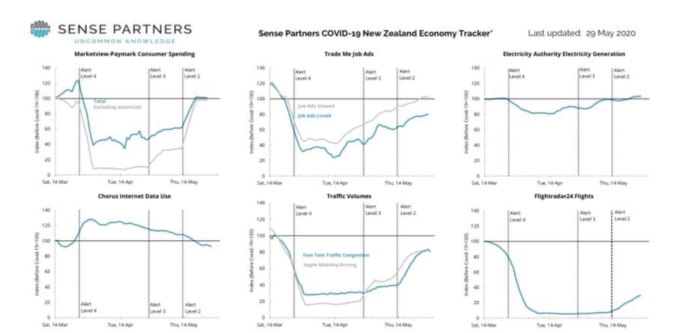

Economic activity continues to increase. But indicators are still pretty volatile, as we grope towards a new normal.

Sense Partners are showing the tracker data on a weekly average basis to show trends.

Electricity use is running at around 3% ahead of last year, suggesting businesses are back up and running.

But 30% lower traffic volumes suggest we are still working differently. Auckland and Wellington are most affected. We can also see people going to work later in the morning, and coming home earlier. Working from home – according to internet use – is still running about 30% ahead of pre-Covid levels. Overall internet use is down.

Businesses are cautiously getting back towards normal. More businesses are listing new job ads on Trade Me, and is now back to around 80% of normal.

Job searching is above normal – unsurprising given recent job losses. Encouragingly, Jobseeker Benefit numbers rose by just 384 in the week ending 22 May, the best since mid March. The first wave of job losses is over (around 45,000 cumulative increase in Jobseeker benefits). But the second wave may be starting, reflected in ‘unemployment’ rising in google trends and spate of job cutting announcements from high profile businesses over recent days.

Despite job losses, consumer spending has rebounded to normal. Although a big chunk appears to be catchup spending still.

Manu Caddie is Kaihautu of Innovation & Regulation at Rua Bioscience

In the 80’s Roger Douglas dealt with high interest rates, low unemployment and relatively high rates of government borrowing for that time by shrinking the size of government with what was called a blitzkrieg of privatisation and deregulation policies.

Now that interest rates are zero or close to zero it has signalled that the government is as close to dwarfism as interest rates will allow. If interest rates go negative I couldn’t imagine how anyone could put the dwarfs back into the womb.

There for to deal with record low interest rates, high unemployment and relatively high rates of government the government has to recognise which industry are prime nationalization targets and expand the size of the government. At 1% interest the government has near unlimited borrowing capacity meaning that money costs the government almost nothing.

The mainstream economic narrative is collapsing as I write, with the US leading the charge ‘off the cliff’ and Brazil, India, Bangladesh, South Africa not too far behind, and a with huge collection of countries doing very badly -Saudi Arabia, UK, Italy, France, Germany, Japan etc.- and pretending pretending things are nearly as bad as they actually are. Even Russia, which is better placed than most nations as far a resources and systems that actually work is concerned has not been doing at all well on the Covid-19 front.

China has tens of millions of factory workers it doesn’t know what to do with, but apparently those able to are already heading back to their traditional roots and what remains of their villages -the ones that were not demolished to make way for ‘progress’ of factories, dams and high-rise apartments that have a bleak future.

The ‘Great Turning’ has a marvelous ally in the form of Donald Trump, whose self-serving policies, incompetence, cowardice and inability to lead have finally been fully exposed for all to see.

‘He is a destroyer’: how the George Floyd protests left Donald Trump exposed’

https://www.theguardian.com/us-news/2020/jun/01/george-floyd-donald-trump-black-lives-matter

Attempts to talk up the NZ economy are a futile waste of time as far as orthodox economy is concerned but may have a short-term calming effect on the uninformed/misinformed sectors of NZ populace, i.e. the bulk of NZ society.

However, attempts to talk up the NZ economy do present a serious obstacle blocking discussion about what actually needs to be done to prepare for the REAL future, and will therefore cause additional unnecessary suffering.

Comments are closed.