The Mendacities of Mr Key # 16: No one deserves a free tertiary education (except my mates and me)

.

.

Prologue

As reported in a previous blogpost last year (Steven Joyce – Hypocrite of the Week);

Fun Fact #1: Student loan stood at $14.235 billion, as at 30 June 2014 – up from 9.573 billion in 2008.

*Up-date* – Student loan stood at $14.837 billion as at 30 June 2015 – up from $14.235 billion in 2014.

Fun Fact #2: As at 30 June 2013, 721,437 people had an outstanding student loan, registered with Inland Revenue. That’s roughly 16% of the population.

Fun Fact #3: Approximately 1.2 million people – roughly a quarter of the population – have taken out student loans.

Fun Fact #4: Students have borrowed $20.119 billion of which $9.157 billion has been collected in loan repayments. More than 415,000 loans have been fully repaid.

Fun Fact #5: $1.031.7 billion in loan repayments were received, $22.2 million less than last year. The total number of students completing formal qualifications reached 144,000 in 2013 – a decrease of 0.6% from 2012. The number of people enrolled in tertiary education has dropped, from 504,000 in 2005 to about 420,000 (in 2014).

Fun Fact #6: The student fees/debt system began in 1992. Prior to that, students had access to Bursaries and Student Allowances and tuition fees were minimal.

Fun Fact #7: “The median borrowing increased – from $7,441 in 2013 to $7,708 in 2014. The median loan balance also increased – from $13,882 in 2013 to $14,421 in 2014. Both were driven by higher fee borrowing: fees are rising and students are more likely to take more expensive courses. In the 2014 academic year, 72.4% of eligible students took out a loan, down from 73.8% in 2013… The number of borrowers in default has declined slightly on 2013/14, but the amount in default has increased.”

Fun Fact #8: On 17 May 2013, National announced new legislation would give the IRD powers to arrest loan defaulters at “the border” (ie, airports) if they are “about to leave or attempt to leave New Zealand after returning from overseas”.

Fun Fact #9: On 18 January this year, the first person arrested at the border for non-payment of a student debt was a 40-year-old with an outstanding debt that, with interest, had ballooned from $40,000 to $130,000.

Fun Fact #10: The Prime Minister, John Key, and Tertiary Education Minister, Steven Joyce, both received near-free tertiary education, paid nearly entirely by the New Zealand taxpayer.

Sources: Ministry of Education, Beehive, NBR, and The Wireless

Some Recent History: 1972 – 1992

Prior to 1992, tertiary education at Universities was mostly free, with minimal course fees. On top of which, a student allowance plus part-time paid employment, was usually sufficient for students to graduate with minimal debt hanging over them.

This allowed graduates to start their adult lives, careers, and families with only as much debt as they chose to take on. This was usually in the form of a mortgage and business start-up costs (if they elected to be self-employed).

Those that earned more in a professional capacity, paid a higher rate of tax. This ensured that those who stood to gain the most, financially, from a near-free tertiary system, paid more in taxation. This – in part – assisted funding for future generations to move through the tertiary education system.

Those that did not achieve high income-brackets could contribute in other ways.

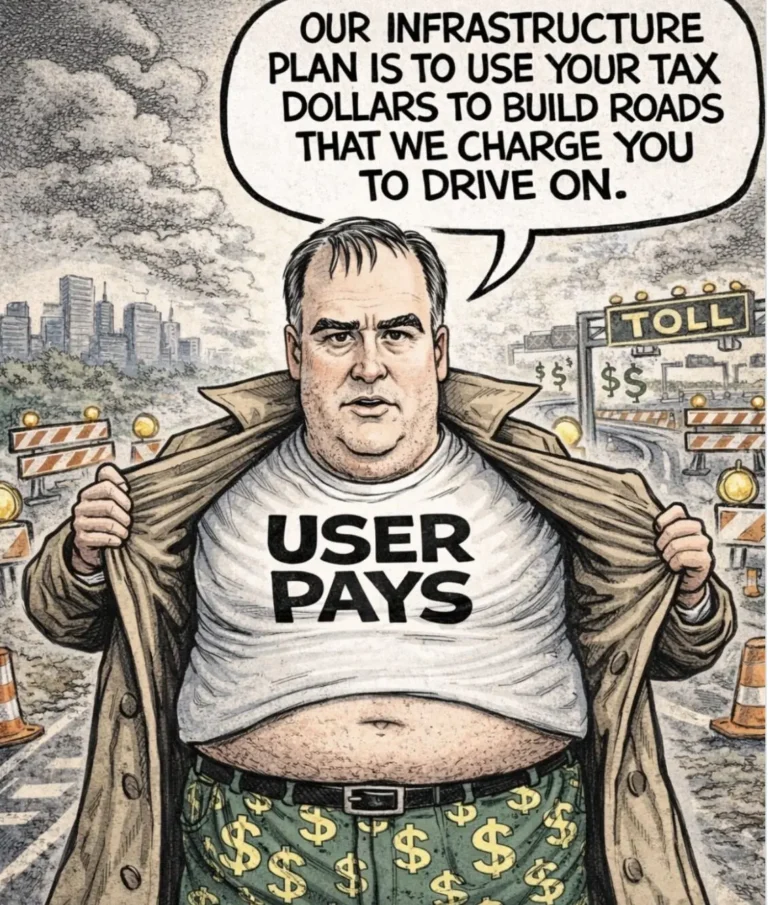

When National’s Ruth Richardson became Finance Minister in 1990, the social contract between generations “paying it forward” was broken. University fees were increased; student loans were made available to cover payment for increasing user-pays;

.

Acknowledgement of image: NZ Herald

.

Ironically, Ruth Richardson herself was a beneficiary of New Zealand’s then near-free tertiary education system. In 1972, she graduated from the University of Canterbury with a Bachelor of Law (Honours). She immediately went to work – debt-free – for the NZ Department of Justice (NZ).

She has made herself a Limited Liability Company, ostensibly to minimise her tax “liabilities”. According to her website, her husband is General Manager of “Ruth Richardson Ltd”.

Some Recent History: 1986 – 2010

Though the tertiary education system was far from perfect – for example polytechnics could charge higher student fees – it offered near-free higher education and taxpayers were ultimately beneficiaries of a system that produced doctors, engineers, scientists, and other skilled professionals to take New Zealand into the 21st Century.

Even those who went overseas in pursuit of lucrative work gained valuable experience which benefited the country as a whole, upon their return.

Unfortunately, the social contract between generations was broken as the Lange-Douglas Labour Government implemented neo-liberal policies that included user-pays as a new concept upon which to base State/individual transactions.

Labour did not implement user-pays in tertiary education – but it laid the fertile ground for the following Bolger-Richardson National government to radically change University funding for course fees.

For the right-wing Labour (of the 1980s) and National, smaller government meant tax-cuts, and from 1986 there were no less than seven cuts to taxation;

1 October 1986 – Labour

1 October 1988 – Labour

1 July 1996 – National

1 July 1998 – National

1 October 2008 – Labour

1 April 2009 – National

1 October 2010 – National

Each cut to taxation has meant less revenue for the government and resulted in either reductions to social services, and/or increases in user-pays.

The ballooning of “voluntary” school fees to over a billion dollars since 2000 is the clearest example yet of tax-cuts making way for the covert rise in user-pays for what is supposedly “free” schooling in this country.

The under-funding of schools and desperate need for parents’ “donations” has become such a pressing problem that Patrick Walsh, of the Principals Association of New Zealand, has openly suggested that the ideal of free education should be abandoned;

“I think the basic principle is you undertake a study … of what it costs to actually run a school, all the operational costs including staffing, and you either fund it to the level it actually costs, or you say the pie isn’t big enough to support that and we will now allow schools to charge parents for some of the services.”

Perhaps Walsh has a point. It would at least acknowledge the current semi-user-pays system as a reality, rather than fooling ourselves with dishonest and quaint notions of “school donations”. Only then might New Zealanders clearly comprehend how we have arrived at a toxic mix of tax-cut bribes and implementation-by-stealth of user-pays in education, and other state services.

Education is not the only state service suffering from lack of adequate funding, as recent media reports from Canterbury and Waikato DHBs indicate. The increasing waiting times for public operations, and painful suffering of people with debilitating medical conditions, is a telling indicator that our health care system is ailing through lack of funding.

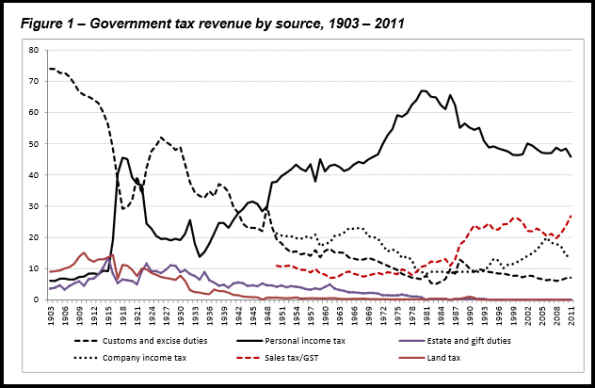

A September 2012 Treasury paper, “Average Marginal Income Tax Rates for New Zealand, 1907-2009“, revealed;

In 1900 tax revenues were approximately 8% of GDP. They rose to 28% of GDP during WWII and to a high of 37% in 2006. Currently tax revenues make up around 29% of GDP.

.

.

Taxation has fallen – as have once-free services which New Zealanders took for granted. At the same time, population growth has put pressure on (reduced) government revenue and spending.

In 1984 the population stood at 3,175,737 (as at 1981 Census).

By 2013: our population had swelled by over a million to 4,242,048 (as at 2013 Census).

We are spending less, for more people, to meet expectations that are simply unrealistic after seven tax cuts.

Rather unsurprisingly, the consequences of successive tax-cuts have been predictable, and well-reported in the media;

According to the most recent data, taken from the 2013 Credit Suisse Global Wealth Databook, 44,000 Kiwis – who could comfortably fit into Eden Park with thousands of empty seats to spare – hold more wealth than three million New Zealanders. Put differently, this lists the share of wealth owned by the top one per cent of Kiwis as 25.1 per cent, meaning they control more than the bottom 70 per cent of the population.

New Zealand’s wealthiest individual, Graeme Hart, is ranked number 200 on the Forbes list of the world’s billionaires, with US$7 billion. That makes his net worth more than the bottom 30 per cent of New Zealanders, or 1.3 million people.

The Progressive Response

January 31st marked a giant step Kiwi-kind that – if endorsed by voters – could prove to be the the first nail-in-the-coffin for user-pays.

Labour leader, Andrew Little, announced a policy that, while seemingly radical in the 21st century, was common-place policy in this country pre-1980s.

.

.

Little proposed;

“… that the next Labour government will invest in three years of free training and education after high school throughout a person’s life.

[…]

Three years of free skills training, of apprenticeships or higher education right across your working life.”

He then pointedly explained not just where the money would come from – but that bribes in the form of successive tax-cuts had under-mined our once-proud cultural expectations of state-provided services;

“The money is there – the Government just has it earmarked for tax cuts. We will use that money instead to invest in New Zealand’s future.”

In effect, this would be a massive admission of failure in user-pays, and the beginning of rolling back thirty years of New Right doctrine.

The Neo-Libs Strike Back

The response of the National Party and it’s front-organisation, the so-called “Taxpayers’ Union“, has been utterly predictable.

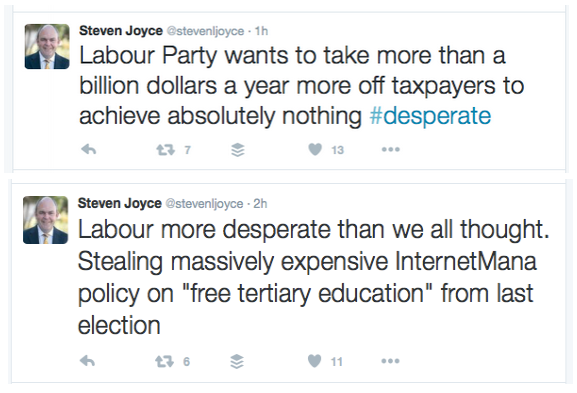

From Tertiary Education minister, Steven Joyce, came these two ‘clangers’ via Twitter;

.

.

Judging by the angry responses on Joyce’s Twitter account, his comments were more provocative and self-defeating, than achieving any ‘hits’ on Labour’s policy-announcement.

John Key fared little better after his jaw-dropping gaffe on this issue;

.

.

Aside from the usual tactic of playing on low-paid workers’ dire plight to criticise free education (or free anything provided by the State), links were quickly drawn to Key’s on-going assault on waitress Amanda Bailey, in Auckland’s Rosie Cafe;

Prime Minister John Key has drawn a barrage of criticism after questioning if Labour’s fee free study policy was fair on waitresses who would be paying tax to subsidise students.

His comments also drew a quick response from some critics on social media who drew the link with Key’s repeated pulling of Auckland cafe waitress Amanda Bailey’s ponytail.

Key’s rhetorical question attempted to paint free tertiary education as unfair on low-paid workers;

“How much should the waitress.. how much of her taxes should go to a student who will absolutely earn a lot more?”

The question could equally be put;

“How much should the waitress.. how much of her taxes should go to…”;

- National Ministers gifting themselves 34 new BMWs. The last batch – bought in 2011 – are to be replaced only after about three years’ use. Cost? Unknown. According to National, the price is “commercially sensitive”. (Code for *politically embarrassing*.)

- Farms in the middle of the Saudi Arabian desert. Cost to taxpayer: $11.5 million (with a further $3 million in the pipeline)

- A luxury $11 million apartment in New York, and a $6.2 million luxury Hawaiian mansion. Total cost to taxpayer: $17.2 million.

- Bailing out Tiwai Point aluminium smelter, and helping Rio Tinto make a good profit ($10.2 billion!) that year? Cost to taxpayer: $30 million.

- Subsidies and special tax concessions to Warner Bros for ‘The Hobbit‘, and to other movie companies? Cost – ongoing.

But the main question should be;

“How much should the waitress.. how much of her taxes should go to paying for tax-cuts for the top 1% of New Zealanders.”

When National cut taxes for high-income earners in 2010, and raised GST from 12.5% to 15%, this was essentially a transfer of wealth from low-income earners to the uber-wealthy. Low income earners pay disproportionately more in GST than the wealthy.

People like Ruth Richardson can structure their tax-affairs by registering as a limited liability company (or using Trusts and other accounting trickery) – which allows her to claim back on GST – this puts the rest of us at a distinct disadvantage.

Other companies such as Facebook and Apple have made big profits in New Zealand, but paid minimal tax. Facebook paid $23,034 in 2013/14 (out of alleged revenue of just $846,391), whilst Apple paid $5.5 million in 2012/13 (out of $571 million revenue).

As for criticisms from the so-called “Taxpayers Union” – this is a front-organisation for National. It’s organisers are party apparatchiks from National and ACT;

Jordan Williams is closely connected to the likes of David Farrar, Cameron Slater, and Simon Lusk – all of whom are hard-Right National/ACT supporters and apparatchiks.

Right-wing blogger, David Farrar, is one of the Board members of the Taxpayers Union. He has been a member of the National Party since 1986, as his candid Disclosure Statement on Kiwiblog reveals.

John Bishop; businessman; columnist for the right-leaning NBR; and authored a “puff piece” on National’s Deputy Leader, Bill English; Constituency Services Manager, ACT Parliamentary Office, April 2000 – August 2002, “developing relationships with key target groups and organising events”.

Gabrielle O’Brien; businesswoman; National Party office holder, 2000-2009.

Jordan McCluskey; University student; member of the Young Nationals.

Jono (Jonathan) Brown; Administrator/Accounts Clerk at the Apostolic Equippers [Church] Wellington, which, amongst other conservative policies, opposed the marriage equality Bill.

See: A Query to the Taxpayers Union – ***UP DATE ***

Publishing criticisms from the “Taxpayers Union” is simply another PR statement from National, masquerading as independent analysis.

People’s Exhibit #1 – The Case for Key’s and Joyce’s Hypocrisy

Undeniably the worst aspect of National’s condemnation of free tertiary education rests with our esteemed Dear Leader, John Key, and Tertiary Education minister, Steven Joyce.

Both men were recipients of free, tax-payer-funded, University education.

In Key’s case, his was obtained at Canterbury University, from 1979 to 1981;

.

.

Has Key re-paid any of his University education? One suspects the answer is a firm “no”.

And with seven tax cuts, neither did he pay for it with taxation, as high-income earners paid less and less since 1986 – five years before graduating.

In Joyce’s case, as first reported on 6 August 2015, in a previous blogpost;

-

Steven Joyce, born: 1963.

-

After completing a zoology degree at Massey University, Steven started his first radio station, Energy FM, in his home town of New Plymouth, at age 21 (1984).

-

Student Loan system is started: 1992.

Joyce completed his University studies and gained his degree eight years before the Bolger-led National government introduced student fees/debt in 1992.

One wonders how Joyce reconciles his free tertiary education – as well as benefiting from seven tax-cuts, along with John Key – with justifying National’s issuing warrants-to-arrest for loans defaulters;

“Just because people have left New Zealand it doesn’t mean they can leave behind their debt. The New Zealand taxpayer helped to fund their education and they have an obligation to repay it so the scheme can continue to support future generations of students.”

Key and Joyce never paid for their free University tuition.

Yet they expect other New Zealanders who followed in their foot-steps to pay for theirs.

Or face arrest.

What does it say about us as a nation, when we elect hypocrites as our elected representatives, who bludge of the tax-payer?

If this does not fly in the face of New Zealanders’ values of fairness and giving everyone a fair go – then we are not the same people we once were.

Postscript

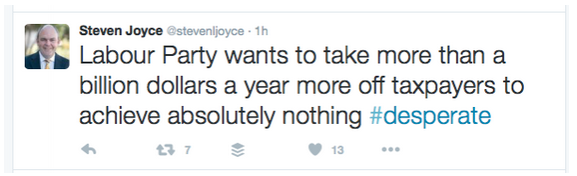

Tweet from Steven Joyce, condemning Labour’s policy for free tertiary education;

.

.

Can we take it from the Tertiary Education Minister that his own university education “achieved absolutely nothing”?

.

.

.

References

National Business Review: Budget 2015 – student loans – does the government dare to act?

Ministry of Education: Student Loan Scheme Annual Report 2014

Beehive.govt.nz: Celebrating student support under Labour

Ministry of Education: Student Loan Scheme Annual Report 2015

The Wireless: Getting by on a student budget

IRD: Student Loan Scheme Amendment Act 2014 – Arrest at border

Fairfax media: Joyce defends student loan crackdown

Fairfax media: Student loan arrest could prompt others to address debt

NZ Herald: ‘I don’t think I’m a criminal’

Teara.govt.nz: National Party – The ‘mother of all budgets’

Statistics NZ: Annual unemployment rate has increased from 1987

Ruth Richardson NZ Ltd: Ruth Richardson CV

Ruth Richardson NZ Ltd: Home page

Fairfax media: ‘Free’ education cost set to mount to more than $1 billion

Fairfax media: ‘Human scandal’ as Christchurch elderly refused access to surgeries

Fairfax media: ‘Painful wait’ for surgery

NZ Treasury: Average Marginal Income Tax Rates for New Zealand, 1907-2009

NZ 1984 Yearbook: 3A – General Summary – Increase of population

Statistics NZ: 2013 Census Usually Resident Population Counts

Oxfam NZ: Richest 10% of Kiwis control more wealth than remaining 90%

Radio NZ: Labour’s announcement welcomed and slammed

Andrew Little: State of the Nation speech

Twitter: Steven Joyce

Twitter: Steven Joyce

Fairfax media: John Key draws flak after questioning why waitresses’ taxes should fund students

NZ Herald: Govt backtracks on limo statements

NZ Herald: Complaints laid against Murray McCully over Saudi farm deal

Radio NZ: Saudi abattoir deal will proceed – PM

Fairfax media: NZ government shells out $11m on New York apartment for UN representative

Fairfax media: NZ diplomat involved in decision to buy $6.2m luxury Hawaiian mansion

Otago Daily Times: Smelter gets Meridian, Govt lifeline

Rio Tinto.com: Rio Tinto announces a 10 per cent increase in underlying earnings to $10.2 billion and 15 per cent increase in full year dividend

NZ Herald: GST rise will hurt poor the most

Fairfax media: Time to pay some tax, Facebook?

NZ Herald: Apple’s NZ unit coughs up 0.4pc tax

Kiwiblog: Disclosure Statement

Sunday Star Times: Politics – John Key – A snapshot

Wikipedia: Steven Joyce

National Party: Steven Joyce

Fairfax media: IRD monitoring 20 for possible arrest in student loan repayment crackdown

Additional

Salient: A short history of tertiary education funding in New Zealand

NZ Herald: Minister to students – ‘keep your heads down’

Other bloggers

The Daily Blog: John Key said WHAT about waitresses’???

The Daily Blog: Why does Steven Joyce hate education so much?

Previous related blogposts

A Query to the Taxpayers Union

A Query to the Taxpayers Union – ***UP DATE ***

Know your Tory fellow travellers and ideologues: John Bishop, Taxpayers Union, and the NZ Herald

It’s official: Political Dissent Discouraged in NZ!

Shafting our own children’s future? Hell yeah, why not!

Hon. Paula Bennett, Minister of Hypocrisy

Budget 2013: How NOT to deal with Student loan defaulters

Budget 2013: Student debt, politicians, and “social contracts”

Steven Joyce – Hypocrite of the Week

Anne Tolley’s psycopathy – public for all to see

Letter to the Editor: Steven Joyce – Hypocrite of the Year

The Mendacities of Mr Key # 15: John Key lies to NZ on consultation and ratification of TPPA

.

.

.

.

This blogpost was first published on The Daily Blog on day month year.

.

.

= fs =

“No one deserves a free tertiary education (except my mates and me) ” …..or a decent state home to call my own, and bring my family in a decent and secure environment!

Thanks for the post once again Frank

We had a super plan to pay for as well as well.

This is why trickle down dosnt work. Because people like you don’t understand the economy.

Despite trying to justify Key’s and Joyce’s free varsity education, Oxyood, you still haven’t made the connection between free state services given to your National party mates, and the rest of us having to pay for our tuition.

I’ve got a $65,000 debt hanging over me and in March I’m of to the US where I can earn a better salary to pay of that debt. I don’t know when I’ll be back, if ever. So really, what has been the benefit of that education to New Zealand? None at all. You’ve over-looked that, haven’t you?

Having read Frank’s article, if I decide not to repay my student debt, it means I will be exiled from the country of my birth. Not that it worries me terribly much. My forebears got free education, as did Key and Joyce, and now they’ve saddled me with a debt that I’ll probably not pay off for decades. So tell me why I should ever come back? What has the last generation done for me, except burdened me with debt??

This is not a level playing field by any stretch of the imagination.

Cheers & goodbye!

GD

Nice work, Frank. Well researched, well doxxed, and well written. MOAR!

I concur, BLiP. He does good research and backs it up with references.

The best that Act apologists like Oxyood can manage is to attempt to repeat garbage to cloud the issues. Doesn’t work. They only draw more attention to Frank’s research.

Call me old school. But we should just pay our taxes

In the 1970s running a small family-owned business my husband and I were paying income tax at the rate of $1 for every $ profit we made. That was unsustainable. At least that is better now and must have have helped all the small businesses.

Today the NZ economy provides employment for more people than at any time in our history. That is largely the result of the economic policies adopted by successive governments in NZ for the past 30 years or so, including reducing income tax rates.

Again, you are indulging in wishful thinking, Oxyood.

Yet unemployment is at 5.3% (or higher, judging by a number who have given up looking), compared to about 3.4% in 2007.

In January 2008, there were 78,000 unemployed people.

The latest HLFS survey suggests at least 133,000 unemployed – probably higher ( that figure has been questioned by some).

On top of which, economic growth is predicated largely on the Christchurch re-build and the rise in Auckland’s housing prices. The regions are not doing so well.

Wages continue to lag behind Australia.

The cost of housing has risen to such a degree that home ownership has continued to fall.

Claiming the reduction of income tax as the reason for economic growth is disingenuous – but that doesn’t seem to bother dishonest commentators from the Right. If nil income tax was such a vital determinant of economic growth, Somalia should be the economic power-house of the world.

One of the greatest side-effects of reduced tax revenue is the fall in funding for social and state services. As I pointed out, education now requires high tertiary course fees and “voluntary donations” from parents for other schools.

On top of which, waiting lists for operations in our hospitals continue to grow.

So your simplistic cause and effect is founded more on faith-based political dogma rather than reality.

Not that ACT-types like you are concerned with facts.

However, I’ve noticed that every time I report on these issues, someone in ACT feels sufficiently threatened to devote a lot of time trying to fudge the facts.

That nerve I’m hitting must be getting fairy raw, I’m guessing.

Excellent writing, Frank. I’m sharing this on Facebook with all my contacts.

As for Oxyood, he’s a delusionist living in la-la-land.

Spoken like a true Act member, Oxyood. Though it’s all bullshit. Unemployment is still higher than it every was before your mates introduced your neo-lib revolution. Houses are more expensive. Education costs more and more.

That’s why your party is known as the 1% Party. Hardly anyone votes for it.

You should be careful doing that. I’m not the only one who’s spotted the nonsense in Franjs argument.

You are the only one

“You should be careful doing that. I’m not the only one who’s spotted the nonsense in Franjs argument.” – Oxyood

Really, Oxy? Who else are you referring to? So far there’s only you here, parroting your right-wing garbage. If the “others” you are referring to are voices in your head, they don’t count.

“Today the NZ economy provides employment for more people than at any time in our history. That is largely the result of the economic policies adopted by successive governments in NZ for the past 30 years or so, including reducing income tax rates – Oxyood

Untrue.

Unemployment is much higher than it ever was.

More lies from an Act Party flunky.

Governments with Reserve Banks owned by the Khazarian Zionist Mafia aren’t in power to resolve the condition within countries but to increase the burden. Come on, guys, get with the programme – and that’s the word programme – exists in education, health, television, news, blah, blah, blah ….. we’ve been programmed up to our necks. You must work harder, longer, for less, but keep us in power and we’ll look after you.

No more, John, there’s a light coming behind you and yes it is a train!

Problem is the last tax cuts benefitted the wealthy then they smacked the rest of us with a GST increase?

Then the missing million or the disengaged put their heads in the sand and didn’t bother to vote?

A lot of people didn’t vote because they had concluded the adage ‘if voting made any difference they’d ban it’ applied.

Let’s face, whichever party is in power the policies are essentially the same, and are not for the benefit ordinary folk.

Well done , Frank ….this is a point I often made when talking with those of the neo liberal persuasion… the sheer and blatant hypocrisy of these neo liberals who , like Key , attained their degrees during the 1960’s and 1970’s when it was relatively free…

And it was accepted then , that society would reap the benefits of an educated public.

Speak to any person and they will all nod sagely that this is true. Speak to them about the current neo liberal policies and many will say the country cant afford free tertiary education.

Its parroted , of course , – and un-thought through nonsense.

What many of these people all seem to forget is the funding used to come through taxation , and that taxation was accepted as the means and mode to invest in medical, engineering , scientific and educational professionals etc of the future…

Taxation that as had been mentioned – is now being diminished by tax cuts – and tax cuts that generally almost always favour the rich and by those who almost certainly can afford to pay that little bit more than they are currently getting away with not paying.

We now have to import people from other country’s to do the same thing we used to do. Such is the negative aspects of the user pays system in discouraging Kiwis from tertiary education and its exorbitant debt saddling.

There is a reason the neo liberal will oppose free ( or relatively free) tertiary education – because it goes against the upward flow of capitol – into their bank accounts . Literally.

This is the fundamental premise behind the ‘small govt’ doctrine.

Clothed in the noble concept of being ‘wise’ with public expenditure… at its core is none other than the privatizing of all and everything into the user pays system – such as education has been – having not the publics interests at heart at all…but the relocating of further wealth of the commons into the hands of the elite few.

This is its real and SOLE agenda.

THE TAX CUTS cry of the neo liberal serves these two purposes.

1) Dresses govt expenditure with an air of concern over the allocation of govt spending – it is a ruse. As has been proven , the funding is already there in the form of tax cuts . This is a direct rebuttal against those who,- on the one hand , – agree education is important , yet insist we cannot afford it.

The fact of the matter is that in the era of Key and Joyce – we COULD afford it. And we DID. And for any neo liberal to say we cannot is tantamount to admitting that neo liberal economics is a failure.

2) TAX CUTS … dovetails in with the whole neo liberal dogma of ‘small govt’. It is actually code for privatization of many assets ,- education being but one of them.

Surreptitiously done , its real perniciousness lies in stripping a country of those items that create a high standard of living by a certain sanctimoniousness – that air of sanctimony is usually achieved by a combination of high sounding ethics and morals in tandem with reports into excessive expenditures which appear startling at first in ‘waste’ -until upon further perusal are found to be nothing more that trumped up statistics and figures.

This was how the neo liberal presented their case in the 1980’s and 1990’s.

The appalling state of poverty in this country in modern times is a direct result of the implementation of this ideology. Not seen since the 1930’s.

( Interestingly it was the USA Laizze Fairre system which caused the Great Depression – which is virtually the same as the current neo liberal monetarist theory )

Therefore this whole ideology of ‘small govt’ , ‘tax cuts’ , has but one and ultimate final objective : creating a total user- pays state system that means those without means are kept locked in that position and those with means can advantage themselves of that system , and are in effect, the beneficial troughers of an artificial economic construct designed to create a tiered society ,- whereby those who hold most of the wealth maintain that wealth and also the political power to perpetuate that system.

IT IS FOR THESE REASONS AND THESE REASONS ALONE that we see Joyce and the likes of the Taxpayers Union opposing vociferously any hint of the actual taxpayers enjoying the benefits of an educated community and nation …

Their fear is that if they were to cave on this one issue… that the public would soon start to reason ( and justifiably so ) why the same cannot be extended to many other areas of public service – and in fact why we allowed them these liberty’s to negatively change our system in the first place – thus dismantling the carefully constructed neo liberal lies of the past 32 years.

In reality, nothing is truly ‘free’. The ‘free’ tertiary education Mssrs Joyce and Key enjoyed was paid for by other taxpayers. The key difference between this and public utilities (e.g. roading) is that tertiary education primarily benefits the individual, and on that basis the individual should pay, at the very least, a significant portion of it’s cost. That is the current position, and there is no good reason to change that.

But the wider issue raised here is taxation. Over the past 30 years, successive governments in NZ have steered toward an economy where income taxes are reducing, and more emphasis is placed on user pays for private utilities. Long may that continue, because it has produced a strong and sustainable economic foundation.

The Melbourne Age recently wrote about the remarkable turnaround of migration flows between Australia and NZ, and had this say: (http://www.stuff.co.nz/national/76475500/exodus-to-new-zealand-kiwis-fleeing-back-home-joined-by-australians)

“It comes as the country of 4.6 million is experiencing consistent political stability and strong economic performance while other countries falter.”

“Halting the “brain drain” was a major campaign commitment of Prime Minister John Key who, after more than seven years in power, is a popular leader running a steady, successful government.”

“The continued economic growth, low unemployment numbers, strong New Zealand dollar, budget surplus and migration success story of the country are all feathers in the cap of the Prime Minister, who last year joked that you “wouldn’t know who’s going to show up” when you’re expecting an Australian prime minister.”

“One victim of this revolving door of political leadership, former treasurer Joe Hockey, last year insisted that the lower tax rates of New Zealand were “unquestionably” part of the exodus.”

Long may that continue.

Really, Oxygood?

So if everyone with tertiary education decided to bugger off overseas, who would design, maintain, and build those public utilities you referred to? Who built our roads, rail network, power production and transmission, airlines, telecommunications, healthcare, education, weather reporting, education system, et al?

And if “tertiary education primarily benefits the individual”, then surely it would be cheaper to import every graduate we need from China or some other developing nation, and leave every New Zealander under-educated?

Because, really, that is the nonsensical gibberish you are parroting from ACT’s policies.

By the way,Oxyood, the point here is not whether tertiary education should be user-pays or not. The point is that your esteemed Tory representatives benefited directly from a free tertiary education, plus seven tax cuts, and then loaded multi-billion dollars costs onto succeeding generations.

If that is fair to you, then I politely suggest your concept of fair-play is fucked.

Have a nice day.

“So if everyone with tertiary education decided to bugger off overseas…”

Student loans have been in place in NZ since 1992. In the intervening period, roads, schools, hospitals etc etc have continued to be built, refurbished and expanded.

“And if “tertiary education primarily benefits the individual””’

Since 1992, graduates have, by a significant majority, continued to stay in, or return to NZ (after their OE).

“The point is that your esteemed Tory representatives benefited directly from a free tertiary education, plus seven tax cuts…”

You spell out in your article when the tax cuts occurred. Anyone who completed their tertiary education prior to 1992 will have paid higher taxes than today’s graduates for 18 of the past 25 years (1992 to 2010), possibly longer if they worked prior to graduating. And that’s a fairly large flaw in what you seem to imply is the main point of your article.

You are delusional (or can’t count).

Key completed his tertiary education in 1981. Joyce started his business in 1884. That’s five and two years respectively before the first tax cuts in 1986.

Therefore any high tax they paid was for a brief period, and in Joyce’s case was offset as business start-up costs.

The rest of your “argument” is weak justification and doesn’t address the points I made. Higher education is not simple a “private good”. Without it, no modern society could function – witness Third World countries.

In fact, a person might earn a living as a street sweeper instead of a doctor – but society is the poorer if we have plenty of street sweepers and insufficient doctors. (No aspersions intended toward street sweepers.)

What you are attempting to do is imply that a modern society can function without highly educated professionals.

That is clearly an absurdo reductum.

In fact, for your ACT policy to hold weight, tertiary education must be more of a private good than social benefit – otherwise it becomes apparent that it is counter-productive to the betterment of a nation’s economic well-being.

Making vague judgements as you engage in is a poor attempt to bolster policies that are clearly failing; have failed; and will continue to fail.

Oxygood you cite a roading as real free????

QUOTE,

“The key difference between this and public utilities (e.g. roading) is that tertiary education primarily benefits the individual, and on that basis the individual should pay, at the very least, a significant portion of it’s cost”

Our roading is amongst the most expensive cost to the taxpayer and mostly paid by average taxpayers and mostly benefits trucking companies mostly foreign owned now.

We the private broad user according to the IPENZ (Institute of Professional Engineers of NZ) study shows Rail pays almost 80% od their cost in maintain the rail network, while Private roads users pay 66% and trucking 56% so you are so wrong.

You should say Roading primarily benefits the individual trucking companies”

“you cite a roading as real free????”

No.

Yeah well the employment numbers that matter ie youth unemployment hasn’t changed. It’s mostly old people moving into other categories not counted in employment stats. So when you want to go on like you know something, have a look at the states before you open your mouth.

And remember, the Act party handbook is not a valid form of information

“What you are attempting to do is imply that a modern society can function without highly educated professionals.”

I never implied anything of the sort. A modern society needs highly educated professionals. However by your own measure (roading, hospitals etc etc) NZ has had it’s fair share over the past 24 years, undeterred by the advent of student loans.

“…otherwise it becomes apparent that it is counter-productive to the betterment of a nation’s economic well-being.”

Are you suggesting that a private good cannot also be a social benefit?

“Therefore any high tax they paid was for a brief period…”

Linking the notion of ‘free’ tertiary education and the benefit of tax cuts remains the most serious logical flaw in your post, one you don’t seem to have grasped from my previous response. By your own material, Key started full time work in 1982, Joyce in 1984. That means that both men paid higher taxes than todays graduates for 24 years (1986 through 2010, the period in which you list 10 tax cuts) which is clearly not a ‘brief period’. That is why I made the comment “Anyone who completed their tertiary education prior to 1992 will have paid higher taxes than today’s graduates for 18 of the past 25 years” (the 18 years being from 1992 through 2010).

Actually, you did.

By asserting that education is a private good, you are clearly supporting the dogma that it benefits an individual more than the society in which s/he lives, and gained that education.

Which is simplistic tripe. There’s no point in having a tertiary education to become a lawyer, doctor, or astro-physicist, if you live in a non-technological village in the middle of a jungle.

A modern education can only be of practical benefit if it is relevant to the society in which s/he lives and works.

A modern education is of little value to an individual without a modern society in which to apply that knowledge.

No, you are. All your posts thus far have parroted ACT dogma on this issue.

You continue to wilfully cloud the issue.

As I pointed out at 9:30AM; “Key completed his tertiary education in 1981. Joyce started his business in 1884. That’s five and two years respectively before the first tax cuts in 1986.”

The first tax cut occurred in 1986, and the top tax rate was cut from 66% to 48% for the high-income earners (see: http://www.teara.govt.nz/en/taxes/page-7)

Therefore, Key (may have) paid that top tax rate for only five years. Thereafter, he paid less and less tax with each successive six tax cuts.

When he married his current partner and ostensibly set up house with her (in 1984), he had no student debt – nada, zero, zip – when he would have applied for a mortgage. Two years later, as well as no student debt, he would have recieved his first tax cut. Followed by tax cuts in 1988, 1996, 1998 , 2008, 2009 and 2010.

By contrast, probably every student from 1992 on-ward came away from their University tuition with hefty debt. With interest accruing on that debt.

So your attempt at spinning this in weird and wonderful ways, ostensibly to cloud the issue, only shows that my analysis is deeply troubling for you and your National/ACT colleagues.

The facts are there. Argue all you like – they won’t change one iota.

You are developing a bit of a rep for fudging issues, Oxyoon. I noticed this on the “Bill Rosenberg – A nuclear-free moment” blogpost where you replied to another poster who quite rightly pointed out that the TPPA would “prevent future elected governments from making progressive change” with the jaw-droppingly asinine assertion that the claim was “patently false”. (https://thedailyblog.co.nz/2016/02/06/guest-blog-bill-rosenberg-a-nuclear-free-moment/#comment-324746)

I pointed out that Veolia was suing Egypt for intending to raise the minimum wage, and that Phillip Morris had sued the Australian government for intending to introduce plain packaging for tobacco products.

You seem to have a problem with facts and figures.

You’re wiping the boards with that fool, Frank. Oxyood has spent too much time with his Act mates to comprehend the information you’ve presented.

It’s dogmatic idiots like him that refuse the evidence in front of their eyes, preferring instead to cling to their bankrupt ideology.

Key and Joyce and Richardson benefitted from university education paid by other taxpayers. Then they cut taxes for themselves, implemented user-pays for tertiary courses, effectively pulling up the ladder after therm.

Judging by the determination of “Oxyood” to fudge and cloud the issues, your research has Act-types very, very worried. I’m guessing they’re panicking that the MAM will pick up on your findings.

Well done!!

Oxyood, your argument doesn’t gel at all. According to Frank’s figures and dates (and he’s rarely wrong on these things) wage and salary earners got seven tax cuts from 1986 onwards. So people’s tax liabilities went down as student debt increased.

If seems a bit silly to try to spin it some other way. What other way is there??

I think you’re overdoing the Act spin on this.

“So people’s tax liabilities went down as student debt increased.”

Yes, but they still paid a lot more than do students who graduate today. That is the obvious flaw in Franks argument.

And the obvious floor your argument is people try and weasel there way out of paying the correct amount of taxes today.

What you’ve been saying is

-pay less taxes

-pay more Uni fees

-pay less in wages

-pay less benefits

We simply can not run a country like that. Trying to get the bottom half of the population to invest in research so private organisations can swoop in and pay minimium wage for the research students do at uni is difinetley not a road to economic prosperity, that’s just another form of rent seeking.

Oxyood, you’ve agreed with Samwise’s comment – and THEN STILL ARGUED THE POINT???

Frank is correct, tax’s were cut seven times, their tax liabilities dropped, and that shortfall in revenue was passed on to students post-1992. (His article is a bit on the lengthy side, but is thoroughly informative.)

I don’t know why you’re arguing to the contrary, unless you’re just getting some weird satisfaction from being contrary.

So students are paying for something they once got free, including Joyce and Key. Argue that as much as you like, but it’s still true.

“So students are paying for something they once got free, including Joyce and Key.”

This is a really simple concept, so I may not be making myself clear.

Franks article focused on the apparent contradiction between pre 1992 graduates getting a ‘free’ tertiary education and also benefitting from the tax cuts between 1986 and 2010.

But here’s the problem with that.

According to Frank’s own data, pre 1992 graduates (specifically Joyce and Key who graduated in the mid 1980’s) paid a top rate of 66% until 1986, 48% until 2009, 38% until 2010, and 33% thereafter.

(https://en.wikipedia.org/wiki/Taxation_in_New_Zealand)

That means that from their graduation in the mid 1980’s until 2010, Key and Joyce paid a considerably higher rate of tax than do todays graduates. Frank was relying on the period from their graduation until 1986, omitting the 13 years they paid a top rate of 48%, plus the 11 years they paid 38%. That defies the argument Frank is trying to make.

I hope that is clearer.

[I see you are back, after being banned several times. This will be your last post. – ScarletMod]

Actually, I said no such thing. You’re making it up.

At 12:15 (9 Feb), I said; The first tax cut occurred in 1986, and the top tax rate was cut from 66% to 48% for the high-income earners .

The other figures – “48% until 2009, 38% until 2010, and 33% thereafter” – come from you.

Please don’t attribute data to me I never provided. Your dishonesty is disturbing.

Still letting Frank hide behind your skirts scarlett? More for my book.

By Tui

Oxyood, so you’ve been banned from this site before and you’ve ignored that banning?? I thought your righties were big on respecting property rights?

Anyways, I guess Frank’s research much really bother you is you’ve coming back from under your rock, to post your rubbish.

What are you afraid of, I wonder??

There is no “flaw”.

Students post-1992 are lumbered with debt from $20,000 to $100,000 (approx figures), and this is a millstone around their necks.

And you still fail to address that Joyce and Key enjoyed free education and then six tax cuts. That means they never paid for their education either directly (through fees) or indirectly (through taxation).

Who pays more? Pre or post 92 grads. The only one making a big deal about it is you. No one here disputes that post 92 grads pay way more. And I fail to see how Frank pretty much saying post 92 grades pay more strengthens yours, or weakens his argument.

I mean seriously. With an argument like yours. The government should be self funding.

On another note. If you have any degrees. You should hand them in immediately and say sorry, I’m too stupid to own these

+1 Sam!

[The contents of this post has been deleted, as the author is not the usual contributor known as CLEANGREEN. We have recorded the time, date, and IP number of this person (whose identity is suspected), and will be passing it on to his ISP. – ScarletMod]

That just dosnt sit right with me. The average wage back then was $60 give or take.

I think we are comparing to different eras.

Government whips always make the mistake of think students are worth a hundred thousand dollars, because there degrees are worth a hundred thousand. Ignoring the student loan worth a hundred and fifty thousand.

The government IMO destroys more money than it makes, in this day and age

The key thing here I think some are missing is – if the government takes money from you for any reason, it’s a tax.

Well done Frank,

Sure shows Key is a twisted bastard alright as he got a hand up but denies others the same help.

What a creep.

its not just students the baby boomer have screwed us all over house hold debt in NZ is staggering younger generations who will never own there own home are being taxed to fund the entitled generation while facing job insecurity, zero hour contracts ,

unaffordable rents. the cost of living this cant continue there has to be some justice

alot boomers are siting in million dollar homes and large superannuation schemes they argue they worked for it well the rest us are working our back sides off as well but the ladder has been pulled up and that not fair and that has to change look at the land entitled golfers a using when a lot of none boomers are living in garages

its not just students the baby boomer have screwed us all over house hold debt in NZ is staggering younger generations who will never own there own home are being taxed to fund the entitled generation while facing job insecurity, zero hour contracts ,

unaffordable rents. the cost of living this cant continue there has to be some justice

alot boomers are siting in million dollar homes and large superannuation schemes they argue they worked for it well the rest us are working our back sides off as well but the ladder has been pulled up and that not fair and that has to change look at the land entitled golfers a using when a lot of none boomers are living in garages

In all fairness, how many times has a Prime minister said one thing before elections and totally screwed every one after elections.

We are a little luckier these days where the Internet allows us to access information mainstream media refuses to publish. It’s even luckier we have people like Frank and Martin to collect and arrange that info in ways people can read.

I mean. Who actually goes out and reads budget 2015 and understands it.

The concept that uni is a requirement to be successful has created such a glut of uni grads that the average uni grad doesn’t reach the lifetime earnings of a plumber until they’re in their 40’s. Classic economics – increase the supply and the demand price will go down. For that matter, increasing the supply normally increases the per-unit cost. When Uni graduates were a couple percent of the population, they were highly valued, and relatively cheap. Hell, when less than 20% of people graduated high school, that certificate meant things – like being a local manager after suitable work experience had been obtained. Today, when something like 90% of people graduate high school, it’s not so much a benefit to graduate as a hurdle to clear(otherwise life sucks). We’re busily turning uni into that. I mean, there are businesses out there trying to hire Uni grads for minimum wage! That shit doesn’t work, shouldn’t work, especially when people have to pay for college. I could get away with it now but then I sign up for a full ride scholarship paid for by military service. But 4 years of training for minimum wage still isn’t a deal.

Good article Frank but student debt and further education should be among the least of our concerns.

‘The Mendacities of Mr Key # 16′

Ironically enough, ’16 is the year that everything changes.

1. The bankers’ global Ponzi scheme now dependent on negative interest rates. Negative interest rates are unprecedented and unsustainable.

2. Oil prices are so low major oil companies are crumbling (Shell profit is down 87% and BP just made a record loss of $6.5 billion) and entire nation’s budgets are being wrecked. (The NZ oil sector has come to a near standstill.) On the other hand, the substantial rise in international oil prices necessary to return to ‘normal’ would quickly choke off faltering economic growth. The oil sector is unsustainable.

3. NZ diary product prices and payout are dismally low and there is little prospect of them rising. The NZ dairy sector is unsustainable.

4. Global environmental collapse is moving into a new, terrifying phase of Abrupt Climate Change (atmospheric CO2 has hit a new record high of 406ppm, and it won’t stop there). Industrial civilisation based on burning fossil fuels and Ponzi economics is unsustainable.

And we are governed by criminals and clowns who lie to us continuously.

A system founded on lies is unsustainable.

2016 is going to be a very ‘interesting’ year.

You sniped the relevant part, that’s not record losses. It’s storage fees