I have a small amount of sympathy for Winston. While we don’t know the full story and it sounds like the tax rate applied in Winston’s case is another confounding issue, the newspapers are most likely wrong when they claimed he was on the living alone rate on NZ Super.

I should know this stuff but it is very confusing. I had been erroneously under the impression that one could chose to be on the single sharing rate if not including an underage spouse.

The website is clear that Winston was entitled to only the married rate. So it is likely someone erred and put him on the single sharing rate.

It begs the bigger question:

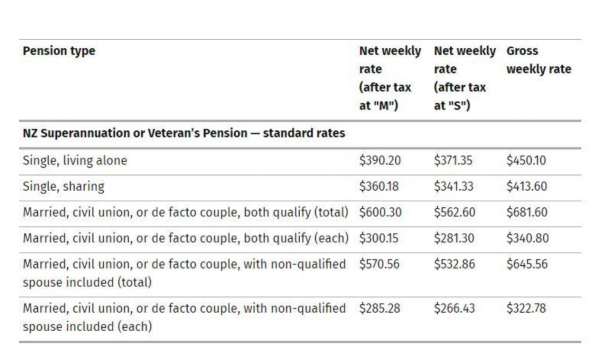

Why do we have big differences between rates of NZ Super? Why does a single sharing pensioner get $ 60 a week more than if their relationship is defined to be in the nature of marriage?

Why does a superannuitant living alone get $90 a week more than a married person?

When two people are deemed to be not just ‘sharing’ but living in the nature of marriage, their combined weekly income is $120 less.

The justificaiton from the MSD is particularly weak. They claim couples are advantaged because they:

- could be able to enjoy lower accommodation costs than two single people

- could be able to have their personal household effects on one insurance policy whereas two single people who are sharing accommodation would be more likely to have separate insurance costs totalling a higher amount

- could share vehicle expenses, while two single people may be more likely to have their own individual transport and vehicle costs

- could generally share meals, while two single people sharing accommodation may not have merged their lives to that extent.

Lots of couples do not share finances and some may even live in different houses. Lots of married couples have separate bedrooms. Lots of singles share meals and costs.

The argument is weird anyway. It says there are economies of being in a relationship that give couples an unfair advantage and therefore should be taken away. Surely any economies of scale should be an incentive for either flatting or marriage. Why are they deemed special in some cases and pounced on and extracted from those who are deemed to be ‘married’.

Older people’s relationships are often multiple and complex and having sex may not be the defining element. Who is going to determine who is in a relationship like marriage.? There is significant money involved and worryingly MSD have the same powers to prosecute and persecute as they have shown willing to use aggressively in the welfare system.

If there is one rate, then NZS is neutral to ‘marriage’ just as the tax system is. Winston’s problem would not have arisen. The single sharing rate should be frozen and the married rate allowed to catch up.

The next issue for another day is the living alone rate.

Up until a few years ago, a gay couple’s partnership was not legally recognised – so they had to claim super as singles sharing.

A defacto couple with two houses can claim 2 single rates.

2 siblings sharing can save on living expenses.

I have never understood why they saw being married as an advantage- at least not financially

Quite simple really, One bedroom flat single $300 PW.??? One bdr flat married, partnered couple, $300pw??? Outgoings power phone etc. shared by couple,argument would be that couples costs would be exactly double, but that is rarely the case,Lighting heating charges would be similar for singles couples. Line and connection charges etc. are same for singles as couple. Economies of scale food purchasing cooking etc. As far as i am aware, any accommodation supplement is calculated on the amount of rent payed, to a maximum allowance for an area so would not have much affect on totals, as above.

The issue about living alone v sharing is a different one. Singles sharing can enjoy the same economies as a couple. That is the issue highlighted here.

if people are living alone there may be a case for a higher rate– but the issues need to be teased out esp when there is an accommodaiion supplement

Perhaps if you try again and rewrite your comment, readers might have a show of understanding the point you are trying to make.

It is always the honest straight up that get shafted especially under national so they encourage cheating to survive now.

As far as i am aware I have been getting the same (thereabouts) $260 to $270 every week for years since I retired seven years ago so why hasn’t my rate gone up very much since then as it sits now at a poultry $281 shit?

We went to the city 80 kms away for our weekly food stocks from our farmlet yesterday and bought sparsely some mince and veggies for our stew with other cans and butter and confectionery for us two and that wiped out one of our weekly incomes.

It’s getting very expensive to live now bloody National Party sack them all.

Yep. “Shared expenses” is the reason why, and imo it’s fair enough – i.e. they should get less because they need less to have the same standard of living as an individual. If every individual person got the same, couples living together would have an “unfair” disposable income advantage over their single counterparts since their total per person costs are lower (shared internet, phone, electricity, heating, rent, rates, etc bills). That said, this is true regardless of marital status. So imo ANY two people living at the same address should get the exact SAME rate as a married couple living together.

Well said G.A.P. I think you have answered the questions. I suspect that Susan does not live alone.

And yet, if a superannuitant is flatting, with another person who is not his/her partner, then they’d be on the Single Person’s rate? Yet, there are still two living, breathing, consuming adults under one roof.

yes Frank thank you this is the point of criticising the different single sharing/married rate. I was going to write about the living alone rate but ran out of time. There is no separate living alone rate for other benefits. The higher costs for those with little other income need to be recognised

Agree abolish the distinctions, it is too confusing. Gone are the days when people lived in committed relationships all their lives. People flit in and out of relationships or need to get borders in to help share costs.

In DPB cases the money is for the kids so should be independent from whether the parent is pursuing a relationship or not and if one parent is working then they are paying child support as well as their taxes directly to the state so it should not matter whether the other person is trying or in another relationship.

One look at Facebook and you can see some young people seem to be in “new” relationships every few months! By the time the baby boomers are on the pension it’ll be the norm for some of them too, by the looks of things. Even if you get a flatmate as a pensioner WINZ can deem them a relationship – for gods sake can someone get WINZ workers out of the surveillance bedroom!

These are the times we live in, and the government has to change with the times and how some people now seem to live and whether someone is in a platonic relationship or a sexual one should be nobodies business.

Savenz

hear hear — get them out of the bedroom it is really distasteful

There doesn’t appear to be any NZ figures, but internationally it is well recognised that married couples are, generally, statistically, far better off than singles, and everyone is better off than divorcees.

there is no consensus as to why exactly, so I won’t throw my two cents worth into the ring.

But the point is, singles need more financial help.

Meantime, universal benefits are fine, if we had proper claw back (which we don’t)…but are we really supporting pensioners who are lifetime renters??

Nope…but lets ignore that elephant in the room till we start tripping over homeless pensioners wandering the streets of Takapuna.

http://www.moneycrashers.com/financial-benefits-marriage-single/

To be precise, I question this sentence; “Surely any economies of scale should be an incentive for either flatting or marriage.”

Exactly what are you suggesting by this? That people who wish to live alone should be ‘incentivised’ into having to share their life with another person regardless?

good point- it is easy to fall into linguisitic traps here.

Currently the economies of scale advantage is removed by having the lower couple rate– so two people living alone/ single sharing are clearly not incentivised into marriage. Of course they shouldnt have to share their lives with another person when they dont want to-

To my mind, living alone and single sharing are not the same. For the reasons G.A.P. gave, living alone should be strictly that.

Single sharing means certain fixed expenses are shared, regardless of relationship.

But I think I may be prematurely discussing your next post, considering your final sentence?

yes indeed. I am sorry to have confused the two issues in this blog!!!

There is an interesting inconsistency here: everywhere else in society, the doctrine of the “individual” is king. However, when the government wants to save money, two people suddenly become “a couple” or “married”!

Bear in mind I am not familiar with these areas, but from memory these rates are also much higher than the rates a disabled person is able to access on a benefit (which I find interesting).

[…] can you be surprised when example after example after example after example after example after example and example and example and example have been exposed showing the sadism and toxic culture of […]

Yup. Agree with those who understand that a single person has to pay all the bills themselves whereas if they share the same place, electricity, water, phone, internet etc with another then two incomes is better than one.

BTW … as a senior I receive $360/week in pension. My outgoing expenses of rent, electricity, phone, garbage, heating is $280+. Not a lot left over!

Comments are closed.