We have a problem in NZ.

For the longest time, the only way the middle classes could become wealthy was to speculate in property, and that illusion of paper wealth and the extra credit card consumption that it brings with it is a big political problem.

One of the main reasons the middle classes walked away from their liberal values under Key was because Key gave them annual increases in their property value that were larger than the salaries they received.

Now sure, to get those capital gains, National turned on the immigration tap and privatised state housing and yes there was obscene homelessness and child poverty, but when you are earning more each year than your actual salary you can have every copy of Marx in the family bookcase and you’ll still vote National year in and year out.

And that’s exactly what the middle classes of NZ did. Once upon a time they were an essential amplifier for the concerns and pains of the working classes, but once they got a taste of being property speculators, they went mute on the poverty and the inequality because they benefited too much from its cause.

Which brings us to Labour’s attempt to rebuild the tax playing field…

Commentators agree Capital Gains Tax won’t be an easy sell for Labour

While a Capital Gains Tax (CGT) has yet to be mooted by the Tax Working Group, commentators are already saying any CGT would be an extremely tough sell for Labour and is likely to hurt the business sector.

In her post-cabinet press conference on Tuesday, Prime Minister Jacinda Ardern fielded questions regarding a CGT that is expected to be recommended by the Government’s Tax Working Group when it reports back this week.

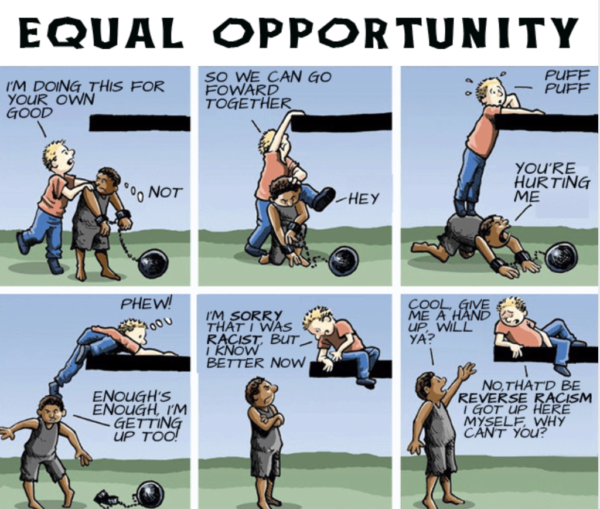

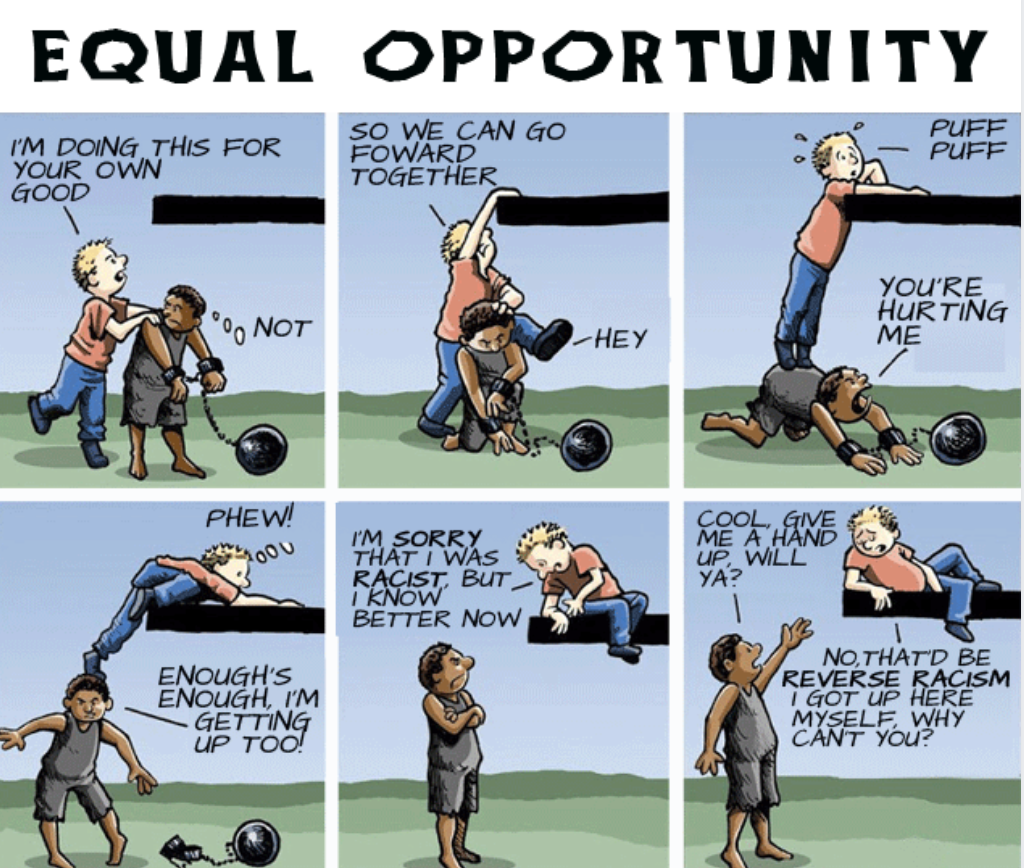

…the problem is that the entire rigged game of middle class property speculation is unjust so the outcry will be vicious. Add to this the cultural values of neoliberalism which state that if you succeed, that is an individual success where as poverty is an individual responsibility.

Labour are not just trying to fight vested self interest, they are fighting a neoliberal cultural myth that rewards greed while mocking economic failure.

Making this tax neutral helps, a giant tax cut to offset the capital gains tax will take the sting out, but to truly be effective, Labour simply needs to bite the bullet, appreciate it has a real war on its hands and promise the poor, the homeless, the beneficiaries, the first time home buyers and the renting class that they will see affordable houses and the aim is for total home ownership or secure long term housing tenancies.

The only way you can win a war like this is by making the homeless, the poor, the beneficiaries, the first home buyers and the renting class as self interested as the property speculators because kindness is only going to get you so far when you tell the Millennial, Xer and Boomer middle class property speculator that you are taking 20% of their imaginary wealth.

Labour better rally their troops because the Rights sure as Christ will.

With the sort of gains houses were/are having (10% in some cases) per annum, then a pensioner living entirely on Super in a house they purchased for $30,000 back in the day, but just increased by $100,000 (going from say $1,000,000 to $1,100,000) and now have to cough up $2,000 (assuming 2% CGT) from money they don’t have, is not going to work. Same would go for someone who has a massive mortgage they can barely afford as it is. I guess you’d say “well in that case they should sell it and rent”, but when it is a home that you’ve been attached to or worked toward for most of your life that is going to be a very tough sell both politically and morally. IMO CGT can really only work if it’s bought in at a ridiculously low level and/or tax deductible so that is affordable by everyone at the receiving end (like 0.1%, and then only slowly raised over multiple decades to allow the market to adjust).

As I understand it won’t apply to the home you live in. If you own multiple properties whilst others have no home at all then grow up and pay the damn tax. I’ve owned properies in Aussie and paid CGT – it was no big deal. Come on kiwis, don’t let the greedies spook you.

Yeah but if you apply it to rental properties, guess who’s ultimately going to pay the CGT. All of it. Yep.

Not worth having a cgt if it won’t even pay for admin costs. Best way to raise funds for more housing is to tax those who are making the most money in that same market. If folk don’t like it they can sell up and find a productive investment that creates jobs.

iI believe it is an envy tax to slam those that are willing to take a change on the market. Property can lose value will the government pay a refund if that happens.?

If they try to bring it in it will be another nail in their demise .

I think the clue is in the G… if a property does not gain value there will be no gains tax to pay. If it lowers in value I expect (not an expert) there are ways that can be applied to offset bottom line tax charges.

Meanwhile if a property value swells obscenely thanks to market trends, it would be nice to think any applicable gains taxes are mandated to covering costs for affordable and state housing …what are the chances?

Lower tax rates result in lower minimum earnings levels nationally.

It is unwise for a society to exempt too many people from paying the significant forms of taxes. Everyone needs to be concerned about how the money is spent. If it’s just a tax on investment IQ, the poor will not have any financial reason to hold government accountable.

There are more holes in capital gains taxes than leaks in leaky buildings mostly because it does not tax the family home which might be worth 30 million, family trusts and relies on income tax information . It is not a tax on the super rich, as we already have 50% of the rich listers in NZ who are not on the highest income tax rate!

To redistribute wealth in the age of globalism you need to tax capital and money flows such as a financial service tax or tax money coming in and out of NZ.

Or have direct taxes like petrol taxes, stamp duty and so forth so that everyone pays the same and the more you use or pay the more taxes you are up for.

If taxes are rorted through income taxes then essentially people who are rich/fraudsters/overseas based/assuming multiple identities and corporations or what have you are able to reduce or not pay any taxes they owe including capital gains taxes.

As we can see in NZ those that are the most fraudulent are actually knocking out the others in business and the same will happen with capital gains taxes, it will tax the honest and small fry who pay it and then leave the larger players with superior tax abilities alone to gobble up more of NZ assets and profits without paying taxes, while at the same time encouraging more expensive builds to avoid paying taxes.

When we have people gambling hundreds of million at Sky City in NZ, wealthy people not paying any taxes or putting in tax returns, have multiple identities and many complex tax activities then what the hell will capital gains do?

Taxing some Kiwi teacher who was told in the 1990’s that there is going to be no pension and they have to start saving for retirement by owning a rental property worth a few hundred thousand and not able to easily minimise her taxable income like those who can gamble $293 million at Sky City below… it is not a fair tax because richer people are not paying their share, yet again!

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11837117

“The investigation also uncovered Yan’s SkyCity records where he gambled $293m over 12 years, despite being banned twice for two years and losing $23m.”

They had raided his Metropolis home in August 2014 and seized around $40m of assets, on the grounds he was an “economic fugitive” wanted for fraud in China.

Together with his partner Vienna You, police alleged Yan had slipped millions of dollars of stolen money into New Zealand through “large-scale money laundering transactions”.

“Police believe that Yan and You have accumulated a substantial asset base in New Zealand and are concealing the true ownership of those assets by registering or purchasing the assets in the names of associates, using the assistance of professionals and other persons mentioned in this affidavit,” said Detective Inspector Bruce Good.”

In a separate case these ‘financial’ traders gained residency in NZ despite never putting in a tax return in, in 26 years…

“According to Inland Revenue records neither Yim nor Wu, who arrived in New Zealand in 1991 and 1994, have ever declared their income nor paid any tax.”

“As part of the raids on Yim, police also seized 12 luxury sports cars valued at more than $1.3m, including a Ferrari worth more than $500,000 and a Lamborghini Gallardo. More than $1.8m in cash was seized and a further 1kg of methamphetamine found.

Watches, jewellery, electronics, and 48 bottles of vintage French wine valued at about $42,000 were also seized.”

“Yim was sentenced this month in the High Court at Auckland to 11 and a half years in prison for possession of a class A drug for supply.

During sentencing he was described by Justice Geoffrey Venning as being vital to the drug scheme which imported the equivalent of 30kg of pure methamphetamine with a street value of $40m.”

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11842563

Yim, who came to New Zealand from Hong Kong on a resident visa before gaining citizenship in 1995, has previously been convicted on three unrelated charges.

In July 2006 he was convicted at the Auckland District Court for drink-driving and on a dangerous driving charge, while in April 1997 he was convicted of shoplifting.”

Seriously do we really think that the world’s companies who somehow turnover hundreds of millions while paying very little in taxes will be up for capital gains taxes in NZ… they have capital gains taxes in OZ and the US but as we can see many legal loopholes deliberately created so that paying taxes become optional if you care to manipulate the situation.

Out of 1539 of Australia’s largest corporate entities, 38 per cent did not pay any tax in 2013-14.

Tax Commissioner Chris Jordan has released the tax details of corporate entities with $100 million or more annual turnover – 985 of which are foreign-owned, and 554 of which are Australian foreign entities.

https://www.cbsnews.com/news/meet-the-18-companies-that-paid-no-taxes-over-8-years/

Ten companies pay 45% of all corporate tax in Australia

https://www.theguardian.com/australia-news/2018/dec/13/ten-companies-pay-45-per-cent-of-all-corporate-tax-in-australia

Note NZ is too gutless and in the corporations pockets to have a similar to OZ tax transparency reports so we have no idea what is happening here, but my guess is that our loose rules as shown by the Panama papers, Cadbury deals and so forth and our ease of buying residency quickly here means we have attracted a huge percentage for our size of crooks routing money through here on the 0% tax havens, that again the capital gains taxes will make them richer while making that average Joe poorer and removing even more rental properties available which (like unitary plan, Kiwibuild and fake Meth levels) the powerful control both sides of the discourse aka the right view and the new woke left view and putting forward only 1 solution each time that benefits them, aka in this area of capital gains on taxation rather than effective taxes on the rich like financial transaction taxes, stamp duty, consumer taxes!

(P>S> also since the middle class ever fell for Kiwibuild, unitary plan, and whatever the Green vision is these days, it then has the great effect of a one idea party, to stop Labour winning another election and removing Green voters and keeping the Natz in power).

I wonder why the heavily stacked ‘financial’ interests (banking, insurance, lawyers, consultancy) of the tax working group failed to suggest any taxes like financial transactions taxes or direct taxes that will effect high spending individuals here like stamp duty on housing???

Think how much they raised with the ‘direct’ petrol taxes in the Supercity and how much they could raise with actual taxes based on usage like financial transaction taxes and stamp duty rather than NZ income which seems easy for high wealth people and corporations to avoid paying…

Along with chair Sir Michael Cullen, the Working Group members being appointed are:

Professor Craig Elliffe, University of Auckland

Joanne Hodge, former tax partner at Bell Gully

Kirk Hope, Chief Executive of Business New Zealand

Nick Malarao, senior partner at Meredith Connell

Geof Nightingale, partner at PwC New Zealand

Robin Oliver, former Deputy Commissioner at Inland Revenue

Hinerangi Raumati, Chair of Parininihi ki Waitotara Inc

Michelle Redington, Head of Group Taxation and Insurance at Air New Zealand

Bill Rosenberg, Economist and Director of Policy at the CTU

Marjan Van Den Belt, Assistant Vice Chancellor (Sustainability) at Victoria University of Wellington

Apparently our tax working group and advisors not interested why so little taxes on profits here..

So much revenue, so little profit. So little interest in governments checking why they make so little profit (aka transferring “intellectual charges” else where often to low tax countries).

TOP DRUGS FIRMS LATEST NZ NUMBERS

Johnson & Johnson NZ

Revenues: $136m Net profit: $9m Tax: $972,000

Roche Products

Revenues: $60m Net profit: $1.3m Tax: $598,000

Sanofi-Anentis NZ

Revenues: $59m Net profit: $2.5m Tax: $1.2m

Merck Sharp & Dohme

Revenues: $59m Net profit: $1.5m Tax: $638,000

Pfizer NZ

Revenues: $45m Net profit: $528,000 Tax: $302,000

Novartis NZ

Revenues: $35m Net profit: $1.7m Tax: 483,000

Also how they can do it, the Cadbury example of how the companies was put in debt by a multinational and that used to close it down and transfer profit out of the country.

https://www.radionz.co.nz/national/programmes/ninetonoon/audio/201843153/business-commentator-rod-oram

and who is effected by that financial engineering…

“Axed over the Christmas break, told to be out by lunchtime after 50 years’ loyalty – this is redundancy in New Zealand, where there’s no mandatory notice period or compensation payments and little support for those searching for new work.”

https://www.radionz.co.nz/news/in-depth/365540/why-being-made-redundant-in-nz-is-so-tough

Another company owned by a Hong Kong based billionaire… funny we worry about our hospitals and not getting enough taxes, then we find out how little big Pharma pays in taxes and when you pay outrageous parking charges in hospital to Wilsons.. how many taxes their company is paying, and where it is going…

Wilson Parking’s tax numbers appear to defy economic reality

https://www.smh.com.au/business/wilson-parkings-tax-numbers-appear-to-defy-economic-reality-20160408-go1w4u.html

So my question to the lefties who want the rich to pay, why is every option advocated always a capital gains tax which is not anticipated to bring in that much tax, however the Robin Hood taxes, financial transaction taxes, banking taxes and direct taxes like stamp duty are not advocated the same way by lefties which could bring in a fortune and make the public services rich again!

Lefties don’t be echo chambers, middle class nurses and teachers are not the enemy due to owning a mum and dad rental of which the country is desperately short of nor is (hopefully) most business bad, but business and individuals that are legally allowed to pay little in taxes while turning over significant amounts (aka millions) in this country needs to be stopped and that should be what is being shouted from the lefties.

What also needs to be changed is those who come to NZ to defraud and launder money and drive local businesses and individuals out of business need to be stopped before they get here and deported out of NZ… we need to show zero tolerance to people coming to NZ who are committing crimes and frauds here and seem to be able to get residency no questions asked…

Before we open free benefits and free hospitals and free schools to new arrivals maybe our officials should wait 10 years before people coming to NZ get granted permanent residency and citizenship which should include a tax audit and criminal check over that decade of their taxable activity before residency is granted!!!!

Why can’t NZ just be thorough and get decent migrants who really want to live here and not just see us as a fast, easy residency option and then they can leave again or get money from getting more people in?

+100…wow very good SAVENZ !…to all those comments

…and imo a Capital Gains Tax is stupid and will lose the Coalition Government votes (and possibly the next Election) from the very New Zealanders who vote for them and who they need

…do we want another crooked Nactional Government?!

Fuck 10% or 20%! 40% is reasonable! They still get to keep 60 cents in the dollar! Personal Tax liabilities for income needs to be kept separate from the real profit made to be taxed as a capital gain, not one offsetting the other. If youre borrowing to make a profit, then thats the risk you take, hate the game, Capitalism, market forces and all that bs. What was the saying pre GFC? “Risk & Reward.”

They world was a better place when the profits of the wealthy were taxed properly. Infrastructure, Education, Health ect … systems were of a good standard and a decent quality compared to now.

Here are just a few kiwi that can afford a 40% CGT.

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12107265

Prepare for a class war, Bomber 😉 Which side will you be on?

Tax free capital gains on property is to New Zealanders what guns are to Americans

A fairer tax would be stamp duty on property and like the petrol tax will deliver money immediately and a lot of it!

Unlike capital gains which just tax the gain (which can be manipulated in many ways or litigated for years) a stamp duty has the advantage of being easy to calculate and it is often much more tax than you can hope for from a capital gain, because it is over the entire sales price.

Capital gains taxes are not expected to raise much money for taxes because the family home is excluded and there are many ways to avoid it, including the many people in NZ who already seem to get by just fine in NZ being rich and paying no taxes at all.

Stamp duty on the other hand will get everyone who buys an asset and the more you pay the more you pay the tax so it is much fairer and there is no litigation or getting away with not paying because the lawyers literally have to provide the money when the transaction goes through and the title is changed. It is very difficult to avoid unlike capital gains.

To keep the voter happy the government could even just start with targeting a stamp duty on only land, property and assets sales over $5million dollars… that would keep most Kiwis out of it, while taxing those who have more money.

People already pay 2.5% to real estate agents, so another 2.5% in taxes should be fine!

Labours plans for capital gains taxes each election kept Labour out of power for nearly a decade when they should have won, likewise the Greens. Labour finally say, they won’t bring it capital gains and they scape in,

Greens are decimated tho for many reasons. Could they not just compromise and go for a stamp duty on high priced assets to start with?Greens seem more than happy to give away the water permits to the super rich offshore business but staunch on the middle classes as the enemy who inexplicably probably make up most of their support base!

I only vote for a party with a CGT plan.

I prefer one that includes tax on assets purchased before the introduction of the tax on the grounds that the income occurs after the tax came into law.

Any tax regime without a CGT is unfair.

Wouldn’t you prefer a tax that actually brings in a lot of money to run our hospital’s and schools and target everyone the same… rather than stick to 20th century taxation that no longer works in the age of Panamas papers, tax havens, lobbyists from the financial industry leading the tax discourses and large multinationals?

I guess part of the tax discourse has become so politicised that people are brainwashed into believing it… like unitary plan, which was supported by Labour, Greens and National who group thi

nked their way to believing the same discourse. Now shown to be what it is, the unitary plan zoning changes did not bring in affordable houses or lower the cost of land, quite the opposite it raised the cost of land and produced a slew of demolition of affordable houses for unaffordable new builds that sit empty on rubbish filled sites!

The governments own calculations show a CGT will not bring in much taxation…

meanwhile there is a serious shortage of rental properties and now the tenants are actually killing the landlords which ain’t going to help matters https://www.radionz.co.nz/national/programmes/checkpoint/audio/2018681235/taranaki-man-sentenced-for-killing-landlord

https://www.news.com.au/world/tenant-who-opened-fire-during-a-rental-inspection-in-new-zealand-killing-two-has-set-the-house-on-fire/news-story/050c4781d089a60f3ef1b2c171abfbc9

Meanwhile our new rich residents and even non residents are bringing unemployed people in from around the world, and charging them $40k for the job opportunities here who all need accomodation, https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12171615

Another example of 50 unemployed Chinese people bought in and given one year work visas but of course there is no work but also are contributing to the affordable housing shortages and made some middle man rich (40k x 50 people..) …. https://www.radionz.co.nz/national/programmes/checkpoint/audio/2018681217/chinese-migrant-workers-we-ve-been-cheated

The mind boggles how this people trafficking “business opportunity’ has become a mainstream activity in NZ during major rental shortages, infrastructure shortages, hospital shortages and Jobseeker benefits are up all helped by NZ government helping these dispicable scammers by giving a steady stream of work permits, student permits and entry into NZ to the world’s unemployed, to support the scammer’s growing rich, which is all probably tax free to them and knocking out NZ local Construction and better paid businesses at the same time, yippee!

NZ has created a massive cash economy, of their own making, and now expects the Kiwis to pay double taxes to support the scams, while ignoring the growing cash and money laundering economy here!

+100 SAVENZ…it is corruption that needs to be tackled

I support CGT. Tracking down unpaid tax is a separate argument.

Ashamed that I share a family bach (husband’s family) because it is wrong to own an extra house for leisure when so many people don’t have houses, including one of my sons.

Having a bach in the family is more “good fortune” than something to be ashamed about. A bit of a waste though if its left unused when it could be let out to others (friends etc).

Back in the day many state sector unions (railways post office) had baches for their employees.

Yet under National, at the height of the housing crisis, people were screaming for a CGT, it forced National to introduce its watered down version to appease the growing anger.

And Labour and this government have kept the watered down version, very watered down.

????? Speculation tax is completely different, and because people were going around buying up property and putting them on the market the next day or within. a short period at a much higher price with no work done.

Not sure the Natz voters were braying for a CGT.

My guess is, that this tax hardly raised any money though, because people who were doing it, can manipulate their taxes or just avoid paying it!

It then because expensive for the government to pursue all the payers who don’t pay, many of whom seem to be operating under multiple identities!

Labour are NOT going to upset the middle class property owners, absolutely not, so there won’t be a capital gains tax that goes further than what the tax levied within the so called bright line scope will raise.

Labour will not change the neo-liberal settings, as most middle class voters are so self serving and corrupt, they will always try and find ways to serve themselves, and ignore the worse off, as they will simply continue the blame game, blaming the poor for lack of effort, motivation and so forth.

To even think that Labour will dare do what is suggested, that is living in a dream world.

“The only way you can win a war like this is by making the homeless, the poor, the beneficiaries, the first home buyers and the renting class as self interested as the property speculators because kindness is only going to get you so far when you tell the Millennial, Xer and Boomer middle class property speculator that you are taking 20% of their imaginary wealth.”

Problem is those interest groups of the downtrodden do not organise themselves, do not fight, do not even protest, do simply rather put up with all the BS, so nothing will change, as they behave like masochists who like to be beaten.

And for the rest, it is all a ‘market game’, like Monopoly, and when you have a virtual ‘global’ market for property, which still exists to a degree, then you invite players with some money in, i.e. migrants and investors, who compete with the locals for the limited stock of residential housing there is.

It is easy shouting slogans and talking politics, to change the game, real courage is needed, and some would be hurt. But as Labour, aka Nat Light, do not want to upset their voters and prospective voters, they will be soft again on those who own property, who have investments and who like to play Monopoly now and then.

NZ Inc is NOT a country of revolutionaries, I note.

Official 25-Point Demands of the Yellow Vests France

(summarized)

Economy/Work

A constitutional cap on taxes – at 25%

Increase of 40% in the basic pension and social welfare

Increase hiring in public sector to re-establish public services

Massive construction projects to house 5 million homeless, and severe penalties for mayors/prefectures that leave people on the streets

Break up the ‘too-big-to-fail’ banks, re-separate regular banking from investment banking

Cancel debts accrued through usurious rates of interest

Politics

Constitutional amendments to protect the people’s interests, including binding referenda

The barring of lobby groups and vested interests from political decision-making

Frexit: Leave the EU to regain our economic, monetary and political sovereignty (In other words, respect the 2005 referendum result, when France voted against the EU Constitution Treaty, which was then renamed the Lisbon Treaty, and the French people ignored)

Clampdown on tax evasion by the ultra-rich

The immediate cessation of privatization, and the re-nationalization of public goods like motorways, airports, rail, etc

Remove all ideology from the ministry of education, ending all destructive education techniques

Quadruple the budget for law and order and put time-limits on judicial procedures. Make access to the justice system available for all

Break up media monopolies and end their interference in politics. Make media accessible to citizens and guarantee a plurality of opinions. End editorial propaganda

Guarantee citizens’ liberty by including in the constitution a complete prohibition on state interference in their decisions concerning education, health and family matters

Health/Environment

No more ‘planned obsolescence’ – Mandate guarantee from producers that their products will last 10 years, and that spare parts will be available during that period

Ban plastic bottles and other polluting packaging

Weaken the influence of big pharma on health in general and hospitals in particular

Ban on GMO crops, carcinogenic pesticides, endocrine disruptors and monocrops

Reindustrialize France (thereby reducing imports and thus pollution)

Foreign Affairs

End France’s participation in foreign wars of aggression, and exit from NATO

Cease pillaging and interfering – politically and militarily – in ‘Francafrique’, which keeps Africa poor. Immediately repatriate all French soldiers. Establish relations with African states on an equal peer-to-peer basis

Prevent migratory flows that cannot be accommodated or integrated, given the profound civilizational crisis we are experiencing

Scrupulously respect international law and the treaties we have signed.

A better idea than a CGT would be to introduce an interest clawback, similar to the depreciation clawback in place at present. The reasoning behind this is that interest is not a true business expense, and should not be deductible anyway; and since interest deductibility is well entrenched, and difficult to get rid of, a clawback of interest at the time of sale would be a worthwhile substitute.I would envisage that the upper limit for the combined interest and depreciation clawbacks would be any capital gain which might have been achieved.

Such a device would not affect homeowners as they do not receive tax deductions for interest paid. Nor would it affect persons who have invested their own hard earned cash to invest without actually borrowing to do so. It would only affect those who have avoided tax by claiming large interest deductions while relying on capital gains to justify their investment.

Comments are closed.