We all know the issues: children going to hungry, lines at food banks, families sleeping in cars

Our tax system should be the central tool in fixing these problems. Sadly the best we can hope for following the Tax Working Group’s recommendations is that these problems will continue to get worse; only a bit more slowly.

For the past twenty years the rich have been getting richer and the poor getting poorer. The reason isn’t stagnant wages as some claim, but housing. For twenty years wages have been increasing, but rents have been increasing even faster. People have more money in their pocket than ever before, but a bigger chunk of it is going to their landlord.

We often talk about the haves and the have nots, but the story of the last two decades in New Zealand it is about the “have houses” and the “have not houses”. This is driving a wedge between the rich and the poor, but also between the old and the young.

The Tax Working Group was supposed to make our tax system fair. Sadly the Government tied their hands at the outset, ruling out the biggest tax loophole we have – the “family home”. If you don’t believe me, the officials behind the Tax Working Group said so in one of their reports.

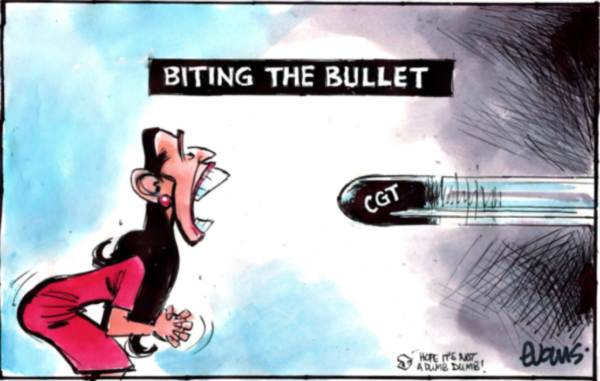

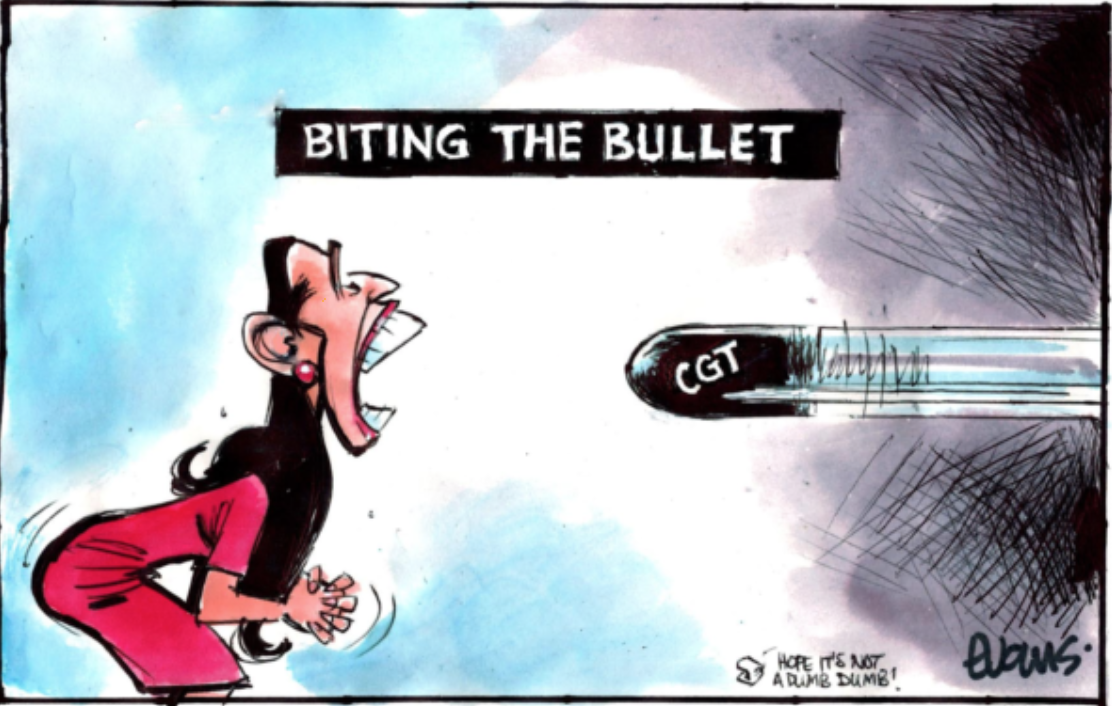

The result was depressingly predictable: a “comprehensive” Capital Gains Tax. Comprehensive that is, apart from the largest group of assets in the country (42%): the family home. What can we expect from such a change, if it is ever enacted into law?

What Can We Expect from A Capital Gains Tax?

House prices might come down a bit, as landlords sell up, before recommencing their unstoppable rise. House prices are predicted return to an annual 3% increase. Of course house prices will rise when ¾ of the value of your housing stock is exempt. Besides, how else will a Capital Gains Tax make any revenue for the government if asset prices don’t rise?

Meanwhile rents will rise as the remaining landlords look to get the same return. All in all this does little if anything to reduce inequality.

This is why Capital Gains Tax (excluding the family home) has failed to reduce house prices and inequality in Australia. Incidentally, Australia was second to last (just ahead of New Zealand) in the recent housing affordability survey. This isn’t even a second best policy, it is a second to last policy.

If we care about poverty, the best a Capital Gains Tax does is raise a bit of revenue for the government to spend. We have to hope like hell that money gets spent on the real problems facing the country like child poverty, rather than middle class welfare like free tertiary education.

Businesses would get hit also. This is bizarre, because businesses already pay tax on profits. Capital gains for businesses only happen if the prospect of future profits increase. So paying tax on capital gains is double taxation. Besides, it reduces the incentive to invest in businesses (which produce jobs and incomes) rather than sticking all our money into housing.

As a result, under a CGT Kiwis will probably end up sticking even more of their money into housing than ever before, particularly the family home. This is known in Aussie as “the Mansion Effect”.

How Could a Capital Gains Tax be Better?

Easy, include the family home.

Levy the tax every year, not just when the asset is sold (as that provides a disincentive to sell).

Time travel back 30 years and put the Capital Gains Tax in place before all the capital gain happened.

Also, it would be better to exclude businesses as the minority report stated, as they already pay tax on their returns.

Could we do Even Better?

The Opportunities Party proposal is that all assets (including the family home) have to pay as much tax as a bank deposit would. This would happen each and every year, not just when the asset is sold. This would mean all assets pay a similar amount of tax – no more loopholes. It could generate enough revenue to reduce all income taxes by one third making 80% of people better off. Such tax cuts could be focussed on low income earners in particular.

Meanwhile investment in productive assets would grow – there would be a real incentive to invest in businesses that created jobs and incomes.

That is the real way to reduce inequality.

Geoff Simmons is an economist and Leader of the TOP Party.

The Kiwi love of housing made us one of the richest in wealth per adult in the world.

https://www.investopedia.com/articles/managing-wealth/112916/richest-and-poorest-countries-capita-2016.aspworld per capita.

What created housing poverty here, is neoliberalism and immigration and the rise of cheap workers on working visas here. As well as rampant tourism with many on tourist visas while using all the service such as health, ACC and infrastructure and living here not visiting here.

No questions asked work visas, as well as bizarre immigration criteria from 11 day marriages…

“Immigration officials have failed in an attempt to deport a 60-year-old who they believed paid a woman to marry him for residence after only 11 days of first meeting.”

https://www.radionz.co.nz/news/national/376220/10k-11-days-and-one-failed-deportation

dowry scams..

“A special needs 18-year-old Kiwi woman with the mental age of 7 is targeted by a much older Indian national for marriage in order to get permanent residence.”

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12123831

…to low paid workers coming and then bringing in the rest of the family when they are on poverty wages themselves and having more children while they are in NZ…

“Zara’s mother, Aileen, a nursing support worker, came to New Zealand first on a student visa in 2014. She was joined by her machine operator husband, Arnold, 41, two years later after she got her work visa.

They have another daughter, Zia, 8, and a son, Aaron, 15, who have also come as dependent children of worker visitor visa holders.”

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12203129

The bizarre work permit and immigration culture has driven up house prices in particular the prices at the bottom as the migration targets low paid workers who compete with other low paid workers for rents and scarcity while lowering wages and creating generations who now not only are supporting high student loans from the Rogernomics era, but in real terms are themselves lower paid with less secure jobs than their parents.

Wages are dropping like stones as it’s a way to get residency here and be provided for with our social welfare system, for life or until it breaks.

All this so that the multinational business interests are met with low wages and enough wage slaves to keep the production of plundering NZ natural resources like water, sand, wood etc going …. and drive up new construction and retirement villages popping up everywhere, (but at eye watering prices, clearly not aimed at the mugs actually working here).

Love how 99% of commentators never mention immigration as a factor in house scarcity… not sure whether they are just ignorant and think new visa holders live in thin air once living here not housing, and think Kiwi’s are stupid enough not to notice that last year for example 150,000 work permits were given out, approx 80,000 new citizens and residents created and nearly 4 million tourists coming here.

Not sure how 1000 Kiwibuild houses can manage to house those sorts of numbers… especially as they have only managed 44 aimed at people on $120k which are not well received, . or how people on a $40k ‘living’ wage or less can afford a mortgage or rents when we have the above out of control immigration, visa and tourism figures.

Everyday yet another story about another migrant who has been asked to leave but has children/partner/low paid job/restaurant/criminal or what have you in NZ and surely they should get residency here too, no wonder we have a housing and poverty crisis!!!

It’s not so much the migrants coming here’s fault (although we seem to increasing our criminal component attracted to living here) as the government encouraging migrants to suck up to poor quality and dysfunctional business and get some handy bribes and donations at the same time…

“We have to hope like hell that money gets spent on the real problems facing the country like child poverty, rather than middle class welfare like free tertiary education.”

Funny how when progressive govts want to bring in radical changes, the response from the Right is a sudden gush of crocodile tears for the poor and how such reforms will impact on them, or the progressive reforms are “welfare for the middle class” because the benefits will flow up to the Middle as well as benefitting the poor.

Yet, and here’s the nub, the Right love telling us the neoliberalism will trickle down from the rich to the poor. But we can’t have improved state services flowing from bottom to top.

So best not have any improved social state services, then, is the answer.

And when you have “targetted” social services for the poor, the criteria and hurdles are so stringent that few qualify.

Doncha love it when the affluent tell the poor what they do or don’t need to live and better themselves?

But sure as fuck the affluent don’t like to be told they aren’t paying their fair share of tax on unearned income.

“We have to hope like hell that money gets spent on the real problems facing the country like child poverty, rather than middle class welfare like free tertiary education.”

Tertiary education – middle class. What the hell are you talking about.

Low income families don’t have a show of sending kids to tertiary education at $6-7K a year minimum for tuition.

You may not recall when these sort of charges did not exist but a process of creeping neoliberalism put an end to that and created a debt regime for poorer families to contemplate before setting their children into the shackles of debt and anxiety as a penalty for seeking education.

Many more enlightened states have free tertiary education and health care but also have more taxation on those who have high earnings.

Free and available tertiary education and health care is the path to a fairer society with many benefits apparent, lower rates of imprisonment, lower birthrates, less poverty and a fairer society.

It is a hope of most poorer families that a full 3+ year, fees free tertiary education is restored.

I suppose you could say universal education at primary is also feeding middle classes and should be stopped. That would be just as much a nonsense.

Your comparison lacks depth and avoids the real issues such as why this country is in debt and why banks are allowed to make free money for themselves at the country’s expense. These are multi billion dollar issues annually.

Where is the Left’s demand for RMA reforms that would free up land for houses, so making it cheaper?

Where is the push for Auckland’s urban growth boundary to be abolished?

Where are the practical legislative changes from this Government that would make house building cheaper?

Appetite for RMA reform is pretty low really because most of them are on the right trying to cheap skate there way out of paying water rights access, extend city limits into areas that will cause servere enviromental harm not just to the natural beauty of New Zealand but harms its agriculture sector as well. Basically a bunch of right wing minorities with load voices and fat wallets want to trash the place by stealth.

The left just doesn’t talk about it in that way. We want better for New Zealand, always better.

Comments are closed.