliers and producers could all get a boost. Cut the worst private developers out of the loop and source pre built, flat pack or what ever works best.

Timid Tax tinkering seems a by product of 35 years of neo liberal individualism-“but what about meeeee!!…did I mention MY needs…”

The tide will turn eventually and it will be generation student loan and generation renting over priced dumps, that will do it as boomers fade out of majority political influence.

The tax base of any particular property will need to take into account any principal outstanding on a mortgage. This would seem to be an additional complication.

Not really. you take the CV at the begining of the tax year and deduct the outstanding mortgage

One of NZ’s biggest issues is that amount of profits that go overseas especially in banking….

I have yet to see the woke address this concern, instead campaigns seem to focus more on the easier extraction of wealth from locals, such as more money out of wage earners in NZ or just anybody that has paid off their mortgages with a wealth tax ….

Likewise for Superannuation, the woke failed to address the ability for elderly foreign pensioners who have only spent 5-10 years in NZ’s ability to claim the NZ pension and free health care and aged care and travel/power benefits while not having to contribute a cent to NZ. This has ballooned the super bill for the next generation … instead the woke seem to have campaigned for NZ pensioners who paid significant taxes in NZ as being rich, to not receive a pension….

No wonder there is such a brain drain in NZ and propaganda and echo chambers are the norm. How many people know for example that NZ’s fruit pickers are the most productive in the world…https://www.nzherald.co.nz/nz/teuila-fuatai-orchard-scheme-needs-to-be-picked-apart/ZGLTSCZFEFTTYHPOEQFEGT3F5E/ all we hear from media is how the industry can’t attract anyone… possibly because we encourage unworkable slave conditions in many sectors in NZ that those who live here are reluctant to take up, and those who come to NZ are surprised at the extreme levels they are expected to achieve.

As more overseas people come to NZ for jobs, infrastructure and housing and competition is increased for NZ’s locals. Places like Napier and Hawkes bay now have housing shortages. There is congestion, shortages of medical care and education all over NZ. The taxes of low wage earners and non earners like foreign pensioners, can not ever make up the shortfall in taxes and the inability for government to address the fundamental problems of NZ’s use of overseas labour/neoliberal immigration policies to hide our appalling laws on labour, our declining domestic tertiary sector, and many issues in NZ are not addressed by the so called experts.

Context, critical thinking and balanced reporting is absent now in NZ for our paid for/dirty politics mainstream views.

“I have yet to see the woke address this concern”.. And you won’t, ever.. The woke are so absorbed with themselves that all they can see is a reflection of their own faces… I’ve had some of these cretins promoting National party mp’s as “heros of free speech”.. It doesn’t get any sillier, or more delusional than a bunch of self entitled children in adult bodies… My advice is to completely ignore their drivel.. Like little children, if they don’t get the attention they crave, they will either get even sillier, or wake up, and get on with living in the real world.. Either way it’s a win..

@saveNZ

Hear!Hear!

Yes lets kick mum and dad investors in the proverbials whilst failing to get state housing schemes underway. Its only the latter that will make any real difference.

I’d prefer to see them lynched 🙂 But hey, if everyone has two properties, who’s gonna rent? Fuck the underclass renting in retirement if I can have one widdle inwestment pwoperdy….

Jacinda Ardern has ruled out both a capital gains tax and a wealth tax while she is prime minister. But how about a Rebuild the Nation Levy added as an extra line on existing rates bills? This, assessed on the unimproved land value GV and payable annually, would need to apply to all land, including that beneath the family home, but excluding dedicated reserves and communally owned noncommercial Maori land. The levy could be hypothecated to be specifically spent on buying land (taken under the Public Works Act if necessary) for building state rental housing, and for the building of those houses: 100,000 of them. Saturate the country with quality state rental housing paid for out of a universal land levy, and New Zealand’s housing problems will evaporate.

this is less progressive than what is suggested. Low income people living in poor housing may have large land tax while wealthy people living in expensive apartments may have very little land. also younger people are protected when mortgages are deducted

Yes you are right saveNZ and we know why. The cost of the land, labour and building materials make building houses too expensive. And we also know builders don’t make much money building two/three bedroom homes in the lower price range. ( if there is one now) Builders make money on the 800k and up priced homes. And when foreigners were allowed to buy up homes they fed this market and our builders got use to the bigger profits this practise provided. National let Fletchers have a monopoly of building materials creating less competition. The RMA may need to be revised but they have to balance changes with environmental and cultural issues not rail road the entire act as it is there for a purpose. The gentrification of many state housing areas is disgusting it has reduced the pool of homes for low income peoples, our disabled, our elderly, our mentally ill and our prisoners. Many of our prisoners are sitting in prison cause they have no where to live, this is appalling. And to make matters worse we have an aging population. So there is a lot of work to be done and we have to be careful bringing in too many people until we fix this housing dilemma. If companies want foreign workers then they need to look at providing decent housing, and they need to ensure they look after their workers.

Such a levy would, in effect, constitute a land tax, and would mean Labour breaking its promise of no new taxes, (other than the introduction of the new 39 cents/dollar threshold).

Perhaps the government should look at Melbourne where the price of homes has fallen by 20% and has been in decline for the last 3 years after a price explosing for years.

Constant bleating about the symptoms and never tackling the disease will achieve nothing, other than perpetuate the mess we are in.

The disease is Fractional Reserve Banking, with interest charged on money created out of thin air, on the basis that the economy will grow and that the Ponzi scheme can be maintained.

Well, economic growth is no possible globally (all the prerequisites for genuine growth have been used up), and since we are post Peak Oil and skidding down the slope of declining EROI (Energy Return On Energy Invested) the game is now extend and pretend.

What is more, whatever growth occurs locally simply exacerbates every other aspect of our collective predicament, as more energy and resources are squandered and the environment is ever-more contaminated.

The wisest action at this point in the game is to sell up and ‘get the hell out of Dodge’ before it all implodes.

However, the psychology of previous investment will deter the majority from doing what is required for self-preservation ‘as the ship goes down’, and the government will lie egregiously in order to prop up the collapsing system for just a little longer -one of the most important components of the phony narrative delivered by the government being hope.

Hope keeps people trapped in the dysfunctional system, which is good for the rest of us because the system needs uninformed hopers to keep the system running [just a little while longer] while we consolidate.

Meanwhile, in the real world, everything, including global finance, is falling apart at an ever-increasing pace.

For instance, just today (adding to an extensive catalogue of economic/financial disasters):

‘Japan has reported merchandise trade data for September and that wasn’t as buoyant as expected. Exports fell -4.9% when a -2.4% fall was expected, and imports fell -17.2% when a -21% fall was expected.’

In Australia, three firms trading in CFDs have been hit with fines totaling for than AU$75 mln for “systemic unconscionable conduct while providing over-the-counter derivative products to retail investors” by their Federal Court. Lose-only leveraged trading is behind the judgement. It didn’t help that evidence showed that account managers for the firms were instructed to “kill your customers”.

Wall Street has started the week lower with the S&P500 down -0.4% in early afternoon trade. Overnight European markets fell by a similar amount.

New Zealand Govt 10 year yield is little-changed, remaining at 0.55%.

The price of gold is up +US$9 from this time yesterday and now at US$1909/oz’

https://www.interest.co.nz/news/107595/china-records-good-q3-economic-growth-japan-trade-data-stumbles-australia-hits-cfd-firms

Sure, China is still managing to fudge the figures to make it look as though it is doing well, even as environmental factors devastate the place.

As for the US, well that’s a basket case, as I indicated would be the case towards the beginning of the year. Sure by running the printing presses at full speed the Fed is able to delay the day of reckoning a little, and create an even bigger catastrophe when it all finally does go down in the biggest crash in history.

Europe has now joined the basket case category, of course, as it continues with counter-productive policies that created the mess in the first place.

‘Interesting times’, indeed.

Keep the texts coming Afewknowthe truth, I for one find them highly informative and I agree with most of what you write.

” Low taxes on capital gains [ or none at all as in NZ ] create a vested interest in a bubble economy. In an economy of asset price inflation the objective of investors and speculators is to buy real estate, stocks and bonds whose price is being inflated by debt leveraging. the arbitage strategy is simply to borrow at a lower interest rate than the rate at which prices are rising. [ Also to rent out the property to cover the costs of rates R&M and the mortgage. Pending your capital gain]. The policy is to create financial wealth by financially engineering price gains. ”

J is for Junk Economics by Michael Hudson

My opinion: It’s baloney that a CGT cannot be levied I’d say at least 50% . Family home and beach house would be exempt. Houses are for homes not to make capital gains from. It’s scandalous the capital gain windfalls speculators are making. It’s a scandal our young couples can’t buy homes which are price inflated to scifi levels! And if they do they’re in debt the rest of their lives. Also a wealth tax shld be brought in. I suspect S.S.J is just another neoliberal econmist who has forgotten the early economists such as Adam Smith were primarily concerned about eliminating rentier privilege from the economy which privilege is now enabled by our F.I.R.E sector and the new religion of landlordism for capital gain! Suffice I’ll never vote laboppur again, not that I did.

” Amazing weather, beautiful beaches, plentiful natural resources, great standards of living and a fantastic education system… Australia deserved the title “The Lucky Country”.

But today Australians are world champions in private debt, the country presides over a massive housing affordability crisis and inequality rages – so what went wrong down under?

Real Estate commentator Asher Spira and Financial strategist Tony Locantro join host Ross Ashcroft to discuss. ”

https://www.youtube.com/watch?v=dPlVvKSItQA

Same lessons apply to NZ.

I’m confused why my texts are being classed as spam???? Why?

Put a huge tax on non-citizens owning and/or buying property in NZ.

State, that this is NOT a new tax on citizens, so they’ve NOT broken their promise.

That will create a LOT of money and use that to build LOTS of state housing. NO excuses, just do it and requisition land that is being land banked if needed. Explaining to the public that they are speculating whilst citizens live on the street and they had no intention any time soon of using the land. So for the benefit of the country the land has been purchased at the original purchase price plus any improvements. Nationalizing land-banks if you prefer that description.

How about a ban on non-citizens owning property (and a ban on them voting in “our” elections, too)?

Great work as always SSJ!

Just a little comparison to some of the talk of wealth: As recently as late last year, I heard from Work and Income staff that they have a maximum cap on savings for people to access the ‘Temporary Additional Support’ payment – a top-up that helps disabled people pay rent, because the Accommodation Supplement is too low – for even the most basic of rental properties. The cap on savings stated by Work and Income staff was just $1084 – and if Work and Income staff saw that the person applying was close to that cap, they would request a bank statement and do an interrogation. In other words, if a disabled person has more than $1084 in savings, Work and Income would refuse to provide the Temporary Additional Support payment, leaving the person unable to pay the rent for even the most austere of housing options – creating a cap on money in the bank.

I don’t know if that cap amount has changed now – I haven’t heard of any adjustments to it – but that is just completely … broken to say the least.

It also is outrageous that Work and Income _continue_ to police poor and disabled people’s relationships – the policy on checking whether someone is in a relationship “in the nature of marriage” is despicable and inhuman. Benefits must be individualised without delay.

It’s one law for those at the top – perfect liberty – and one law for those at the bottom – perfect captivity.

The time to act is now.

I have had no direct dealings with Work and Income. But anecdotal stuff confirms what you say, LR. Even with the word of ‘kindness’ fresh on everyone minds front line staff at W&I continue to be bullies. Why is this so? Is it the legacy of the late 80’s and 90’s? Does the work attract a certain type of person? Does W&I recruit a certain type of person? Surely it can’t be led from the Minsters Office. But surely the buck stops with Carmel Sepuloni, or whoever may take that role in the future.

Well it is not true that a 1% tax on all net equity is more progressive than the Greens proposal.

And how exactly would someone pay the “income” tax on the home ownership? The tax method for foreign assets is based on a presumption that dividends are earnt, actual cash.

Perhaps someone should do a poll to see whether the public thinks such a tax on a net equity is an income tax not a wealth tax.

The chances of this are non existent while the current leader of the Labour Party is PM.

PS How many votes did TOP get?

“Perhaps someone should do a poll to see whether the public thinks such a tax on a net equity is an income tax not a wealth tax.”

An equity tax is not a tax on home ownership as such. It is a tax based on the rent that one would receive if the home were rented out Rent received is income. The home owner is, in effect, his own landlord.

thanks for that mikesh. I think it could be presented as an expansion of the income tax base. L

ets stop talking about wealth taxes

Even the Green Party will not suppoort this. And the chance of Ardern believing that the dead wealth tax parrot can live on in this form as an income tax is zero.

Of course it is. It’s based on net equity in the home. Thus not applied on those without home ownership. And the amount of tax is assessed the same a wealth tax – not based on any actual income generated.

CGT is an income tax because its only paid when income is generated by sale.

What next, taxing the net equity in a car because oif the free use of something owned? If its based on owning something, its an asset or wealth tax,. If its on rent income or realised sale gain, its income tax.

PS the tax on offshore investments is based on presumption of the generation of income – dividends and the like. It’s a simplication for local tax purposes and it comes out in the wash in the end downstream.

SPC The idea is to reframe it as a taxing all returns to wealth the same. WE dont call the tax on interest on bank deposits or tax on dividends from shares ‘wealth taxes’. The CGT is unworkable as in practical terms it only applies on realization and cannot capture past untaxed capital gains. If people have net equity in housing earning no cash return there must be an implicit return of at least what the bank is paying. It is about horizontal equity in the treatment of all income- implicit or direct. it is not perfect- but it has a credible narrative and what other way forward is there?

Sure as to narrative, a CGT applied in 1984 (Douglas was supposedly working on an assets tax alternative and in the end did neither) would have served us well. As would National not ending gift and estate tax in the early 90’s.

You might see a tax on home equity as restorative. But most nations do not apply CGT to the family home (except where it is in the top percentile) and they exempt smaller estates (average home) from the tax.

So in that sense a net equity tax is more regressive, as it includes all and has no progressivity (Greens only above a threshold and 1 or 2% rates).

Then there is collection of it as income tax when there is no income (interest and dividends are income) received. People also invest time to grow their own food in gardens or to hunt and fish – yet this saving on buying food is not taxed. Why should rent cost saved by ownership of property be regarded as income?

One option, given the long political delay in introduction of a CGT, is to make it retrospective and assess the CG from the time of original cost at purchase. And so of course is an estate tax to get all the wealth accumulated buying and selling property before that CGT. These two things and the Greens wealth tax are where my support lies.

And the beauty of that a lot of money, and most homeowners would not pay a thing (below the estate tax and wealth tax thresholds) and thus its electorally possible.

That is my preference.

Taxing all homeowners is why TOP never got traction. The best argument for it is that is that those who rent are struggling to pay their bills and cannot pay more tax whereas many of those who own property could (lower mortgage costs). But when government can and is borrowing (printing money) so cheaply this is not an immediate problem. But calling a net equity tax, an income tax, when some do not have the income to pay for it, is always going to be a problem (maybe bring in an exemption for those on low incomes or have deferral to the estate).

PS We need a global campaign to write off pandemic debt, debt occuring to support the economy through lockdown. This burden to nation states is affordable now, but not if carried over to the next generation as debt costs return to norms. And easing the debt burden now, while debt is still cheap, might encourage earlier action on global warming.

Sweden built one million homes in ten years between 1965 and 1974 when the country’s population was eight million. They pulled down 350,000 for a net gain of 650,000.

One third high rise flats, one third low rise flats, one third ordinary houses.

The New Zealand equivalent would have been Kiwibuild with a target of 625,000 new dwellings (not 100,000) and actually achieved in ten years, not scrapped.

See https://en.wikipedia.org/wiki/Million_Programme.

Good way to soak up unemployment, too.

We are just going to have to hope property investors flush with cheap cash from banks will buy up sections and do the same. Buy one section and build 4 houses etc.

How to arrange for this, the RB restricts finance to investors unless its for property development or the government place a stamp duty on their buys – a duty exempt, if the investment is for such development?

People are not comparing apples to apples here. In most countries that have a CGT, it does not kick in until about 600,000 USD — other countries simply do not have enormous PAYE + a 15% GST on everything including basics (clothing, fruit and vegetables) By virtue of PAYE and GST we are already double taxed. It is illegal in other countries to have a tax on a tax, but not here. So those trumpeting for a CGT don’t realize we already have one with the bright line test, and those advocating a “LAND TAX’ don’t realize that most of us all already paying RATES? We are taxed to death in this country with a very dismal health care system (people die waiting for treament here) — it all needs to be fixed and raising taxes aint gonna do it peoples…..

Comments are closed.