Marx’s theory explains the business cycle and the need for crises – no alternative exists 150 years later.

Marx had an integrated value theory that explained how the so-called business cycle operated. The perfected labour value theory requires a money commodity to make it work. This is not a “nice to have” part of the theory. It is essential to making it work.

Marx’s perfected theory also allows us to disprove and reject the three fundamental pillars of all bourgeois economic theory.

Modern neoclassical economics is based on the trinity of Say’s law, the quantity theory of money and the law of comparative advantage. This trinity is found in Ricardo as well. While Marx inherited and greatly deepened the Ricardian labor-based theory of value, neoclassical economics took over the Ricardian trinity rejected by Marx while discarding the Ricardian labor-based theory of value. Wikipedia summarises Says Law as follows.

“In classical economics, Say’s law, or the law of markets, is the claim that the production of a product creates demand for another product by providing something of value which can be exchanged for that other product. So, production is the source of demand.”

Under Say’s law, there can be no “overproduction” crisis because production creates its own demand. Marx dismissed this theory as that of a “trivial thinker”. Commodities don’t create their own demand. Exchange, Marx explained, can be interrupted by any number of factors. Say’s Law can be undermined by money hoarding, for example, when an interruption or delay in the circulation of commodities drags aggregate demand below aggregate supply; but if the money hoard consists of a produced commodity, which for Marx is gold, then hoarding can be considered to be just one form of commodity demand. The history of capitalism is proof that Marx was correct.

The Quantity Theory of Money, supported by Ricardo, argues that prices and wages are directly commensurable to the ratio of the number of commodities on one side and the quantity of money on the other in circulation. If the quantity of money in circulation halved, prices and wages would halve. Alternatively, if the quanity of money doubled prices would double. Monetarists use this kernal of truth to criticise central bank policies without understanding what money actually is.

This theory is needed for the operation of free trade. Ricardo argued that if a country ran a deficit, money would flow out, prices would decline, and therefore become more competitive internationally, and so would eliminate the trade deficit. To produce this result, Ricardo argued that in national markets, absolute advantage prevails, but in international markets, comparative advantage operates. But that notion is also disproved as it is obvious today that the world market determines prices.

Marx used the crises in the UK in the mid-19th century to prove that Ricardo’s theory did not work in practice. When money (in this case gold) flowed out of the UK when it ran a trade deficit, prices did not decline. What happened was that interest rates rose and forced the economy into a recession to restore balance.

Bourgeois economists view interest as simply the reward that capital receives for holding money. Marx saw interest as being governed by the supply and demand for gold. That is why central banks, in the last analysis, can’t control interest rates; the market does. It is inevitable that as the business cycle peaks, the demand for money capital peaks, and interest rates will rise and choke off the recovery. As the crisis deepens, money capital is accumulated and becomes more abundant, and interest rates decline, restoring the profit of enterprise and the desire to invest and produce more goods.

If the monetary authority allows the token money to depreciate as shown by a rising “price” of gold, the money capitalists will defend themselves by demanding a higher rate of interest. And they have the power to collectively enforce their will. This collective money power is greater than the powers of the central banks.

This rise and fall in interest rates is part of the proof that gold remains the money commodity.

Marx did, of course, have a quantity theory of money when it came to token money. But if token money is halved, prices double, the opposite of what Ricardo predicted.

In the history of capitalism, who has been proven correct? Have trade balances been restored by free trade? Has the business cycle been eliminated? Has the gold price plummeted because of the reduction in demand? Post-Ricardo, bourgeois economists adopted marginalism as an economic theory. Marginalism argues that free-market capitalism would tend toward zero growth. Has that happened anywhere not subject to brutal US sanctions or war?

Marx predicted capitalism would be a system of expanded reproduction, and continual overall growth but with repeated crises. Has that happened? He predicted it would conquer and transform the globe in its image. Has that happened? He predicted there would be concentration and centralisation of capital. Has that happened?

We should be super proud of the old man. No one has surpassed his insight into how the system works, why it must be overthrown, and why the working class is and will remain the only class that can do that.

Trying to stop the law of value operating is doomed

The operation of the law of value under capitalism as explained by Marx, led to industrial cycles of boom and bust that ultimately produced a larger and more powerful system of production that conquered the globe. The system would rebound more strongly during periods of recovery if the laws of motion governing that system are allowed to do their magic. That continued to be true after World War for two for three decades because of the depth of the Great Depression and the suppressed demand for consumer goods as a consequence of the War itself.

Since 1987 central banks have reflated the bubble with more token money. We now have the biggest distortion from values in capitalism’s history. Bringing this back to balance will most likely require another Great Depression. The scale of the rescue operations has become staggering. This Financial Times report reprinted in the January 31, NZ Herald notes:

“Since 1980, the US economy has spent only 10 per cent of the time in a recession, compared with nearly 20 per cent between the end of the second world war in 1945 and 1980, and more than 40 per cent between 1870 and 1945. One increasingly important reason is government rescues. Combined stimulus in the US, the EU, Japan and the UK, including government spending and central bank asset purchases, rose from 1 per cent of gross domestic product in the recessions of 1980 and 1990 to 3 per cent in 2001, 12 per cent in 2008 and a staggering 35 per cent in 2020.”

Both the Keynesians and the monetarists have attempted to stop the law of value from operating with full force by using fiscal or monetary policies to stop a deep recession happening that would clean out the least productive capitalists (industrial or financial) and reward the most efficient and productive capitalists. The only results possible by these policies have been either an inflationary crisis or an explosion of debt that can never be repaid. Today, protecting that debt from the operation of the market to reveal its true value drags the entire system toward permanent stagnation and depression.

Financialisation

The current crisis has been accentuated by the financialisation of economic activity over the last three decades following the Volker shock. This has created a tiny financial oligarchy that controls most economic activity on the globe. Financialisation was also associated with an explosion of all forms of debt – personal, government, and corporate debt. But rather than this debt being used to accelerate growth under capitalism, the greed and predations of the dominant financial oligarchy appear to have become a brake on the system. Growth over each of the last three decade-long cycles has been progressively weaker despite (or maybe because of) the ever-growing debt.

But this financial oligarchy calls the shots on what type of government policies are considered acceptable. The debt market and interest rates are used to police those governments when necessary. This is especially true when it comes to monetary policy. After the inflationary 1970s, it was an article of faith that no government would be allowed to simply print money and spend it – especially on social programmes that benefited working people. Tax cuts for the rich were OK because that caused the governments to be even less able to spend money on anything useful.

Central banks were removed from government control and made “independent” to prevent inflation beyond 2-3%. Many governments, including both Labour and National in New Zealand, turned the need to always run budget surpluses into religious dogma. All those dogmas have now been abandoned without explanation. Pushing back against complaints about their policies, the New Zealand Reserve Bank Governor Adrian Orr simply asserted that booming house prices were a “first-class problem” and that the alternative is “recession or depression” (13/11/20). That may be true, but we have a right to discuss alternatives to how the money being created should be used.

Essentially the world has gone through two crises over the last few decades where it became necessary to print money on a vast scale and simply hand it to the 1% who control the banks and other financial institutions to use to facilitate payments between themselves. No alternative policies have been allowed by the “independent” Central Banks and governments serving the 1%.

The following warning from Nouriele Roubini shouldn’t be dismissed out of hand:

“For now, loose monetary and fiscal policies will continue to fuel asset and credit bubbles, propelling a slow-motion train wreck. The warning signs are already apparent in today’s high price-to-earnings ratios, low equity risk premia, inflated housing and tech assets, and the irrational exuberance surrounding special purpose acquisition companies, the crypto sector, high-yield corporate debt, collateralised loan obligations, private equity, meme stocks, and runaway retail day trading. At some point, this boom will culminate in a Minsky moment (a sudden loss of confidence), and tighter monetary policies will trigger a bust and crash” (2/7/21).

The Federal Reserve System faces a quandary: If it creates more dollars not backed by gold to keep the boom going, profits in dollar terms would remain high for a while but turn negative in gold terms. This would cause capitalists to transform as much of their capital as possible into gold. The resulting run to gold would accelerate dollar inflation and threaten to bring down the dollar-centred international monetary system.

On the other hand, if the Federal Reserve allows the bank money system to become paralysed by bank runs, the dollar would be saved, but the economy would fall into a second Great Depression.

So the Federal Reserve is attempting a middle way: to keep the system of bank deposits as currency functioning, without bringing down the dollar’s role as the world currency — and other currencies linked to it.

The aim is to achieve a relatively soft landing, even if that means a recession with millions losing their jobs. But if the Federal Reserve is successful, it will keep a recession from turning into a depression, while saving the international monetary system.

Whether the Federal Reserve can pull it off this time remains to be seen. But even if it does, the world will face a similar crisis again in a decade or so.

Huge Growth In Inequality

The direct consequence of handing the financial oligarchy trillions of dollars in the midst of one of the worst economic crises in human history is that the 1% has hugely expanded its wealth and power with inflated asset prices, and stock market values over the past years. Michael Roberts reports:

“The top 1% of households globally own 43% of all personal wealth while the bottom 50% have only 1%. The 1% are all millionaires in net wealth (after debt) and there are 52m of them. Within this 1%, there are 175,000 ultra-wealthy people with over $50m in net wealth – that’s a minuscule number of people (less than 0.1%) owning 25% of the world’s wealth!”.

Working people across the globe are caught in a dilemma. We don’t want an economic collapse because we know we will be the worst affected. So, actions by governments to “rescue” the entire capitalist system of finance and production and trade are needed. But if we are going to do that, why don’t we place the commanding heights of the economy, especially in the area of finance and money creation, into the hands of a publicly-owned and democratically controlled entity rather than simply hand the 1% our cash as if they have some God-given right to it? We have socialised all risks associated with private banking, so why not socialise banking itself? We must now build for a future that involves putting people and the planet before the pursuit of private profit.

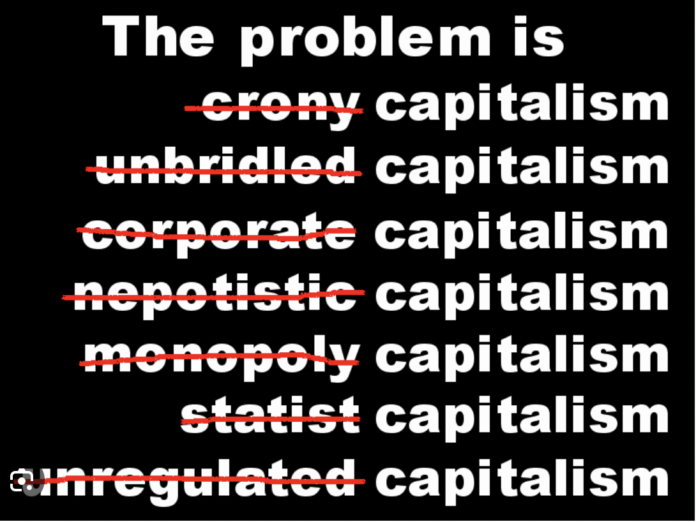

The current combination of policies to combat the pandemic and associated economic crisis – which involves both a monetary and fiscal explosion – will sooner or later lead to an implosion of the entire credit and monetary system and along with it the system of capitalist production itself. The alternative is not to let capitalism operate without any limits in terms of subjecting all labour and the planet to its uncontrolled passion to exploit all and everything for the private benefit of a tiny class of owners. The planet cannot survive another few decades of the same old shit.

Working people need to put forward solutions in the here and now that protect our class and the planet we live on in an immediate sense. Those immediate demands can form part of a programm to transform the way we produce and live with each other. But we should do so with our eyes open to the fact that this system cannot accommodate what we need without generating new forms of crises.

The creation of money, in all its forms, should be a publicly controlled process without capitalist greed periodically putting entire financial systems at risk and we end up having to bail them out because of their greed and that they are “too big to fail”. This is effectively what happened in Ireland, the UK and the US after the 2008 crisis and we should make sure we do not repeat similar policies this time as we face the economic dangers ahead.

We must be prepared to go beyond a system based on private greed towards one based on human needs – a socialist world.

As George Monbiot said we need to create a new narrative/story to Stoke the working class out of the quagmire. Giving them hope and hopefully changing the economic direction. It going to take a new charismatic leader outside the main status quo.

Marx? He died a stateless pauper in London?

Yep, that what’s having no social security can do to people.

Leave them poor and destitute.

Just another victim of capitalism.

You’re right to highlight this Bob. Marx’s own personal lived experiences backed his insightful and correct critique of capitalisms many failings.

Glad you are cottoning on.

Thanks Jase but as you know I’m pointing out what a dismal failure he was.

You are saying his personal circumstances somehow render his critique and analysis of Capitalism’s failings as incorrect.

In that case, you should apply the same standard to painter Vincent van Gogh, composer Franz Schubert, artist and poet William Blake, author Herman Melville, writer Oscar Wilde, inventor Nikola Tesla, author Edgar Allan Poe, painter Johannes Vermeer and many many others and call their works all worthless and invalid.

Sorry to be blunt but your reasoning, or lack thereof, characterises so many of the right wing nut jobs who leave spurious comments here.

Marx’s theory explains capitalism’s business cycle and the need for crises (And War)

Financialisation was also associated with an explosion of all forms of debt – personal, government, and corporate debt. MIKE TREEN

https://www.tandfonline.com/doi/full/10.1080/13563467.2019.1613349

The 2014–15 Financial Crisis in Russia and the Foundations of Weak Monetary Power Autonomy in the International Political Economy

Ilja Viktorov & Alexander Abramov

Alexander Abramov is Professor of Finance at the Russian Presidential Academy of National Economy and Public Administration, Moscow, Russia. His main research interests span the development of financial markets in Russia, with a special focus on institutional investors, including pension and mutual funds.

https://documents1.worldbank.org/curated/en/242221468780001198/101501322_20041117153502/additional/multi-page.pdf

DIVIDING THE SPOILS:

PENSIONS, PRIVATIZATION AND REFORM IN RUSSIA’S TRANSITION

Ethan B. Kapstein and Branko Milanovic

…..For our purposes it is critical to emphasize that western analysts have tended to contrast Russia’s privatization “success” with Poland’s failure to achieve similar results.

As Andrei Shleifer and Daniel Treisman have written, “…in privatization Russia moved far ahead of Poland. In mid-1994, as Moscow wrapped up its mass voucher privatization, Warsaw had barely started its own.”33

As already noted, it may well be that, from a social welfare perspective, it is Warsaw that had good reason to delay its own privatization scheme….

….the lessons to be drawn from the Russian case are more general. The

Russian case may be an extreme example of the role of political economy in policymaking. This is because of the openness and flagrancy with which the favors were given by government, and the electoral support (money) provided in return. But the same behavior –endogeneity of economic policies—exists elsewhere. The selling of favors may not be as open, and misbehavior may not be as egregious, but the difference is rather one of degree than of kind….

https://www.cfr.org/backgrounder/ukraine-conflict-crossroads-europe-and-russia#:~:text=Ukraine%20became%20a%20battleground%20in,annexed%20the%20territory%20of%20another.

Ukraine: Conflict at the Crossroads of Europe and Russia

Ukraine’s Westward drift since independence has been countered by the sometimes violent tug of Russia, felt most recently with Putin’s 2022 invasion.

…Ukraine has long played an important, yet sometimes overlooked, role in the global security order. Today, the country is on the front lines of a renewed great-power rivalry that many analysts say will dominate international relations in the decades ahead….

…..Ukraine was a cornerstone of the Soviet Union, the archrival of the United States during the Cold War. Behind only Russia, it was the second-most-populous and -powerful of the fifteen Soviet republics, home to much of the union’s agricultural production, defense industries, and military, including the Black Sea Fleet and some of the nuclear arsenal. Ukraine was so vital to the union that its decision to sever ties in 1991 proved to be a coup de grâce for the ailing superpower…..

….The hostilities marked a clear shift in the global security environment from a unipolar period of U.S. dominance to one defined by renewed competition between great powers [PDF]…..

….Russia was for a long time Ukraine’s largest trading partner, although this link withered dramatically in recent years. China eventually surpassed Russia in trade with Ukraine. Prior to its invasion of Crimea, Russia had hoped to pull Ukraine into its single market, the Eurasian Economic Union, which today includes Armenia, Belarus, Kazakhstan, and Kyrgyzstan…..

you should read Jack Carrs latest novel… sure it’s fiction but the political and military observations are astute.

Hi Mike, You have a very good analysis. The problem with Marx is that determinism and the inevitability of collapse do not seem to happen. We already have collapse and rather than change we are running back to more oppression in National. So there is no determinism.

The issue is to get people to see the truth that the dominant economic narrative, market capitalism fails. Marx no longer does this. We need to tell an old story in a new context. It must be done in their context not the context of a very good academic.

Agree Marx was a theorist only.

Thank you Mike for an excellent series of articles.

It has been notable that the few resident TDB right wing trolls who have deigned to reply have only offered strawman arguments attacking Marx as a person.

They have no counter narrative to Marx’s analysis.