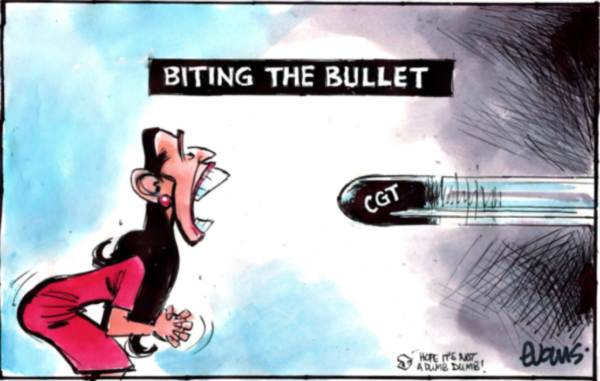

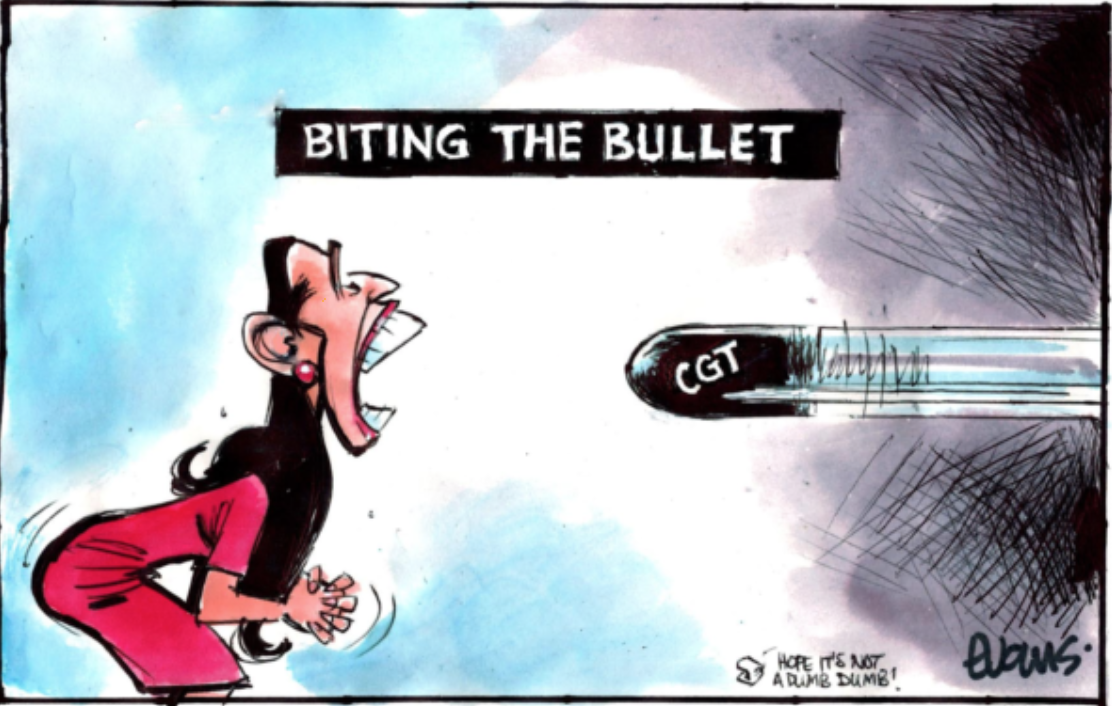

The hysteria over a Capital Gains Tax that is only realised when you actually sell your asset post 2021, (which would be well past the point when the vast majority of untaxed wealth was created) is so over blown it makes the media’s hysteria that NZ civilisation would fall when Winston took over while Jacinda gave birth and the state housing meth hysteria combined.

There is something about the knee jerk reaction of negative egalitarianism in this country that makes book burning look sophisticated and cosmopolitan.

That there is hysteria should surprise no one, but the Government seem to have been incredibly flat footed in their response. Where were the Governments heavy hitters to face the media platforms the day after the announcement and the narrative build up to defend the tax?

Where was the expert NGOs to appear and explain why social services needed this extra income to combat inequality?

Where were the pundits ready to debate?

All we’ve had is the usual social media tribal guerrilla war with unchallenged assertions and total falsehoods. The Government should have known this was coming and should have taken control of the narrative but instead seem to have gone into hiding with no one front fitting the debate.

It’s like the Government were caught surprised by the negative reaction and have been stumbling ever since.

If Labour don’t pass some sort of CGT, the n National will claim that as a victory.

Labour seem to have been asleep at the wheel on this one.

The coms campaign looks amateur hour.

Yes Government are playing a fox in the hole move and letting the subject be thrashed around in the media so I am not surprised as they are using the same ‘fishing expedition’ as they have no reaL IDEAS OR APPETITE for change.

Labour are really just another populist party and ‘not a bold lead by example’ functionary.

So we are just sitting waiting for them to WAKE UP!!!. .

Labour have been asleep at the wheel since they took power.After 9 years in the starting blocks you would think they would have hit the ground running but instead they set up multiple commissions many of which are still to report back. Kiwibuild has been a disaster free fees at university has seen no great increase in uptake teachers needs are not being met and are set to join the junior doctors and go on strike. No improvement has been made in the way we handle prisoners and more families are doing it tough especially in Auckland where the petrol tax is hurting .Now they indicate a tax that will hit small businesses and framers but will have so much wiggle room that the really rich will get Smart accountants on the job and escape any payment as is the case in Australia

If Labour was asleep. What the fuck was National doing?

At the start of their period in power they protected NZ from the worst of the financial downturn and put in place the foundations for a strong economy.By the time of the 2016 election they had lost touch with housing and mental health and the enviroment. I was pleased to see Labour get in as they presented a new approach but I have been very disappointed with the leadership from many of the minsters the Greens in particular seem to be very poor in achieving any goals for most normal people

Jesus, Trevor you don’t expect much in just 16 months, do you? If Labour achieved everything you listed, wtf would they have to do the rest of their term in office?? Twiddle thumbs?? We really have become a “We want it NOW!!” society.

Who cares cos right now labour is allegedly running the government. The past is the past useful to get historical perspective but useless as a lever for altering the here and now since time doesn’t work that way – not having a machine to take us back and all.

The thing that strikes me most about airhead Ardern’s reaction to the tax review findings is that her primary motive governing her every move is “don’t let me lose my cushy gig”. What use is a government which is so defensive? Big rewards for we the people always means big risk there is no other way. Yet the government is too risk averse.

This country is going down the gurgler as the increasing poverty leads to homelessness, crime and despair, yet this mob of bourgeois wannabes who make up the current government ignore the danger to social cohesion increasing wealth disparity poses. Why?

It seems to me they run scared from the Herald’s staff of inbred Natz family puppets every single day. Keeping it as glossy and artificial as the last mob did. This while real people are hurting, I’m sure we all have our stories of friends and family kicked to the curb by a society which treats disadvantaged kiwis as a useless commodity to be ignored unless their cries get so loud they are silenced by threats.

The whole dualistic one side good, the other side evil, view of party politics simply doesn’t cut it any longer as both sides are chocka with mendacious little self promoters who won’t do anything that doesn’t advantage themselves. Yep natz pols are the worst, but the Labour party mob have spent so long living right next to the Natzos that now like Orwell’s pigs they look, talk and act just the same.

We know substantial numbers of labour, NZ First & Green pols own investment properties yet we trust them to close off the income tax loophole of capital gains, are we mad or are they just another gang of greedy liars?

The purpose of free tertiary education is not to have more students (we want more in apprenticeships and on the job training) but to reduce tertiary debt.

KiwiBuild is not yet a disaster, it might be if it fails to note the optimum method of delivery and sale.

1. Factory built small homes (nationwide consents) – the only ones that can fit on the remaining unsubdivided sections of Auckland (increases land available for new housing).

2. Sale to existing homeowners trading up from older doer upper first homes (these then sold to first homebuyers).

I will not vote for a party that does not place a tax on all income, via a CGT. I might accept a deferral on inclusion of small business (new start ups and recent start ups still receiving capital inputs) while compliance and legislation is worked through – allowing IRD to focus on the rest of CGT compliance for a time. Inclusion of farms would be for me non negotiable (barring stepping stone and family roll over), as would lifestyle blocks beyond the home area exemption (given so many are landbanking investments).

NO you fool. Alot of us (policemen, nurses, etc.) have saved our entire lives to live on a lifestyle block – and why shouldn’t we be able to enjoy our lives without being taxed to the hilt? We are not rich, but have paid a hell of a lot in taxes and saved to buy a place of our own. WHY ON EARTH should we pay taxes on it again when we have paid PAYE our entire lives to save up for this place and now pay the banks another cool couple hundred thousand on top of 15% GST on everything else – including any food for our chickens. (that is right – none of it is deductable fruit loop yet we spend alot of our days improving the land we live on) You are a bloody idiot if you think average KIWIs want to be taxed more. We already have INSANE taxes in this country, but our govt is doing a crappy job with our hard earned money –

The problem with this tax, is that it doesn’t hit the mega corporations, only people that have worked their bums off to be where they are. Cops, nurses, teachers, farmers – anyone with a lifestyle block, anyone with a boarder or kids that live at home, small businesses.

The end result is that no one will sell, and thus, there will be even less housing available to all the freeloaders that are already getting a free ride on the tabs of those of us paying over 30% taxes on everything we make. So go home already you socialist fool.

The higher up the escalator you go the more you realise that it’s not the middle 2nd class carriages you’ve got to worry about, it’s the bottom classes you’ve got to worry about.

Among other things, because the middle and upper-middle class has internalized very well how society and meritocracy works, and, through a combination of money, knowledge and networking, provides the best it can to its kids to give them a quite considerable comparative advantage to those who lack these three elements. I avoided the shitty primary schools in my part of town because my mom feared a drug habit and got a much better one by joining the children of doctors lawyers and bankers through a relatively simple exam. Knowing this allowed her son to get a leg-up and to be in a good position to enjoy further opportunities society gives to everyone but that a minority actually realizes exist. I could get access to people and resources when I lagged behind, to avoid really hard problems (and I was borderline academic failure in high school). Then my mom groomed me for uni, which not everyone knows exist nor know the ins and outs. Still went through went through it on my own, and I benefitted from a bit more tutoring, all the books I could need and public transport is always better to the school that gets more wealthy parents and the foods better than those forced to travel a lot more or to stay in dormitories.

My grandfather taught me maths and English aside from school, while showing me movies, series and books that cemented a very high level of culture. He got me internships that would build my character like nothing else, giving me another leg-up on the competition and a work capability that will serve me until my last breath.

So I know for a fact that the upper classes have no idea about Mad Max. Children today go from there covered bus stops to the nice jobs. They have no idea things can go terribly wrong terribly fast. I was at a nice hotel and my daughter dropped a ball and the bell boy chased after it and brought it back and that just can’t be. The world isn’t soft and lovely all the time. There has to be away of rewarding the normal people for grinding it out.

And Nero Fiddled while Rome burned

Martyn I am not happy. You always seem to find fault with the Government. I think Jacinda is handling the situation well and Robertson has also spoken confidently. But you are right, if the CGT is not implemented or watered down, that will be a huge let down by this Government and may be Greens are right – it doesn’t deserve to be reelected.

Yup, and Jacinda asked Iwi Māori people to hold her government to account. Martyn writes for Iwi Māori radio station Watea radio. Thus it’s reasonable for some one like Martyn to produce something when there’s a fault with the Jacinda government. It’s perfectly logical really. What doesn’t kill Jacinda will make her stronger.

Yes implementing a CGT has been a Green policy for a while, I wonder why they are haemorrhaging and not gaining so many voters then, if it is so popular?

Also when Labour wanted to implement a CGT for the last decade and gave the Natz the election each time, when they finally said they would not bring one in, they won the election????

The people most cheering for CGT are the Natz because they know that is the gift that they need to win the next election.

I’m waiting for the independent farmers lobby telling us what a great job they are doing protecting the environment. … Oh wait, they are off to irrigate their Canterbury dairy farms. These commissions / reports / etc. show that the government is being cautious and not prepared to upset the powerful interest groups. How did the new TV channel promised pre election go?

Yeah Bomber i want then to come out swinging with regards to the crap that is being forced fed here by the usual suspects but Jacinda is all about kindness and not rocking the boat so i would not expect much fire power here sadly.

Also Winston and his influence is at work here and i would wager that they will let this rage on for a while and let it die a slow death in the coming months.

As Key had huge political capital to spend starting with the increase to gst to fund the brighter future after declaring there would be no tax increases in the first term he got away with it , Jacinda also has room and time on her side to maybe depending on NZF deliver some form of CGT as a policy for 2020.

The communication is probably bad because they don’t have their heart in it – they’ve given up already and are probably looking for an excuse to bury the idea

[Comment declined for publication. Offensive. – Scarletmod]]

Recently the mainstream NZ Media have been carrying on to the point of nausea that the majority of NZers are against a CGT.

Not even 24 hours before one ‘breaking news’ item it was stated, again in the mainstream NZ media, that the majority of National Party supporters were against a CGT.

Can’t the mainstream NZ media get anything right or do they always have to parrot the words and instructions from their Leaders aka the NZ National Party?

Whilst I harp on about the mainstream NZ media and their bullshit and lies at the behest of the National Party what I am trying to put across is what appears to be an obvious fact that the so-called ‘polls’ on the possible CGT are a load of codswallop is a manipulation of data inspired by National and referred onto say the NZ Herald(the primary Mouthpiece of the NZ National Party) and its so-called ‘journos’ eg Soper, Du Plessis Allan, Hosking, etc,etc,etc.

Not once have I and probably the majority of NZers been approached by anyone asking me as to what I think of the CGT. I am all for it but then I am one of the 99% of NZers who do not own more than one asset i.e in the form of land or houses.

So in my opinion the so-called ‘majority of NZers’ that are against the CGT are probably the one percenters that consist of the wealthy and National Party MPs and their supporters in the mainstream NZ Media.

Nowadays whenever I hear on the telly Simon Bridges, Amy Adams or anyone else carrying on about the CGT and how bad it will be for NZers I look at them as being part and parcel of the One Percenters who have done well over the years on the NZ taxpayers purse and don’t want a tax because they have gotten away with that form of tax avoidance/evasion for many years too long.

Capital gains is a wasted opportunity that is mostly ‘tax neutral’ aka it is ideological tax not a tax to actually raise money for improving public services.

It is not a fair tax which is why people are against it as there are many loop holes and difficult to enforce.

I’m all for taxing property a bit more IF the money went to social services like hospitals and schools and super for people who were born in NZ or those that pay NZ taxes here for much of their lives…

but it should be clear to the more financially literate that CGT is like student fees another ‘Rogernmomics’ tinkering idea, and many of the failures of Labour from Kiwibuild to unitary plan support, has not worked out. For example there are more than 5000 added to the state house waiting lists last year and people are kicked out of their woke deemed ‘dangerous’ 3 bedroom, plus garden state house for $150 p/w rent to their woke paradise business focused emergency housing option of 1 bedroom hotels at $1200 p/w that the Greens and Labour feel are ‘warmer and dryer’…

https://www.radionz.co.nz/news/national/381847/waiting-lists-for-state-houses-emergency-housing-hits-record-levels

The CGT is as usual another way for the power interests to muzzle other ways under globalism that taxes should be collected to make taxation fairer to the local people and to make more money from the growing poor and homeless to construction and hotel industry.

It is another wasted opportunity when a stamp duty could have been analysed which is a straight forward tax and much fairer because the more you buy the more you pay so you can’t avoid taxes by living in McMansions as your family home to avoid taxes.

On CGT there are so many ways not to pay… which is why it is tax neutral and not expected to raise much money.

Labour just can’t help themselves from the introduction of student fees in the 1980’s to all their terrible tax ideas which are deeply unpopular and their flawed (egged on by the Rogernoms) reasoning without any practicality. Such as their personal ‘redistribution efforts; not expected to raise much taxes or get the dishonest or going for a tax that does not equally tax capital, instead encourages more financial engineering…

The government could have also looked more at a Tobin tax to tax people moving money into and out of NZ… but apparently the FTT was too frightening for all the financial types on the tax working group, aka tax the local Joe disproportionally and but allow the loopholes for the usual suspects to avoid taxes, not tax the foreigners and John Key types that might ‘scare the markets’!

The government are completely out of touch of the issues facing people, which are things like Meth destroying people’s lives or housing shortages not their woke leftie social engineering making people live in 1 room ‘warm, dry’ hotels or apartments which the tax payer pays $1200 p/w for or the $500k one bed Kiwibuild apartment…

https://www.radionz.co.nz/news/national/378070/towns-throughout-nz-worried-about-drugs-and-housing-crisis

SaveNZ:

>> but it should be clear to the more financially literate that CGT is like student fees another ‘Rogernmomics’ tinkering idea

What?!? If anything here smacks of “Rogernomics”, it’s taxing people on money they earn through labour, and then taxing them again when they spend it (GST), but then *not* taxing the wealthy on income they gain by owning stuff. As Piketty made clear in his book, the only way to prevent wealth inequality increasing with every generation is to tax wealth, as well as income.

Besides, if CGT is a “Rogernomics” policy, why are all the outfits that usually support such policies (ACT, Business NZ, Fed Farmers, Property Investors Federation, Taxpayers Union etc) totally opposed to it?

Roger Douglas claimed he preferred an assets to a CGT when he proposed tax reform back in the 80’s. But only becausde he wanted to deceive those on the left as to how much he was intent on betrayal of their support.

Now he openly opposes any tax on the wealthy – no estate no CGT no assets tax no wealth tax – the man is and was a fraud.

Now who’d have thought that a degree from Waikato Uni in “Communucations” and no real work experience wouldn’t prepare a person to be an effective prime minister?

Never been a minister

Never got a private members bill beyond a draft

The fact is that Cindy is WAY out of her depth!

Martyn, some suggested topics for TDB:

1. The Labour bust-up over anti-Semitism in the UK

2. Labour in NZ refusing to allow John T back into the party

3. James Shaw having the largest carbon footprint in Parliament

🙂

Comments are closed.