The ramifications of Orr surrendering inflation to the market are still being digested, but it is a clear signal from the Reserve Bank Governor that NZ Free Market Monetarism alone will not and can not get the Government out of the neoliberal straightjacket both National and Labour have collectively agreed to to strap themselves into.

Orr will now refuse to burn the economy to save the economy.

Despite the enormous inflationary pressures about to rip through NZ in the wake of Orr’s capitulation, Orr is telling Government they can’t rely on him screwing the scrum any longer and they have to either borrow more for the infrastructure or raise taxes on the rich to pay for it.

Inflation softened in our last quarter because of softening oil prices caused by Biden tapping the US strategic oil reserves. OPEC responded with cuts which take effect next month on top of the 25cent fuel subsidy relief coming off meaning the deflationary item that caused cooling inflation (softening oil prices) won’t be available next quarter.

This on top of the unprecedented 100 000 new migrant workers, on top of 12.4% food inflation on top of the full impact on our horticultural industry from the storms and there is a very good chance food inflation will push past 20% before the election.

Orr risks all that to spell out it is the Government’s responsibility for all of this and they are going to either have to grow wages to compete or reign in the corporations whose price gouging is generating most of the inflation in the first place!

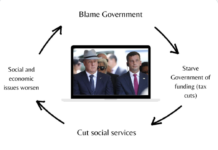

As Professor Wayne Hope pointed out earlier this week on The Daily Blog…

Behind this policy correspondence lies the fundamental truth of New Zealand party politics. Labour and National are both die-hard monetarists, the Reserve Bank Act is their unspoken article of faith. On this doctrine, advanced in the late 1970s, excessive public expenditure and real wage growth will increase aggregate demand and inflation levels. If central banks can adjust the money supply to increase commercial/investment bank interest rates, demand will contract, and inflation will be manageable. Unemployment rise is a necessary if unfortunate side effect.

Research from William Phillips, Paul Samuelson, Milton Friedman and others seemed to indicate a trade-off between inflation and unemployment. Fiscally responsible governments would target the former through monetary policy. Well-meaning spend-up governments would over-inflate and damage the economy. In New Zealand, Labour’s 1989 Reserve Bank Act effectively ended the debate. Both major parties concurred with the legislation. The 2021 RBNZ Act modernised operations and tweaked the legal wording but didn’t change the basic doctrine.

Aside from older macro-economic arguments, the doctrine is wrong. Inflation today does not have monetary causes and monetarist solutions cannot work. Edward Miller, economic researcher for FIRST UNION, cites a US Federal Reserve study which debunks the Phillips Curve. Organised labour’s declining bargaining power weakens the relation between unemployment and inflation. Wage-push inflation growth is just not there, so why contract the economy? In New Zealand, between 1991 and 2023, union density declined from over 50 to 20% of the workforce. Clearly, today’s stunted, uneven wage growth is not going to trigger an inflationary surge.

…exactly, this isn’t a wage generated inflation, it’s naked price gouging in a weak regulatory environment!

As Emeritus economics professor Tim Hazeldine noted:

It’s COVID inflation that was driven by a supply push from the pricing side of the market. The initial transportation logjams caused by lockdowns gave shippers—especially container shippers—the excuse to drastically hike their prices. In the confusion, many other sellers of many other products discovered that they suddenly had, as one analyst put it, ‘real pricing power’. And boy did they use it!

…this Price gouging inflation is backed up by International research…

For US economists Isabella Weber and Evan Wasner, evidence acknowledged by US and European central bankers indicates that “price setting by firms with market power drive inflation”. Giant corporations have the product portfolios, dominant market positions and revenue management systems to maintain margins and customers. With global reach, they are less dependent on any single national market and can shape prices. By contrast, small businesses cannot easily raise prices as costs go up and interest rate repayments increase. Creditworthiness and access to loans will therefore diminish.

…which is exactly what we are seeing in NZ…

Sound familiar? As Tim Hazledine would attest, supermarkets, power companies and banks are pricemakers who drive up inflation while the rest of us struggle. Most obviously, the four largest Australian banks in New Zealand collectively made over NZ$6 billion in 2022. They exploit, ruthlessly, the margins between the interest rates of wholesale money for them and the mortgage rates for captive homeowners.

…into this debate Orr has clearly drawn a line under how far the Reserve Bank Governor now sees the limits of NZ Free Market Monetarism.

I’m no longer looking for Socialism from Labour, just basic regulated capitalism and even the Independent Reserve Bank Governor seems to be communicating that to Treasury.

The message is clear.

Borrow more, push up wages, regulate the market and tax the rich!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

So what will Prime Minister Chippy do?

The large number of bad debts will either need to be cleared through mass defaults, be written off via some kind of debt reorganization, or be inflated away.

They appear to have opted for an inflationary policy. If they return to rate cuts and Q.E., it will effectively be a bailout for the large corporate debtors, at the expense of workers’ wages.

It would be a repeat of the massive upward wealth transfer of the previous decade.

The great government debt debate is pure political theatre and distracts from the real problem of productivity. AI (chat gpt) is going to destroy the economy. You think 60 billion in corona wage supports are massive. Just you wait.

What a load of baloney. The economy is made up of people and those people need goods and services to live. How will AI pay people to to live? No UBI will ever allow humans to live without worked for income. So AI is to do is supplement to the manner in which people earn a living, AI can never replace the people.

Worth a read;

https://www.forbes.com/sites/cognitiveworld/2020/06/04/is-ai-overhyped/?sh=17a161b763ee

“On top of this, the continual bold promises made by some AI companies often remain undelivered. Where are our autonomous vehicles? Where is the superintelligence that’s supposedly around the corner? Why are the voice assistants still so dumb? While narrow applications of AI are moving ahead with gusto, these more significant challenges for intelligence still stand in the way. Rather than seeing rapid proliferation of autonomous systems, the most widely implemented solutions are those of the augmented intelligence nature in which the human remains in the loop. They might not be as interesting as the science-fiction style implementations grabbing headlines and creating hype in AI projects.”

In engineering we have developed CNC software programs and machines to make incredible copies of stuff we need but it has hit a peak in cost versus reward.

Sure we have multi (up to 27 in the latest) axis machines that cost many many millions and can make parts at an astonishing rate. But those parts need to be purchased by the people and the market is limited to peoples needs and spending power.

AI is another tool that is limited by what information is in the public domain. Keep your information off line and no amount of AI will ever learn its secret for distribution to others.

Then we have the problem of IP rights. Think AI will get access to, and distribute the technology that Tesla have developed for self drive cars?

Dream on, Lusk will have you in court before you can turn the key on that self drive car using stolen Tesla technology.

Massive unemployment due technology has been predicted for decades yet there is the lowest unemployment numbers in decades.

Jacinda won a great victory winning an MMP majority but she built bad and now can not continue.

Government controlled AI will always be more powerful than any AI controlled Civilian devices. It whispers in our ears allowing us to align with either heaven or hell. Maybe you want to live a Christian life. Maybe you want to be a billionaire AI will be the devil’s and angles on our shoulder teaching humanity the Biden secrets of the universe and that’s available pretty much right now.

Sausage roll, anyone?

I prefer BBQ sausages, fries onion, Wattie sauce and bread and butter. Not that cheap margarine trash.

Ribeye.

The government keeps borrowing and spending to stroke this crisis.

So what can Orr do when every effort he makes is actively thwarted by the people he works for?

Won’t someone please think of the rich?

Tax the rich!

It’s the only way…

Well Labour certainly is, because the inflation killing the poor will eventually lead to massive rises in capital assets.

Watch for house prices to sky rocket once interest rates drop and the economy stabilizes.

Labour do not have the balls to Tax the Rish as they are also being fed by them and their donors.ie Nashie from Hawkes Bay.

Nahh – once bitten twice shy.

House prices will now need to fall quite a bit before people will over-commit themselves in torrents.

When Bazooka Robo and Eeey Orr in 2020 first talked about the first load, the $100b Bazooka. Orr also said that there is enough in the tank for another load if it’s needed.

Guess what they should do… Just for fun!

Orr’s mentor and advisor.

US Fed Chair J Powell.

“The buck stops and starts with the 16th Chair of the Federal Reserve Bank. His is the responsibility for the health of the Americans – and consequently the global economy. Yet, like a brain surgeon with a butter knife and a hammer, Powell’s got the bluntest of instruments to deal with the most complex of problems.”

He has all the power, none of the control.

We could be world leading.

Zimbabwe under Mugabe does not count.

Mass migration housing Ponzi for the win… I wonder how that works out long term? *crickets chirping*

It ends up with people who own multiple houses getting rich and all else suffering.

The stoking of inflation caused by the absurd response to the pLandemic is what caused house prices to rise (AFAIK) faster than in NZ history.

Slow clap Liebour.

…and then? What do your elf eyes see?

It’s just ridiculous to wank on about over regulation. Labour hardly do anything and National are going all Trump like with their bs messaging.

It seems to be forgotten Orr is also responsible to keep employment high .Cutting spending to curb inflation will coat jobs .It is a hardbalancing act.

Why did people buy houses over inflated, why could they not wait and why could they not live within their means, too many keep up with jones whanau in our country and now they are all moaning like babies.

So given that these giant corporations have always been greedy for increased profits why are they only using their pricing power now to increase prices? Why were they not doing that in the last forty years? Why are they not always doing it, and if they are, why was inflation so low for so long?

Globalisation meant manufacturing shifted. Competition model changed.

De-globalisation has another name but the effect would be the opposite. But we know that if stuff spilled from a container that it is difficult to put it back in the container.

Therefore, Humpy Dumpty will never be the same again.

Globalisation hit hard here starting in 1984, and grew even further with China since 2000. But in all that time, right up to 2022/2023 inflation was still floating around 1-2%.

So what else changed in the last couple of years?

Context is important.

I was responding to a question by “acies” and not commenting on inflation.

They were always doing it. Real prices still fell (productivity increases), but nominal prices rose (due to deliberate devaluation of the currency).

Okay. So productivity fell off a cliff in the last two years and the currency devalued more than it had?

I don’t see any numbers on either of those. In fact our dollar is worth more against the US and Britain than it was in ’99/’00 – and we also didn’t get inflation then.

So as I keep asking, what other factors changed in the last two years? So far I’ve got:

1. Corporate Greed?

2. Monopoly power to massively and rapidly increase prices?

3. Productivity drop

4. Devaluation?

But I don’t see any dramatic changes in any of those factors in the last two years. The first two have been around for a long time – No. 2 especially in NZ. We’ve been hopeless on No. 3 for decades and we’ve had devaluation before (esp. the big crashes in 99/00) that did not result in this level of inflation.

the duopoly and various NZ cartels have been overcharging since the countries inception this is nothing new except in magnitude…but kiwis put up with it historically under the line ‘imported’ so screw us as much as you like..maybe that might change now acies

If that what you say is true then the market is over regulated.

Surely venture capitalists will be willing to take on the duopoly if there was easy money to be made.

… this is nothing new except in magnitude…

Okay. But how is this magnitude of over-charging possible in the last two years compared to the previous 40 or so?

And as far as overcharging is concerned, I have a distinct childhood memory of my Dad showing me a hammer bought in Australia in the mid-1970’s for perhaps $A 3.00, that cost about $NZ 7-8 here when $NZ 1.00 was worth about $A1.20 – all thanks to some little person who had a state protected monopoly (factory, import license, whatever).

So you can get screwed that way too. Perhaps having no private sector is the answer?

If you bought your A$3.00 hammer in 1970 with a £1 sovereign coin from the Perth Mint, you would have received 11s. 12d. in change (i.e. the price is 8s. 2d., or £0.4078).

Bunnings is now selling the hammer for A$4.95. If I paid with a brand new £1 sovereign coin (still 0.234 Oz. of gold), I now receive 19s. 10d. in change — the price of the hammer has plummeted to 0s. 1¾d. (or £0.007, down 98.3%!).

We can see that prices are not “high” at all (the recent rises are barely a blip in real terms). The value of the paper currency has simply collapsed even faster — i.e. a devaluation, via Q.E. and negative real rates.

Where does all the worry come from? Because the number of large houses being built, the number of SUV’s being purchased, holidays taken, etc, does not illustrate an economy in recession or one even nearing a recession.

A primary area of concern, in my view, is jobs for unskilled workers and indeed entry level employment positions for those who do have some qualifications but whom are often overlooked when it comes to employment because of external factors.

There is plenty of work at the bottom level but NZ workers do not want to do them . 180000 on unemployment benefit and a fishing company needs to bring in 100 workers from Vietnam and 80 from Samoa .Last year this company lost millions because of lack of workers . There is a fundemental problem and I do not know how it is fixed but until we do many people will carry on just get by instead of growing.

This will not be the last rate hike. Unless Orr knows something we don’t (which might be true?) Powell in the US will continue to raise raise as mandated by the Federal Reserve Act of 1913. Assuming that happens, which it will given inflation will persist for another year at a minimum, the lower NZD vs USD will force a rise since inflation here will spiral out of control given all the shit we import (especially oil and now petrol since Jacinda shut down our only oil refinery), i.e. all that made in China rubbish at The Warehouse and Bunnings that we build and furnish our house with. Orr is a joke. Don’t believe anything that fraud says. Rates will go higher. Much higher. 8-10% by the end of next year.

But no one, surely, can argue that the RBNZ has control over its own self.

When there are nine multi-billionaires also four foreign owned banksters stealing $180.00 a second from us in net profits annually we must realise that we have literally zero control of our own economy.

Orr will be doing what he’s told. What we have the right and dire need to know is who the fuck is it?

My guess is it’s in whom ever’s best interests it is to weaken AO/NZ to a point of acquiescing to foreign corporate demands to cede AO/NZ to them as an insurance against a melting planet.

In that regard, we really matter. Take a look! There’s literally nowhere else to go. Space I suppose but that looks a bit shit. The moon looks dreary as fuck and Mars too. It might be pink but it’s no party planet is it.

So yep. [Here’s] what we got and if we’re not careful one of the neoliberal sell out’s slipped in by roger the ACT and Jimbo The Natzo will fuck it up for us.

” this isn’t a wage generated inflation, it’s naked price gouging in a weak regulatory environment! ”

Yes summed up here by No Right Turn.

LINO Lectures on five minute showers.

” EECA’s campaign is all about saving $500 from your power bill. Another way of doing this of course would be to reduce the bills at source, by lowering power prices. And this is absolutely possible: according to its most recent annual report, Meridian Energy made $664 million last year from 365,000 customers – an average of over $1800 per customer. That’s simply obscene. And there seems to be plenty of space there to lower power bills, while still making more than enough money to fund future investment. So rather than lecturing us about how we should all be having cold showers so Tiwai doesn’t have to shut down a pot-line, and being miserable to save money, maybe the government could actually govern, regulate this industry’s obscene profits down to something reasonable, so we don’t have to pay so much in the first place?

http://norightturn.blogspot.com/2023/05/labour-lectures-rather-than-acts.html

Mind, i don’t think they want people to save money, they want people to save electricity as shortages and cuts are already advertised, cause we can either heat or drive electric vehicles….but so as long as its only the poor and soon to be poor to be inconvenienced with short showers, lower temps, and such its all good.

Invest in Candles comrades……hard days are a coming.

It’s going to get worse as the proportion on renewables rises inside the grid. Because they’re not reliable they need backup and that backup is typically fossil-fuel-powered.

So we basically have two generating systems running in parallel, hence the increased cost. I see our outgoing Transpower wallah reckons prices will double, but looking at Europe I’d say they could be four or five times what they are today.

Oh, and judging from the warnings coming from power engineers in the US, the grid there is getting pushed closer to instability all the time due to renewables. We’re not immune to that here so not only will we be paying more for power we’ll be getting more blackouts with it.

yawn – silly tokens are just a proxy for energy – everyone should just give up now and start building their own ploughs and engaging in animal husbandry.

where is the energy coming from to keep this ponzi going? you’re all just fooling yourselves. the only future is a managed decline or an abrupt stop. choose wisely. the steady state economy is coming whether you like it or not.

Choosing a Greek tragedy is no choice at all. Some say apes are now entering the stone Age. It’s going to be interesting whating thier development. I’m often consumed by how intelligent humans have to become in order for apes to break one of the filters into type one, two or three types of civilization.

Comments are closed.