The woke are remarkably quiet on the Tax report for two important reasons.

1 – Since the death of Bruce Jesson, the majority of the NZ Left wing intelligentsia (with the bold exceptions of Professor Jane Kelsey, Dr Wayne Hope and Professor Susan St John) have capitulated to free market capitalism and Left wing activism has in turn become identity focused rather than class focused and as such simply don’t have the intellectual muscle required to challenge neoliberal economic hegemony.

The woke are great at organising a ‘free-the-nipple’ rally for militant vegan queer ally mommy bloggers, not so good at taxing then rich.

2 – The second reason the woke be so quiet is because of course they are all middle class and have one foot on the property ladder and want all the privileges that come with owning land. It’s similar to their militant defence of migrants, the woke have transferable global skill sets so any restriction on migrants is a restriction on their interests as well.

The woke are great at the low hanging fruit of identity politics because the solution is always exclusion of those who don’t accept identity politics dogma, but they are very quiet when it comes to class warfare in the form of a rigged capitalism because they themselves want to benefit from that rigged capitalism.

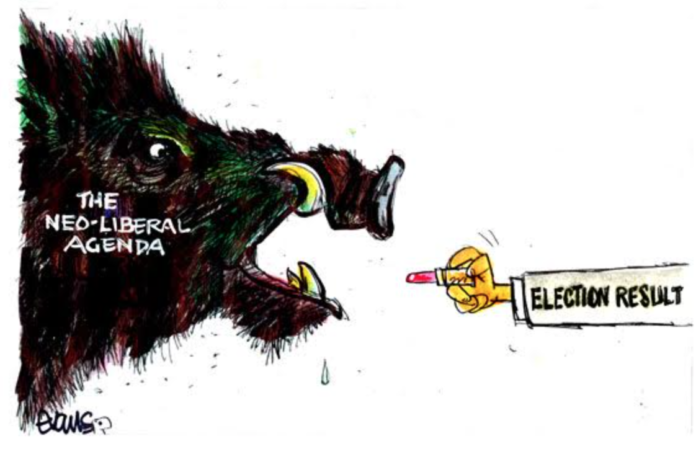

Watching the remarkable push back from the lobbyists the rich have put out to talk down any tax justice against them has reminded us class is the fundamental fault line in NZ and identity politics are simply a distraction!

There’s a class war in NZ but we don’t have the political vocabulary to articulate it because identity politics and not class is the only lens the middle class activists want to view society through!

Identity Politics simply cements into place a caste system of intersectionism alongside a terminal tribal affiliation to your skin colour, gender or identity.

There needs to be far more common ground and shared values.

The minefield of social justice and its never ending pure temple deplatforming of everything that triggers it will only drive people further from the Left in an intense economic downturn because you can’t eat virtue signalling aesthetics.

If you think the worst inflation in 30 years is bad now, wait until the impact of the Ukrainian war and broken supply chains in China hit.

We need a new taxation and regulation model to stop the neoliberal rot. We need to remove the yoke of taxation from the 90% and reset it to the 10% richest.

In 2010, the 388 richest individuals owned more wealth than half of the entire human population on Earth

By 2015, this number was reduced to only 62 individuals

In 2018, it was 42

In 2019, it was down to only 26 individuals who own more wealth than 3.8 billion people.

And in 2021, 20 people owned more than 50% of the entire planet.

The Big Tech Tzars have manipulated our collective fear, ego, anger and insecurities through social media in a way that has led to the largest psychological civil war ever launched against one another.

Meanwhile, the planet burns and every aspect of our existence is monetarised for big data to sell us more stuff we can’t afford. We are alienated and anesthetized by a consumer culture that keeps us neurotic and disconnected. Our work, our existence, every move we make are all built to suck money to a minority class that sits above us while under neoliberalism, globalization, financialization, and automation, our existence as individuals has only become more disposable.

This isn’t progress.

Unfortunately the Left are culturally too busy micro aggression policing everyone under the rules of the new woke dogma while the Right are silently harvesting that alienation for more neoliberal exploitation.

A Left Yin and Right Yang of petty spite and broad malice locked in a death spiral on a melting planet.

We either attack the economic settings of this madness now and fight to retain our egalitarianism or we are doomed to live in the shadow of its greed.

We need to be kinder to individuals and crueller to corporations.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

The dirty secret of taxing wealth in NZ is that the great bulk of the wealth is in ordinary homes now worth 10x annual incomes.

So if a government wanted to tax wealth it would either have to tax the ordinary homeowner’s capital gains after sale or have some arbitrary cut off point that is open to manipulation, either by the next Finance Minister or the wealthies’ accountants.

I think the argument that everything is just too hard is a cop out. The family home was exempt under the last proposal and if you only own one home it’s pretty easy. There will always be odd ball examples to any legislation. It doesn’t mean you don’t try. You don’t ditch speed limits because you don’t catch every one going over it.

In any case CGT should be about taxing forms of income, shares included to remove some of the burden on salaries and wages. I don’t think it should be about targeting the Uber rich.

Death seems a pretty well defined cut off date.

Indeed!

That is one of the excellent reasons that a tax on inheritances (as income like wages) would be much more administratively simpler than a capital gains tax, especially taxes on unrealized gains – i.e. before the assets are actually sold.

When the deceased estate is settled by the executor, that process is a very clear accounting of the wealth that is being transferred to other people.

See. Capital gains tax.

Problem solved.

When wealth is transferred tax it in the hands of the recipient.

Sorry next generation. But you are asking for it.

Wont affect inter-generational wealth owned by families. One person dies does not mean the family wealth is up for taxation. Just the part owned by the deceased. You can bet that wont be much as the family wealth will be legally ring-fenced.

What is missing from the taxation report is how to deal with IWI owned wealth. Are we going to witness an increase in the already limited tax IWI pay?

IWI and Maori authorities (like family owned businesses)already pay less tax though a racial divided taxation system and that will be left as is.

“Māori authorities file annual returns, have a reduced provisional rate of 17.5%”

Worth a read in full https://www.ird.govt.nz/roles/maori-authorities

“A Māori authority is also required to maintain a Māori authority credit account (MACA). This records how much tax a Māori authority has paid on income, and how many tax credits are available to pass on to its members.”

Be nice if the non Maori owners of family owned concerns could pass tax credits to its members.

No system is perfect. But the principle should be to tax income and wealth transfer.

Designing the system to be imperfect is not fair.

If fairness is the most most important kiwi value then one should not distort that value.

“Care” before “fairness” is how we should calibrate our system.

Because, as treaty settlements are less than 2% of an ‘agreed’ quantum. Because the Crown doesn’t want to cough up 100% of a treaty settlement.

That’s why iwi get the tax discount which if you calculate what is owed, the 98% of the quantum that is not paid….you get my drift.

“Be nice if the non Maori owners of family owned concerns could pass tax credits to its members.”

You can. It’s called the dividend imputation credit, and it covers dividends from any NZ-registered company to its NZ-resident shareholders. The effect is that income earned by the family-owned business and passed on to the family owners is taxed at their personal tax rate. Of course, if they have a high income, that personal tax rate will be high also.

the ‘woke’ are the rich middle upper class of this country and the rest are the worker. Of course they are quiet, they don’t want to pay taxes, they want the worker to pay taxes. Are you really that far removed from reality, Mr. Comrade that you don’t know that?

Martyn – most woke people are too silly to understand day to day stuff let alone the tax system

You are absolutely correct in your analysis. We are totally confused. We do not know what a woman is and what a man is not.

The $3mil study confirmed that what we knew. Read the tax code and one will understand why it is so.

Wealth is different from income. Trusts, companies etc are a way that allow the wealthy to game the system. Tax income received as well as well transfers of wealth in the hands of the recipient and see the demise of trusts.

This change will result in trusts and companies to be set up to limit personal liability and not a means to avoid paying tax.

Unfortunately, like climate change we need planet wide compliance to make this work. …..

In conclusion:

We can improve our management of the risks associated with climate change without a planet wide alliance. We cannot mitigate our way out of the risks associated with anthropogenic climate change without a planet wide alliance and taxation is no different. Therefore, we will need to focus on that what we can affect until we have an effective planet wide government.

yup funny how the woke don’t rail against ‘middle class priviledge’ their priviledged groups are very selective….juz sayin loike juz sayin

To illustrate part of Martyn’s point…those that should be leading the revolt against Rogernomics, Ruthanasia, and monetarist orthodoxy include central Labour organisation the NZCTU. But who fronted the media for the CTU after the release of the rich bastard exposing Tax Report?–the Secretary Melissa Ansell Bridges, President Richard Wagstaff? no it was their wimpish economist Mr Craig Rennie ducking and diving on RNZ, “well a capital gains tax is a simplistic answer, we need to look at a number of settings” he simpered on. Union leaders should be saying “this is war! are you with us, fight for economic justice now…”

Rennie worked most recently for the Minister of Finance, Grant Robertson as his Senior Economic Advisor for five years and worked at The Reserve Bank, Treasury, and the Ministry for Business Innovation and Employment (MBIE),”

So workers of Aotearoa New Zealand if you are looking for fighting class left leadership you will need to rebuild the CTU from the ground up.

Even right wing pundits are essentially saying–“right you have caught the richos with their pants down–but–is Labour going to act…and the answer is no unless there is fightback.

Really good point TM.

Where’s the ‘union movement’? Is there even one? Insipid union leadership, incapable of challenging neo-liberalism, privatisation, and reduction of public and state services.

There are still over 300,000 union members, and many regularly fight hard for their employment agreements and in their industries. The problem is there is little combined action across the sectors and a lack of political oomph from the very body (NZCTU) that should be leading the working class.

Is Woke plural?

The ideology seems singularly stupid to me.

“It’s similar to their militant defence of migrants, the woke have transferable global skill sets so any restriction on migrants is a restriction on their interests as well”

Actually most of them don’t. Engineers and tradespeople have the most transferable skill sets, and most of them are not woke, or at least fewer are proportionally speaking.

Try being ‘woke’ in Singapore or Hong Kong.

New Zealanders have a huge proportion of the population working offshore, so we as a country benefit from international mobility of employment more than perhaps any other country

“It’s similar to their militant defence of migrants, the woke have transferable global skill sets so any restriction on migrants is a restriction on their interests as well”

Actually most of them don’t. Engineers and tradespeople have the most transferable skill sets, and most of them are not woke, or at least fewer are proportionally speaking.

Try being ‘woke’ in Singapore or Hong Kong.

New Zealanders have a huge proportion of the population working offshore, so we as a country benefit from international mobility of employment more than perhaps any other country

The intersection of class and identity is culture.

We need to reassess the values the underpin culture, define them and promote them as things that transcend class and identity.

Developing a unique Pasifikan culture that incorporates the best of Euro Colonial and Indigenous Maori values is something that would unite Aotearoa/NZ to become the Utopia we believe it can be.

We can be either Pasifikan by birth or by nature.

Well said Mark.

I’ve been saying for a long time that underneath woke politics you often find class politics – or more accurately, class hatred.

In the last 2 decades effective activists never indulged in hating on people but if you were on the left you weren’t allowed to hate along lines of race, gender or orientation so that only really left “white trash” to direct your hatred toward. Fast forward to now and its working class men who have found themselves on the front lines of a culture war – hated by educated types and exploited by right wing politicians.

Around the time the Labour Party was changing into a Liberal Party the left also moved away from it’s focus on economic justice for working class people. I don’t think we should call identity politics left wing any more. It’s certainly liberal but it has nothing to do with economic justice.

What I’m looking for are the signs of a movement that is going to bring economic and ecological justice. And while it’s normal to focus on the people doing the hating I think we might be better off try to stop woke madness and just get on with organising the revolution.

Class trumps race every time, woke too.

Will it be more classy if we can stop grouping people, people stop grouping themselves and focus on individuals and their needs?

But here we are. Humans have a desire to identify with a group.

Hives and Jonathan Haidt.

JeezMartyn. Stop using the wordk ‘woke. You overuse it. People I know see that word from you and immediately stop reading.You produce some good stuff but for chrisakes think of a better word than woke.It’s done it’s time.

Because if you can afford to be woke, you probably aren’t broke.