World capitalism got out of the 2008 and 2020 crises with massive debt creation.

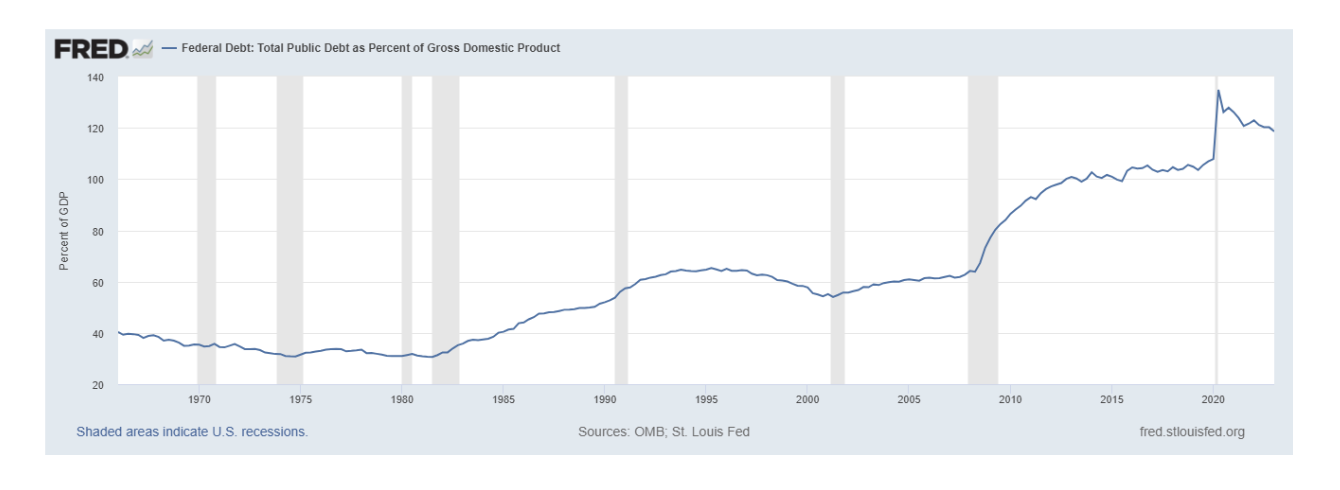

The US public debt is the most important indicator of this process of debt creation because of the weight of the US economy. From about 60% of GDP before the 2007 crisis, it exceeded 130% after the 2020 recession.

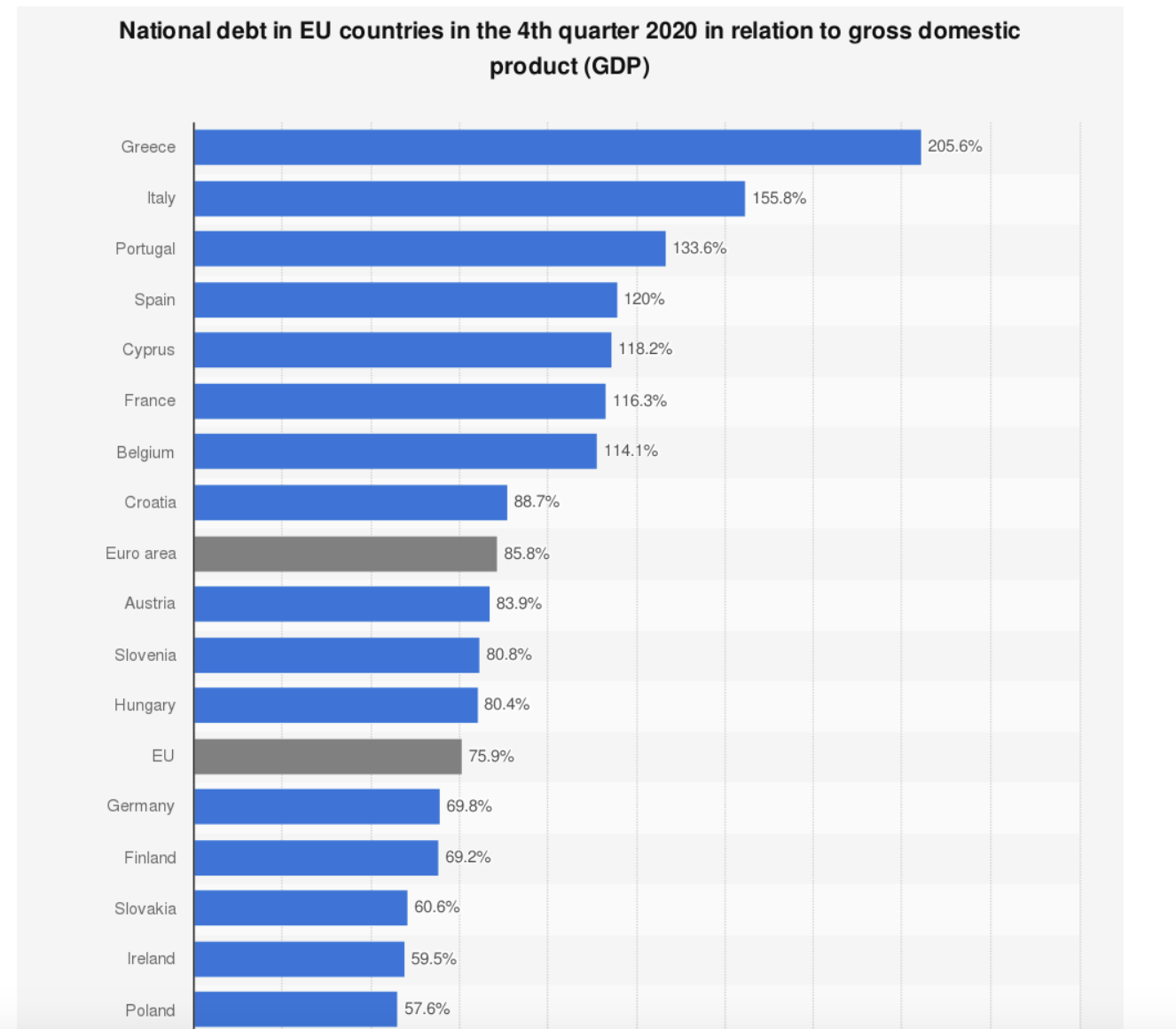

In the EU, the average debt-to-GDP ratio was 88% at the end of 2021. Although the EU’s founding Maastricht Treaty provides for a maximum of 60%, many countries are well above the 100% of GDP level, as the table below shows.

In 2020, on a global level, according to the International Monetary Fund, “we observed the largest one-year debt surge since World War II, with global debt rising to $226 trillion as the world was hit by a global health crisis and a deep recession. Debt was already elevated going into the crisis, but now governments must navigate a world of record-high public and private debt levels, new virus mutations, and rising inflation.

“Global debt [public and private] rose by 28 percentage points, to 256 percent of GDP, in 2020 [i.e., in the course of one year] … The global public debt ratio jumped to a record 99 percent of global GDP.”

At the end of World War Two, total debt after the massive borrowing to pay for the war, was around 100% of GDP. It remained around that level until the end of the 1970s. Besides acting as a brake on government spending in terms of fiscal policy, this avalanche of debt, coupled with rising interest rates, will push several economies toward default. This applies to some heavily indebted rich countries like Greece and Italy but will savage many poor countries.

The debt problem is not only affecting states but also corporations. There is no offocial standard for “Zombie” firms unable to service debts so estimates vary as to the number. Seeing Alpha reports: “In 2021 Goldman Sachs reported that some 13% of U.S.-listed companies ‘could be considered’ zombies, which it called ‘firms that haven’t produced enough profit to service their debts.’ The Federal Reserve study found that only roughly 10% of public firms were zombie companies in 2019. Finally, a Deutsche Bank study by Jim Reid in 2021 found that over 25% of U.S. companies were zombies in 2020.”

Bloomberg reports that zombie company debts total $900 billion. This is not only a US phenomenon. Zombies account for more than 20% of Europe’s companies, according to DW.

High-interest rates will make it much more difficult for these companies to re-finance their debts, which can lead to defaults – which in turn means mass layoffs of workers.

The world is also being hit by a double whammy of war-induced shortages and price rises for basic food, fertiliser, and other commodities. This will accentuate the downturn.

The US currency is rising against most others because there is a flight of capital to the safety of the world’s biggest and safest financial market. This means the poor countries’ debt, usually in US dollars, is getting increasingly unpayable.

As Oxfam notes in a new analysis, during the pandemic’s second year (from March 2021 to March 2022), the IMF approved 23 loans to 22 countries in the Global South – all of which either encouraged or required austerity measures.

Global poverty accelerating

The International Monetary Fund has announced that the global economy is entering a major slowdown, downgrading the growth prospects of 143 countries. At the same time, inflation rates have reached historic levels. Around the world, hundreds of millions of people are falling into poverty, particularly in the Global South. Oxfam has sounded the alarm that we are ‘witnessing the most profound collapse of humanity into extreme poverty and suffering in memory’.

David Beasley, the director of the UN World Food Programme describes the situation in the following terms: “Even before the Ukraine crisis, we were facing an unprecedented global food crisis … Then, we thought it couldn’t get any worse, but this war has been devastating.”

He added: “…the number of people suffering from ‘chronic hunger’ had risen from 650 million to 810 million in the past five years… the number of people experiencing ‘shock hunger’ had increased from 80 million to 325 million over the same period. They are classified as living in crisis levels of food insecurity, a term he described as ‘marching towards starvation and you don’t know where your next meal is coming from’…

“… after the economic crash of 2007-09, riots and other unrest erupted in 48 countries around the world as commodity prices and inflation rose… The economic factors we have today are much worse than those we saw 15 years ago,”

If the crisis was not addressed, he said, it would result in: “famine, destabilisation of nations and mass migration”.

And concluded: “It is a very, very frightening time. We are facing hell on earth if we do not respond immediately.”

But the World Bank and IMF solutions for the crisis these nations face are more free market and privatisation policies. This is what is now being imposed on bankrupt Sri Lanka as the price of a bailout from bankruptcy. It is the price the Zelenksy regime in Ukraine has agreed to pay for Nato support against Russia.

The climate crisis is also being compounded because the capitalist crises and imperialist wars are driving up the production of planet-destroying energy sources. Capitalists have no alternative but to be capitalists, and the planet is doomed if we continue business as usual.

Covid-Aftermath boom

The cause of the current crisis is the overproduction of commodities in the COVID-aftermath boom. The entire history of capitalism since the early 1800s has been marked a cyclical movement of boom and bust every decade or so. Marx dubbed the ensuing crises as crises of overproduction. This was not overproduction in terms of human needs but overproduction in terms of being able to sell the commodities at at least the average rate of profit.

After the 2007‒09 bank crisis and the Great Recession, capitalists were cautious about accumulating inventories and investing. This prevented a new worldwide overproduction crisis for some years at the price of lingering unemployment and eroding living standards. Stagnation appeared to be “the new normal for the world economy.”

However, by late 2019 signs of overproduction were again developing, causing a spike in interest rates, though the situation had not yet reached a crisis.

But then came COVID. In March 2020, the ruling class feared the virus would decimate the working-class population to such an extent their ability to squeeze surplus value out of the survivors would be impaired. They used state power to shut down much of the economy, throwing millions out of work overnight.

The COVID shutdowns also caused a forced underproduction of commodities and a reduction of inventories.

When the shutdowns were eased, the boom began to rebuild inventories as demand for commodities soared. Demand exceeded supply at prevailing prices, resulting in high prices and higher profits. There was a rise in demand for labour power. But wages didn’t keep up with inflation, so real wages declined.

The Critique of Crisis Theory blog highlighted the accelerating signs of crisis in a post on May 22 headed ‘”The Phony Crisis, the Real Crisis, and the Whip of Hunger”. It noted:

The massive overproduction resulting from the COVID aftermath boom has pushed the economy to the brink of what could become a deep recession. This is shown by the collapse of four regional banks, as well as by leading indicators such as the relationship between short- and long-term interest rates, called the yield curve — and measures of the money supply, dollar bills, coins, and bank deposits, that function as currency. The yield curve has not been so inverted — short-term interest higher than long-term — since the early 1980s. The global money supply, a predictor of approaching recession, has also been contracting at rates not seen since the super-crisis of the early 1930s.

If this was not enough, the dollar price of gold has been above $2,000 for several weeks as I write these lines on May 13, 2023. Its significance is that if the Federal Reserve System tries to stave off the crisis by moving to reverse the contraction of the global money supply, a run on the dollar could develop that has the potential to sink the dollar-denominated international monetary system, the financial foundation of the U.S. empire. Many countries have already built up gold reserves and taken other steps to reduce their dependence on the dollar.

Whenever a global crisis of the overproduction of commodities approaches, governments come under pressure to limit their borrowing and spending. When plenty of money and credit is available, central governments can borrow without reducing the quantity of loan money available to the rest of the economy. But when loan money starts to dry up, as it does just before a recession, government borrowing accelerates the credit crunch in the economy.

The recession in the US is happening now. Recessions set in when the credit system contracts due to a shortage of ready cash. This forces business to cease over-trading and overproduction and shift to liquidating previous overproduction.

The US Fed faces a dilemma. It needs a recession to eliminate overproduction. But a recession before the 2024 election could result in the election of Donald Trump who is feared by many in the ruling class for his erratic and dictatorial pretensions.

So the US Fed is hoping for a soft landing by pausing the series of interest rate rises in June 2023. However, the rate increases resumed on July 27 and at 5.5% is the highest level in 22 years with more rises indicated.

Monetarist economists accuse the Fed of being too weak. Keynesians generally accuse it of being too hard.

This debate around how effective monetary policies are in regulating the ups and downs of the business cycle is not one working people have a stake in. Neither side has our interests at heart.

Just a question. Who is the debt owed to? With a trade imbalance, we must owe money for the excess imports. But in order to reduce the deficit by increased taxes means that the money in circulation in the public domain must decrease and make the public surplus into a public deficit> Correct?

The debt is owed to whoever you lend the money from, in the situation with QE or other artificial increases in the money supply the currency is obviously worth less which reduces our ability to import, causes inflation & increases the debt burden on future generations in various combinations. The only thing you can be sure of is that those at the top of the heap will suffer the least if at all.

Let’s do the time warp, AGAIN?!? So very sad that so many did not listen to Split Enz “History Never Repeats” as a good lullaby for waking up to reality!

the middle class should understand the neo-libs having squeezed the poor till the pips squeek are coming for YOUR assets…house, savings mortgage payments, pensions, aged care, insurance, foreclosures etc etc etc enjoy the treatment that was meted out to others.

Don’t worry, the plutocrats will be careful. Debt will only rise as high as they think the poor will manage to pay without revolting when or if the debts are called in.

” Debt will only rise as high as they think the poor will manage to pay without revolting”… That would be wishful thinking at best… If you’ve ever had to go days without food, then you can tell me what kind of mood the “proletariat” will be in.. It won’t be a forgiving one, I can guarantee you.. The wealthy have one major weakness, in that they have no idea of what ordinary people will descend to (or raise to) when they are pushed hard enough.. You give those “elites” more credit for brains than is justified..

As a child, I was moved from Otara, to my Fathers state house in Remuera.. It was there that I first started to get to know the children of NZ’s wealthiest, and they proved to be utterly ignorant of anything “below” their station in life…. Nothing has changed, and the ignorance, and bigotry that has been the British way since they discovered there were opportunities to rape and plunder countries, and people who simply didn’t possess the engineering/industrial skills and knowledge to fight them… What makes people think that the Brits are any smarter than those they tried to wipe out? Since being trapped her by a family emergency, I have had many opportunities to gauge the average IQ, and the level of maturity regarding political/economic debate here, and it’s utterly shameful, in that most of what passes for “debate” here is nothing more than self absorbed, small minded, and childish name calling… Your assumption that there is a conscious effort being made to limit gouging to a point below where revolution is triggered is to massively overestimate the intelligence of the descendants, and beneficiaries, of NZ’s British colonial power structure… These people will resort to brutality the second they feel pressure from below, and If you think otherwise, you haven’t been listening..

Comments are closed.