Adrian the Lionheart, fighting the good fight against the evil forces of demand, and their rapacious consumption of needed goods and service, wants to save their souls from the heresy of inflation. I’ll leave it up to the reader to decide if Adrian Orr the Lionheart of the Reserve Bank would have been better to stay at home and protect his realm from the few rapacious and wealthy local barons.

Inflation is a problem as it steals savings and undermines the purchasing power of salary and wages, and this worries ordinary people, the lower and middle classes So Mr Orr raising interest rates to deal with inflation must be fighting the good fight? That is, raising interest rates to create inflation, to create a recession, so people have less money to spend. It does have a track record of stopping inflation; because people don’t have money to spend. This inflation fix is based around the theology of neo-liberal economics.

Neo-liberalism chooses this fix because, it wants to protect the supply side of the economy, the producers of goods and services, to protect the sources of wealth and investment that drive the economy.

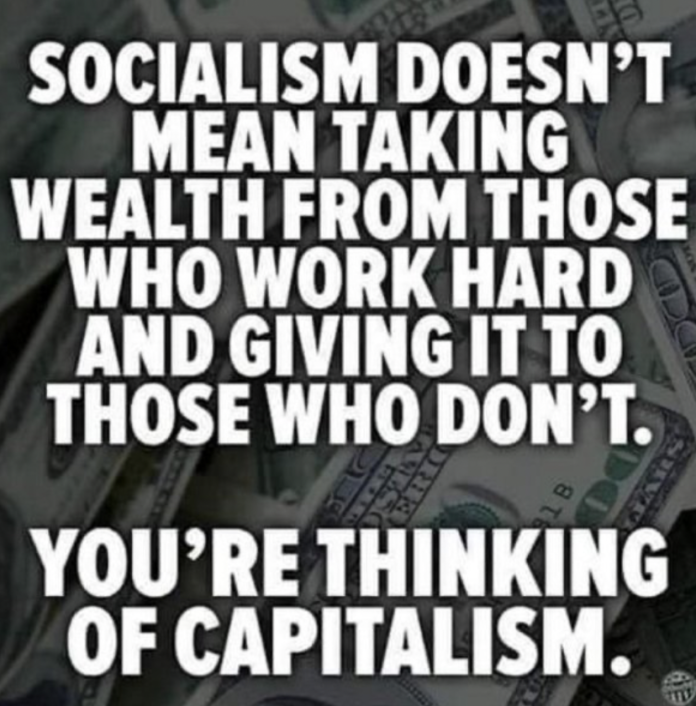

So they rationalise this position – A person commented on one of my previous articles ‘Inflation is an increase in the supply of paper currency, once it enters circulation.’ This is a neo-liberal doctrine. i.e. too much money supply causes inflation. The lower and middle class had too much money because unions pushed up salary and wages, government spent too much money, government gave people too much money. This causes demand and demand causes inflation – cost push, demand pull etc etc.

And this is where the logic of neo-liberalism all starts falling over and it becomes metaphysical.

The neo-liberal protection of the supply side producers only really applies to the large firms. Small businesses supply goods and services to the lower and middle classes. If you raise interest rates to create a recession those classes don’t spend and small businesses fail. Neo-liberalism therefore inherently favours the large established players, (despite all their bullshit talk otherwise). This is a risk to innovation and adaptation within the economy.

The neo-liberals assessment of inflation (too much money causes it) is directly counter to actual observation of the pricing process. A business person has to make a conscious decision to raise the price of a good or service to maximise profit on an item across many transactions. There is no organic market price; it is a decision making process that drives inflation.

Neo liberals are careful not to directly blame demand as the problem for inflation because they know that is the real driver and lifeblood of the economy, but demand expectation is what they want to control so there are not high demands for wages, or for government programmes. Because that will put pressure on raising taxes.

So they blame the money supply as an indirect way to control demand by people. It depersonalises the problem of inflation away from people and projects the problem of inflation onto institutions like unions and governments. Who people can then be trained to blame for inflation.

As importantly, neo-liberals focus on the money supply because they are trying to recreate a de-facto gold standard. A fixed finite resource of money, like the supply of gold was. Why? to secure the wealth for the wealthy supply side of the economy. If there is a tight amount of money then the value of your money will not be eroded. They fear money creation by government as watering down their oh so hard earned wealth.

Neo-liberalism is really political theology dressed in economic drag. Through tautology it creates a sense of laws in economics, like money supply goes up = inflation, but the laws don’t stand up to empirical observation, e.g. 2008 the US Federal Reserve bailed out large banks/corporations by typing extra zeroes behind the numbers; the financial crash was stopped. But no inflation. Massive increase of money supply. Neo liberals say; but it would be if it’s printed money. That’s just soooo lame, e.g. so little cash used in New Zealand.

The inflation New Zealand is currently experiencing is largely imported and it follows the political trends in the US and their inflation is very political. After the Trump election loss the Republican politicians talk of inflation went through the roof as they tried to signal to business to try and create it. Just think of Saudi deliberately not raising oil production to reduce inflation pressures. All political.

But there is a real thing called inflation where prices rise. Covid and supply chain, and Ukraine and oil impacts are real. And these examples show that inflation is way more than just the money supply.

But Labour can’t win an election with inflation and can’t win one with this cure (neo-liberal raising of interest rates to create a recession) . Which is just how this neo-liberal scheme is supposed to work. National and Act can more easily get away with rising interest rates as the hardship it causes is always portrayed as temporary, and they are business people so they know how to make money, so they know how to run the economy, and we will all be better off, just around the corner. Yeah right.

By contrast Labour is supposedly the party of change and compassion. This inflation interest rate rise fix just doesn’t align or promote the Labour brand; so voters think why not vote for the others. Why Labour has gone along with neo-liberalism for so long reflects a lot of poor quality middle of the road leadership lacking in strategic insight.

There are many ways to control inflation that aren’t political theology, but I’ve written too much.

But Adrian the Lionheart, it’s not your personal fault. The great enforcer of Neo-liberal economic theology. Your neo-liberal banner looks so big and grand – don’t worry abut the resulting family arguments over money, the separations, domestic violence, scared or hungry children, the suicides, those with depression, the mental health impacts, the poor quality food or products brought, the sleeping in cars.

It’s all in a good cause.

You say: ‘Inflation is an increase in the supply of paper currency, once it enters circulation.’ This is a neo-liberal doctrine. i.e. too much money supply causes inflation.

The supply of paper currency comes from two places. !. Banks, they provide credit to people and organisations mostly with assets already and at the same time give themselves an asset- the obligation of the borrower to repay (with interest). The banks equity is not changed and depositors money is not altered. (Economic dogma here is refuted- Bank of England 2014 statement justifies this).

2. The government creates money creating a deficit in its books and mostly uses that for the public good (no corresponding income stream).

Inflation is caused by corporations raising prices because they can (Note how big outfits have increased their profits during the pandemic) and raw materials require more inputs to extract as the cheap to extract raw materials get used up. And of course some inflation is imported.

The reductionist approach of economists (called ceteris paribus) looking at one influence at a time does not allow for the interactions of multiple factors all at once. Such interactions produces complex behaviours of complex systems can defy understanding unless ‘complex systems analysis’ is understanding of economists is revolutionised. The complex weather system using modern computers gets enough understanding to predict weather a few days ahead so why cannot economists upgrade a century or two in analysis?

You forgot to mention the banks can use a TEN FOLD multiplier to the money they borrow versus the deposits-assets they have on hand. Known as Fractional reserve lending.

And given we have a ‘closed loop’ banking system (i.e. money moving from bank A (e.g. deposit on a house) WILL necessarily end up eventually in another bank), this means the 10 fold multiplier has a 90-100 fold effect on money supply.

I don’t want to know if we are being played because we are being taken for a ride.

Just don’t turn around and question the left when we want to take a fraction of that I’ll gotten gain and make things better.

What’s worse is that the orthodoxy that you have to raise interest rates to fight inflation is totally wrong – inflation is actually caused by rising prices which eventually corrects due to un affordability, which is certainly the case in the US and our imported higher prices.

There’s ample empirical evidence that this classical theory of inflation is total bollocks:

https://economicsfromthetopdown.com/2023/02/04/do-high-interest-rates-reduce-inflation-a-test-of-monetary-faith/

“According to canon, higher interest rates slow the growth of the money supply, and thus reduce inflation. And yet, when we look at the evidence, there is no sign of this pattern. Instead, higher interest rates are associated with both a faster expansion of the money supply, and higher rates of inflation.”

and

https://economicsfromthetopdown.com/2023/02/19/interest-rates-and-inflation-knives-out/

“The idea here is that inflation is not about ‘too much money chasing too few goods’. Instead, inflation is a business strategy in which businesses expand their income by raising prices.

Now the key is that this greater income is not shared equally. When businesses raise prices, they tend to keep the profits for themselves. Yes, some of the added income trickles down to workers. But not enough to offset rising prices. As a result, when inflation rears its head, workers see their purchasing power erode, and so they’re forced to buy less stuff. When workers can no longer afford the items whose prices are being hiked, the inflation cycle ends.

In this second scenario, the baseline effect is for inflation to by cyclical. Just like a cold, inflation resolves itself, regardless of what we do.”

Allow me to outline why this view has traditionally been rejected by most socialists.

Higher wages do not cause inflation, but nor do rises in the cost of raw materials — despite what the Keynesians say.

If wages rise, or oil rises, this is only a single price that has risen. It cannot cause all prices to rise — there will be less available money to be spent, lowering demand for other goods, and therefore causing those other prices to eventually fall.

However, prices DID rise after Q.E. began circa 2008 — there were enormous price rises in real estate, and a massive bubble was inflated on the stock market. (Not properly measured by C.P.I.)

This occured because the only currency that was printed was bank reserve certificates, which cannot leave the Fed clearinghouse.

Banks then had to use those reserves as collateral to make loans. The only people who could access those were investors in real estate, and large companies.

Socialists were not responsible for abolishing the gold standard, and in fact were mostly supporters of it.

This came about because Marx agreed with Ricardo on what constitutes money, and where value itself is derived from.

It was actually a rejection of the quantity theory of money: because (hard) money is a commodity used as a universal equivalent, it has intrinsic value — the quantity of bullion in the reserves of the bank does not affect its underlying value.

Paper currency is a claim upon that hard money, and is therefore a form of credit. Chequebook currency, not withdrawn as dollar bills, is still both paper currency and credit. But what does it represent?

Because value originates from labour, money is used to measure labour-time embodied within other commodities, and therefore is used to measure prices.

Hard money itself has value because it is a commodity which takes labour to produce — the metal must be mined, turned into bullion, and sent to the bank vaults.

Printing more paper currency makes each note represent less of the total hard money stored in the reserve. Therefore, it represents less labour-time, and is exchangeable for fewer goods — causing prices to rise.

It also causes wages denominated in that paper currency to fall in real terms.

“This came about because Marx agreed with Ricardo on what constitutes money, and where value itself is derived from.

“It was actually a rejection of the quantity theory of money: because (hard) money is a commodity used as a universal equivalent, it has intrinsic value — the quantity of bullion in the reserves of the bank does not affect its underlying value.”

As Polanyi pointed out, money is not a commodity since it is produced at no cost, and is mainly used as medium of exchange. Gold is a commodity which is sometimes used as a token of money, but is not in itself money. Sea shells have sometimes been used as monetary tokens, as have cigarettes (in POW camps). These days we use bank notes and coins, cheques, and electronic entries. It seems sensible therefor that the money supply, or the income aggregate – which is simply the money supply multiplied by its velocity – to in some way match our aggregate production.

If improvements in productivity led to an increase in the amounts of goods produced, while the money supply, and therefor aggregate incomes, remained the same, then prices should fall, which would be of benefit to workers etc. In fact everyone would be better off.

Thanks for comment Kristoff – one of the goodies on TDB – an extended explanation of whatever has been posited which helps to makes sense of the mixed allsorts prevailing.

The poor, the working class will always pay for the excesses of the rich, and the rich include the people that sit in parliament.

So what is the ‘real’ inflation figure. Because, remember, land was removed in 1996-1998 from the inflation calculation. So it could be well above 17%.

Time to crash the economy! Its the only way to stop this bs going on and on. Enough of the talk about what could happen if someone does something and it’ll help a little bit and it’ll improve the lives of some, bla bla bla ….less talk and more doooey!

Timing is everything as some people say. Sneak it through when they up north make WWIII official!

I don’t know about “crashing the economy”, but why not nationalise all the countries’ land and see what happens.

we don’t have inflation in NZ what we have is gouging on property and commodities

And an incompetent Government.

bob the last cheap repetative jibe fails

Rising interest rates is simply making the banks richer and causing the government to fall into more and more debt, especially with recent events and also the global pandemic. Before that, there were the Christchurch earthquakes and the global financial crisis. The result is too much debt for the New Zealand government and too many riches for the banks.

if limiting wages reduces inflation why doesn’t increasing taxes on the middle classes and the elite surely that would ‘reduce the money supply’ too….in fact they were the beneficiaries of the banks ‘free money’ anyway

if limiting wages reduces inflation why doesn’t increasing taxes on the middle classes and the elite surely that would ‘reduce the money supply’ too….in fact they were the beneficiaries of the banks ‘free money’ anyway