New survey shows widespread support for taxes on capital gains and windfall profits

Most people support taxes on excess profits and capital gains, according to a new survey of more than 1000 Kiwis.

These are taxes which both major parties, Labour and National, have ruled out. Yet according to the latest survey, and other polls, it looks like the public is keen on significant tax reform.

Despite ruling out major tax changes, Hipkins has faced pressure, from within his own party and his would-be coalition partners, to reassess the country’s tax system.

Inheritance taxes

Japan 55%

South Korea 50%

France 45%

United Kingdom 40%

United States 40%

Spain 34%

Ireland 33%

Belgium 30%

Germany 30%

Chile 25%

Greece 20%

Finland 19%

Denmark 15%

Iceland 10%

Turkey 10%

Poland 7%

Switzerland 7%

NZ 0%

ENVY the Rights scream at any challenge of their rigged capitalism.

Bernard Hickey has argued, “We could have gotten $200 billion in extra tax revenues if only there had been a fair tax system which meant that capital gains were taxed at the same rate as every other type of income.”

Envy? Oh no my dear wealth pimps, incandescent mother fucking rage is more where we are all at rather than basic bitch envy!

In a liberal progressive democracy, it doesn’t matter what role you play in the complex super structure of our society and economy.

It doesn’t matter of you are a garbage collector, a dr, a nurse, a drain layer, teacher or tradie – if you all stopped doing your jobs the system can’t work.

Everyone deserves to share the collective harvest of civil society with public services and policies focused on the public good enshrined in the intrinsic civil liberties each individual has.

Wealthy individuals who become mega rich thanks to the landscape generated by those values are required to pay more back into the system they have benefited from beyond the bare necessity of ruthless accountancy practices.

These rich pricks have designed the system for themselves, ‘you can’t tax unrealised capital gains’ the Right scream, like bullshit we can’t!

If it means the mega rich have to sell a mansion or two to pay the tax bill, so fucking be it!

The obligation of the Government is to regulate Capitalism so that we the people benefit from the competitive dynamics of competition!

We are not an over taxed, over regulated economy!

Our top tax rate is the 39th highest in the world behind all the Scandinavian countries plus Germany, the United Kingdom, Ireland, France and South Africa!

Australia’s top tax rate is 47cents!

Our GST rate doesn’t even get us into the top 50 and our corporate tax rate is 40th while Government spending against GDP ranks 56th!

And we are voted easiest to do business by the World Bank!

Total hours spent at work per year (OECD):

Germany- 1330

Denmark- 1346

Japan- 1598

Australia- 1683

Canada- 1644

UK- 1367

New Zealand- 1739

I’m not looking for socialism here folks, just basic garden variety regulated capitalism!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

You should be angry, NZ Capitalism is a rigged trick for the rich and powerful. The real demarcation line of power in a western democracy is the 1% + their 9% enablers vs the 90% rest of us!

Do not allow their smears of ‘Envy’ dilute the righteous rage you should all be feeling!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

Lift the tax yoke from the workers and the people and place it on the mega wealthy and have them pay their fair share for once!

The true demarcation off power in a liberal progressive democracy is the 1% wealthy + their 9% enablers vs the 90% rest of us.

Stand. Stand now and demand more from this rigged capitalism!

The political project of National and ACT is to starve the State of revenue so that it can’t redistribute wealth in the first place.

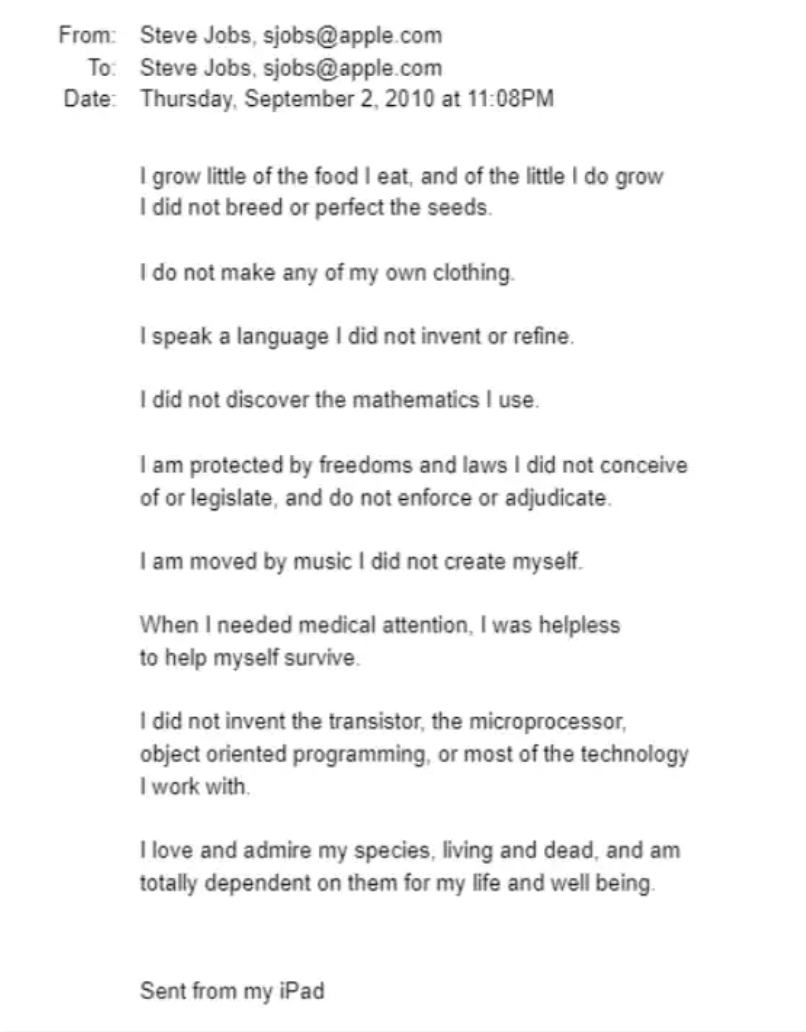

For those rich pricks screaming they are self made and fuck us for wanting a slice of their bread to properly fund society, let’s remember the email Steve Jobs sent to himself before he died…

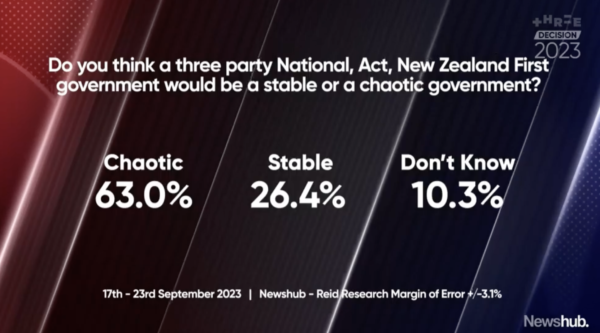

As for this…

…you all know it’s true!

If you are voting NZF, ACT or National because Jacinda saved 6000 lives from Covid, then you need to take a good hard look at yourself in the mirror!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Only one thing missing…it ain’t over until the fat blogger sings.

Nice email to himself from Jobs. Except, except he did not say this: “I do not scrub my own shit off the side of the toilet bowl”. All but two of the things he said that he did not do, are fine and grandiose things. Only growing food and making clothes are mundane. He needed to go further. Everything that is necessary for life and happiness is created collectively.

Steve Jobs died on 5 October 2011, 13 months after this email.

NZers may want a wealth tax but NZ’s owners say no.

Chippy’s Captain,he doesn’t like wealth taxes.

Financial transaction tax would be much better. Fair and extremely difficult to dodge.

This could be helpful for Chippy introducing something new or uncomfortable; better the reaction from those behind him, or those he is facing off.

[Two sales pitches – one straight and pleasant, the second same with a wee joke.]’.. we used it to test a simple question: Can one joke make a meaningful difference in how people are viewed by others? In our study, the answer was unequivocally yes.

Participants who heard the second presenter make the joke rated him as more confident and more competent than those who heard his joke-free delivery. The jokey presenter was also more likely to be voted as the leader for subsequent group tasks.

We tend to view humor as an ancillary leadership behavior. In fact, it’s a powerful tool that some people use instinctively but more could wield purposefully. One good laugh—or better still, a workplace culture that encourages levity—facilitates interpersonal communication and builds social cohesion.

https://hbr.org/2020/07/sarcasm-self-deprecation-and-inside-jokes-a-users-guide-to-humor-at-work

If only someone would spread the above educative message far and wide. Who knows may be its these guys. https://www.labour.org.nz/donate

It indeed will be chaos and who do we have to blame?

Thanks Labour and the Greens!

With Chipkins ruling out any of the above reform of the tax base including not adopting any of the TWG they paid a fortune to convene they just ignored everything the group said was unfair and needed correcting he is not the leader that can deliver what most Kiwis say is urgently needed.

Its time for a “the market is not the answer” leader of the NZLP or someone who stands against the continued plutocracy of the NASTIES but I am not holding my breath.

Really good points, and I have bookmarked this. Fundamentally, as income to wages and salaries has declined as a % of the total and incomes to capital have grown, so, the old-fashioned tendency to rely on taxation of wages and salaries can no longer carry the burden, and we have to be thinking of more taxes on capital income.

Define a wealth tax ? or are you talking about a net asset tax –

then how you tax it – 20 years ago anyone with a million dollars in assets was “wealthy” today that million won’t buy a decent house in Auckland.

If we exempt houses this is unfair on people in provincial Nz with similar houses worth 1/3 or less for the same house in Auckland .

If the intention is to hit the really wealthy with 20million + they can afford the lawyers and accountants to avoid it or leave the country and become tax resident so where else.

Only Spain and Norway France and Italy are the countries with a net wealth tax which varies depending on where you live rate .2% up to 1.5% but few people seem to pay it, lots of exemptions and ways of avoiding it . In France only land and buildings are taxed in Switzerland all assets are taxed at rates from .13% to 1% depending on the canton. Norway charges 1% and up but with exemptions – many of norways rich have left or are leaving the country . It seems the wealth taxes generate relatively little income in these countries due to problems of assigning values to assets and the exemptions allowed compared to regular taxation.

A nice idea that appeals to us lowly workers but hard to make work.

A problem with the inheritance tax right now is that a lot of family’s see the inheritance from the grandparents as the only way the kids will be able to afford a house. If the inheritance tax came with the full suite of economic justice policies that would be ok but if we’re sticking with labours incremental approach then we should be talking about a financial transactions tax. After all it’s the financial class that has stolen all the loot not the middle class.

Interesting article! The decision to increase the taxes seems curious!

Absolutely discussing stats, National and Labour should be ashamed of themselves. This country will be going no where until the economic cake is decided fairly, and that will never happen under Labour or National.