The IMF have already warned us that borrowing for Tax Cuts will hurt us as National hurtle towards a Lizz Truss moment of reckoning with the Market, and the Market don’t like it…

Budget outlook ‘electioneering’, ‘light on details’ – economist

An economist says the Government’s latest economic declaration is “very light on details and very high on electioneering”.

Finance Minister Nicola Willis yesterday announced this year’s Budget Policy Statement, revealing tax cuts and getting the Government’s finances “back on a sustainable track” would be the priorities of the upcoming Budget.

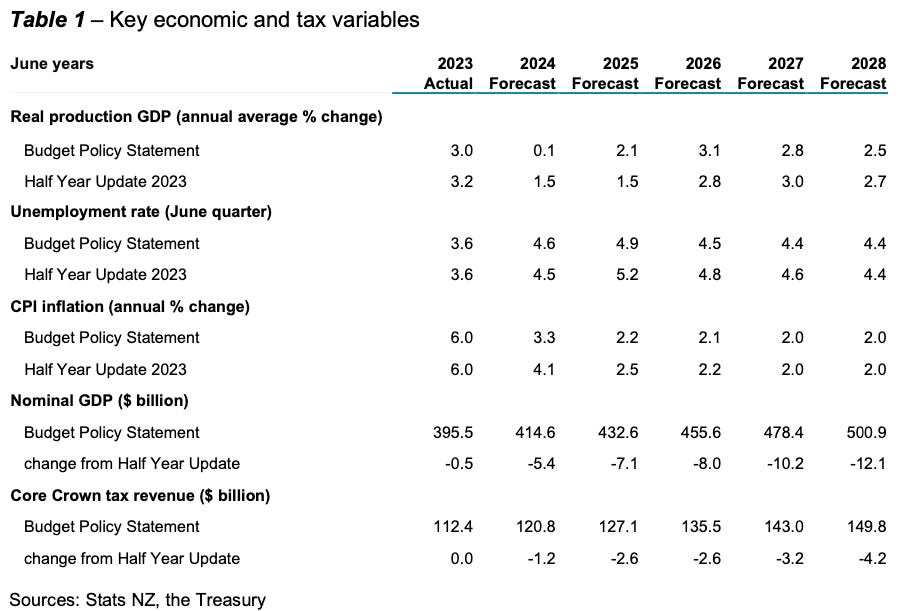

Treasury’s forecast scenario – provided alongside the Government’s Budget Policy Statement – suggested the country’s economic outlook had deteriorated since the December Half Year Update.

Willis said tax cuts would be funded within the Government’s operating allowance through a combination of “savings, reprioritisation and additional revenue sources”. Her statement did not include what those additional revenue sources would be.

Labour leader Chris Hipkins said the Government “can’t even answer the most fundamental question, which is how much money they’re going to spend in the Budget”. He argued “tax cuts simply aren’t affordable”.

Economist Shamubeel Eaqub told Breakfast this morning: “Compared to previous years, this Budget Policy Statement was more of a pamphlet – very light on details and very high on electioneering.

…Bernard Hickey over at Kaka is scathing…

Borrowing even more to pay for tax cuts

The new Government’s Budget Policy Statement yesterday showed Treasury expects an economic slowdown will reduce forecast income taxes by $13.9 billion over the next four years. That means the Government’s borrowing programme over the next three years will have to be $10 billion to $15 billion bigger than forecast last December, according to notes from economists for Westpac and ANZ.

That’s if the Government goes ahead with its promised $14.9 billion worth of tax cuts over the same period, which Finance Minister Nicola Willis again committed to broadly, describing it as “responsible tax relief.”

Fiscal conservatives who normally support the new Government didn’t see it the same way. Former ACT Leader Richard Prebble yesterday joined NZ Initiative Executive Director Oliver Hartwich in calling for the tax cuts to be delayed, via his NZ Herald-$$$ column

“This Budget, if it contains unfunded tax cuts causing inflation and increased borrowing, will be both a political and economic disaster. Luxon must tell his Finance Minister and his coalition partners that the country voted for sound economic management. If that means the tax cuts and other policies must be delayed, so be it.” Former ACT Leader Richard Prebble via his NZ Herald-$$$ column

Here’s the Treasury forecasts for a lower nominal GDP than forecast at December’s Half Yearly Fiscal Update (HYEFU) and the resulting fall in tax revenue.

Bank economists see extra borrowing of same size as tax cuts

The slower economic growth forecast means Treasury sees less tax revenue, which in turns means higher Government borrowing over the next four years, as long as the Government carries through with its tax cuts. The amounts are almost exactly equal over the next four years:

-

- Tax cuts proposed in National election policy costed $14.9 billion;

- Tax revenue reductions due to slower real GDP growth and lower inflation total $13.9 billion; and,

- Higher borrowing of $10 billion to $15 billion if the Government carries through with its tax cuts, say Westpac (up to $15 billion) and ANZ ($10 billion to $12 billion.

…they are borrowing for these tax cuts and will need to make cuts for their $2.9billion tax break for Landlords plus $100million for public servant redundancies!

That’s $19.1Billion we should be investing into schools, roads, hospitals, police, teachers, nurses, Cook Strait Ferry etc etc etc.

Yet here we are borrowing for Tax Cuts all because Nicola Willis was wild enough to stake her job on delivering Tax Cuts and Tax Breaks we can’t afford!

When Matthew Hooton, John Key, the IMF and the the NZ Initiative are all begging to stop tax cuts, you really have to wonder at who is pulling the strings in the background for Luxon to be this tone deaf.

Perhaps Christopher believes he’s entitled to a tax cut?

Bernard is very skeptical of Nicola Willis’ argument in all of this…

Willis went out of her way yesterday to say the tax cuts would not be paid for with borrowing. In my view, that would be true if the economic situation had not deteriorated since December, reducing the revenues elsewhere. The effect of that means a discretionary decision by the Government will mean it has to borrow almost exactly the same amount as the tax reductions.

Here’s how she described the mix of spending, taxation and borrowing in this statement:

“Tax reductions will be funded within the operating allowance through a mixture of savings, reprioritisation and additional revenue sources.

“Funding tax relief in this way means we won’t have to borrow extra to provide tax relief and we won’t be adding to inflationary pressures.” Nicola Willis statement

That is a disingenuous view at best. At worst it is misleading.

The pressure is now mounting from National’s own side of politics. Her comments around the scale of the tax cuts left some wriggle room to be less than the $14.9 billion promised next year, but not that much, given the changes to childcare rebates, interest deductibility and the bright-line test have already been legislated.

The irony of course is that the economy slowdown is due at least partially to the Government’s own actions. Its freezing of funding decisions by Waka Kotahi-NZTA and Kāinga Ora, along with refusal to help councils with funds for water projects, has plunged the development and infrastructure sectors into a state of suspended animation. Spending cuts across most Government departments of 6.5% and 7.5% has chilled consumer and business spending in many places, especially Wellington.

…So National have started the economic recession while needing to borrow for Tax Cuts we now can’t afford!

The lesson from Covid was that we need more State Capacity, NOT LESS!

We don’t just need more teachers, drs and nurses, we need new hospitals, now schools and new capacity!

New Zealand has an egregious infrastructure deficit in NZ!

The Left have to make the argument for a bigger capacity State funded by taxing the mega wealthy. They have to show where the money will come from and they have to show they will have a plan ready to go.

Because our under regulated capitalism has been robbed of revenue by a rigged economic system that benefits the rich, we are desperately needing more hospitals, more passenger rail, roads, schools, storm repair, tens of thousands still waiting for State Houses

The reality is that we are not spending nearly enough and we need a far larger State capacity, not less of it!

There is a class war happening right in front of our eyes as the wealthy pour millions in donations to National and ACT while Climate Denying Federated Farmers join ACT and National push for landlords to have the power to evict when some of their biggest donors are Real Estate pimps.

The political project of the right is to amputate the State’s capacity to raise revenue so that it can’t be redistributed in the first place.

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals with over $50million each, why not start start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry to pay their fair share before making workers pay more tax!

When Treasury is being for a capital Gains tax, you know shit has gone cray…

Treasury’s warning to new Government: Consider Capital Gains Tax quickly to plug spending hole

Our under funded social infrastructure, our ‘me first’ consumerism, our 30 years of neoliberal mythology, our disconnection from one another, our untreated pain, our lack of hope from grinding poverty in a first world country, our damaged masculinity, the intergenerational consequences of colonialism, our unspoken rage culture, our inability to express emotion beyond anger – all of this demands questions we don’t want to hear as a society.

If we don’t provide people with Hope that there is a better way of being for us all, if we don’t provide vision that actually addresses the material well being of our voters, if we aren’t prepared to debate the expansion of State Capacity by taxing the mega wealthy and funding the climate change adaptation, if we don’t do all that, this hard right racist Government will win again.

Jobs and crayfish for us!

Austerity for you!

This is NuZilind now. This is what we have become because we were angry Jacinda saved 20 000 lives.

We have all the cultural maturity of a can of day old coke.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media.

I think we need a CGT to remove such reliance on PAYE contributions. It’s not just “the rich” that make capital gains. Sure it would increase their tax contributions but it should not be about going after any one group.

The sad thing is people still have this notion that National are better at managing the economy. It’s so obviously untrue. I don’t have a problem with a level of borrowing but they do it for fundamentally the wrong reasons.

I agree with your idea about GST .

Should have gone to speck savers

Yes because it’s spelt “spec”

Hahahaha you keep us amused Trev.

I agree with your whole comment.

right wing administrations everywhere cannot be trusted with the economy or social provision.

..evil or incompitant take your pick

right wing administrations everywhere cannot be trusted with the economy or social provision.

..evil or incompitant take your pick

” Treasury expects an economic slowdown will reduce forecast income taxes by $13.9 billion over the next four years. ”

” That’s if the Government goes ahead with its promised $14.9 billion worth of tax cuts over the same period, ”

So, correct me if I’m mistaken over the next 4 years the governments shortfall of revenue in total will be: 28.8 billion paid for by starving infrastructure spending such as new ferries plus getting rid off spending on salaries for government jobs.

Borrowing on which we pay interest would be up to 15 billion!!

Sounds like a suicide for the country financial policy to me. It’s the Greedies who voted this shower in. They only care for their clique certainly not the country.

From the standard.org.nz

” Mike the Lefty

28 March 2024 at 1:21 pm

Tax cuts WILL go ahead.

They will go ahead because I believe this was one of the secret clauses in the coalition agreement demanded by ACT.

ACT and their rich list mates made tax cuts a bottom line and if National reneges on this ACT could retaliate by voting against specific government legislation – nothing very important of course, but symbolic and embarrassing.

As I write this, I wonder whether ACT’s failure to vote against a Labour party amendment in parliament which lowered the RUC ( road user charges ) for hybrid vehicles was not a blunder, perhaps it was a deliberate subtle warning to National that tax cuts WILL go ahead, or you will be sorry!

It wouldn’t matter a jot to ACT whether the tax cuts bankrupted the country. All they care about is getting a lot more figures in their bank account balances. “

Every business needs customers to survive in the money go round cycle.

Who’s the biggest customer in NZ ? The government. And they’re contracting !! Jeesh.

NZs Liz Truss is as thick as two short planks

Labour got thanked by voters for their covid response by voting them back into power without needing partners.The next 3 years were a disaster for NZ .No leadership poor economic management causing inflation and social pain .That is why they were voted out and will remain side lined until they can reform totally.

Off topic, Trevor.

National got voted in because people thought they couldn’t be any worse than Labour but that illusion has been demolished already. Given your earlier reply when you mix CGT & GST that explains why you can’t see their problems.

Half of that was the covid response. Trevor can you honestly say you are happy with this coalition behaving like a runaway train not stopping for anyone. Trevor do you agree with people losing their jobs,increasing smoking, the disability support sector cuts and now the foreign buyers tax etc.etc. For just a couple of dollars tax relief . Trevor do you think that all these jobs for the boys at the expense of ordinary workers in the public sector is acceptable paid thousands of dollars per week. Trevor do you think Shane Jones should be allowed carte blanche over our precious environmental resources, he’s now got the Kermadec’s in his sights. Trevor do you think Christopher Luxon a millionaire should have expected to be paid for living in his mortgage free home which he said was his entitlement. Trevor should Melissa Lee give interviews to the press even though she said they would be boring. Trevor should we keep the safer speed limits around our schools and unsafe roads or do you agree with Simeon Brown that money is better than lives. Trevor I haven’t even started on the ACT party, school lunches,guns,fair pay legislation through urgency from a young woman who has probably never done a days work in her life. Trevor if you agree with all this then sorry to say you are a sad wee man

It sure makes you wonder how it’s escaped Nicola Willis’ notice that businesses need customers. If there are no customers it won’t matter how brilliantly you run your business, it will fail.

Businesses need customers who are willing to buy things, Nicola. If you starve 90% of the population of money to spend, the other 10% cannot spend enough to keep your businesses going. I’d have thought it was obvious.

Many people have warned you of this and you still refuse to listen. That makes you appear incompetent and pig headed, not listening to good advice.

Forget your silly tax cut bribe for the whining right. No-one is fooled by it.

Furthermore, your obvious nepotism is looking more like a jack up every day. That will not work out well, paying ex-Nasty MPs large sums to find out what’s wrong with us. They caused half the problems you perceive.

Dead right, Joy

Unfortunately, Key, and that hypocritical dwarf English, may be slithering in the shadows, calling the shots. They had their chance and blew it. Time to sod off, anywhere.

Taxing the rich should only be the start. How about we also very publically investigate just exactly how the rich got that rich in the first place? Simply taxing the now criminally and grotesquely rich is two things. It’s like going up to the guy who’s just burgled your house and say “Ok. I see you’ve burgled my house because that’s all my stuff in your van so here’s the deal. Give me back some of my stuff, then you can go. I could even pay for gas to get you and my stuff back to your home if you like.” The second thing is that taxing criminal endeavours is also laundering that same money derived from those criminal activities.

I see the double dipping Dipton dribbler in the image above guffawing with the other freak-show escapees.

Farmers? That, right there, is a good example of the treachery that exists within your area of engagement.

Dirty cockies like english are rife and rampant within our primary industry sector, or farming if you prefer, and are equally so within politics and post-farm-gate commerce, i.e., their criminal exploitation of your wealth creation by using isolation and indebtedness to control you sell you out to one or more of the now foreign owned and equally criminal banks.

Of course, such observations comes with a price and that price is in the form of a question and the question will be ” But what the fuck can we do about it?”

Well, I can tell you what the fuck you can do about it. You strike. Are you now going to ask? “But how do we strike?” If that was your question then I can tell you the answer to that as well.

Come Monday morning you get up and go outside and feed the dogs then the hens and ducks. Then you get on your quad bike and have a bit of a spin around to make sure no one’s cast or lambing.

Then? You go back to bed. You can shear, wean, dock and cull as you need to but there’s one important, critical thing. NOTHING leaves the farm by way of produce. Not. One. Thing. And that applies to your neighbours farms also because what’s equally critical is that every other farmer must be in or you’re all fucked.

You might have notice your EU counterparts driving their fucking tractors here and there in protest. Some of you might have tried it here also. If so, what have you learned from that? That you’re an infuriating annoyance to others while achieving nothing? Was that it? You could drive your tractors defiantly to Mars and back and come back with a Martian Missus and Martian kids with pre adolescent antenna sticking up out of their little heads and still achieve nothing economically worthwhile. Mind you, you would get your picture in the paper, I suppose.The most powerful action any farmer can take is to do nothing in a well managed and unified manner.

When the phone starts ringing it’ll be wrightsons / PGG or RD or asb, westpac or that scum of scum, the bnz. Then there’s their all bought and paid for asssin, the ird, or Rural Bank or any one of the 14 multi-billionaires or one of the 3118 multi-millionairs each with a net tax wealth starting at $50 million each.

Farmers? Just stop it. Go back to bed and don’t forget to turn the banket off.

On a lighter note: If you don’t take back control then delouse the economy you provide for all of AO/NZ we will lose our country to foreign ownership and yes, I lied about there being a lighter note.

Will this save them money by dumping the proposed Kermadec ocean sanctuary for revenue exploitation?

”

Scrapping Kermadec Ocean Sanctuary A ‘Huge Blow’ For Marine Protection

Thursday, 28 March 2024, 1:03 pm

Press Release: World Wide Fund For Nature

The Government’s announcement that it will scrap plans for a vast marine sanctuary around the Kermadec Islands is ‘shameful’ and will make it impossible for Aotearoa New Zealand to meet its international commitments, says the World Wide Fund for Nature (WWF) New Zealand. ” https://www.scoop.co.nz/stories/PO2403/S00246/scrapping-kermadec-ocean-sanctuary-a-huge-blow-for-marine-protection.htm

“The Kermadecs are a critical hotspot for global biodiversity and home to rare birds, whales, dolphins, sea turtles, and fish species. We don’t just owe it to future generations of New Zealanders to protect this special place – we owe it to the rest of the world.

“Abandoning this proposal now is utterly shameful and shows a blatant disregard not only for our marine life, but for the New Zealanders who rely on a healthy ocean for their livelihoods.

Landlord Profits and capital Gains are far more important than pristine environments and rare bird species!

The Kermadecs are a strategic piece of seaway and real estate for Shane Jones’s ‘ ‘belt and road ‘ China project swap. Pacific naval base , fishing fleets, volcanic mining

They obviously think that profit is easier to say & sell than protect so it will only be when the oceans are dead that they will start trying to find someone to blame.

That was a dead duck anyways absolutly zero chance of it progressing especially once the Greens withdrew their support. Winstons mob have never been in favour given their ‘interest’ in the fishing industry.

But this government is a dictatorship government…more evidence…

https://www.stuff.co.nz/politics/350229993/did-culture-minister-overstep-te-papa-letter

RESURRECTION OF “THE GREAT SHAME”.

( to the cadence of a runaway train )

I had to win, win, win…

Give Winnie my media spots

The other wee cracker…

Regulations and nutty plots

Piranha lurk closer

Give Her spies and alien’s watch

PeeWee Herman potholes

And Witless to protect my crotch

Little Boy Whipping Top

Translate te reo for me please

A Penny for your thoughts

Let the cripples crawl on their knees

Oh coward that I am

Front, fat Jones to pillage instead

Call them Nazis e Pa

Shit in our water, we’re all dead

Throw out the peasants, Bish

Louise, sanction that filthy crowd !

Potato blight ’em, Hog

Sack them now they protest too loud.

Holding hands with McKee

Auto-gun porn dreams coming true

Take veils off the nuns, Mark

You mercenary muscle you.

Tenants you’ve had your day

Co govern with feudal landlords

Apartheid, Dr. Shane ?

Equal disease for all the hordes

Quell the bottom feeder

F#k FPA Lieutenant Brooke

Let them eat cigarettes

TPU Casey what a crook.

Hey, Watt is climate change

More cows, more coal and motorcars

Get NZ back on track..

Minister of Intell..my ARSE

Baffling them with bullshit

Baked cookers easy prey

Sold my soul for power

To the thrice headed CoC, HOORAY !

Good heavens what is that all about?

” Landlord Profits and capital Gains are far more important than pristine environments and rare bird species! ”

Sadly yes.

And under half of the voting public voted for it !

Soon there will be nothing left to protect.

Luxon on the campaign trail said ,we will cut consultants.

Since we have employed past has beens at $2500 to $4000 per day .What the fuck why did we not just use existing staff that have been sacked .We could have kept 50 for that money ,I mean how is some old cunt worth $4000 per day .

So another lie by Luxon.

Let’s not forget that whilst NZ police need donations and food parcels to live, National give tax cuts that every pundit say’s we cant afford , add to that Steven Joyce $4,000 a day, Bill English $2000 a day and Murray McCully $2000 a day but to name a few. When one sees just how destructive this government and it’s worst credentialled finance minister in history are, it is hardly surprising record numbers are leaving for Australia.

https://www.nzherald.co.nz/nz/why-new-zealand-police-are-moving-to-australia-in-their-own-words/DKZ35LAVVBEKFJLMDQZ6R5WMCU/

NZ has a spending problem, not a revenue problem.

yeah yeti we don’t spend enough and the reliance on charities for social services is positivly 3rd world

the way to spend more(the oversight is another question) is CGT, end of….

and before ANYONE goes off on one we have some of the lowest taxes in an allegedly developed 1st world country so quit with the bitching

The workers deserve a tax break. Labour didn’t do it.

At the same time they have made a number of things more expensive, but smoking not so much

“Tax reductions will be funded within the operating allowance through a mixture of savings, reprioritisation and additional revenue sources.

“Funding tax relief in this way means we won’t have to borrow extra to provide tax relief and we won’t be adding to inflationary pressures.” Nicola Willis

Can she be held to account on these lies? The media need to get a straight answer on this one. If borrowing does increase (which everyone including blind freddy foresees) will she resign?

No doubt she will later riggle out as they all do by saying it was borrowing for something else or deteriorating conditions etc etc.

Money for nothing, and our patronization is free.