Inflation nudges higher, with those on lower incomes likely to have been hit hardest

Prices rose 0.8 per cent in the three months to the end of March.

The quarterly inflation figure reported by Stats NZ was up from 0.5 per cent in the December quarter and in line with banks’ expectations, but shy of the Reserve Bank’s 1 per cent forecast.

It leaves annual inflation marginally higher at 1.5 per cent, versus 1.4 per cent for the year to the end of December.

That small change appears unlikely to settle growing debate over whether rising prices could knock the Reserve Bank and other central banks around the world off course later this year in their general intent to keep interest rates “lower for longer”.

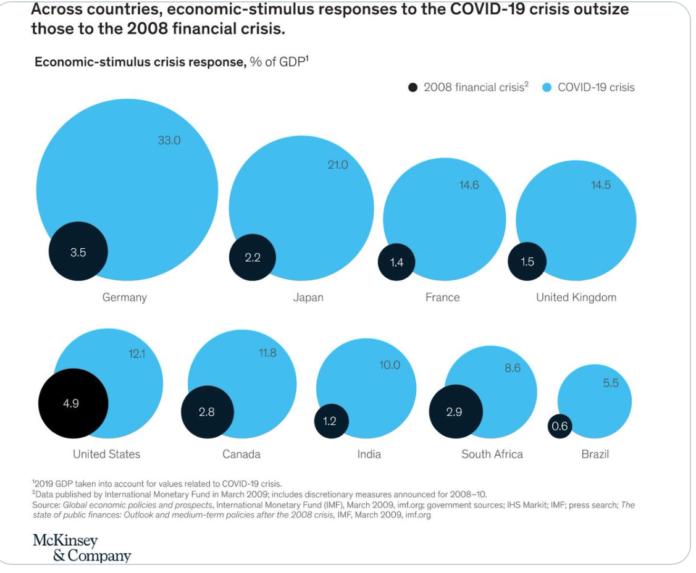

Covid has seen the main banks of the West sink trillions more into quantitive easing to deal with the economic whiplash the pandemic has created and in NZ we saw with the pumping of billions into the pockets of property speculators how our own house prices have skyrocketed.

This game of printing money to pump into property and stock market speculation to create a false illusion of wealth can continue playing as long as hyper inflation doesn’t overturn the apple cart.

But what happens if it does?

‘Perfect storm’: Cost of living rises 0.8 percent, tipped to increase further

Household living costs rose 0.8 percent in the March 2021 quarter, the latest Statistics New Zealand Consumer Price Index survey shows.

Consumer prices are on their way up, as petrol, transport and rent are becoming more expensive.

What happens if hyper inflation does suddenly explode out of nowhere?

To date all the inflationary pressures caused by this mass printing has led to driving up property prices and stock markets without touching the essentials and basics of life, but one of the impacts of Covid has been to shut down the global supply chains which is now creating scarcity of products that can’t get to market because they are bottlenecked at a Port.

This seems insanely dangerous because all those hyper inflation pressures will immediately jump to the very basics everyone uses.

Your Kiwisaver going up and your property value climbing is one thing, paying $15 for a loaf of bread and $20 for milk is completely another.

To date the cost rises have been in things poor people have to pay, transport, rent and gas. That means food will be cut, hungry people get angry quickly.

There are already arson attacks on Landlords…

Auckland house fire blamed on frustration over skyrocketing rents

A resident of a street where an empty house went up in flames on Saturday morning thinks someone angry about the housing crisis could be to blame.

…after every great pandemic throughout history, the peasant revolt in the 1300s, the London riots of the 1600s and the social unrest right after the Influenza pandemic of 1918, society always goes through intense social change brought on by the economic collapse lockdowns generate.

If the bottlenecks of supply chains are blocked unleashing a tsunami of hyper inflation on the goods everyone requires for life, Central Banks will have no choice but to lift inflation rates to desperately attempt to curtail that hyper inflation, which of course will mean the ocean of low interest debt that has been created to fuel hyper speculation will suddenly start feeling the true gravity of trillions in borrowing.

Inflation is coming, which could mean higher interest rates – expert

Experts are tipping rising oil prices and cargo disruptions will soon lead to higher prices and inflation.

And that could result in higher interest rates for borrowers, says Felix Fok of Milford Asset Management.

“It’s almost certainly coming… I think some of it is already here,” he told The AM Show on Thursday. “There have been stories written about the costs of second-hand cars in New Zealand going up, for example.”

I’m no economist or financial guru, but it seems the basic laws of capitalism’s supply and demand will unleash a terrible tsunami of hyper inflation that the Global Reserve Banks will struggle to contain in any other way than to allow stock markets and house prices to shatter and crash by forcing interest rates back up.

Now if a vaccine can reach the 75% herd immunity threshold, those supply chains will reopen, but if we don’t gain that herd immunity, quarantine will continue to force those supply chains closed and the prices of scarce ordinary goods will start to dangerously inflate.

I fear all our Black Swans are coming home to roost in 2021.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

I read yesterday that the cost of shipping has gone up x 5 minimum, if a container is available that is. The shipping companies are exploiting the uncertainty to some extent plus factoring in delay costs.

Global production and supply chains are very much out of sorts. Retailers have less on the shelves and are upping prices on the back of that and shipping costs, in a society that doesn’t do price rises. So something has to give.

Essentials going up will mean people cutting back. And despite what some retailers say about consumers having to pay more for consumer goods, all it will simply mean is we stop buying and I would not want to be a retailer. The NZ retail model is highly reliant on fast bulk stock turnover on low margins to pay the bills. That is about to end meaning retailers landlords, probably leveraged up to the eyeballs are next to take the hit. The flow on if unchecked is concerning.

I’m picking temporarily at least, IF prices go up substantially and keep rising the consumer society, our economy is at least partly based on, will slow right down, something unseen for decades. We will live and learn to do without unecessary things.

Although the usual broken arsed Nat groupies will blame the government for this, I do not. But as in many other things with our economic model, being reliant on private enterprise, I.e. private shipping companies, exposes us to shocks badly like this, they are going to have to strategize well in advance (something Labour seem useless at) and not in typical neo liberal economic orthodoxy either, to mitigate what may happen next! But will they?

I am not an economist but a historian. I admit to a limited understanding of credit reform but here goes.

The Hyper-inflation in weimar Republic Germany had two causes

1. The reparations forced on Germany could be paid back in worthless money.

2. German exports were cheaper than that of competitors. Contempary observers in Germany at this time remarked Germany had nearly full employment, manufacturing industries were working and German exports were being marketed all over the world.

This was in contrast to Britain, the U.S.A and other countries using conventional economics.

In World War II New Zealand did not borrow money to pay for the costs of the war. It created credit. Banks and investors screamed long and hard about the hyper inflation that would result.

Inflation did happen but it was not hyper-inflation and there is one significant thing the wartime Labour government did.

IT CONTROLLED LAND PRICES! ( Yes it is possible to do that). It used its coercive powers to tax wealthy people, prevent speculation, control prices of essential items such as food and clothing, build houses, keep essential industries in state control and fight a war.

At the end of the war New Zealand was able to gift several million pounds to the broke and exhausted British( whose government had stuck to the capitalist model and borrowed masses of money that took them about a century to pay back).

So we have already shown a model that prevents hyper-inflation and debt. Why can we not use it again?

kia ora katoa

It also helped that britain bought New zealands entire wool clip for the duration of the war at generous prices. It helped that new zealand provided vast amounts of food for the Americans in the Pacific.

1.5% anual inflation is below the long held target of the reserve bank act of 2% since Rogernomics started. So they will be pleased with it being positive . They will be concerned that it is made up from mostly rent increases which I assume it is.

Raising interest rates in the foreseeable future I think is purely propaganda aimed in desperation at trying to cool the house price hyperinflation. I don’t believe it is being contemplated. With the volume of debt around the world locked in at the current rates the resultant collapse of the system is inevitable.

IMHO D J S

Our inflation figures are Bullshit!

They’re rigged to stay between 1% to 3%, mandated.

It’s the ‘methodology in how they calculate each sector and it’s a selective basket of goods it uses at specific price points that drags inflation to its lowest.

It also doesn’t take into account the $52b pumped into the economy!!

Agree entirely.

In the 1990s Shipley and Bolger removed the cost of land, the cost of existing houses and the cost of servicing a mortgage from the CPI.

So you can have ever increasing house prices without it showing in CPI and therefore have the dream of falling interest rates and the housing boom.

The basket of goods is manipulated all the time. When red meat prices doubled a few years ago, they simply reduced the weighting in CPI to minimise the impact and replaced it with olives of which there was a global glut.

Now we have only the cost of a new build and the cost of rent in the CPI to cover housing.

A couple of years ago the % weighting was 4% and 9% respectively, although I think since then it has increased.

But the fact remains the CPI does not include the true cost of accommodation, nor the true cost of living for an average kiwi.

It is a tool to keep blue collar wages low as most wage increases are tied to CPI.

Sure but the imported goods involved are middle class nice to haves rather than essentials (upgrade of electronics and cars etc – the impact of deferred sales because of higher price and or lack of stock will be on business retailers and GST revenue).

Ultimately it impacts on the bond market and bank lending (mortgage cost), but as our RBG is not going to change the OCR till the end of next year it will be a slow process. Thus manageable – providing the global distribution system gets back to normal next year and processes the backlog.

The people struggling to pay rent and other necessities are not directly in line of this one (the risk of higher power bill costs or next year with a stronger La Nina can be met with another doubling of the power cost income supplement) – though one hopes and expects some boost to AS in this years budget (especially some provincial areas where rents have increased more sharply).

My understanding is since the GFC 0f 2008 trillions have been poured into banks and finance house bailouts at the expense of the taxpayer. Case in point bond holders in Euro banks said banks invested in the irish banks fuelling a massive home building orgy. When it went bust instead of making the euro bond holders take the smash down they were bailed out by the corrupt Irish government who charged it back as austerity to the taxpayer.

Greece too.

So the asset wealth of the 1% has not only been protected but inflated at the expense of ordinary working joes. Same in NZ Plenty of dosh for mortgages no matter how crazy they are. THERE’S YOUR HYPER INFLATION.

Hyper deflation for the ordinary worker paid hardly enough to cover their living costs as mortgage slaves and rent paying slaves.

There’s been a massive transfer of wealth to the 1% via share market, bond market and housing hyper inflation. result inequalty has skyrocketed. 🙁

Ghost homes about to be a very very hot topic……….. : )

There won’t be hyper inflation Martyn. Trust me on this.

Reserve banks used the virus as an excuse to print money, but they’ve been doing this at every possible occasion since the 1990’s, with Ben Bernanke’s famous quote of threatening to bomb Americans with cash from helicopters. Reserve banks would LOVE to see some inflation and that’s why they’re printing – to try and stimulate some, but no matter how hard they try, the real ogre won’t go away: DEFLATION. Allow me to explain:

A combination of factors post WW2 have slowly but consistently undermined the value of western labour and these are all deflationary factors for the West:

>The opening up of China in the late ’70’s added 50% to the global labour pool.

>The development of robots in the ’80’s for production line manufacture reduced the need for labour in several key industries.

>The internet enabling the offshoring of simple computer jobs such as call centres, in the ’90’s

>The economic rise of other Asian nations in the early 2000’s (Thailand, Vietnam, Korea etc) further increased the global labour pool.

>In the 2010’s smart online systems resulted in more job losses. Taxi drivers, technical draughtsman, customs staff, dock workers all lost jobs to disruption by emerging online systems.

> Also in the 2010’s advanced systems began doing the core work of western professionals: Lawyers & accountants are now facing the same terminal decline in incomes and the number employed as blue collar workers faced in the 70’s’.

>My prediction for the 2020’s is the disruption of academia as remote learning undercuts these wildly inefficient institutions. In the end our grandchildren will all study at Oxford, MIT or Harvard albeit remotely. Microsoft has been doing this for decades with its MCSE qualification and when hiring the IT market now prefers Google’s 6 month online course to a 4 year computer science degree from a top uni.

The above factors are the ‘Perfect Storm’ of deflation and governments are terrified of deflation, because once it sets in, it is a spiral toward the pit of a full depression. So they printed to try and stimulate inflation. Starting with Japan in the 80’s and subsequently copied by Allan (helicopter) Greenspan in the 90’s. Since then all western nations have been printing like mad to stave off deflation. Upon every minor economic bump on the road they’ve increased liquidity. It didn’t work. Instead this excess liquidity went into the economy asymmetrically:

a) Despite their best efforts, the real cost of goods and services has continued to decline because of the above factors. For example I can buy a new car now for less than I paid 25 years ago, and it’s a better car in every way. That is deflation.

b) Instead, a lot of the hot cash central bankers created has flown into assets; mainly property, but also conspicuous consumption by our newly minted feudal overlords who control everything these days. Super yachts, executive jets and private islands. Bill Gates has in recent years bought over a quarter of a million acres of US farmland. One can only wonder what sort of feudal kingdom is planning there!

So no – there won’t be hyper inflation.

The True CPI & Inflation rate is closer to 20% not the 1-2% they are telling the general public? They conveniently leave out of their calculations Housing Inflation & Rents Inflation! This is done on purpose to hide the true Inflation rate? And you can see Commodity prices such as Timber & shipping costs are rising exponentially & that cost is being passed on to Consumers by stealth! Hyperinflation is on the way people & your dollars are going to buy less goods & the cost of living is going to skyrocket.

Comments are closed.