Bernard Hickey is devastating in his appraisal of how under funded our social infrastructure is and how cheap mass immigration is to blame…

In my view, this is the culmination of 30 years of under-investment in health infrastructure to ensure Budget surpluses and low public debt, but with low income taxes and no wealth taxes. This coincied with a tipping point in the 30-50% pay gap between Australian and New Zealand health sector wages. Australia’s decision to announce on Anzac Day this year it would welcome any New Zealander as a first class citizen accelerated the exodus, along with significant upfront bonuses and relocation pay offers from Australia’s health system in the wake of covid.

All roads lead to the 30/30/30 fiscal rules. Both National and Labour-led Governments have tried to keep net debt and the size of Government spending well under 30% of GDP by running surpluses whenever possible for 30 years, but without a capital gains or wealth taxes. That was fine when the strategy was set in stone in 1989 when population growth was low with an ageing population. But politicians, planners and ultimately median voters realised in the last 20 years they could generate GDP growth, higher land price inflation for leveraged tax-free capital gains and get lower interest rates by engineering 1.5-2% population growth per year, but without enough infrastructure investment. It worked until it didn’t, which is now.

This accidentally-on-purpose ‘strategy’ of engineering low taxes with unfunded population growth happened because politicians and ultimately voters decided not to talk about or create population growth or infrastructure investment strategies. That was largely because it would become clear in the conversation that the 30/30/30 rule was unsustainable without higher user-pays charges and taxes on households, especially through wealth or capital gains taxes. That higher tax share of GDP for investment is needed to pay for higher levels of infrastructure spending that goes with this population growth, which was three times faster than officially forecast and still is.

Yet we just had another election, at least the fifth in 15 years, where the same accidentally-on-purpose strategy of unfunded population growth to keep taxes low on today’s home owners was adopted.

So how does this end? Tens of thousands of young renters are opting to leave the country and are being replaced by over 100,000 (net) new workers on temporary work visas. Taxpayers are now somewhat surprised and alarmed that the EDs are full when they need them, largely because politicians from both sides of Parliament assured them they could have it all: low taxes AND a fully publicly-funded hospital system.

Labour’s disintegration and reintegration of the DHBs into one national authority was the latest attempt to square an impossible circle by pretending more could be achieved by spending the same amount. Somehow, we are promised, less can be spent in the ‘back offices and we’ll get the same level of service at the front line.

The whistles of the escape valves in our political economy are;

-

- rising net migration rates of residents, including some of the 200,000 temporary workers awarded residency last year after the covid lockdowns;

- more desperate pleas from nurses, doctors and administrators for help, while administrators and politicians limit spending growth on hospitals, staff and drugs to ensure their Budgets return to supluses; and,

- the richest taxpayers will increasingly opt for private health insurance.¹

…the Labour Party are strapped into the exact same neoliberal economic straightjacket as National is and that is why nothing ever gets done in NZ because the self serving public service Professional Managerial Class Consultants ensure it never happens while the interests of the Landlords are now calling the shots.

Bernard Hickey calls it the ‘Dark Heart of NZ’s Political Economy‘, and it’s the Real Estate Pimps protecting their golden goose while Governments simply import fake growth from exploiting migrant workers but not taxing the rich to pay for the infrastructure…

The failure of yet another pre-fabricated house builder1 and a legal threat2 against our biggest council to force more greenfields development are two more signs, if we needed them, that our economy and society are now just a residential land market with bits tacked on.

These two latest events again demonstrate the massive skew in our tax settings in favour of housing land ownership has so changed the DNA of our political economy that nothing really changes without the removal of that skew. They also show the election debate we’re having has yet again failed to address the three elephants in our societal room:

-

- residential land will have to be taxed and business investment incentivised to change the land-seeking, inequality-widening and low-capital-investment biases now embedded throughout our economy, politics and society;

- our infrastructure financing and taxation systems are totally broken and inadequate at both central and governmental level, yet no politicians want to have honest conversations with each other or voters about how to fix it by increasing taxes and/or user-pays charges; and,

- the bipartisan and accidentally-on-purpose Government policy settings enabling and encouraging population growth of 1.5-2% per annum through migration of guest workers dominates our economic and societal outlook, and remains undebated and unacknowledged.

…none of this is being acknowledged or debated…

The dominant way that house builders, land owners, land bankers and households make outsized profits and capital gains in Aotearoa-NZ is to buy more land, preferably with a big mortgage, and wait. They don’t need to build a house efficiently, or any house at all. They don’t need to build a profitable business or invest in shares in someone else’s business. It’s always, always about the business of driving up land values and using mortgage debt to increase the leveraged returns, which aren’t available from other investments.

Home owners and land bankers just need that land zoned residential, and can then wait for the leverage, time and the failure of central and local Government to build the infrastructure to cope with regular 1.5-2% population growth to deliver the rents and untaxed capital gains to make the owner far richer than they ever be from saving wages or profits.

Working in a job or profession or investing in a business or managed fund is a mug’s game, compared to the leveraged, spectacular, government-guaranteed, ongoing and tax-free capital gains on residential land. The differences in incentives between investing equity in leveraged-up land and investing equity in unable to be leveraged stocks or business investments are so vast. In other countries, capital gains on land and other asset value increases are taxed, while savings in funds that invest in businesses receive tax incentives, either on the way into the fund or in the fund itself. Savings in our investment funds are taxed throughout.

This royally skewed set of incentives is why our housing market is worth NZ$1.6 trillion, which is four times our GDP (NZ$400 billion), 10 times the value of our listed companies (NZX total market value of $160 billion), eight times larger than our total managed funds sector ($200 billion including NZ Super Fund and ACC) and 16 times larger than our only-very-marginally-incentivised household pension funds (Kiwisaverat $100 billion). For comparison, Australia’s housing market is worth the same four times GDP, but is worth four times stocks, three times and funds under management. In the United States, its housing market is worth twice GDP, once the stock market, twice funds under management and 7.5 times its comparable ‘subsidised’ household pensions market, which is known as 401k in America, rather than KiwiSaver.

This dark heart of our political economy shows up regularly in all sorts of ways, in particular the focus of investors, developers, politicians and equity-rich home owners on greenfields development of clearly-titled and mortgageable plots of land. An actual occupied house on the land is a bonus, but not necessary to be exposed to these gains.

…I told you the Real Estate Pimps were buying this election!

Analysis: Property industry tops political donations

An RNZ analysis of political donations since 2021 shows people involved in the property industry are giving the most – and almost all of it is going to National, ACT and NZ First.

Since 2021, people aligned with the property industry have donated more than $2.5 million to political parties.

More than half of the cash from the property industry went to the National Party (53 percent), followed by ACT (32 percent) and New Zealand First (12 percent). Labour received 2 percent.

Real Estate Pimps have donated millions to National and in return National have lifted the Foreign Buyers Ban and will give landlords the right to kick tenants out with no notice.

National and ACT will also role back Tenants rights while reopening Landlord tax loop holes.

There is a class war on renters but we don’t have the political vocabulary to articulate it.

By opening NZ up to foreign speculators while reopening landlord tax loops holes, National and ACT are opening NZ up for sale to their overseas wealthy mates.

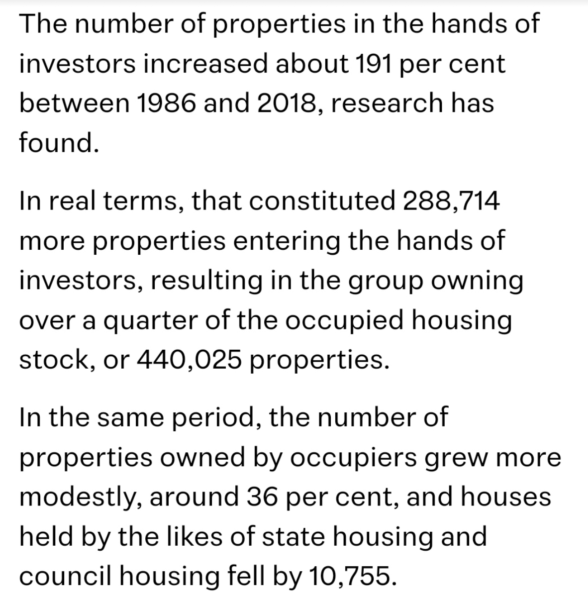

Let’s remind ourselves just how vested the Landlord class is..

…there is an unspoken promise between the neoliberal State and the untaxed capital gains private landlord class that the neoliberal State never builds enough State Houses to alleviate housing desperation so that the untaxed capital gains private landlord class can exploit that housing desperation ON TOP OF getting a $2Billion annual subsidy in the form of the Accommodation Allowance EVERY SINGLE YEAR!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Sure sounds like a recipe for some decent civil conflict… give it time…

If the gang members would stop fighting each other and.realise that they are not each others enemies and turn the attention to those who are. The gangs have alot of power they could put to good use.

This is how New Zealand has always been. Let’s not forget the first and second wave of migrants from Europe.

Bernard is a bit to soft in his conclusions. Don’t be fooled by spiking equity values. From a fundamental and macro perspective, GOAT blood, crimson red blood signs are flashing a ridiculously obvious problem in New Zealand.

The government can’t successfully centrally plan markets. They can only manipulate short-term prices.

As Martyn warned many times about the unliklihood of transformational change using New Zealands own stimulus packages to supplant the cost of living in geopolitical terms, a substitute simply does not “currently” exist.

Look at how much more expensive oil, food etc is when paying for USD-priced goods. Got any yuan?

Money systems run on belief.

Belief in entropy really began when everysingle Corporate hore known as the Government did needle tip eugenics on the population.

Why are you guys so cool with a handful of backroom dwellers deciding what money is and who can “create” it?

The reason for this behaviour is because there are never any consequences.

Needle tip eugenics? What?

I believe that we’ve lost reproductive fitness in the wild and have created carefully controlled environments where competition is eliminated. I just think that the infrastructure issues are a bit deeper than neoliberalism.

Yknow when we talk about exhausting the possibility space yknow kiwi build fail, shitty infrastructure, NZDF attrition rates or benefit rates, Oranga Tamsriki and so on and so on, its all a fail. So when I talk about needle tip ugenics in this context then anything logically contradictory that we haven’t thought of is going to be in that possibility space.

TOP wants land tax. TOP isn’t Lab/Grn/TPM. I voted TOP, I did my bit, the public wasn’t done with neoliberalism.

Agree- TOP had the solutions.

The problem is not Neo- Liberalism. The problem is the Greens and Labour. The Greens won’t work with anyone but Labour so will never get any policy enacted and Labour didn’t have the policy to fix the problem.

Given the value of land in NZ, the land tax is the most efficient method of discouraging speculation and encouraging productive investment. Forget the Greens wealth tax – its messy and will encourage tax avoidance and capital flight.

My hope is that Labour pulls its head out of the sand, looks in the mirror and then loads up the TOP website and plagiarises their policies.

TOP seems to have moved away from its founding principles. It seems to have abandoned the UBI/flat tax combo; and while urban land taxes are OK, I think its original advocacy of RFRR taxes was just as good. I liked their policy of insisting on a 100% deposit on rental property purchases, but I didn’t like their plan to reverse non deductibility of interest in respect of rental properties.

I gave them two ticks in 2017, give them my candidate vote only in 2020, and abandoned them altogether this year.

And your vote was wasted. If you are going to vote it is essential to choose a party that will get over 5 % or an electorate seal otherwise you might as well have voted for whoever gets the most votes.

You should not be influenced by the 5% threshold!!!

Not voting because of that is a self fulfilling prophecy.

The 5% threshold is not democratic and needs to change.

Wonder why this hasn’t been addressed (despite two independent reviews that call for change)???

Because those in power don’t want to be held account by extra competition for your vote. They have a vested interest in keeping the barriers to entry in place (just like the supermarket duopoly).

The current situation can be summarised as follows; National and Labour are the purple party- effectively the same party (compare polices not people). The Greens and ACT are also effectively the same – both sit of the fringe of the political spectrum. Neither ACT or the Greens are willing work with anyone but their side of the purple party. This is not how MMP is meant to work. ACT should work with Labour and the Greens should work with National. If they don’t the Purple party just takes advantage of them and nothing gets done – and that is a true wasted vote.

Bernard fails at the first fence because he’s not an economist. He prattles on endlessly about inequality, house prices, medical services etc. in doing so he ignores the key fact that underpins all this:

THE NZ ECONOMY IS WEAK.

We do not generate enough wealth to pay for the things we want. No matter how we slice and dice tax revenue, there’s not enough of it. OK you can increase taxes, but that will drive even more wealth out of the country, leaving us all the poorer.

So, we need to grow the economy. We need to ensure that the industries we do have operate near maximum efficiently and we need new investment for new industries to add to our economy.

But none of that will happen as long as we are an unattractive destination for fixed capital investment.

The economy is too weak but that is because housing has dominated the economy and investment returns.

100% Ada

Ratings agency are telling you guys that more than willing to issue loans out to you guys if.you keep three waters you just have to make adjustments to your mentalities yknow making money isn’t supposed to be the easy option. You have to be very imaginative and driven. New Zealand has to create factories and jobs to grow your way out of it. That takes hard work. Just got to make the appropriate adjustments to your mentalities.

It may also require import controls to protect fledgling industries.

Like open the up the economy to immigration and foreign buyers? Nough of the gist I think New Zealand has gone to far to the right which is why New Zealanders won’t understand how or why a Universal Basic Income will have to be issuesed.

So you make your money from property too Andrew?

“THE NZ ECONOMY IS WEAK.”

Yup. That’s right.

We’ve had 38 years of applied neoliberalism, did you expect anything other outcome?

Thirty eight years of applying neoliberal economic policy and the “THE NZ ECONOMY IS WEAK”

Thirty-Eight-years.

Say it slowly, Andrew, don’t just write it, understand it..

Being an economist is no guarantee that their ideas are correct. Bernard lives in the real world & observes real results from policy changes, none of the assume this rubbish that economists use.

Well said Andrew.

All of this train wreck has been the blindingly obvious future outcome (now arrived) from the inception of the neoliberal low taxation, low wage paradigm.

It’s of very little comfort that the realisation is finally finding some traction and an audible voice amongst academic economists.

As a right leaner I have no problem with having a capital or wealth tax so long as it is fairly applied. Because Labour governments are really just right lite, they see many of their own being caught in the net so at the risk of becoming unpopular they put it in the too hard basket. For the most part I completely agree with Andrew. We are a piddly little country with an economy about the size of Sydney. We need to maximise what we have to make up for where we are situated on the globe. Rising productivity are words not in the Lefts dictionary. We have under 3M people keeping over 5M people fed and clothed and half housed. We are jealous of the rich and we pay lip service to the poor. IMO As a complete population we don’t work hard enough and we do expect money to grow on trees.

Well right leaning types just got elected and proudly won’t tax capital gains at all, and have a constant boner over the property market. Maybe because they took the money from their mates with property. They are the ones not working hard enough.

Why lefties think right voters as a whole give a toss about the property market has me confused. Anybody would think all lefties live in tents. We all want a house doesn’t matter how we vote.

So why all the money be shovelled into the right by the property industry?

It’s about generating tax revenues from property speculation. That’s not a roof over your head argument is it. How many roofs do you need?

How is all the money shovelled into the right.

Are there no labour voters that are Landlords.

‘Neo-liberalism’ is one other vitally important thing to comprehend. It’s a mechanism for hiding the origins of our financial wealth which is in agriculture, not in the logical fallacy AKA real estate. An agriculture that’s been exploited for generations by unscrupulous scum bags who are now the wealthy elite because to survive they’ve had to capitalise i.e. liquidated the farmer subsidised social infrastructure we’re known for. The rich elite who are now well above recrimination simply by virtue of the strength of our money they think is theirs and their political connections both there and abroad have given them a false sense of security.

The only way for AO/NZ to reconnect with AO/NZ is for farmers to strike until the new rich start to squeak.

Real estate values are a simple bi product of institutionalised skullduggery and Bernard Hickey needs to go back to his drawing board look back further than 1984. Try from 1936 Bernard Hickey?

Why is the industry (farming) that National bends over backwards to support so unproductive then if the right are such great economic managers?

Politics in a class left sense over time is generally “one step up and two steps back…” until certain changes occur, like 1935, and 1984, and 1991. The change that will occur in 2026 is that those that try and live in overpriced mouldy dumps paying off someone else’s mortgage, and harassed by property managers will finally outnumber the selfish quotient of boomers (many boomers, particularly women, already now endure elder poverty).

The working class abandoned in the 80s, sacked and never retrained, and generations of the created underclass can be enlisted too to finally purge Rogernomics and Ruthanasia. There is a lot of power in new gens and legacy oppressed if organised and direct action undertaken. We need a class left leadership of the central labour organisation and a unity between class left activists and Māori activists and Greens to build a new political movement (not party) that pushes Baldrick and his mates to the brink.

Martyn has described well what happened, the point is to do something about it!

“Tens of thousands of young renters are opting to leave the country and are being replaced by over 100,000 (net) new workers on temporary work visas.”

Well, that’s the whole point isn’t it? Get rid of anyone who might actually demand the pre-1990s standard of living — or even just a standard of living that doesn’t continuously collapse (QLD. and W.A. will take them all). And then replace everybody with people accustomed to being paid 50¢ per hour, with no employee benefits and no trade unions allowed.

Hopefully those people have never heard of social security or universal healthcare either, so that once the controlled demolition of welfare is complete, everybody can be forced into buying overpriced insurance policies from Wall Street instead.

The local oligarchs are just jealous they don’t have a southern border where millions of people-trafficked slave labourers could be delivered to them for free by the drug cartels.

There is a minimum wage in New Zealand so to say 50 cents an hour is silly.