Despite the Government’s Budget being called “boring”, a leading economist fears it could see the inflationary challenge hitting Kiwis harder for longer.

Budget 2023 was released last week against a backdrop of the cost of living crisis – inflation is at 6.7 percent and a high official cash rate (OCR).

The OCR has risen from 0.25 percent in August 2021 to the current rate of 5.25 percent as it tries to bring spiralling inflation – sitting at 6.7 percent – under control.

Many thought April’s hike could’ve been the last, but ASB economists are now picking a rise of 50 basis points to the official cash rate this week, and possibly a further 25bp hike in July – peaking at about 6 percent.

The bank was previously picking a 5.5 percent peak in 2023.

The narrative forming now is that because of the Government’s slightly larger spending (that is well within the neoliberal economic straightjacket), Orr will lift the OCR another 50 points.

Yes and no.

Yes, extra Government spending is fuelling some of the pressure but that ignores the reality that Orr was always going to lift the OCR by another 50 points!

Food inflation is at 12.4%!

The petrol tax subsidy is about to come off next month.

The full impact of the storm damage to our horticultural heartland is yet to realised.

100000 extra people will flood the economy with inflationary pressures.

Orr was always going to raise by 50points, believing this is all on Government spending simply ignore just how much trouble the NZ economy is actually in and how hard the shockwave will be.

UPDATE: BOOM – Orr chickens out and waves white flag to market and proclaims OCR Peak and inflation war is over with a puny 25 points in what must be day of political cowardice for a Reserve Bank caught between what the economics demand and political consideration to the Government of the day!

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Martyn – Damn it! You are right again….

Orr was going to raise the cash rate by 0.75% but will now only raise it by 0.25% because of the great budget restraint shown by the government.

If the C.P.I. is at 6.6% at the end of Q4 (Infometrics forecast), and they pause the rate hikes at 6.0%, the R.B.N.Z. would still have negative real rates.

To get back to (somewhat) normalised real rates, the C.P.I. would have to fall by over 2.5%, if the R.B.N.Z. kept rates steady.

But how long can all the insolvent zombie companies handle normalised rates, before there are mass defaults on debts, forcing the central banks to cut rates?

Many businesses are self harming in an effort to survive. It is human nature. Who likes to fail? Stupidity or resilience?

Interesting that the cash-rate hike was voted on. 5 for 2 against.

I hope the keep reporting the split in votes.

The narrative of no more rises actually comes from Robertson who thinks Orr won’t need to raise them after his budget.

So let’s see if Robertson is right or if his budget is inflationary and rates go up.

His budget by every measure is inflationary thus rises in the official cash rate.

Robertson definitely knew that.

So the government is going to raise more tax revenue with there awesome economic stimulus packages?

Correct.

That is how inflation works.

I do think Labour and National members are more atuned to criticism. Not so much ACT or gweens. Unless we start nationalizing stuff neoliberal stimulus packages will always be underwhelming well soon be talking about trillion dollar stimulus packages. But to get ahead of that huge number we have to start spending hundreds of billions now not less.

It’s like do we want trains and electric cars or wait till all the oil been drilled out. Y’know spend the money now or wait till we have to build technology that is on par with Star trek with a bunch of post nuclear war sticks and stones.

Resource scarcity seems such a fundamental constraint.

It is hard to understand a world when there is no resource scarcity when our economic theory is based on resource scarcity.

Until we realise that we do not need to ski down snowy mountains, fly to exotic places….. we choose to do these things.

The markets failed to signal scarcity long ago when the ice polls started melting. Infact market indicators have always been rigged. Where have you been since 2008?

Indeed.

The “ice polls” melted well before money was invented.

In the South Island.

“…the reality that Orr was always going to lift the OCR by another 50 points!”

In which version of ‘reality’ is that?

Can I borrow your crystal ball Martyn?

So the left attack Luxon for being mean for taking about taking away $5 prescription charges, all while people mortgages are going up $100s per week because of govt mismanagement.

Ok Robbo

Orr should go 75, even 100 imo

Why should he bother?

He only causes more pain for those who bought houses at the wrong time.

Pain and Labour Government are synonymous,take the last 5 plus years.

Apart from the wealthy who is better off?

We have a cost of living crisis not denied by the Labour Government.

A house is an investment and along with it the risk. Those of us that new that an investment in an overinflated market was never a positive risk to take. Orr isn’t responsible for poor investment.

Don’t disagree Charles.

Labour policy causing the pain.

Bob the first causing blockages in flow of truthful information.

It depends on what J Powell from the US Fed says.

“I have a soft spot for the man behind everyone’s problems, US Fed Chair J Powell.

The buck, literally, stops and starts with the 16th Chair of the Federal Reserve Bank. His is the responsibility for the health of the Americans – and consequently the global economy. Yet, like a brain surgeon with a butter knife and a hammer, Powell’s got the bluntest of instruments to deal with the most complex of problems.

He has all the power, none of the control.”

The latest budget sealed it for Orr,he has no option but raise the rate.

Again Labour Government instrumental in putting more financial pressure on those that can least afford it.

I confess to being confused .Inflation is high and Orr says interest rates need to go up to try and curb demand .by taking money away from home owners but to do this the banks need to put their rates up which means they make more profit . This profit then goes to shareholders and those with deposits so they have more to spend . The banks face criticism for making more profit but if they do not increase mortgages it would not do what the government wants . It seems this government has got us in a mess and thinks are getting worse as they flounder around.

Trevor, “in a mess floundering around.”

Never a truer word.

You are right in your element there, Bob.

Nothing is free!

We have to pay for our excesses.

Who pays is the real question. But more importantly, who is it that makes those who pay, pay for the excesses.

Yep, you sound confused. The profit from Australian owned banks goes to mainly Australian Shareholders, and maybe some NZ Kiwisaver funds. People with positive money in the bank and without a mortgage are mainly pensioners, who wont feel rich when their 6 month fixed deposit comes in at $220 return rather than $150, particularly when they next need to buy a block of cheese. No-one feels better off.

As Mortgage rates go up, everyone with a mortgage (who bought in the last 20 years at least) has more expense and stops any discretionary spend, which then affects cafes, pubs, restaurants, movies, car dealers, holday destinations etc.

You are accurate that the cause is the government and they are making it worse as they flounder around!

The Banks and the Supermarkets are having a Field Day and screwing the average New Zealander blind IMHO ?

Oh, how we have short memories. Just a few years back governments were cautioned about ‘printing money’ hand over fist, arguably to save the economy in the fallout from CoV19 lockdowns. I’m pretty sure that most economists, govt advisors and politicians alike, of all shades, knew what was coming. Disrupted supply chains and subsequent price taking.

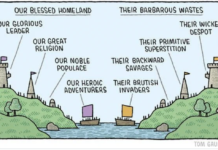

Wayne Hope (TDB) and Tim Hazledine are on to it, to quote, in the aftermath of CoV19 price selling by firms with real market power drive inflation. Hazledine would argue that the supermarket duopoly, the handful of privatized power companies and the big 5 off-shore-controlled banks are the price makers who drive up inflation while the rest of us struggle.

The RBNZ? The government? Dont hold your breath. It’s just an endless game of trying to deal to the (un)intended consequences.

Several variations exist of “Destroy the village/town in order to save it”–the provenance of that statement by an unnamed US Major, as reported by war correspondent Peter Arnett at the Battle of Bến Tre, 31 Jan 1968, has long been argued over online.

Regardless, when TDB Editor Martyn uses the phrase in conjunction with unelected Reserve Bank head honcho Adrian Orr it is quite clear what he means. This ponce is happy to inflict pain and suffering on ordinary New Zealanders, and to increase unemployment. So what is he really up to, given that much inflation is plain corporate price gouging because they can get away with it.

What Mr Orr is trying to save is nothing less than finance capital’s profits (yes the Aussie Banks) and the entrenched NZ neo liberal state.

There was a second tier, no nasty case manager, COVID benefit for middle class people. Will there perhaps be a similar “hero of the nation” benefit for those made jobless in the interests of fighting inflation?

There really needs to be a new NZCTU leadership, people that will battle for the working class everyday in the media and at workplaces. Monetarism will roll on until there is fightback.

In this post, Martyn doubles down on his economic illiteracy.

The only thing worth saying here is: “has the government’s budget increased or decreased inflationary pressures?”

It’s obviously increased it so everything else is irrelevant.

Btw the government could have spent slightly less in this budget than anticipated tipping things towards a 25 bps.

Heck there are even budgets that could lead to a 0 bps hike here.

To suggest that regardless of what the budget is, it’s always going to be 50 bps is, I’m sorry, but Martyn, that is just really really really dumb.

We are literally talking about spending pressures in the context of an entity who’s spending accounts for 30% of total spending in the economy announcing it’s spending intentions.

as NZ inflation is actually ‘greedflation’ from excessive prices interest rates won’t effect anything except putting the screws to kiwis

greedflation. nice

It’s the supply of currency, not monopoly pricing.

Great news.

Stuff reports: Chippie says his government will look at tax cuts for workers in the future.

Do not despair. Help is coming your way …….

Or is this irresponsible? What will Orr make of this when he looks at the cash-rate. Panic?….. Chuckle?

This is why I was against so many new bonds being issued. I understand completely that it was to avoid a recession but then the Reserve Bank kept spouting the possibility of actually creating a recession for a short period of time this year directly before a general election, and now the Reserve Bank continues to raise the official cash rate which adds to our inflationary pressures.

One of the problems rests with voters. We’re to ‘blame’ for the unholy festival of financial debauchery involving foreign owned banks and the eye watering greed of now nine multi-billionaires, one of whom is graeme hart, National’s largest donor.

But it doesn’t matter if it’s Labour, National or the silly little MMP deflection parties shambling about in the shadows at the dance with a pimple on their face and no one to love. MMP was a national party thing, right. Jim bolger did it.

The other problem is that our primary industry is agriculture. And I see we’re down a few head of sheep per head of human population. Now, while that might sound like a wacky-giggle now pass the Lattes dahlings to far too many it’s also a harbinger of deep shittedness for us all.

Agriculture is a very, very, very complex wee beastie. Just try and turn a farm off to go for hol’s in Spain for six months and see what I mean.

Farms are like nuclear reactors, in reality. You can start one but you can’t stop one. Once you let the rams out you have a year long commitment to a fluffy animal that’s more valuable to almost everyone in more ways than can be imagined except the sheep farmer, of course. They get exploited then castrated by debt then they have their precious product stolen off them by banks ratcheting up interest rates while their dancing partners, the mercantile firms, increase costs of maintenance and supply.

Our AO/NZ’s at a critical tipping point in its very existence and we’re all hanging on for grim death and we’re too stupid to know it. And do you know what happens to delicious and beautiful things who don’t have a clue that they are? They get eaten alive.

Farmers? You really need to get your shit together for all our sake’s. You have to win over your city bound service industries then together you must strike the fuck out of it. You also need King Charles to swing by with a royal commission of inquiry to sieve out the rats from the woodpile. Yeah, I know. I have bumped my head more than a few times, perhaps that’s it.

I agree but the problem here is not the individual billionaires themselves, but it is the trust entities which they are using to avoid paying a reasonable amount of taxation on their profits. Not on their income. Not on the interest of their personal savings. But on the profits made by the private companies that they control, which rightfully should be paying tax to Central government

All deficit spending by the government adds to inflation, since all new debt will be spent into the economy using money that didn’t exist prior to the issuing of said debt. It’s why a balanced budget (or better yet a budget surplus) right now by heavily cutting spending is what must be done. Of course Labour, who created this inflationary environment, are doubling down. Rates will go to 8%-10% before this is over. NZ voted for this – and evidently want more punishment. You reap what you sow.

I agree. You real what you sow. If you take on debt in order to spend, you have inflation and interest accruing on the debt. A balanced budget is what is needed.

Chippie and his government good at looking very poor at doing.

Bob good at sounding smart, very poor at intelligent input.

Considering the current Govt has increased taxes to the tine if 48 billion more more than the last plus has increased the countries debt nearly 3 fold and is still short of coin, I’d suggest the comment ‘govt slightly higher spending’ is a total crock of shit.

Well Peter Barry, I wonder where the country would have been without a pandemic and latterly some pretty horrific weather events. What would you and your ilk done.

US Fed Chairman J Powell doesn’t want to get Volknered like P. Volkner did in the late 1980s and 1990s when interest rates hit 25%! Eeey Orr, Bazooka Robo & Powell made a blood pact in 2021/2022(?) at Jacksons’ Hole. Theyre just focusing on the CPI & inflation only and the markets can look after themselves.

Orr basically fired the gun for the housing market to go off to the races again. He almost creamed himself talking about the high immigration numbers. Robbo gave this elitist an extension. Sack them both.

Here’s what went down:

Orr was called in by Bollbertson. “if you fuck up my budget, the shit will hit the fan! I will make sure you get sacked.” And that’s what happened. Orr, being the LAbour Stooge that he is, made sure not to fuck up Labour’s most uninspiring budget.

May be Orr’s bet is that he can get away with a small rise because after the election he gets a chunk of govt spending reduction from ACT Austerity or a private spending reduction from TMP Wealth Taxes.

Its, MMT for dumbies.

By inflation, by increasing prices, increases revenue(s) for the Goverment and the Crowns coffers stupid.

Comments are closed.