The debate about WFF including Matthew Hooton’s extreme view that WFF is communism by stealth is full of sound, fury and little substance. Eric Crampton contributes a more academic approach to support the view that Working for Families is an employer subsidy.

The essence of his argument is, yes, it is an employer subsidy, but that is no bad thing. He even prefers a subsidy to minimum wage legislation:

Wage subsidies place the burden of supporting the employment of those with lower productivity on the tax base in general. Minimum wages place that burden on those who would employ those workers, their customers, and on workers disemployed in the process. The former seems to me both more efficient and more equitable.

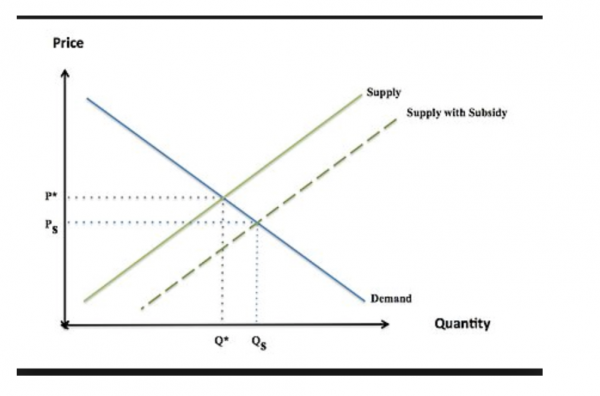

His argument is that “Labour markets are generally competitive – employers have to compete for workers, and workers have to compete for jobs.” So, it seems, we can draw standard demand and supply curves.

Having assumed it is a “competitive market” he then bases his analysis on thinking that WFF is like any standard tax or subsidy. As any stage one student of economics knows, who gets the advantage depends on the slope (elasticity) of the curves. In the extreme:

‘If the demand for labour were perfectly inelastic (and labour supply were other than perfectly inelastic), a government wage subsidy would only benefit employers. They would employ the same amount of labour at a lower cost (to them), with workers taking home the exact same amount as before. The supply of labour depends on the after-tax-and-transfer salary on offer, and take-home pay would not change’’.

In essence, Crampton says neither demand or supply will be perfectly inelastic, and therefore some of the benefit- maybe the bigger share, will go to the worker.

But does this reflect how WFF actually works? Unlike demand and supply in a competitive market for, say, fresh fish, the labour market is based on rules and regulations of which the minimum wage is a good example. But even if the labour market were like the market for fish, the simple diagram above works only if WFF is an hourly subsidy not a lump sum.

WFF is quite different to the Earned Income Tax Credit in the US. WFF does not subsidise the hourly rate. Let’s take a low wage, one-full time earner family, with children on the living wage rate of $20.20 per hour or $42,000 per annum. First, WFF is a payment for the children, going to the caregiver not to the worker. The caregiver gets the same WFF of $9646 for the one child family (more for additional children) whether their partner works 20 hours, 30 hours or 40 hours, and so it does not shift the labour supply of the worker.

A plausible way WFF can affect this very low income labour market is through something called an ‘income effect’. The idea here is that the lumpsum might make the family feel wealthier and so can ‘afford’ to work less. However, the family qualifies for the lumpsum WFF only if there is a child. The extra mouth to feed is likely even, after WFF, to make them feel, and be, poorer not wealthier.

So what if income for this family is more than $42,700. The problem for the ‘WFF is an employer subsidy’ argument is that the exact reverse is true. Extra income is effectively taxed because an extra dollar earned reduces WFF by 25 cents. That additional tax, if shared between employer and employee in a competitive market, would mean the employer might actually raise the wage rate somewhat. The opposite of a subsidy in fact.

Crampton notes that “At least some of the point of Working for Families was to increase the benefit of being in work relative to being on benefit for people like single parents.” The part he refers to is the ‘In Work Tax Credit’ (IWTC) that can be received only if the sole parent works 20 or more hours per week and is off the benefit. This is a clumsy discriminatory and ineffective part of WFF but again this is a lump sum not an hourly subsidy. The sole parent is a subset of the labour supply with a vertical supply curve at 20 hours. Thus a perverse effect might be that a sole parent working fewer than 20 hours could ask for her wage rate to be reduced on the condition that the employer falsifies her hours to say she is working 20 hours.

There is a tiny, tiny, part of WFF that could be construed to be an employer subsidy. It is a nasty little twist called the Minimum Family Tax Credit that tops up family incomes to around $26,000. There are only about 3000 families that access this tax credit. Sole parents have to work 20 hours to get it, and be off benefit. Any extra income from any source including child support reduces this tax credit dollar for dollar. In terms of the diagram, the labour supply is vertical at 20 hours. If you twist yourself into knots, it is conceivable that a sole parent might forego a wage rate increase the employer is giving to others as it won’t actually help them. This pernicious tax credit is an insignificant part of the WFF cost and does not mean WFF in total can be described a wage subsidy.

The treasury modelling Crampton refers to showed “the introduction of the new policy [WFF] increases labour supply of sole parents by an average of 0.62 hours per week, but decreases labour supply of married men and women by 0.10 and 0.50 hours per week, respectively”. But there are more married people than sole parents. If the aim was to increase overall work effort it was a miserable failure because Treasury’s figures imply that overall hours of work must have declined.

Forgotten in the ‘WFF is a subsidy to employers’ debate is the understanding that WFF is a payment for children. Indeed, I can’t recall children getting a mention in any of the recent attacks on WFF. They are invisible in Crampton’s analysis.

Labour made a huge mistake in calling family payments for children paid to the caregiver ‘Working for Families’. There has been confusion ever since. We need to delink WFF from any fixed hours of work requirement, rename it ‘Family Assistance’ or ‘Child Tax Credits’ , make it more generous and more like the system they have in Australia. Over there they don’t seem confused about the purpose of their family assistance.

There is one more thing that is disturbing in Crampton’s analysis. To return to his conclusion quoted at the beginning of this commentary- he would prefer a wage subsidy to a minimum wage. The competitive market for low skilled workers might drive the wage down from the minimum or $16 50 an hour to $12 say. Will WFF kick in to save the day? Sadly no, it will be the same amount as before, so the only outcome will be increased family misery.

If Crampton wants to argue that WFF should be like the earned income tax credit in the US then he should say so and be prepared to explain why the US has one of the worst records on child poverty.

Yes, we need a minimum wage based on a living wage, plus a tax credit for each child.

But who will decide what is a living wage. Not politicians or economists.

A living wage must be determined by those who live on it, the class that creates all the wealth in the first place.

We have to aim higher and end the wage system itself, as the exploitation of wage labour for profit.

I always thought that people in charge did this for hubris and electioneering rather than economic and national interest. Thus explaining double digit inflation.

The current way the living wage is set does not make sense. Set the minimum wage rate to provide an adequate standard of living for individuals who work 40 hours. Use focus groups to find out the required income. Then share the costs of bringing up children with payments from taxpayers (WFF).

Yep , it’s a mess. I started a job for a community organization a few years ago that was transitioning from being all-volunteer to having one part time staff member (me). Originally I was going to be payed $20 an hour for 20 hours a week but then we learnt about the 30 hour rule and changed it to minimum wage for 30 hours a week. As is the nature of community organizations the job required me to do 30 hours a week anyway.

We were then in the strange situation of praying that the minimum wage wouldn’t go up too fast because the organisation couldn’t afford to pay any more than I was getting for about the first 4 years. If my hours had dropped to 29 hours a week I would have been better off on the dole – except that I wanted to make sure our organisation survived so would have kept doing the work anyway.

Even when the pay rate started to go up most of the value dissapeared because of the Minimum Family Tax Credit. It was very hard to put the organisation under more financial pressure when I was barely getting any benefit from it.

Lately we have gone up to a Living Wage and again a lot of the wage rise has evaporated because of how WFF works but at least things are more stable – although I have to say that a Living Wage is still exceptionally low, little more than a subsistence wage.

Aaron

yes you sound like you are one of the 3000 who get the MFTC– in your case 30 hours required as it is only 20 for a sole parent. It is a mess

If it wasn’t for WFF, our family could not have afforded to finance our own home on our combined wages. WFF made the difference between having to rent a damp old home or own a modest but comparatively modern and dry home.

Hard choice eh?

Whatever their failings I will always be grateful to Helen Clarke’s Labour government for that.

Thanks Mike

More people need to speak up for WFF. We need to start seeing it as a critical program for the young that is as important as NZ Super for the old

Hi Susan,

I agree with you that we should view WFF as primarily benefiting the families receiving it. I was trying to argue against Hooton’s argument to the contrary!

I tend to think about the extensive margin for WFF. But discontinuities make my brain hurt.

Consider a worker whose labour supply curve is above the relevant labour demand curve because of a fixed cost of being in work associated with the hassles of being a working parent (supply curve), combined with lower relative productivity (demand curve). And suppose that the in-work tax credit is at least sufficient to cover that fixed cost.

You then get a supply curve that, from the employer’s perspective, effectively starts at 20-hours and is upward sloping from there – and is below the employer’s labour demand curve for at least some of the range after 20-hours.

I’d be pretty surprised if employers didn’t get *some* of the incidence of that, but it doesn’t much worry me where the point of the tax credit was to get folks into work.

So I don’t see that as giving you a vertical supply curve for those workers at 20 hours.

I also hadn’t said that the point of the policy was to increase labour supply overall – or if I wrote it in ways that could be interpreted that way, then I screwed up. The point of the policy, as I understood it, was to encourage a shift from benefits into work. The increase in labour force participation among single parents seems consistent with that. But the higher EMTRs for those on higher earnings reduces their labour supply – the results among married couples.

Working for Families increases incomes for families in work who have children. It comes at a cost of particularly high EMTRs for people in the clawback ranges, and higher tax rates across the board to cover the costs of the transfer.

I agree with you contra Hooton that it is wrong to see the programme as employer subsidy. While I expect there’s some effect there, it’s not the main thing going on. But I would disagree with your recommendation to abolish the in-work link because I largely support the earlier Labour government effort to encourage labour force participation.

And if I had to choose between Labour’s increases in the minimum wage and increases to the in-work tax credit, I’d lean to the latter – which is what I was thinking about in the bit on minimum wages.

Eric

Thanks for reading and for the reply.

My brain is hurting too!

The problem with this

“I agree with you that we should view WFF as primarily benefiting the families receiving it. I was trying to argue against Hooton’s argument to the contrary!”

is that this reduces it to an argument about elasticities. You are arguing the worker gets more of the benefit than the employer. My point was this analysis presupposes that WFF can be analysed as a wage subsidy when it is not only a lump sum, but it is a payment to the caregiver for the children. We don’t analyse healthcare subsidies and education payments, paid parental leave, childcare subsidies, free tertiary education and many other things as wage subsidies, so in my view is it also inappropriate for family child-related payments.

WFF is not like the IETC in the US that does subsidise an extra hour of work and is therefore a genuine work incentive (until it abates of course)

Can I also comment on this:

“Consider a worker whose labour supply curve is above the relevant labour demand curve because of a fixed cost of being in work associated with the hassles of being a working parent (supply curve), combined with lower relative productivity (demand curve). And suppose that the in-work tax credit is at least sufficient to cover that fixed cost.”

The problem here is that the IWTC is only a small part of the payment for children – about 20% of the total WFF tax credits and is also a lump-sum that is paid only if there is a given number of hours of work and there is no welfare benefit paid.

Note that the courts decreed the IWTC was a payment for children. If it is a payment for children to assist with poverty reduction then it should be given to all low income families on the same basis. So it is badly designed- does not act as an incentive to work (see Treasury analysis) and perpetuates the worst poverty by being denied to the worst off children.

“You then get a supply curve that, from the employer’s perspective, effectively starts at 20-hours and is upward sloping from there – and is below the employer’s labour demand curve for at least some of the range after 20-hours.”

BUT

If a sole parent works 20 hours (30hours for a partnered parent) and is not on a benefit she is topped up by the MFTC-that tax credit abates at 100% for an extra dollar earned so she has no incentive to increase hours of work– ie vertical supply at 20 (or 30) hours.

“I’d be pretty surprised if employers didn’t get *some* of the incidence of that, but it doesn’t much worry me where the point of the tax credit was to get folks into work.”

The IWTC is paid to the caregiver and the income effect appears to decrease her labour supply if married.

“I also hadn’t said that the point of the policy was to increase labour supply overall – or if I wrote it in ways that could be interpreted that way, then I screwed up. The point of the policy, as I understood it, was to encourage a shift from benefits into work. The increase in labour force participation among single parents seems consistent with that. But the higher EMTRs for those on higher earnings reduces their labour supply – the results among married couples.”

Not sure I see how this means it wasn’t to increase labour supply?

Not sure also I agree with how you have interpreted the Treasury findings.

Married women reduced their hours of work because of the income effect. The introduction of WFF saw a big jump in the threshold for abatement– so many ‘higher earners’ had much lower EMTRs over $27,000- $35,000. The rate of abatement was reduced to 20% also. Your argument about higher EMTRs to have validity would be looking at the Labour supply of very high earners who formerly would have got no family support– now with the bigger payment the abatement effect reached higher into the income distribution.

“Working for Families increases incomes for families in work who have children. It comes at a cost of particularly high EMTRs for people in the clawback ranges, and higher tax rates across the board to cover the costs of the transfer.”

Under National the threshold was to reduce to $35,000 again. Crazy. And I agree the clawback of 25% is too high. The costs of the transfer are not huge- $3 b compared to $13b for NZ Super. That cost has to be seen in terms of the benefits for society from well cared for children.

“I agree with you contra Hooton that it is wrong to see the programme as employer subsidy. While I expect there’s some effect there, it’s not the main thing going on. But I would disagree with your recommendation to abolish the in-work link because I largely support the earlier Labour government effort to encourage labour force participation.”

So what is the main thing going on? Support for children or incentive to work? The whole of WFF is needed for poor families. Marking a bit off (the IWTC) and tying it to work pretending it incentivises work has done nothing but create a huge child poverty problem:

See

St John S.& So, Y (2018) How effective are 2018 policy settings for the worst-off children? Working paper 18/2, Institute for Governance and Policy Studies, Victoria University of Wellington

When you say “And if I had to choose between Labour’s increases in the minimum wage and increases to the in-work tax credit, I’d lean to the latter – which is what I was thinking about in the bit on minimum wages.” I just fail to see how your analysis gets you there. These are two different policies with different outcomes. Single people without children need an adequate minimum. The incentive for the IWTC is for 20 hours of work or 30 hours for a couple but has no incentive effect above that. Either you get it or you don’t. It is cruel the way it works- denying a payment for children when misfortune strikes and hours are lost. It had a miniscule impact on the target group of sole parents as Treasury shows. Using your thoughts above- it may have a disincentive effect for married people who get your increase – remember it abates last after the other non-work related Family Tax Credit has gone- so your increase drags the top end in.

Thanks for engaging in this very important debate, I imagine you will be the only one who has read this far….

Thanks Susan.

I expect that there’s no substantive difference between viewing the WFF IWTC payment as going to the caregiver conditional on someone in the household meeting the hours threshold; going to the person putting in the hours; or, going to the kid. Or, at least I can’t see how it affects the analysis. In any case the payment is triggered for working at least the threshold hours if there’s a child of the right age in the household. And where that participation was induced by the payment, then we should be able to think about incidence.

Fun one on ECE – some neat work out of the AUT group found that free ECE reduced labour force participation in advance of the child hitting the trigger age, with income-smoothing as explanation. So we could think about incidence of that too!

I hadn’t taken the point of WFF’s IWTC as trying to increase labour supply generally but rather to encourage shifts from benefit to work by providing a larger gap between incomes in work and incomes out of work. So the reduction in labour supply among married women doesn’t mean the policy failed on its own grounds but rather that it had a spillover effect.

I suppose that if I started from your position that there should be greater payments to kids full-stop, I’d probably be looking at ways of doing that that didn’t undo the purpose of the IWTC in building that incentive to be in work.

Eric

You say on your blog site

As an economist if you had been tasked with designing a work incentive to help the transition from benefit to ‘work’ I suspect you would have come up with something that actually does that at minimal cost like the UK’s working tax credit. It would be targeted at the group coming off the benefit and not affect those in secured work at all.

Instead we have the IWTC which is a payment for children that excludes single people, dressed up as a work incentive that costs a huge $6-700m per annum and goes way up the income scale so that families on incomes well over $100,000 can have it. Do they need an incentive to be in paid work? Clearly not–

Married women apparently don’t count in the desire to get parents into work-they get incentivised to stay home but they too can be one step away from being a sole parent. Sole parents cant get the IWTC even if they are working 2o hours unless they come of the benefit ,and then they need to be topped with the MFTC with its 100% abatement. Nothing could be a worse work incentive

Here is another kicker- suppose she work as a teacher aid– the IWTC for children stops over summer break as she has not got 20hours of work any more. How does she pay for the child then? Or if she is a student- no sorry that is not work and her child misses out. And so on.

As CPAG has repeatedly said it is the worst designed and most expensive work incentive in the developed world. It would be a scandal if an economist had designed it. Tying it to children has intensified the poverty of those who have missed out.

In a nutshell; vote grabbing hand outs for pretty well off middle NZ while penny pinching when it comes to those who really need a helping hand.

The trouble is, along with being a wage subsidy it absolves non payment and collection on child support being passed on making women (usually) but also children being disadvantaged (and enabling abusers)as opposed to those with control of family resources especially and paid labour. People get trapped in an inadequate sadistic bureaucracy for no good reason.

As important is that it does not value the role of Mothering and other unpaid caring functions as contributing to the economy or country at all. An obvious omission which makes the structure of this system unworkable and unsustainable socially or economically.

WFF props up capitalism and destructive paternalistic values. It is already a demonstrable failure for women, children and the vulnerable.Maybe it filled those gaps for a time because got couldnto challenge the institutional misogyny in their institutions but it isn’t a plan when women and children are deprived of equitable resources.

The only solution is an adequate UBI with tax changes to capture it at the top and effective wealth tax collection rather than evasion. Extra supports via services for the elderly and disabled.

A move to Sovereign Money would alleviate the constant whinging about resourcing as it isn’t actally a problem it’s simply been a conditioned fantastical response to keep the slaves doing stuff that is not only destructive and they don’t want to do but also unnecessary simply to keep a few people mega wealthy and sustain a middle class to keep the peasant majority down. It’s feudalism and it hurts the earth women and children consequently us all.

Kath

I am fearful of throwing out the baby with the bath water. I agree that the part of WFF – the IWTC does not recognise the work of mothering and that is crazy.

Because we don’t live in a world that is remotely ready to solve all the problems with a BASIC INCOME, we need to adapt what we have to make it work better.

WFF needs to be called something that highlights its role for the support of children and their caregiver– lets call it New Zealand Families ( like NZ Super) or Kiwikids (like Kiwisaver) — maybe have a competition for renaming it and reclaiming it.

Get rid of the MFTC, Join the IWTC to the Family Tax Credit- so there is one payment per child per week to the caregiver and properly index it. This remove any association with incentivising work, and celebrate its success in allowing our low income kids to be properly looked after.

This seems a very intense debate. What about those who actually receive WFF, how about asking us. My single friends and I frequently discuss how we couldn’t live without it. We are full time working single Mums and with such high rents and living costs (one owns a house luckily for her) we couldn’t live. We would be on the streets simple as that. Why? Because the wages aren’t enough to live off and WFF is the difference which makes working full time just worth it.

Well working is undoubtedly worth it! however the margins are still slim. Jacinda’s accommodation supplement increases recently have made a massive difference. Unfortunately just prior to the increase I moved south to an area with lower rents and more (I hoped) job options. Ironically although I am paying $125 LESS rent pw I am still $30 a week WORSE off due to the accommodation supplement difference.

I was also deeply shocked and appalled to find the going rate down here is $17/$18 per hour. I have a science degree and good experience- so far this seems to account for nothing. I was deeply angered to find myself in this situation initially. I was on $20 an hour more than 20 yrs ago. The job I left to ‘get ahead’ was $21.50. It’s disheartening, however I console myself that once the kids have left home I can hopefully still afford the rent which I couldn’t have done where I was. I’m sure things will improve however it’s been a rude awakening I can tell you.

MFF and the Accommodation allowance have been another important ingredient in creating an out of control ‘Housing Market’. As a former renter I know that any increase in these payments, and minimum wage for that matter, is ‘coincidentally’ matched with an almost exact rise in rent. As is the installation of taxpayer subsidised insulation.

Is the average struggling family better off now that we have these payments than we were before they existed? Or are they just a nice fluffy pillow for us to clutch onto as we slowly sink down into homelessness, employment insecurity and food and rent stress?

Why is my comment still not approved? I have not been abusive and contributed to the debate. This is not the first time my comments have been omitted.

Ok that comment has gone straight up – what’s going on? I was trying to say my single Mum working full time friends and I frequently discuss how we couldn’t live without WFF. Living costs are too high vs wages and we are not unskilled ‘low productivity’ workers!

[Pikachu, most submitted comments are automatically queued in “Pending”, awaiting moderation. This process (a) eliminates 99% of spam (b) denies mindless trolling and (c) allows us to check for posts that may be potentially defamatory and/or break Court suppression orders. Sometimes submitted comments may take a while before Admin or myself can vet queued pending comments as we have family and work commitments as well. We make our best attempts to check all queued submissions as often as possible. – Scarletmod ]

I was also trying to say I recently moved south to make live more ‘affordable and get ahead’ I’m $30 worse off after accom supplement increases even though I pay $135pw less rent. At least I can afford rent once children leave home – I hope. Even though I have a science degree and good exp I cannot find a job paying more that $17/$18 an hour. Horrific wake up call. I was on more 20 yes ago.

Comments are closed.