I’ve had the chance to read the interim report of the tax working group over the weekend and it’s a sorry, sad document.

Tasked with looking at ways to make our tax system more fair and balanced Michael Cullen and his pay-us-to-help-you-dodge-tax working group have fallen over themselves to discount, deny and discard each and every possible way to reduce the gross and increasing inequality in incomes and wealth which pervade the country.

Oh dear they say – this could make a difference but…mumble, mumble…difficult…..mumble, mumble…too hard….mumble, mumble….compliance costs….mumble, mumble…not done overseas….mumble, mumble…. better if the government did this……mumble, mumble….shift money overseas…mumble, mumble…yes…GST is regressive….but…mumble, mumble…and….tinker, tinker…..mumble, mumble…mumble, mumble

And they did this for 194 pages.

It just could be a world record for obfuscation.

Yes, the Tax Working Group just might come up with some half-baked capital gains tax but the brutal truth of their report is that:

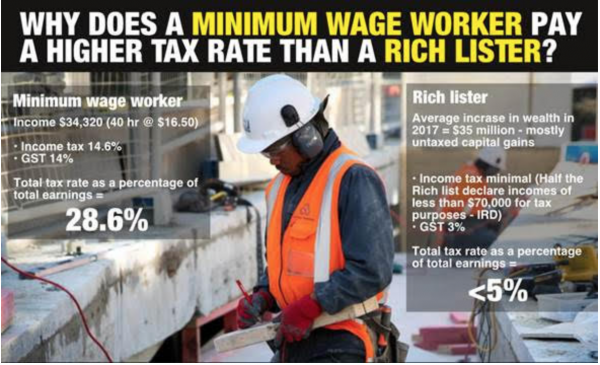

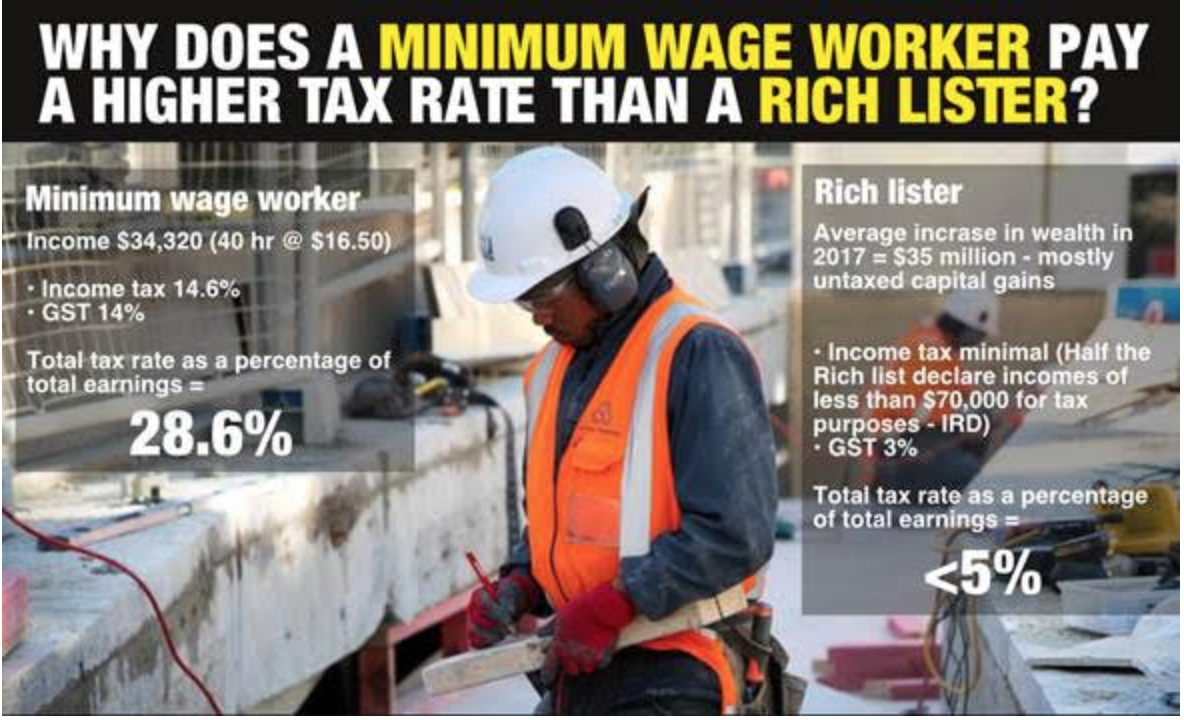

- Working class New Zealanders will continue to pay higher tax rates than rich listers

- Maori will, on average, continue to pay higher tax rates than Pakeha

- Pasifika families will, on average, continue to pay higher tax rates than Pakeha

- Renters will continue to pay higher tax rates than their landlords

- Beneficiaries will continue to pay higher tax rates than the Prime Minister

- Tax, for the wealthy, will continue to be a voluntary activity

What the Tax Working Group are telling us is that the tax system is broken unfair and unbalanced but it’s too hard to change because the rich don’t want change.

So get used to it. Suck it up.

The TWG has done its job of defending the tax system for the rich – change will have to come from outside parliament.

Jacinda will make a ‘captains call’ and all will be good!, she will have a raft of new, and recycled, tax policy that she would like to see put into action (to help the children in poverdy of course) and then put these ideas/dreams to a working group to talk about, and the outcome will be, (Drum roll please… more money to welfare recipients with children under 16 as changing/introducing new tax laws is toooo hard, so here’s more money.) SORTED!

And Soiman will give tax cuts to wealthiest beneficiaries…the filthy rich, the biggest leeches on society. It’s what neoliberal hard right wing National governments do. Oh and it will all trickle down, like a runny shit…SORTED.

Countires that usually have no welfare offset it elsewhere, like home ownership.

They fleece you either way.

And considering how expensive it is to live in Auckland, an income tax for the wealthy would just make them move out of the city.

yes the poor and middle income earners are being screwed over

michael cullen…? Really? cullen? Michael cullen? The same michael cullen that was the last michael cullen? The embalmed vampire neo liberal with a spring in his step for sadism? That flouncing nancy cullen? The same cullen who thought his pretty, twinkle-sparkle self taught bon vivant was a trend thing he dreamed he started? That same cullen? michael cullen?? Really? You read 194 pages of lacy lies and money fetishist gibberish by that wanker? On your weekend? Jeeeeeesus.

@ JM. Take the day off and rest your soul on a beer and a pie man. THE michael cullen aye? The same michael cullen who was all snuggles with helen clark? The same helen clark that gets it on with big jen shipley on the front page of the Nu Zillind wimmins weakly? Big Jen? Did you know? They sent a survey team out onto her arse and they were never seen again? Rumour has it they were captured by a lost tribe who now hide out up the Amazon.

Pardon Your country ways CB

D J S

“The embalmed vampire neo liberal”

You’re not damning with faint praise again, Countryboy? He’ll probably add it to his letterhead…

He won, you lost. Eat that…

The working group aka those who help the richest screw the system is a complete joke. None of the people on it will be earning less than $100,000 so what would they really know, disgusts me.

But but but John you old curmudgeon hard leftie you!

At least the rilly rilly important ussues are being addressed:

Vic Uni has agreed to a name change! The battle has been won (shame about the war)

The only fair taxes these days are ones that get the tax immediately and have nothing to do with whatever income bracket you are on.

That’s why a stamp duty based on the price of housing would be more effective to get the rich to pay their share, and have it at title exchange so that all the tax dodgers based overseas are forced to pay it unlike the capital gains we would never see from them and just hit middle NZ.

In my view it is curtains for Labour if they implemented a capital gains tax unless they limited it to the very wealthy only as a stamp duty for property over 5 million so that it only effects a few people and actually raise some money in taxes.

For example the so called ‘equaliser’ is not taxing the family home, well potentially people like Peter Thiel with multimillion dollar mansions that they don’t actually live in, will be exempt but some teacher on $50k who has property they rent out will be hit for extra taxes??? Doesn’t sound fair to me if tax is supposed to take from the Rich and redistribute to the poorer folks.

Modern taxation seems to have settled on taking from the middle classes to the poor, and carefully avoiding taxing the individuals and corporations that are the wealthiest, who the ex PM’s often get those cushy jobs later from.

Oxfam noticed that somehow big Pharma are only paying about 3% taxes on their turnovers in NZ, but IRD were quick to defend big Phama as being completely legal. Does anyone really believe big Phama only makes a 3% profit in NZ?

It so easy to reduce your taxes and even start to make losses here, so anything that relies on taxable income to determine how much tax they pay on gains is just a joke. Only hits the less wealthy and the more honest…

Likewise many of the biggest rip off corporations like Wilson’s car parking (also do security on Narau) seem to somehow not return much profit for the billionaire equity corps who own it based in Hong Kong.

The biggest amounts of profits leaving our shores are from the overseas banks. So far nothing about that from the tax working group. Even OZ managed to kick up a fuss and rein banks in to pay more.

How can the tax working group be considered seriously when all they do is come up with old solutions that carefully avoid the biggest avoiders and in a rental shortage want to somehow tax rental properties (but will only probably hit locals not bother with the super rich that can create losses of income or overseas tax dodgers who like the meth brothers somehow managed to not put in a tax return for 26 years of operating in NZ https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11842563

I’m not against taxing property if there are zero loopholes and they actually get the overseas investors who somehow get loses and don’t put in tax returns. and so can therefore avoid the taxes or just jet off and we never see the money.

People see red, when the biggest and wealthiest avoiders get away scott free and often legally too or they are just acting illegally the entire time they operate in NZ.

Then you have people like Bernard Hickey giving his predictable advice on bringing in a capital gains tax.

Hickey somehow predicted a property crash for the last decade instead of the record price increases, and told renters not to buy a house. Had numerous friends believed that crap and are not unable to afford to buy a house as they followed this clowns advice. Personally think you should go to jail if you advice people on financial issues that are so inaccurate. I have no idea how he become the darling of the left, when he left so many people renting and penniless by bad advice. But noticed that those advocating for capital gains and against property have strong links to the financial industry….

In spite of having been seriously wrong for the last decade about property, I noticed they trolled Hickey out at Q & A session where he then claimed that the reason that we have such high housing prices is that we don’t have a capital gains tax even though the others pointed out that UK, USA etc all have capital gains taxes but high house prices.

Still in denial about NZ being the 3rd highest immigration nation in the world and that having an effect on property prices I see, that was his mistake from the last decade where he predicted the non existent property crash, and being part of the financial MSM decrying that having hundreds of thousands of new migrants entering NZ would have zero effect on both housing and supply. Obviously migrants live in thin air then.

Since then the same type of MSM and government advisors also failed to notice we have a problem with housing quality. One of the reasons we have little housing supply is that is often they are built or designed so poorly that somehow it needs remedial work within a few years??? Zero focus on stopping that one, in fact they seem to be going in the opposite direction and throwing cheaper workers into the mix.

Nor do they notice that the new houses coming up are like multimillion dollar apartments and mansions that the locals can’t afford on local wages….

Therefore a quick ‘millionaire’ stamp duty that can’t be avoided on extreme wealth like 5 million plus deals (property, farms, land, businesses) will be the fairest way. Beauty is, no litigation, super straight forward and would raise a lot of taxes…immediately… unlike the capital gains taxes…

Wonder why that is not recommended? Maybe because it would really catch everyone and the super rich the most of all! (Most of whom would not mind much or even notice!)

Did suggest that the tax working group should include a group of randomly chosen citizens to give voice to those who actually pay both the politicians and those paid for their “expert” advice. Got no reply of course.

The GST rate of 14% is a bit suspect. I know GST in NZ is 15% but since rent accounts for about 40% of most people’s income and there is no GST on rent I am not sure how you get to the 14%.

At a guess, because of working for families (where applicable) and accommodation supplement. Also, interest doesn’t attract GST, so if they pay a lot of interest, that would lower their GST spend as a % of income.

“Maori will, on average, continue to pay higher tax rates than Pakeha

Pasifika families will, on average, continue to pay higher tax rates than Pakeha”

What’s “Pakeha”? Nowadays, who does this term cover? Employed? Self-employed? Employer? WHO exactly are you talking about?

Maori and Pasifika – all of them? All? Really? Or a select few…

All these unsubstantiated little digs at Other Coloured People – olive and ivory, pink and black. Tedious, and tendentious, too. But hey, OCPs are inured to this.

So where’s the campaign to return GST back to 10%? That’s all the Aussies pay. Why not rock star us? I’ve asked before and the hills return the sound of echoes… If that’s not a focused enough mission – cut the curse of GST – then the rest is froth.

It’s a tax change that even the brainwashed aspirational could support, I’m sure.

This is a left wing blog, social justice, progressive tax, law reform or all of the above. So pretty idealistic but you guys don’t really know where art and corporate interests meet yet. Just be prepared to have your hearts broken.

Left wing is bilingual. We speak street vernacular and we speak job interview. So there’s certain ways Iv got to speak to have access. If I’m sitting across from some executive then they do the same to me. They’ll say “chur bro, what up bro,” or what ever. Then Iv got to throw out them big words just to let them know my parents are probably smarter than there parents and much better educated but they may not have had the access that some parents do.

Now I can climb that social economic ladder just off the merits of my skills because I can talk that CV language. So when I speak in street vernacular it’s because I feel comfortable in crowds. It’s just in some situations you got to use that job interview language because where brown people come from they don’t have a lot of accountability figures in our lives. You have to be accountable, nothing is going to be handed to you, ever. You can’t point fingers and blame any more. If you can’t speak in a language people understand then, It’s just really important to understand that access is dependant on staying caught up with local news or your favourite blog.

It was all meant to happen this way, the selection of the advisory panel will have been made with this outcome in mind. So what the Labour NZ First ‘coalition’ with Greens backing in tow can do now, is take the ‘revolutionary’ step to pull something humble out of the hat, that the advisory group did not recommend, but that can thus be presented to the MSM and dumbed down public as ‘bold’ (or pretended ‘bold’).

So they get away with doing little and still look ‘bold’ and ‘good’ and ‘fair’ in view of the status quo loving MSM.

Expect the same outcome with most other advisory, consultation and working groups they have appointed.

Thank you John Minto for your sharply worded illuminating blog. Sickening if the Labour led government follows this ad-vice, safeguarding the interests of big capitalists while the worst off rot.

Andrea,in this context I think Pakeha means non-Maori or non-Pasifika. That means broad, loose class categories for Maori & Pasifika, but of course if we differentiated within the other/Pakeha lot, the lowest working class would match most Maori & Pasifika. Even ‘middle class’ are just well paid working class. Probably not going to be well paid for much longer.

Comments are closed.