Yes – I know most readers of the Daily Blog are very cynical about the Tax Working Group. I share the cynicism. The TWG is stacked 8 to 2 with people who have spent most of their lives earning huge money to advise corporate New Zealand how to avoid tax. I blogged about it here.

But we have to build an alternative tax framework and you can help get your thoughts together on this through preparing a brief submission THIS WEEKEND.

Submission close this Monday 30 April.

The Tax Working Group have emphasised they want peoples’ input without necessarily including detailed arguments. I made some suggestions here.

Submissions can be made on-line under five headings as follows: (Just click on the links to give your input in less than 1000 characters!)

What does the future of tax look like to you?

Are we taxing the right things?

Can tax make housing more affordable?

What tax issues matter most to you?

And ask to be heard in person – the more voices the better!

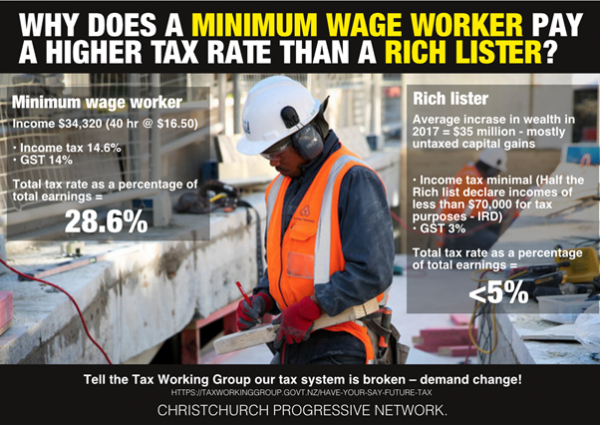

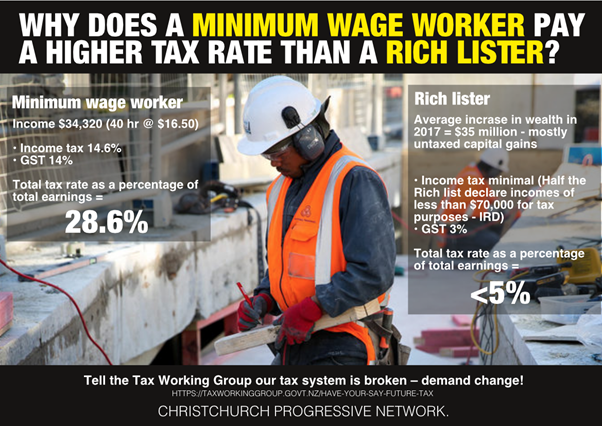

That horrible disparity is why I suggested that tax be calculated at point of spending not earning !

Wow John you must really try harder.

Using the IRD Tax calculator one person pays $5,026 tax per annum and the other (if estimated at $70k/year) pays $14,020 tax per annum?

Why does it concern you that one is wealthier than the other apart from perhaps ‘envy’.

If you have to ask that question, BG, you’ve not been paying attention. The entire problem of income/wealth disparities and the social tensions caused, have been well documented. The fact you ask that redundant question indicates you’re not so much interested in the answer as making a point. That ‘point’ being a rhetorical question in favour of wealth disparity as an outcome of neo-liberalism.

The corollary to that being low income earners are poor because of a flaw in their moral/personal being.

Sorry if I’ve cut to the chase, but I’ve seen your question and read the follow up BS neo-liberal ideology enough times to know how your spiel will work out.

Wow BG. Fuck you.

Take your toxic logic and ram it up your enviable arse hole.

“apart from perhaps ‘envy’.”

Most people I know aren’t envious.

They get a bit bolshie about ‘mates’ rates’ and ‘jobs for the favoured boys and girls’ and ‘it’s not what you know but who you know’ especially when they see so many little bullies hauling in the pay and literally driving some of their staff to suicide or unnecessary death/injury.

If only you could be around to hear the scorn and derision from the people who actually do the work and could, most easily do the $70k work as well, including change and innovation, if it wasn’t for the overlay of busy little jobsworths.

It’s also a bit on the nose that keypad clickers earn so much more than people who can finesse a chainsaw, or a quarter million dollar truck around vile forestry roads, or produce on a factory line, or clean up after fires and floods.

Them I ‘envy’.

On tax – right down to the last cent, on just about everything, unless it’s homemade or illegal. Everyone deserves the initial training and the ‘ tax favours’ extended to enterprise. Level playing field.

“Why does it concern you that one is wealthier than the other apart from perhaps ‘envy’.”

Its called poverty and low wages, Bg.

A surprising question from a teacher!

It’s because it’s a tax RATE John

By comparison, the top 3 per cent of individual income earners, earning more than $150,000 a year, pay 24 per cent of all tax received.

Duh! That’s because they pay tax IN PROPORTION to their income. If their income puts them in the top 24% then it is only fair that they pay their share. As it is, those at the top pay expensive tax lawyers to advise on trusts and other tax minimisation schemes.

Seems a fair price to pay in exchange for free tertiary education. Which is kind of counter causation. You need a higher standard of education to get rich but no one can pay for it when they start a rags to riches story.

You omitted GST, didn’t you, Andrew?

Most right-wingers do.

Oh thats an easy peasy one John. All we have to do is adopt the entire Nordic-Scandinavian tax system! Done! Problems sovled. Next!

It was suggested to minister Grant Robertson that his tax review panel should include some members of the general public, selected by lot, or alternatively that he should run a citizens’ assembly in parallel. No response received. Submissions are what I call black hole consultation, they go in but nothing comes out. The issue here, as with so many difficult topics, is the need for long-form democratic discussion. The poor old internet is simply useless as a tool for discussion. Too many rants, too little willingness listen, or read, differing viewpoints and ask why and how and try to arrive at actions we can all live with.

What is missing from the neoliberal narrative is that:

1. Those at the top of the social-financial pyramid are not necessarily any more intelligent or hardworking than those at the bottom. Indeed, the reverse is often the case; people at the top are in privileged positions that provide high income because of inherited wealth (originally stolen from the indigenous population) or because of personal connection with the sociopaths that run the system. They do deals that raid the commons. They orchestrate projects (via the corrupt bureaucracy) that benefit themselves and their mates at the expense of the general populace.

2. The most basic existence in NZ requires payment of:

a. hundreds of dollars a week in rent -money effectively lost by the tenant and gained by the landlord

or b.

the payment of thousands of dollars in rates to local council and regional councils (these days in the range ($2,000 to $4,000 per annum)

c. the payment of insurance (again measured in hundreds or thousands of dollars per annum

d. the payment of energy bills (again measured in thousands per annum)

e. the purchase of food (again many thousands of dollars per annum

f. the purchase of clothing (hundreds of thousands of dollars per annum)

g. medical and dental treatment (again hundreds or thousands of dollars per annum)

So the important factor is the amount of money left over after the absolute basics are covered. And for many people towards the bottom of the heap there is nothing left over, whereas the ‘haves’ are able to afford all the latest gadgets and several overseas holidays every year.

$15,000 minus expenses of $15,000 = nothing

$150,000 minus expenses of $30,000 = $120,000

Comments are closed.