Hey NZ.

How you doin?

Rough week eh.

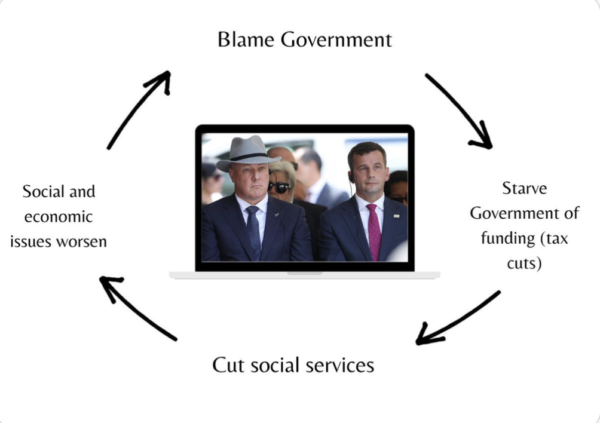

IRD Research shows the rich have been fucking us and because woke identity politics is all the rage now, the Left no longer have the political vocabulary to articulate the class warfare that is being waged upon us.

To get fucked over WHILE lacking the political vocabulary to articulate that because blah blah blah heteronormative-white-cis-male-patriarchy only ensures more identity division and not class solidarity.

NZ Capitalism is a rigged so the rich effectively pay 9% tax while the rest of us pay 20%.

Watching the remarkable push back from the lobbyists the rich have put out to talk down any tax justice against them has reminded us class is the fundamental fault line in NZ and identity politics are simply a distraction.

Look beyond the rich and their rigged capitalism, look at the Landlord debate right now!

Landlords have been given a captured desperate rental market to exploit because the State won’t build more state houses plus a direct state subsidy for rents and they want more???

Landlords want to evict you because the constant churn of desperate renters push up their rents!

We can’t tax their capital gains & we must give them the legal right to be arseholes?

There’s a class war in NZ but we don’t have the vocabulary to articulate it!

The deal between the State and private landlords is the State won’t build enough State houses if the Landlords step in a provide that rental service while getting huge subsidies via the accommodation allowance!

Meanwhile StateTenants have state houses build on flood plains!

Fuck this!

These rich pricks have designed the system for themselves, ‘you can’t tax unrealised capital gains’ the Right scream, like bullshit we can’t!

If it means the mega rich have to sell a mansion or two to pay the tax bill, so fucking be it!

There are 14 Billionaires in NZ + 3118 ultra-high net worth individuals, let’s start with them, then move onto the Banks, then the Property Speculators, the Climate Change polluters and big industry.

You should be angry, NZ Capitalism is a rigged trick for the rich and powerful. The real demarcation line of power in a western democracy is the 1% + their 9% enablers vs the 90% rest of us!

Unfortunately woke middle class identity politics is too busy cancelling people for misusing pronouns to offer a challenge up to neoliberal hegemony.

Put aside their alienating bullshit and a united front of citizens demanding the mega rich pay their fair share to the very society that built them their wealth is not socialism, it’s basic regulated capitalism!

There’s no point making workers pay more to rebuild our resilience, tax the rich!

-Sugar Tax

-Inheritance Tax

-Wealth Tax

-Financial Transactions Tax

-New top tax rate on people earning over $300 000 per year.

-Capital Gains Tax

-Windfall profit taxes

-First $10 000 tax free

The Reserve Bank Governor is clearly telling us to raise taxes to pay for the rebuild, if Chippy’s Bread and Butter politics is to mean anything, he has to tax the rich to pay for the rebuild.

What’s the point of Bread and Butter politics of no one can afford to buy Bread or Butter?

Capitalism is rigged, Democracy is supposed to have the moral authority to challenge that.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

To be honest – and reluctantly fair to the wealthy – they sensibly chose to invest in things we don’t tax – like land and houses. Its easy to invent a group to hate.

The rest of us voters chose what we tax – and we chose not to tax land and houses. We choose to tax wages and consumption – through the GST.

We choose to not tax inheritances because we think that’s not income.

It is a pretty neat income for those who inherit.

Transfer of wealth should be taxed in the hands of the recipient.

Our tax authorities do not have to bring in new processes to achieve this.

Those who receive are obliged to declare it.

If they do not they fall foul of the law.

Capital gain is not the same as wealth transfer. A few more rules around transfer of wealth when one partner cheats on the other and they split up. Or do we play moral police and just punish them through an additional tax.

Well said Ada.

Get a room Bob.

true enough ada the loopholes are the govts responsability but how much lobbying went into creating/preserving them? were they really the peoples CHOICE?

My only problem with what you say Ada is ‘we chose what we tax’. If only that were true – in a democracy the collective ‘we’ should mean we, the voters, decide, but in reality it is the wealthiest lobbiests and self interested corporates that determine such things. We only have to listen to the wealthy squealing about the IRD report and making out they are being made to look like criminals – all the report does is state figures, with no inference of illegality – quite the opposite. It identifies that certain income is not taxed – the question now is ‘is that fair and if not what can/should be done about it?

Where are the public protest marches and mass telephoning/emailing MPs to call for an inheritance tax or a wealth tax???

It’s silence from the great bulk of voters. So the lobbyists get to sway politicians, and the option never gets put to voters.

Excellent point Ada. Ever since Rogernomics ‘we’ have lost our ability to object, for a number of reasons. Martyn is right, we have become too distracted by woke arguments. Point taken.

Well said Peter.

After 100 years of following the UK, around 35 years ago we chose not to tax inheritances/death duties & other clipping the ticket envy taxes such as stamp duty because they were part of the quid pro quo mandate for the original introduction of GST.

And…they don’t work in the long run unless you lockup the wealthy so they can’t leave: https://www.theguardian.com/world/2023/apr/10/super-rich-abandoning-norway-at-record-rate-as-wealth-tax-rises-slightly#:~:text=A%20record%20number%20of%20super,by%20the%20newspaper%20Dagens%20Naeringsliv.

Envy tax? More like pay for public services tax. No coincidence that that our health system was run down after we chopped the inheritance tax. People like you who hated public services so much that you were happy to have them run down for tax cuts.

Outrage again.

NZ abolished estate taxes in 1993.

Voters rewarded the government with two more terms.

Since then labour failed to change this during 14 years in government and National 9 years.

Personal tax was cut once during the last 23 years and that tax cut was a tax switch.

Yep, capitalists put socialists to shame with their unity in pursuit of greed. You cannot over tax one segment of the world when capitalists own the entire world (or near to it). They just create a system from where they can move whatever they want to wherever they want, nice and easy.

Again, we can do something about this but we need awareness, then engagement, on the same global level that they enjoy!

I thought this was obvious, but clearly, what appears as rigged to some, also appears to be fair to others. This kinda sums up the world today – unfortunately. The tax system, like the economic system, the banking system, like the political system, is not designed by – we – as in we, the people, it is designed by them, those with the money to push through whatever changes they see fit, in whatever system and whatever part of the world, they deem necessary. As many have pointed out, there is no fairness in a world where money rules.

Nonetheless, there are things we can do about this,as relatively recent history of the 1940’s to 1970’s shows, a time period that ushered in the greatest amount of wealth for the greatest amount of people, the world had ever seen. It just takes public awareness and public engagement. No wonder there’s a battle over information, huh!

While you are technically correct you neglect to mention that the wealthy pay accountants, lawyers & politicians to make sure the rules suit them and the workers do not get much say in tax policy.

I’ve always thought there are two ways a tax system gets for a government.

1. Taking more from a small pie which usually makes it smaller.

2. Taking more from a large pie but not too much to stop its growth.

This is how I’ve always seen the difference in Labour and National over the years.

However, over the recent years I feel Labour and National have become the same. Labour started taking from the small pie but have become resistant to the changes of CGT and others while still taking. National have stayed reasonably true to their lines but under new leadership have signally more to be done socially like Labour. But as they are not in Govt is this their real stance?

As for ACT I feel you get what you deserve but state assets are sold off to fill the gaps? Very heavily corporation which as we know are all profit driven. If NZ can’t separate a duopoly of a supermarket chain which is already set up as four – five identities then how on earth could they lean on Electricity companies for example when they are already 51% NZ govt owned who seem powerless or deliberately behind the scenes don’t give a.

The Greens just don’t understand the compounding nature of this so let’s leave them out as their pie is in the sky.

Just how I’ve seen it throughout and lately.

Since the government sold 49% the dividends on their investment are higher than what it was when they owned 100%.

(Not counting the tax paid on dividends on the shares owned by private and institutional shareholders.)

Maybe they were too conservative?

The super rich have always excelled under Labour, while at the same time Labour put regulation hobbles on productive enterprises, property owners (landlords and farmers) while throwing welfare crumbs to the rest of the community. Where we are today.

The Nats on the other hand have contained the super rich, freed up productive enterprise. While changing nothing that might improve the lot for the rest of the community.

Thats it. Full stop

No vision of a better NZ from either outfit!

Sigh…The IRD compared high wealth families income that included unrealised capital gains versus ordinary wealth kiwis that excluded unrealised capital gains.

We all know that this is a politically self serving comparison of apples and oranges designed to throw the envy tax dead rat on the table to distract voters from co governance/government.

The Sapere report was conclusive on one thing, the rich pay a higher percentage of income tax on their taxable income that anyone else does.

Bingo

And what about our schools and hospitals? Why do you hate them?

seriously no. I am not a ‘debt’ slave, and so are many others. There are debt slaves, i agree. Those that bought huge idiotic GJ Garderner mansions for a million even though they can’t actually afford too, those that got into huge idiotic student loans for degrees in social engineering and gender woo woo and politically correct art that can only be hired by MacDo, those that put boats/holidays and other shite on their ‘equity’, those that bought houses in the middle of nowhere in the last three years cause they like too hoon down a river on a boat, et etc etc, these people chances are are debt slaves.

Ditto for the people that are on a benefit and can only get pay day loans from the biggest pay day loan shark in the country – Winz aka Government, for emergency and medical health care.

Everyone else who was prudent, saves, lives within their means – even when that is hard and unglamorous – chances are are not debt slaves.

And all of that to some large extend was caused by the rich people in government – and that includes Helen Clark, John Key, Jacinda Ardern, and now Chippie.

And fwiw, Helen Clark, John Key, Jacinda Ardern and chippie all fall in the bracket of ‘rich people’ and if I were to advocate the eating of rich people, these were the first ones to come of mind, the guys that fucked this country over for the last 23 years.

Martyn – Land Tax – except for Farms, and Forestry – or, at least reduced…would hit the land bankers in the pockets.

Dear NZ – how does it feel knowing that you’re rich because you earn over $70000/year? Or own a home?

Well said Free Peach.

If your arguments fail to convince, just repeat them and shout louder. Is that not what you are warning the woke about?

We needed an investigation and a report to tell us this?

All one needs to do is to have a look at the tax code. That would have been a better instruction to IRD. At least they may then understand our tax code and how it affects society.

The bottom 30% effectively pay negative tax because of transfers (welfare etc) so the tax system is in fact highly progressive.

Spoken like an Act party representative.

But largely correct.

Both true AND a compliment!

Thanks!

You must be lonely at night Andrew and no, No Comment, far from correct.

Yes, you and “Andrew” are correct we are a caring community. Willingly paying progressive taxes.

On the other hand it may well be that government just forces us to be nice to those on low wages to cover for their inability to create a more prosperous country.

Let’s tax more and so that we can create more value for NZers. That strategy has worked so well over the 23 years.

Tell me Johan you sound like someone from old Soth Africa.

Those on lower wages ARE responsible for a prosperous country.

What corporates are at ground level doing the hard yards?

What hasn’t worked is the top 1% wealthy paying just over 6 % in tax. But head in the sand thinking that those on low wages don’t contribute to a prosperous country just shows how far from reality your hard right wing ACT thinking is.

“Tax the Rich” should be a clarion cry. At the moment whoever adopts it is going to get a shitload of votes.

It fails the fairness test.

While “fairness” is our dominating shared value instead of “care” we will not make progress to a society where need is the focus of our shared effort.

I.e

Does someone with above average income need super?

Turns lots of voters off hence no movement by Labour before the election.

After the election?

No movement from National, as useless as tits on a bull.

That’s silly.

Hmm, if you wanted to turbocharge the National, Act election campaign this would be one way to do it.

Because The Daily Blog is no longer a fringe blog in the way the Socialist Unity Party was in pre internet days, the ideas set out in the blog will be used as a representation of a Labour, Green, Te Parti government’s agenda, at least in part.

The agenda set out out here would be the most radical in any OECD country. No OECD country has a combination of Financial Transactions Tax and Wealth Tax. Even Wealth Taxes have essentially been abandoned.

If you want run a campaign that would end up driving a significant numbers of New Zealanders to Australia, this would certainly be a way to do it. I can personally think of at least half a dozen reasonably successful people who would do that. Enough of their assets are sufficiently portable that they could do this. Unlike Americans, New Zealanders will actually vote with their feet.

A bit simplistic, like comparing apples with oranges

Money earned through capital investments typically carry significantly can’t risk. So that is factored into the expected value calculation when doing financial analysis. If the potential reward is reduced it would simply discourage investment. If you don’t have investment the economy stalls. For every business or investor that succeeds a bigger number fail and are burned. That’s why I personally prefer a steady job at a higher tax rate, than more risk in going out and doing business at a lower tax rate. The risk of not getting paid for the former is far less than the latter.

If one was to do an expected value calculation of future earnings, taxation rates included, the average wage slaveay we’ll be wealthier than the average investor or business owner

So how will our hospitals and school be funded, Mapp? You lot have ripped the guts out of public services for the past 30 years. Dozens of hospitals have been closed because you wanted to cut taxes. If you are anti tax, you are anti humanity. Plain and simple.

Let’s take the last 23 of that – 2000 – 2008 Helen Clark, 2008 – 2016 John Key, 2016 – ongoing Jacinda Ardern/Chippy. So essentially you lot is a bipartisan mix of fuckery courtesy of Labour and National alike.

well said, RB!

The damage was done in the Key years sausage. Ada was a big fan of the ponytail puller.

Agree +110%, both as bad as each other.

Well said Millsy

New Zealand is a bolthole for the rich. If they want long term security and luxury amenities moving forward then they’re going to have to pay.

Yes the Panama papers proved that Sam.

Just stay on the Whailoil blog then, see ya.

A third of New Zealand’s population are precarious renters, a third of homeowners own multiple properties and a third of these multiple homeowners are rabid speculators owning more than 5 houses. The human right of shelter doesn’t mean much at these rarified heights, it’s just a way to make money, and what a great run they have had ay? The government has known about this for decades, known about supply and demand, known about housing new migrants, known about the price of a shitty do-up in South Auckland being amongst the highest in the world. It might be time to start treating the property fanatics who have infested the country like the indigenous people, take away the lot and give them next to nothing in return.

When shacks in Otara are $600k plus we really do have a housing problem IMHO.

It does not matter how much tax this government takes in if it is wasted on pie in the sky ideas that only benefit the consultants that help draw up the plans and the government workers engaged to run it and then ultimately decide it was not a good idea and plan its abandonment . eg the cycle bridge .

Yes Trevor the list of failures by this incompetent Labour Government continues to grow.

Care to explain Bob?

That’s just a National talking point Trevor. The reality is cut out the waste ( as we should) and it won’t come close to being enough to fix all that needs fixing.

Things like CGT should be about taxing forms of income beyond salaries and wages to ease the burden on people working their arses off. Sure look at a wealth tax of financial transaction tax but taxes on capital should not be just about the Uber wealthy.

Very well said Wheel.

As a card carrying National voter you may be surprised that I can sympathize with those calling for a CGT as it seems unfair that one form of income is taxed while another is not. My proviso would be an allowance needs to be made for the eliminate of risk. Not all businesses are successful and so the tax system needs to except losses as a claim against future profits .

I understand what you are saying Trevor, problem is that offsetting losses on income becomes easy to rort. The U.S. is a really good example of this.

once again the right conflate things….we’re not talking yer average home owning kiwi but the hyper rich who live off you

The hyper rich don’t live off me, it’s the complete opposite. It’s the poor that my taxes go to, they are the ones paying effectively no or less than no tax.

Im Ok with that, generally, but what Im not ok with is the massive Government waste that could be paying nurse, teachers etc more and building new hospitals.

The Govt purchaseing people are fucking useless, lazy and plainly stupid.

So what do you say of the 9 years of National Peter, where effectively there were no increases for nurses and teachers and no investment in infrastructure?

Very curious?

Remove, end council rates and central government funds the essential services necessary.

Councilor/local boards remain in place and role reduced to administrative levels.

There’s a saving of a couple of billion across the motu and an enforced brain drain to Australia for some.

Neglect of local assets has been endemic for decades and the cost to upgrade them to a standard has become too expensive and beyond doable.

Central government has to fund it all.

That’s actually worthy of consideration.

Bring on Capital Gains tax. The more Willis screams the better we know it will benefit the bottom 95% of kiwis.

https://www.nzherald.co.nz/nz/nationals-nicola-willis-claims-labour-cooking-up-a-secret-capital-gains-tax-plan-from-labour/ZEEZ7ZIDXJG3RDDMNFQZFXKWFQ/

Not sure how she managed to get such a big story in the NZ Herald seeing how Labour have a bought and paid for media.

And Nicola, this won’t get back the thousands and thousands of votes you leaked to ACT.

Yes Bert a CGT is well overdue. It’s actually just about common sense and given the tax report confirms what we all knew, it’s interesting that people label those on a benefit as bludgers.

Yes Bert who would have thought Nicola could get a story in the media. Fortunately Bob the first is able to list any failures of the current government because he spends every waking minute churning out OIA requests and doing hours of research. I mean it’s not like he reads any printed or televised media. That would tell him nothing.

Well said Wheel, accurate as always.

Bottom 95%? Care to explain?

Bert old chap you are being silly again.

Capital gains tax will apply to your hundreds of thousands you have in equities.

Bob I appreciate my level of intellect is above your pay scale. Clearly outlined by your lack of understanding a CGT.

Stick to what you know, crayon drawings and your Dulwich school upbringing. Eeewww.

You can’t break a rigged system by wishing, or pressuring them into throwing a few more crumbs (please tax themselves a bit more) our way. We already have this – neoliberalism – anyway.

NZ capitalism is just capitalism, but we are a junior party within it. The people we choose to run their system, the political class, simply follow the dictates of the senior parties of capitalism…have you noticed how the world, certainly the Western world, do and say the same things!

We are not going to break this system with tax, that is laughable. We need to pressure their representatives, the political class, so that they fear us more than they covet them. Non-compliance (to their global-level, rich-friendly polices), civil disobedience, strikes are a few tools we have in our arsenal.

But before we can do this we have got to understand what the problem (or potential solution) is – the rigged political system.

“Inheritance Tax”

So if one prefers to work hard and save money for ones children, instead of spending it on oneself during ones lifetime, that should be punished? Does not seem to make sense.

You are right Mark in truth it should be called an envy tax

So you think that our schools, hospitals, state houses, and other public services be left to fall apart, because you don’t want to be ‘envied’?

Me either.

Bob young lad you are being silly again, back to your crayons

Most make their wealth through asset inflation and rentier privilege: You have a spare 5 bed house you rent out for $600 a week money from position and ownership not work.

No that makes no sense. People buy lotto tickets in the hope of a big win but those that were successful wanting to support their children are smacked. There should be no such thing as an inheritance tax.

No Charles, the deceased don’t pay the tax – because they are dead.

Their children pay the income tax on their inheritance – which they didn’t contribute to or pay any tax on the efforts that went into building it up.

So the children would still get the great bulk of it, just like a wage or salary earner does out of the weekly pay packet.

Fortunately for many people’s children, the rapacious retirement village, health care, reverse mortgages & “you’re worth it/yolo” industries will remove any risk of receiving any inheritance that could be taxed.

The children haven’t worked for that money, nor taken business risks, nor been taxed on those salaries or any profits.

For those who inherit, that is pure gain.

We already have an inheritance tax. It only applies to those on WINZ and ACC, or if your parent has been in a rest home.

Good to see that you acknowledge the wealth transfer. I would never have thought that you would think that a wealth transfer should be encouraged.

Wealth transfer to people at the bottom is a bit different to those at the top.

If someone on a disability benefit sells their house to move into other more suitable living arrangements, or comes into an inheritance, then I dont think that they should be penalised by WINZ.

As another example. I was made redundant from my last job in 2021. I got a hefty holiday pay payout, however WINZ expected me to burn through it before my benefit could start, even though I was going to use it to buy another car and put the rest away as a little nest egg.

Ada you are the voice of reason.Thank you.

You are shitting me. More likely Bob the first is a voice of reason and he’s an absolute moron!

You are right Mark in truth it should be called an envy tax .I am not sure if it still applies in the UK but it destroyed many esblished businesses in my area when I was there .

How are we supposed to pay for our health system then? Or we could just go American.

A good first step would be to define what “rich” is. After all, are we not all “rich” compared to someone in the slums of Mumbai. So “rich” relative to who? Where does “rich” and “poor” start/finish in New Zealand?

Have a house? An income over $70k/annum? Why in Aotearoa, you’re practically a millionaire!

You know you’re rich in New Zealand when you can afford dental care. Or fresh fruit & vegetables. Or cheese. If you can afford all these luxuries, you must be raking in the big bucks!