OCR on hold- Adrian Orr delivers verdict, faces media

The Reserve Bank has left the official cash rate on hold at 5.5 per cent.

The Bank has today delivered a full Monetary Policy Statement including fresh forecasts for the economy.

The RBNZ said the OCR would need to remain restrictive for the foreseeable future.

New forecasts in the Monetary Policy Statement indicated a small chance of one further rate hike in the fourth quarter.

The new forecasts also see New Zealand’s economy to enter recession in the third quarter.

All eyes will be on the Government opening the books next month before the election to gain insight into how bad the Chinese slowdown actually is.

Since the terrible way the Chinese Government simply opened the entire country to Covid, the level of death and damage that caused has been hidden from view.

The property market which has been teetering on black hole level implosions plus the down turn in oil use plus the inability for the middle classes to pick up the slack plus the decision top hide youth unemployment plus the enormous damage climate change has caused recently have all combined to generate a Chinese recession.

Our books will be the kiwi in the minefield in terms of understanding what is going on in China and when the extent of our exposure is clear, the tiny crumbs from Labour’s plate in terms of just removing GST from fruit and vegetables will look like mana from heaven as the economy tanks hard.

We are already starting to see this in the collapse of Dairy prices.

Once the books are open, it could take on a life of its own with the stock market taking hits alongside KiwiSaver depletions alongside the interest rates spiking.

We have a lot more geopolitical shockwaves coming.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

It’s a just a little bit of utu on the West from China with love.

They’ve just re-organised their domestic economy at Western investors and traders expense.

I’ve said many times that exporters shouldn’t get comfortable with reliance on China as a market. Because China isn’t just going into a ‘bit of a recession’ – China is a busted flush in the broadest sense. Consider:

>Their property market is in a deeper hole than anyone in the West can imagine. Millions of people having paid mortgages for years only to find their dream apartment was never built and the company they’ve been paying is now bankrupt.

> The secondary banking sector is also in a massive hole with bank runs and customers locked out of their own accounts by the government to prevent total collapse of the banks. People have seen their life savings evaporate and aren’t even allowed to complain about it for fear of losing their social credit status. Form a queue at an ATM to try and get cash out and men in white overalls with sticks arrive in a bus to beat them.

> China is on the cusp of major demographic decline with their population expected to halve in the next couple of decades, all thanks to their ill-considered ‘One Child’ policy and the rise of the middle-class Tiger Mom who only wants one child (and an SUV). So Chinese consumer demand is only ever going to decline until at least 2050.

I wonder if this is the reason the NZ government is now busy cozying up to western military powers. Because we desperately need alternative markets for our produce?

Buckle up! We’re heading into turbulence.

Do you mean population growth is going to decline by half? Because if their population is going to halve, well… thats a LOT of people.

China’s population will lose over 700 million people in the next 20 years? That’s sounds exaggerated

They have a declining birth rate even with the no one child policy in force now and a ever increasing elderly population. If those figures quoted are right for the elderly population? that would work out 35+/-m per yr over 20yrs.

Then throw in Xi’s possible war with Taiwan and some of those possible Chinese casualty figures being bounced around aren’t actually flash, would also cause problems for the CCP in more ways than one.

China is like the Titanic about to that bloody Iceberg & it’s not going to be pretty for anyone.

Nu Xiland’s bizzare infatuation with China is like some sick, abusive love affair.

No matter how much punishment is inflicted during the course of the relationship, it keeps crawling back on it’s hands and knees, just begging for more, hoping it will get better one day.

China’s miracle economy is grinding to a halt, and the consequences are already affecting the rest of the world

https://www.abc.net.au/news/2023-08-22/china-economy-sputtering-debt-property-japan-australia/102756814

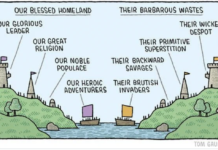

It is notable that the partisan supporters of the rising Chinese and Russian imperialists are the most warlike and belligerent, even threatening to use nuclear weapons to achieve their imperialist war aims.

‘Have Not’ imperialists’ economies depend on expansion and economic penetration into territories already occupied/controlled/influenced by the established legacy imperialists. Facing economic collapse and internal revolt at home. the ruling cliques of ‘the have not’ imperialists feel they have the most to gain and nothing to lose from war.

This does not let the legacy imperialists off the hook, in any imperialist clash for redivision of the world, the legacy imperialists are just as blood thirsty in defending their interests, as the rising powers are in challenging them. Where ever their hegemony is challenged, where ever this challenge comes from, be it from rival imperialists, or national independence movements, the legacy imperialists have always responded with massive unrestrained violence.

The best hope for New Zealanders to avoid being drawn in the coming bloodbath for a new imperialist carve up of the world, is to declare our nation’s neutrality and have it ratified at the UN.

New Zealand can only gain international recognition of our neutrality by closing Waihopai, leaving 5-Eyes, and canceling all other military and spy pacts with any foreign power.

Comments are closed.