Saudi Arabia slashes oil production and threatens to do ‘whatever is necessary’ to boost prices

Saudi Arabia will reduce how much oil it sends to the global economy, taking a unilateral step to prop up the sagging price of crude after two previous cuts to supply by major producing countries in the Opec+ alliance failed to push prices higher.

The Saudi cut of 1 million barrels per day, to start in July, comes as the other Opec+ producers agreed in a meeting in Vienna to extend earlier production cuts through next year.

The problem with Orr’s capitulation to the market with his puny 25 point rise and his refusal to allow monetarism to allow the Government to shirk their fiscal responsibilities any longer by claiming inflation has peaked is that it’s a big gamble.

The big reason inflation dropped in the last quarter was because of softening petrol prices driven by Biden tapping the strategic reserves plus the true cost of China rapidly reopening after Covid has seen sluggish economic sentiment and a looming debt implosion.

OPEC responded to that with a series of cuts they have now extended which will coincide with the 25cent subsidy coming off next month.

On top of that we have an unprecedented 100 000 migrants arriving plus the damage to our horticultural sector that will send food prices into the stratosphere.

Orr’s bluff to make the Government tax more or spend less by claiming inflation has peaked when it is about to explode again will not win Orr any friends.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

The 25c plus GST hike in fuel, mid cost of living crisis, was going to hurt big time. Now all the worse!

I’m the great game of brinksmenship and poker who exactly is playing there cards at random?

Hehehe! Figure it out??

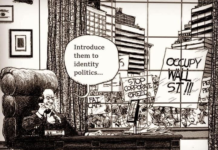

When inflation in the West starts to abate, the Saudis, Russia, OPEC cut oil production! Hehehe!

Forever inflation for the west whilst you wage wars on them!

China, India and other consumers buy crude from Russia at a discount as arranged by America and their buddies.

Who would have thought the Saudi’s would ever cotton on?

All this in an attempt to give the conservatives in NZ an edge come October. He, he….

Martyn – Not looking good for many people, including Labour.

As long as the hydro lakes are full. I am OK.

Nice

The inflation megatrend is far from over. The notion that Orr has finished with increasing interest rates is delusional nonsense (and further pumped by the garbage MSM who either have their heads in the sand or are deliberately falsifying the reality). Orr should resign since he has, imo in bad faith, told NZers that this last hike was it. It isn’t, because he has a mandated obligation to curb inflation. He has to hike (which I think will be 8-10+% before this is over).

So thousands more poeople will be made umemployed, homeless or plunged into severe hardship because rich pricks like you want a cheap latte.

I would have interest rates permanently at 3% I think we should have inflation, as it keeps wages high and ensures funding for social services.

If inflation is kept low, no one has any money.

What you are asking for is Zimbabwean grade hyperinflation leading to a total collapse in the ability of the people to purchase anything. You want to see the peasants queuing up with sacks of money to purchase a loaf of bread.

I would rather have that than cutting one single dollar from the health budget or imposing a wage freeze, lilke what ACT wants to do

Orr can cut interest rates and the inflation rate will still go north and the economy south.

Sad!

And yet still nobody (except Steve Keen) is talking about an orderly write-off of the unpayable debt — which would allow you to finally normalise rates, without a huge crash or endless years of inflation.

capitalism HUZZAH

Pfft what cost of living/fuel crisis. Roads, shops, pubs and cafes busy as usual, this long weekend.

I just don’t understand why making Saudi princes’ New Zealand mortgages more expensive hasn’t brought down inflation.

Shocked I tell ya.

The country could fight inflation by buying cheap Russian oil from India or cheap commie crude from Venezuela.

That might work if we had an oil refinery, except that our US friends would organise a coup if we tried.

Orr is a supporter of Labour. He purposely went soft and defended the government last rate increase due to a politics not economics.

Now he has been pushed into a corner for about the 5th time. Repeat poor performer like a lot of our top public servants doesn’t have the ability to do the job.

Having interest rates kept low ensured that people could afford their mortgages, have and keep jobs and earn high wages.

Unfortunately, Rich pricks like you resented that. People like you think wages should be low and people should pay more than 70% of their income on housing because people should suffer and pay penance

If interest rates had been kept at 3% then I would have bought 50 rentals. There you go.

Of course KH but that’s beyond the understanding of people like millsy.

No. Orr kept them artificially low at the behest of Grunter and the Reserve Bank dual mandate, in order to cover up the disastrous effects of Labour’s COVID management.

Instead of 2% mortgages and 3.5% unemployment we could have had 4% mortgages, 3% inflation and 5% unemployment and avoided a house price blowout. Now we have 8% mortgages, 8% inflation and houses are still expensive. Unemployment is a lagging indicator and could be in our future.

Worst case scenario and the low-mid income earners are the biggest victims.

You do realise by taking the easy option Orr has prolonged inflation and over time meant increased costs for households. You do realise this is the reason we have stubborn inflation that is not going anywhere right?

Right?

With China, India and the Saudis being resellers of Russian oil.

Watch for a bump in sugar prices.

That’s when they’ll be adding sugar to fuel that’s resold to the EU, NATO, Ukraine, Australia, UK, and the US …. Hehehe!