Oh listen to them scream!

Landlord chiefs react to Government housing package

Landlord bosses have expressed shock and dismay at today’s Government announcement to axe interest deductions on rental properties.

Andrew King, NZ Property Investors Federation president, and Sharon Cullwick, federation executive officer, were both taken aback by the Government decision to eliminate interest rate tax deductions, which investors can currently claim on properties.

“What, so every other business in New Zealand can still claim tax deductions, but not landlords?” King asked. “You’re joking! This is just bizarre, it’s crazy.”

15 000 homes were bought by those who own more than 5 properties last year.

Speculators are now the largest percentage of buyers in this housing bubble.

Fuck em.

To all those landlords screaming they will now sell their rentals because of today’s announcement – GREAT! Flood the market and crash those prices now!

We dare you!

We double dare you!

To those Landlords who are already flooding social media with threats to raise rents to punish Jacinda’s voters – we ask readers to send in those Landlord details and we will name and shame them on this blog for you.

It’s time renters start fighting back against these cretins who would commodify a house and cheat their fellow citizen for a venal buck.

Todays announcement of a war on speculators won’t fix the housing crisis (if you didn’t want a war with speculators why give them $60billion to speculate with in the first place?) but it sure does feel good hearing those Landlords scream and until Labour build more bloody State Houses, a speculating Landlords scream will keep many warm at night.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Goody. Goody. My first thought was that interest-only landlords will sell off properties and free up housing for the unhoused. Some of these properties are kept untenanted and should be in pretty good nick. The owners will still get their dosh, so no need for tears or teeth gnashing.

I’m astonished that the group think continues on housing after 20+ years of failed policy that has made housing worse than it even used to be.

It’s simple supply and demand. If there are 600 new people coming to NZ per week and you are not building hundreds of new houses that are suitable for their price range (aka migrant supermarket workers, labourers, aged care support, students and chefs who are generally not making huge incomes) then you will worsen your housing crisis.

Likewise billionaires who pay tax elsewhere and consume massive building resources with palatial mansions are also part of the problem.

Even if somehow the government solves housing, what are government planning with congestion, build new hospitals and schools, justice, prisons , police, water, waste water, superannuation and so forth. Taxes from the groups coming to NZ tend to be loss making to the NZ tax pool.

Sadly the proposals are along the same lines as what the Natz did already and will not solve the housing crisis, but worsen it, as they are ideologically driven by rogernomics globalist principles, not statistically and practically driven.

“More than one in three households are contributing nothing to New Zealand’s tax take.

A table from Finance Minister Bill English’s office shows 663,000 households – or 40 per cent – receive more in tax credits and other benefits than they pay in tax. Thousands more are neutral contributors, or are close to it.

https://www.stuff.co.nz/business/81429047/small-number-of-taxpayers-bear-the-brunt-of-new-zealand-tax-bill

here here SaveNZ. Stop this out of control immigration – a million new residents in 10 years is crazy

Yup

Yes. And I’m sick of the parties in power ignoring it. Keep ’em out!

“What, so every other business in New Zealand can still claim tax deductions, but not landlords?” King asked. “You’re joking! This is just bizarre, it’s crazy.”

Perhaps the removal of interest deductibility with respect to rental properties is just a toe dipping exercise. The next step might be to extend this policy to other businesses. Interest deductibility has long been an anomaly in the Income Tax Act.

So it is ok in your eyes to be able to claim for failed business ventures if you want the tax against business owners if it is profitable. We are a land of small business owners most not fat cats just people that are prepared to back themselves . They deserve some icing on the cake for the risk otherwise why bother

I don’t follow most of that. The language seems a bit garbled. Sorry.

What I am saying is that interest should not be deductible. If deductibility were removed the economy, including small businesses, would adapt.

Mikesh: “The next step might be to extend this policy to other businesses. Interest deductibility has long been an anomaly in the Income Tax Act.”

For the sake of its credibility, the govt needs to do this pronto, to avoid accusations of discrimination.

However: don’t hold yer breath about it. My impression is that this lot ain’t too bright (pardon the pun), and I doubt that it’ll have occurred to either Robertson or his advisors that, in going after only landlords, another anomaly has been created.

For the sake of its credibility, the govt needs to do this pronto, to avoid accusations of discrimination.

While I favour getting rid of interest deductibility I recognize that it would be disruptive for most businesses. Such a move should therefor be introduced gradually – I note that it is being introduced for landlords over a four year period.

It probably better for government to remove deductibility for landlords and getting that settled in before looking at other businesses.

Their current move is not really discriminatory as the rental market is a discrete entity.

Mikesh: “Their current move is not really discriminatory as the rental market is a discrete entity.”

The rental market is unlikely to agree. And I can’t say I blame them. Somebody on TV tonight commented that they’ve been singled out. If it walks like a duck and all that…

This will be fascinating to see how this plays out. Will it torpedo the housing market and if so economically will this be a bad or good thing for the government? More or less rentals? Will this mean the great wad of cash being thrown into residential property goes somewhere else and if so, where as there isn’t many other avenues that will provide as much of a return? Will the Johnny come lately mum and dad investors and retirees that put money into property over the past 12 months suddenly see a loss on investment and if so what are the political ramifications of this? Will the government finally be able to build something or will the ghosts of kiwi build return for 2nd helpings?

Most of the announcement will have the effect of a wet fart into a cyclone although removing interest rate deductibility (the cornerstone of residential property investment) is significant. It will have consequences, most of which will only become apparent in 12-18 months time.

The obvious consequence is that rent will go up – as much as it’ll make the left scream, the deductible aspect of interest has subsidised rents so it follows that the removal of this must require rent to go up to allow a balancing of the returns. It’ll take a few months but as sure as night follows day, renters are going to be paying more.

Bulshit. If they could of charged more they already would be.

Kim: “If they could of charged more they already would be.”

Have you not noticed? Rents have gone up so much in the past few years that they’re now unaffordable for many people. I’m guessing that, as soon as they can, landlords will raise rents.

They would anyway, regardless of these changes.

They can only go to the level where there is someone to left able to pay it. And only those with the hope of owning can pay the higher rents – via the bank of parent or government grant they will be buying soon as.

Real landlords, income return off the asset, require long term reliable tenants.

Speculators, currently building a pyramid portfolio, will have to consider selling off some properties to reduce debt cost exposure as they lose interst cost deductability.

Nonsense. The tax deductibility has merely made buying the properties very attractive. In any case, it is now about time we now introduced better rent controls.

I would hope that if a landlord tries to increase the rent because of this the tenant will refuse, pointing out that it is not his, the tenant’s, responsibility to pay the landlord’s mortgage for him. I think, under current legislation, a landlord cannot increase the rent within a year anyway.

Yep – but that 12 months following rent review will be a bitch. At the moment there is a shortage of rentals (i.e. more people wanting a rental than landlords supplying it) therefore it’s a seller’s market – these changes won’t change that fact.

Wrong, there are more buyers wanting to own(home ownership), it is the speculators(speculator landlords) who have the capital to outbid those buyers. The result is these prospective buyers then become renters.These are facts, so this is at least seen as a start. A landlord increasing rents to make a larger profit is pure greed, but you know that. If that’s too hard, sell and invest elsewhere. They may well do now as they won’t cream it like they have done for years, that’s why they keep investing in property, you’re extremely naive if you believe their doing it for the good of the New Zealand populace.

they uses captal gains in one property to leverage the next an so on in reality its a bloody house of cards and jacinda has just booted out one of the supports there not going to be able to service the huge debt these greedy irrepressible

scum have run up

the cost to the landlord based on a $600000 loan is $6000 . That is a $100 a week and would have been factored in when working out the rent . If they lose that why should they not claim it back through an increase in rent

Trev is there 60 weeks in the year? Your $6000 would be $115 weekly over 52 weeks. Also if the cost has been factored into the rent already then what need other than venal greed is addressed by a rent rise??

Rent can’t go up more than the market can bear. And we’ve reached or about to reach Peak Rent. It’s a game of chicken at this point

The market includes landlords who own without any debt for the rent return.

What is still missing is a tax on vacant land and properties.

I saw this announcement today as nothing more than basic minimal maintenance on the current order, to stop that bubble bursting, to trim a bit of speed off.

It’s given investors 4 years this quit their investment homes before the full no tax deduction on interest kicks in.

There’s no loan value rules updated.

The brightline test even updated remains impotent as it ever was. Catch me if you can suckers!

There is still a ton of money to be made because the settings remain much the same.

Labour thinks you can buy a house in Auckland as a first home buyer for less than $700,000. Dear God!

They’ve raised first home grants. All that does is raise the asking price.

No one in Labour have a clue, do they?

It’s tinkering and Labour still don’t get it. In six months to a year is as the market powers on then what Jacinda? You can piss about all you want, pretend, not give a shit but tinkering will not set you or your party free from this housing beast. And nor should it.

There is SO MUCH MISSING.

This is a ‘Claytons tax’ event. i.e. It is NOT MEANT to have the effect it is claimed to have.

They DO NOT want to fix this problem, they just want to be seen to be trying to fix it, yet again and again.

It is SO SIMPLE to solve, as per numerous remarks on this site and many other sites. IT IS SIMPLY the case that they do NOT want to fix the problem.

And the wailing from the property organisations is propaganda-101. They got a HUGE help at the start of COVID, so they’re going 2 steps forward (some would argue a LOT more) and now one half step back, so a NETT positive, but they need to complain so they Govt LOOKS like it’s done a good job.

Because if like the farmers they said nothing, the sheeple would think NOT enough had been done. Propaganda 101.

Facebook NZ property investors chat is FULL of investors threatening that they will put their rents up $100 to $175 next week. SCUM!!!!!

This announcement is a tinkering. Interest only loans and DTI needed yesterday.

Sadly the only people to suffer financially from these announcements are renters. You are deluded if you think investors wont just pass this cost on.

Whilst you may be right MickeyBoyle, it is still greed! Nothing more, nothing less.

Call it what you want, its human nature and will always exist.

I call it as it is MickeyBoyle, greed.

I don’t see how you could call it greed, most of the rental properties don’t have their mortgage paid off which they need to pay off, everyone is just trying to live a better life for themselves. So to ensure that they can pay off their mortgage repayments and interest on mortgage and not lose money they will have to increase the rent, it’s the only way they can cope. I personally believe the government should focus solely on expanding and urbanising the land around Auckland, setting up more houses and upgrading the infrastructure, this will lead to an increase in job availability sort some of the housing crisis, and better Auckland, in general, would it not; as the more houses there are more stores, petrol stations, etc that have to open up. Regardless of how this bright line test plays out we have to create more properties to cope for the increase in population.

This is not working, our government has failed and the money hungry greedy scum land speculators are crying because their free ride is getting curbed.

As Warren Buffet once said “when the tide goes out we see who’s been swimming naked”.

Those landlords who are complaining about the removal of tax expense deductions are wanting it both ways – they are paying interst rates that homeowners pay, not the interest rates that businesses would pay.

So true.

I work with many property investors and in the lunch room today, there was no complaining or whinging about these new policies. Most of the talk was rents up, sale price up. Doesnt that prove just how insipid these new policies are? Will it turn anyone off investing in property? I dont think so.

This comment ignores one very obvious thing. And that is…if they thought they could get more for rent or more for the houses they would already be doing it.

All I saw was investors hanging onto their properties for longer paying off more which in turn increases profit margin at the end. I think its all just smoke and mirrors and its just making it look like they are fixing a problem when they arent.

You’re onto it Mark.

Haha, no complaints but their actions speak volumes, greed.

I have long been an advocate of interest deductibility removal. However, I never really believed that I would ever see it happen because I thought that de3ductibility was too well entrenched.

What a great day this has been.

No mention of regulating the Real Estate Agents who are sucking $45,000 + out of every house sale in Auckland, thus adding to the overall cost of a house. How about a maximum 1.0 % sales rule or a maximum fixed charge of no more than $10,000. Even that’s too much for unskilled labour.

Slow down the shark frenzy there. They love nothing better than the commodification of housing.

In fact, anywhere where easy month is to be had relating to the housing market should be dealt to. Get ’em all out of the market place.

All those people ; leveragers, scumlords, ticket clipper agents . All gone !!

unskilled labour is not how I would describe professional real estate agents. It is hard work full of legal propels w

for the unwise our hasty. Unskilled labour is the label I would put on this present government .

Well thats an unskilled comment .

Sell the house yourself on TradeMe like my son did and no fees.

You’re not getting it. It becomes more necessary to plug the gap because no organic supply because Govt creates the conditions necessary for low cost housing and employment to prop up the Economy. Under Jacinda pre Covid, NZ was slowly moving away from that. I see memories are very short.

Once again this Labour (???) Government maintains its adherence to neoliberalism. They are, in their own words, making a Market correction- even then $3.8billion is not a lot for the monetary component. They are improving the private housing market, whilst doing precious little for the desperately needed social housing. St Jacinda of the Photo Op, you’ve done it again!

Last years rental we got kicked out on a 90 day notice. The place was a dump, cold draughty and no ventilation. We were paying $320 for that. The investors who bought the place paid $420k. the place has had a quick pain, new carpet and roll up blinds put in and now they want $450 a week for it!

It still has fixed open louvres in the bathroom and louvres in the kitchen and the front door is still the same so cold air passes right through the house still.

Good luck to the new tenant.

Thats the catch though isn’t it….renters have no bargaining power ..because if you name and shame your landlord you’ll have no roof over your head.

Leaving half our population at the mercy of ‘Ma and Pa’ landlords with no hope of ever owning their own home will be referred to by future historians as being as destructive to society as Rogernomics..

Some things included in the package that I think are helpful. Some that will do more harm than good. The point I want to draw attention to is the messaging. The Government just “declared war” to use it’s exact wording on a section of its citizens. Using this sort of messaging never ends up well.

Landlords shouldn’t have a problem with state housing, as this would remove those who are likely to be problem tenants from the private rental market.

I invest in

KiwiSaver instead of houses I have to pay tax this just levels the playing

Field well done labour and jacinade you are awsome

Labour have done well today – even Act can’t knock it.

Labour should be congratulated. Full-Stop-Dot.

National’s response today was pathetic and will hopefully only serve to flatten their popularity curve.

Huge Gleeful Headline from Martyn , like Jacinda has just saved the world! Clearly no clue what the problem is.

What Jacinda has done, gutless as she is, is declare a war on her own voter base…renters and first homers.

The whole thing is thoughtless tinkering. If this govt had any guts it would have done this:

1. Force and override Councils to make land available quick and cheap.

2. Make building easier thus cheaper.

3. Import builders on special visas.

4. Underwrite or sponsor the deposit for genuine 1st home buyers if they can afford monthly mortgage. So no deposit required.

5. Drop the brightline so that houses come on the market. Now they won’t for 10 years.

Of course any of the above requires a head for business. That’s not Jacinda….the great Spinner of Nothing. The Saint of Sweet Fuck All. This could cost her the election mark my words.

You are so spot on, why cant anybody else see it?

An investor who holds a property for 10 years just to to avoid tax on a CG is stupid.

A lame suite of policies. Rents will simply rise. https://www.kiwiblog.co.nz/2021/03/govt_announcement_will_increase_homelessness.html

It was probably no coincidence that my rent went up 15% after the government required rental properties to have insulation, heat pumps, extractor fans and the rest which my rental subsequently had to get. It’s fair enough that if you decide to be a landlord then you should provide the best accommodation and service possible for the fairest price (and f#@k these maggots who are ripping off communities with their mouldy slum portfolios), but these upgrades won’t be advantageous to me as a renter: primarily I won’t use a heat pump because I can’t afford the power (I will continue to open a window for ventilation or use a blanket to stay warm, you know, like the old days before the flashing lights and the shiny technology we couldn’t do without).

I think this government’s solution to predatory landlording is with more woke tinkering which just aggravates their new middle class clique, and worse, they now want to get even more people into the property market (and out of the rental ‘problem’) with first home owners offered incentives into this obscene Ponzi scheme with the other property fanatics. Maybe the answer is to build rent-to-own or build-to-own housing for everyone, or guarantee universal social housing rather than relying on the private market. But only if this government is serious about protecting society in the most basic of human rights, a roof over one’s head.

100% , Mr Bradbury, you have my tick of approval.

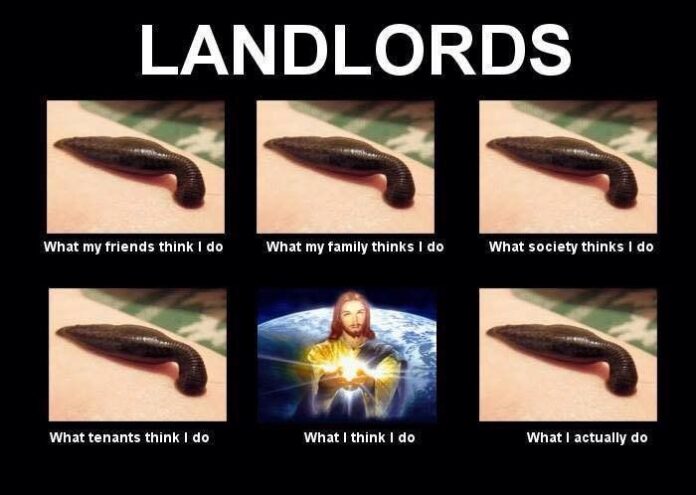

OMG hahahahha the picture is cracking me up so much. Finally Labour got on with it. Sooner rather than later would have been nice. I am interested to see the result, whether a sell off occurs. At least it will cool demand. Certainly there are cries of agony on social media, comment boards, threats to have renters end up living in cars. Some landlords believe that 50 week rent increase will cover 50 a week tax. It may take some investors some time to understand and maybe need a sit down chat with accountant. Some may just cheat and IR will hopefully come after them as due to new Business development they are better at picking up on cheating. If todays announcement makes no increase then perhaps Mr Orr will have some methods too

Just a thought, I wonder how many FHB with a deposit ready, are now going to start ‘holding their line’ (not buying just for a while to see how market cools, wait for a cool-down/sell-off, further reducing demand/competition, while investors keen to sell find it is taking longer and longer, may have to drop price and give in, this could have a real domino effect

They DO NOT want to fix this problem, they just want to be seen to be trying to fix it, yet again and again.

Neoliberal economics and control will not allow any ( real ) progress to be made until we have a group of people willing to do what it takes to change the narrative.

In the meantime its just leeches only caring about their own political legacy and to hell with the people who voted two ticks for Labour.

A 10% stamp duty on investors buying up existing property would have been nice.

“What, so every other business in New Zealand can still claim tax deductions, but not landlords?” King asked. “You’re joking! This is just bizarre, it’s crazy.”

Back the outrage boat up there, Corky. You aren’t a business person, or a landlord, you’re a profiteer. Your organisation is for profiteers. Historically there are other names for you, and many colloqiual epithets. A business person wouldn’t squeal that a political environment existed or changed and therefore their activites were doomed. Business people do business during pandemics, famines, wars, underwater, on mountains, in the jungle, in the desert, during communist regimes and revolutions, any where and way they can, because they adapt and have a keen eye for opportunity. Some of them even try to make it hard for themselves for the challenge. They need no encouraging or praise from me, they just are. Landlords have a different set of traits altogether. Profiteers seem to want to whinge and moan when things change, and then, in an outburst of misunderstanding of who they are, try to imply they will do something curently illegal to sooth the obstruction to their greed, effectively kicking themselves in the teeth by attacking the cash cow they’re bleeding dry – their tenants? Please, bro, please. If you have a problem, ask the government for an alternative activity for you to gouge. Our current government is quite amenable like that. No need to squeal. Your impoverished tenants are a poor source of continuing profit, you did your job too well. Them living in a car costs you your rental. Don’t you find tenants annoyingly stressful anyway? Always crying about a starving or freezing to death, the complaints never end. Who needs them? It’s a shame the government didnt allow you a way out first, but they aren’t attuned to your needs. You’ve done well already, letting go of the husk of a dead investment is just icing on the cake. Cheer up, old chap.

Comments are closed.