So NZ isn’t a tax haven huh? John Key tells us we aren’t a tax haven and he has nothing to do with building it (despite Key changing the laws in 2010 and actively attempting to promote NZ as the Switzerland of the South Pacific).

So no tax haven as far as John and his rich mates are concerned.

And here comes the deluge.

Israeli’s using NZ to buy drones, Rich South American criminals moving money through us, Mossack Fonsecca trading on our reputation to pitch to clients – the deluge of new information is smashing against Key’s claim we are not a tax haven with the power of a tsunami hitting a sand castle.

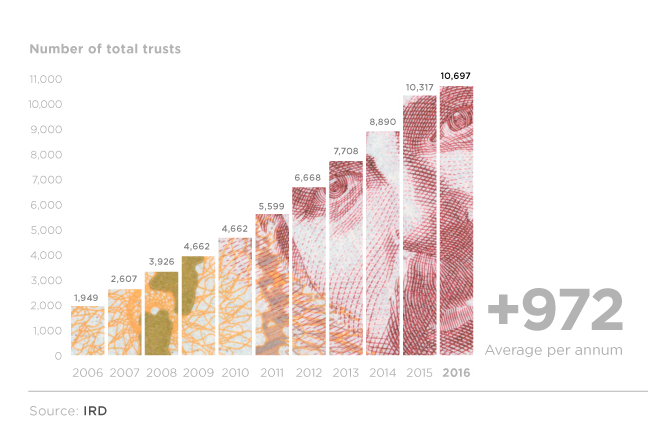

Look at the growth in Trusts under National

In terms of affordable housing, It looks like Tax Haven’s are the only things John Key can build in NZ

A new report suggests globally $18 Trillion is being syphoned off into tax havens. This is why democracy’s can’t have ‘nice’ things, rich elites simply don’t pay tax.

Key is going to have a difficult day pretending he hasn’t built a tax haven. He’ll cry it’s all legal, but is it moral, and on that question our $200m John Key has no answer.

This reflects poorly upon us, surely an over inflated property portfolio isn’t worth being known as a nation of crooks?

Labour is right – we need to ban these trusts now.

Key is a shill. He is not an idiot but a street fighting con man employed to foster transnational stripping of sovereign wealth. The idiots are those who choose believe him and give their vote.

A Labour coalition has to enact legislation to counter the losses NZ has endured with state owned infrastructure privatised and promotion of policies both official and unspoken, that leave most of the people NZ more vulnerable to vampire investor state.

Transnational corporate wealth now rules commerce with small business owners and workers left in the cold.

Rebuilding NZ, its media and journalism, state financial institutions and local manufacture, all has to be coupled with a new view on our future survival preparation.

Local and sustainable with resilience not dependent on distance transport nor private banks.

Amen to Labour banning the trusts.

What is even worse is that National and John Key has used NZ squeaky clean reputation and near corruption free status in the world to advertise us as a way to internationally launder money, avoid taxes, hide money, aid criminals through the trusts.

Is the slippery reputation of John Key going to affect Helen Clarks chances for the top job? NZ used to be a leader in anti corruption but under John, he is personally named as “curiously quiet” in the panama papers. (Maybe John Doe does not understand poor Key has memory issues and has had them for a long time).

I watched One news yesterday which I seldom do, (first 2 articles car crashes) then a bit about the Mossack Fonsecca scandal making sure to mention that it is Labours claims AND has been going on since the 1980’s (Labour does it too). Well better than nothing, but we can still see massive bias getting your news through NZ MSM. However since One News might as well be a National party broadcast most days I gives them a C+ for trying.

Guyon Espiner on Rado NZ this morning reported that John Key has pulled out of his regular mnorning chat on ‘Morning Report’. No explanation given.

Key will, however, appear on Breakfast TV on TV1 and TV3.

As I commented to Guyon Espiner this morning;

That’s exactly what I saw in another blogsite ‘ The Standard’…I thought … then posted…

Huh???

Keys too scared to front up…he’s only going to perform the song and dance act at selected Key friendly media outlets!!!

Maybe he should…. ” GET SOME GUTS ” !!!!

Key has made a habit of not fronting up when an appearance anywhere cannot be carefully stage-managed with friendly sycophantic media and trivial questions.

He is so used to being treated like a demi-god that he cannot handle any hard questions or scrutiny.

On the rare occasions that he cannot escape them, he reacts with ridicule, Trumpisms and red herrings.

I have said it many times before – when will we get a real PM instead of a circus clown?

Dead right Lefty !!

Good email Frank.

I listen to RNZ and heard Guyon Espiner report that “honest” John will be a no show in his regular spot today.

FJK is a coward, demonstrating his weakness as leader, unable to stand up to some hard scrutiny, hence the back out from Morning Report this morning.

He knows Henry, Hosking and whoever is fronting TV ONE’s Breakfast show these days will take the soft option with him.

Parliament should be interesting this week. Will “honest” John also be a no show there as well, denying us the opportunity of seeing him slipping and sliding around question time when challenged, with some assistance from equally corrupt Speaker Carter?

Key has made this country a dirty place all on his watch, and we should hold our head in shame allowing this dodgy money trader to dirty our own name our past generations worked very hard to give us;

Past generations who gave us in care one of the best most respectable reputations globally but Key has just used us all, and meaningless as he lacked the respect he should gave given of the blood sweat and tears of our forbearers who gave so much has greed and filth.

WALK THE PLANK KEY YOU TREASONOUS FILTH as you sneak off to PERU this week!!!!!

Well I just heard Paul Henry apologising for Don Key saying “we should all just move on”. Gower says Nicky Hagar is like “mana from heaven” for Don Key because no one takes anything “conspiracy theorist” Hagar says seriously, which means that this whole Panama Papers thing obviously is just a beat-up. He finished by saying it’s all just “dirty politics” from the left. It was quite something. Don Key has an incredible talent in making National’s actual “dirty politics” into a left-wing smear campaign that is then interpreted as them playing “dirty politics” AGAINST National.

Complaint: You’ve allowed NZ to offer legal tax avoidance schemes.

Key’s response: Ekshully, what I can tell you at the end of the day is that itsh all legal.

It is an excercise in the absurd – Planet Key.

FJK has been telling Parliament NZ is NOT a tax haven.

International documents are now proving otherwise.

Misleading Parliament and the country is an offence.

Will he be dismissed?

Key the car salesman has this tatty, knocked about 1958 VW in front of him and he’s telling us it’s a 2016 BMW 650i.

And the masses pulling their heads out from up his arse to tell us he’s right.

Yes, John Key is a shill for looting and polluting; he got into power by lying and knows that lying works extremely well on lazy, uninformed New Zealanders.

Why change what works for him and his mates when the future of NZ doesn’t even rate any consideration and it’s all about acquiring personal short-term wealth, and destroying society and the environment to do so?

It’s just another day of everything that matters being made worse by the criminals who are in control, and nothing will change until there is a major catastrophe that can be directly attributed to Key or National.

Well…. I think its time for a bit of humour again…

Lets all give John Oliver a shout then , shall we?

I can see it now….’ Key the leader of the biggest banana republic in the south pacific strikes again’….

if NZzzzz were Iceland and had the balls and the will to dis associate the country from this parliament would call for a vote of no confidence and start a new election and get rid of keys and his party of minions who cater to the 1% while blaming the .01% who find them selves on benefits for the run down of the nation – all along its the elite exploiting the wealth of the nation and allowing others to be their fall guys and an ex bankster who initiated it

The majority of the nation lost its balls years ago and haven’t retrieved them yet.

While people like Garner, Henry, Hosking, Plunkett and the rest of the lying cretins are comfortable in their middle-class dreamworld of Keytonia things will never change because the rest of the nation will never wake up to the corruption that is now part of our society.

Steven Joyce summed it up beautifully before the last election – “business as usual” he said proudly.

Corruption has become business as usual in New Zealand.

What a deluded, narcissistic country this has become.

One of John Key’s reasons for harbouring overseas trusts was that it generated income for New Zealand.

Well that income comes to around $24 million a year apparently. Sounds a lot of money to us poor individuals but in terms of the national economy it is little more than loose change.

I bet that the tax these companies avoid is a hell of a lot more than $24 million a year.

And also look at who actually gets the money in fees for setting up these deals – tax avoidance specialist lawyers, who are little better than paid con-men.

Gee, New Zealanders really get a great deal out of this arrangement eh John?

I think the $24 million is probably just a bonus in Shonkey’s eyes. He is a soldier for the crony-capitalist/neoliberal elite and is helping to grease the wheels of its activities. What his real reward for all this could be is anyone’s guess.

What a corrupt government this is.

The irony is Judith Collins who hopes to follow on where John Key leaves off is off to a conference on transparancy in govt, she looks in the mirror and dosnt see a reflection.

Elle that’s right on.

Collins a clone of key no more than that.

“Labour is right – we need to ban these trusts now.”

Is Labour going to ban local trusts too? They’re Kiwis dodging tax.

Labour’s position on this should also be critiqued. It seems as flimsy as their stace on overseas landlords – what about local tax dodgers and local landlords?

Trusts in NZ do not dodge tax. The vast majority are family trusts designed to protect family assets.

Is Little planning to ban them too?

Is the esteemed analysis from our resident plumber I see?

It is a critique from our self professed sewer worker.

FIY. It you are not dodging tax via trusts. You are dodging ownership of assets. Are the only reasons for trusts to exist

1000% Sam couldn’t agree more.

As usual Andrew you weren’t concentrating.

Little was talking about overseas trusts.

Getting a little worried about your own personal horde are you, Andrew?

Better transfer it to the Cayman Islands before its too late.

Actually Andrew they trusts are normally designed to screw one spouse out of assets not to “protect’ families.

trusts are normally designed to screw one spouse out of assets and to protect assets, brought into a relationship by one party, from an opportunistic ex-spouse.

It’s not all a one-way street.

“Trusts in NZ do not dodge tax”

lol. In your dreams.

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10887756

“Is Little planning to ban them too?”

Call me a leftist, but yeah, I hope so.

“The vast majority are family trusts designed to hide assets from creditors”

there ya go FIFY

you meant Hhide & protect family assets so the wealthy don’t have to pay there debts

talk about lack of personal responsibility ,

See when i make a mistake i have to face up to the consequences of that, it appears the (ab)users of these financial vehicles decide they are above paying their bills and dealing with the consequences of their actions..

We’re talking about FOREIGN tax trusts you rightwing moron! Jesus wept!

exactly ban local trust tax dodging too!

yep so many ordinary Kiwis have been herded into having these trusts by accountants and lawyers. How about tax incentives to keep peoples affairs simple and not use trusts.

No, I have to agree with John Key, Foreign Trusts are legal. But so were Gas chambers in Nazi Germany. They were perfectly legal because the executive legislature of the day made gas chambers legal, in fact they went further than that, they made gas chambers a matter of National Importance.

Of course John Key has made a statement in the media that Andrew Little’s plan to abolish foreign trusts if labour is elected, dangerous.

Is this a veiled threat from John Key? Is there the possibility that in this scenario we could see subverted elements of the New Zealand air force attacking the 9th floor of the Beehive? a sort of rerun of the 1973 murder of Allende in Chile?

Shock and Awe delivered to New Zealand by the 1%?

What is legal is what is ordained by those in power.

So was slavery, beating your wife, and selling poisonous concoctions to an unsuspecting public. We don’t do that shit anymore. Well, except that the wife-beating thing is still prevalent, sad to say.

Mike Williams went on RNZ 11am this morning nine to noon with Katherine Ryan and quoted line by line the official; OECD legal definition of what constitutes a tax haven . In four parts . Identical to the NZ situation .

NZ is not a Tax Haven : Yeah Right .

Yeah I heard that also Black lemming. There is no doubt we fit the tax haven model but thee MSM were not telling it yet using the definition yet???

NZ at heart of Panama money-go-round

© RNZ / James Sanday 08.05.16

EXCLUSIVE – Panama Papers NZ – New Zealand is at the heart of a tangled web of secretive shelf companies and obscure trusts being used by well-heeled South Americans to organise their private wealth, business affairs, and channel their funds around the world.

The extent of this country’s involvement in the global money-go-round and intricate asset management and protection industry is showcased by more than 61,000 documents in the leak of papers from the Panamanian law firm Mossack Fonseca – known as the Panama Papers.

The Consortium of Investigative Journalists and German newspaper Süddeutsche Zeitung gave RNZ, TVNZ, and investigative journalist Nicky Hager joint access to the papers. This is the first in a series of reports on what has been uncovered so far, after only a week with the data.

It is already clear that Mossack Fonseca ramped up its interest in using New Zealand as one of its new jurisdictions in 2013, along with Belize in Central America, offering extremely private, zero-tax foreign trusts.

The firm trumpeted New Zealand’s top flight legal and financial reputation as “allowing for the speedy formation of appropriate mechanisms for wealth protection, inheritance and tax planning”.

That’s code for tax havens, and a Mossack Fonseca memo said 95 percent of the company’s work consisted of “selling vehicles to avoid taxes”.

Mossack Fonseca wasted no time setting up the local Auckland branch in December 2013 and from then on enthusiastically chased business, particularly from Mexico, but also from Uruguay, Chile, Brazil and Ecuador.

New Zealand’s tax-free status, high levels of confidentiality, and legal security are seen as the virtues, but a common thread through Mossack Fonseca is the need to avoid any structure or involve people who will attract attention from our authorities.

Initially its business was done through an Auckland accountancy firm Staples Rodway, with the main contact being Roger Thompson.

But by mid-2014 Mr Thompson had left Staples Rodway and set up Bentleys Chartered Accountants, on the 13th floor of a Queen Street office tower. Bentleys is the registered office of Mossack Fonseca New Zealand, and Mr Thompson is one of its directors.

Who is Roger Thompson?

Co-founder of Bentleys New Zealand. Director of Mossack Fonseca’s subsidairy in New Zealand, and Orion Trust (New Zealand), a trustee company for foreign trust and companies, including members of Malta’s government.

Both Mossack Fonseca NZ and Orion Trust use Bentleys address at 205 Queen Street as their registered office.

Mr Thompson has more than 30 years experience both as a chartered accountant and a lawyer.

His LinkedIn profile says he worked for Staples Rodway, where he also worked closely with Mossack Fonseca, before co-founding Bentleys in August 2014.

His resume also includes stints at Inland Revenue in the early 1980s, also Allan Hawkin’s Equiticorp and law firm Kensington Swan.

How does it work?

The system is simple and mechanical.

A foreign investor looking to manage their affairs may be referred to Mossack Fonseca’s home office in Panama by a private advisor, a bank or another Mossack Fonseca branch.

The firm routes the inquiry to its New Zealand branch, which looks at the options – perhaps a special tax free company, known as a look-through company, a trust, or a limited partnership.

And then it becomes a task for Bentleys and Mr Thompson and his staff to put into force.

But there’s a similarity to many of the deals.

Mr Thompson is often the sole New Zealand director of the local companies alongside two Panamanian directors. A further Bentleys company, Orion Trust (New Zealand) Limited, is used over and over as a nominee office holder in foreign trusts and companies.

The trusts set up have anonymous names such as The Eden Trust, The Oslo Trust, The Milfington Trust and the Omicron Trust.

A character check of the original investor is done using a global search machine, while the investors provide a copy of their passport photo and details, and a utility bill such as a power or gas bill to confirm where the person lives. But these details rarely appear in the public documents.

Bentleys then sends a one page IRD 607 Foreign Trust Disclosure form to Inland Revenue once a year for each foreign trust, confirming no tax needs to be paid under New Zealand foreign trustee law.

The extent of Mr Thompson’s links to the industry is shown by the more than 4500 Panama paper documents he’s listed in, the 3500 mentions of Bentleys, and the more than 9000 mentions of the ubiquitous Orion Trust.

But while Bentleys has a dominant role in the industry, similar deals and structures are being constructed by accountants and lawyers throughout the country.

Since the law changes in 2008 and the update in 2011 the number of foreign trusts has more than tripled to 10,697 this year from 3311 – according to Inland Revenue.

The clients

The Panama Papers cast light on the sorts of people using New Zealand.

Typical clients are an Ecuadorian banker, two Colombian car dealers (one New Zealand trust each), a Mexican film director, and wealthy Mexican society figures.

An Israeli man named Asaf Zanzuri, chief executive of the Balam Security company that sells security equipment to various Latin American governments is also in the Papers. In 2015 he negotiated a multi-million dollar contract to supply Dominator XP drones to the Mexican government for use “maintaining Mexico’s internal security”.

At the same time – February 2015 – Zanzuri used Mossack Fonseca NZ to establish a foreign trust in New Zealand called the Sapphire Trust. Another employee of Balam, Rodriguez Ruiz, also got Mossack Fonseca to set up the Diamond Trust in New Zealand.

Another client taking advantage of New Zealand’s opaque structures was Carlos Dorado, the president of Italcambio – a Venezuelan bank. He and a Mexican lawyer, Luis Doporto, set up a New Zealand foreign trust called Abbotsford Trust, which was used in conjunction with a Dutch incorporated company Neuchatel Holdings to buy a Mexican pharmaceutical company.

The papers show a Brazilian mining engineer Bruno Lima looking to use New Zealand structures to run companies exporting chemicals banned in Brazil to Mexico. In the end he abandoned the idea and used the structure to import legal chemicals into Brazil.

And Mexico’s unpredictable and uncertain inheritance laws, which can’t guarantee family wealth goes to the right people, have been a rich source of business for Mossack Fonseca New Zealand and Bentleys.

Mexico City based Bald Eagle Services run by Michael del Vecchio is described as one of the local Mossack’s office best customers, and has sent a steady stream of wealthy Mexicans to set up New Zealand trusts to protect their estates.

And one of the more intriguing constructions was set up for a Russian-speaking, Spanish based electrical engineer, Jose Ramon Lopez Lombana.

He asked for four New Zealand companies and four New Zealand trusts to be established to deal with four Mexican companies, which pass money and fees from internet trading through New Zealand to a bank account in Prague in the Czech Republic.

The Panama Papers provide a paper trail of deals, but rarely divulge the reasons for the New Zealand trusts and companies or the assets at the centre of the transactions.

Safe haven or tax haven?

The Organisation for Economic Co-operation and Development (OECD), which leads the global fight against tax dodges and money laundering says there are four main characteristics of tax havens:

• little or no tax on a company’s income;

• lack of transparency on the ownership and business of a company;

• a company appears to do little or no business;

• and no effective exchange of information between tax authorities.

The government has said New Zealand’s adherence to the OECD guidelines, the double taxation and information sharing agreements with scores of countries, and the Inland Revenue’s ability to seek information if need be, counter charges of New Zealand being a tax haven.

Roger Thompson rebutted any notion that the trusts and companies his company set up were used to dodge taxes, and said claims they were had been exaggerated.

“I don’t see NZ is a tax haven. I would describe it as a high quality jurisdiction for trusts with a benign tax system in certain circumstances.

“I think the assumption that all NZ foreign trusts are being used for illegitimate purposes is unfounded and based largely on ignorance,” he said in reply to written questions.

Read Roger Thompson’s full replies to our questions here

An Auckland University tax law professor Michael Littlewood has previously been in little doubt New Zealand is being used a tax haven.

“A workable definition … is that a tax haven is any country that wilfully allows itself to be used as a means of avoiding other countries’ taxes. By this definition, New Zealand is plainly a tax haven,” he said in a study last month.

The government’s response to the revelations to date has been to appoint a tax expert, former PwC chairman John Shewan to conduct an inquiry and make recommendations on the rules and disclosure conditions for the trusts and companies concened in the industry.

Mr Shewan’s appointment was put under the spotlight for a period, but he’s since been left to get on with the job.

Prime Minister John Key said Inland Revenue would follow up any revelations from the Panama Papers involving New Zealand, but was rejecting calls for the industry to be shut down.

“It would be, I think be a dangerous decision to make as a knee-jerk reaction just to ban a foreign trust overnight, because we have very good tax rules, they’re integrated rules and they’re respected around the world.”

He said New Zealand was working with other OECD countries to shut down tax loopholes, the next step in that co-operation comes this week with London Anti-Corruption Summit being hosted by British Prime Minister David Cameron, which Police Minister Judith Collins will attend.

*The investigation into New Zealand links in the Panama Papers is a journalistic collaboration by reporters from RNZ News, One News and investigative journalist Nicky Hager, and with the assistance of the International Consortium of Investigative Journalistsand the German newspaper Süddeutsche Zeitung.

so New Zealand is not a tax haven, eh John?

It is according to http://www.taxhavens.biz.

http://www.afr.com

http://www.ctctdn.com

http://www.taxresearch.org.uk

Just because John Key can clap his hands over his eyes and ears (like two of the three wise monkeys) and say it is all just a big mistake does not make it so.

Key doesn’t think we are a tax haven.

They do overseas.

How do the greedy right figure that one?

Comments are closed.