NZ GDP has come in -.6 which is worse than the worst predictions.

This as the Cyclones damage the first quarter and the doom loop of imploding Global Banks start as the gravity of all that debt finally becomes realised.

This isn’t a tale of too clever by far Banking Technology whiz kids getting tricked into complex financial debt Ponzi schemes like 2007, this is basic level price of free money lending that was never sustainable and it seems the entire banking industry have been supping from this cup…

Credit Suisse Is ‘Tip of the Iceberg’

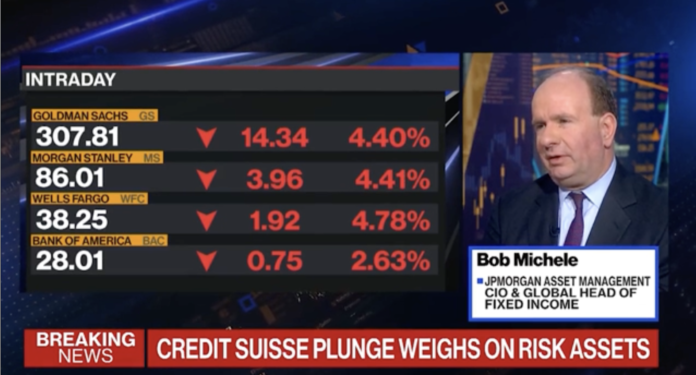

Credit Suisse’s major drop in share price on Wednesday is unlikely to be the end of Wall Street’s current pain, prompting some experts to say that it is the “tip of the iceberg” for the economy going forward.

“If you think about where we were a year ago, the Fed was just starting its rate-hiking cycle. So over the next couple of quarters you’re going to get those long and variable, cumulative and lagged impacts hitting the market further,” Bob Michele, the global head and CIO of fixed income at J.P. Morgan Asset Management, told Bloomberg TV. “So I think this is the tip of the iceberg. I think there’s a lot more consolidation, a lot more pain yet to come.”

Nouriel Roubini, an economist and CEO of Roubini Macro Associates, told NewsweekMichele’s “tip of the iceberg” remark is “not an exaggeration.” He added: “It’s a huge bank in a small country, too big to fail, too big to be saved, and if it were to collapse it will be liminal, not just for Europe but also globally.”

…shit ’bout to get real folks.

The Black Swans are in the uber on their way home.

I do not believe we are ready for this jelly.

Politically the speed of economic carnage looming means this will very quickly feel like a crisis and I think Chippy has the trust of the majority of voters when it comes to crisis where as Luxon and Seymour feel like they would exacerbate the crisis.

Does Chippy have the spine to tax the rich and build State capacity? If he doesn’t, he’ll have no actual solutions and voters will turn as sour on him as they did Jacinda.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

any institution that lends more than it’s assets is fraudulent..deregulation allowed indeed encouraged dodgy accounting we and the system learned nothing from the GFC

and in the case of the SVG bank a board of Clintonistas, Obamas, and other rich Democratic Party donors. And Peter Thiel – this one again, cashing up and advising their client list to do the same. All of that……but its all ok, the tax payer will bail out this bank also.

oh please bratty it’s not party political(other than the disasterous moron reagas deregulation) the bankers own ALL pollies get used to it

and thiel should have his nz citizenship revoked as an outspoken enemy of democracy

that is the problem with that particular brand, they had only 1 banker on the board, the rest were democratic party stooges and donors. Maybe having had bankers aboard would have actually helped. And Thiel will never have his nz citizenship revoked, he paid for it in full and both sides, N and L will not upset the dear, after all he is way way richer then they are.

The key now will be to pour in thousands upon thousands of foreigners every month. The faster you go…

“GDP tanks”. This is bordering on the headline click bait that you rightfully get upset about Martyn. You could just as easily say ‘OCR hikes slow economy as deliberately intended.’ Guess it depends what you want the narrative to be. Sure the economy shouldn’t have been overheated in the first place, but now the headlines go full negative. Imagine if there was growth in the GDP number. The headline would still be paraphrased as ‘we are f*cked”

I agree with you Wheel, Martyn has used a ‘click bait’ headline to cement in his gloomy outlook.

Thank goodness we have strong wealthy banks here in NZ

Unfortunately Trevor they are not NZ banks, their wealth is held overseas, much of it exported from our shores.

They are very strong in Australia and well run and not allowed to extend themselves into risky lending .I am happy to have my money in their deposit funds while the return is not great it is secure. It would be good if the government pushed through its deposit safeguard bill though as extra backup.

@ trev. Thank Christ you’re not running this shit show or we really would be fucked. God knows it’s bad enough you can brain-fart like you do.

The reason we’re approaching terminal lending velocity is because the crooks who set us up are leaving with our money, as they’ve done time and again, so fuck us.

” Thank goodness we have strong wealthy banks here in NZ ”

CORRECTION – the Australians have strong wealthy banks thanks to our brilliant privatisation push to ensure that NOTHING in this capitalist gangsters paradise is owned by its former shareholders……YOU and Me.

Bring back the gold standard

Return to the gold standard! Full reserve banking on Chicago Plan lines! All coinage back to 92% gold and silver!

Re-nationalise B.N.Z. now!

The gloomy outlook is justified because the outlook is gloomy. Chippy has had a good run post cyclone but no one in those affected regions are going to be satisfied with progress now the SOE is over. Generally people have managed till now but extra costs are biting every where . The clowns at the circus, Stuart Nash being one, are eroding the government’s credibility, and as Labour look around for a new minister with a brain, you get the feeling they are in short supply. Now overseas banks are feeling the pinch while in NZ we want to tax their profits. I’m struggling to see a bright side.

You are saying that as a supporter of the right I would say. Look at the likes of Mark Mitchell and “f*cking useless” Maureen Pugh and tell me the right are awash with competence! The reality is the whole model seems fundamentally broken. Financial Markets now get nervous because people have jobs! Ok that’s simplistic but it’s not untrue.

I have to agree with Maureen but would way rather have Mitchell to Nash. They’ll probably roll out Little to fill the gap. Who would you pick as police minister. McNulty. Not much experience there. You lefties are quick to point out any weakness National have but they haven’t been the government for six years. You would think Labour may have learned something in that time.

So, one week the left is whining about the “excess profits” they claim the banks are making here (but are unable to define what they mean by ‘excess’) then the next they’re lighting candles to St. Matthew, the patron saint of bankers, for our wonderful robust banks.

He! He!

is credit suisse an aussie bank operating in NZ…thought not andrew

Well are they Andrew? Are they more thankful that there are capital requirements put in place by regulators to prevent bad stuff happening? Don’t assume the banks would be robust if left to their own devices. Look at the character assassination attempts against Adrian Orr well before COVID etc when the banks were whinging about capital requirements.

What happens when the suits start bailing out, finding the lifeboats overloaded? Are we already going down like the Titanic but while we still hear the orchestra playing we feel only vaguely apprehensive?

Kiwi Bank better not fall over.

” for our wonderful robust banks. ”

How stupid a statement is that !

Replace ours with … Australian and American owned banks !

We sold out years ago and if it came to the crunch the last thing they will care about is the Hobbit’s in the land of the land of the long white neoliberal cloud.

There’s a real good basic rundown on what’s happened and why and possibilities on where it goes now on the Aussie ABC:

https://www.abc.net.au/news/2023-03-16/global-banking-crisis-deepens-fall-of-silicon-valley-bank/102105284

lol – it’s all propped up by cheap energy which is not going to get any cheaper. The perpetual growth model is losing it’s wheels. -0.6 is going to look fucking amazing in coming decades.