- 1: Let’s start with that narrative shall we?

Firstly, it’s a democracy, what the people want isn’t a ‘lolly scramble’ when the investment is for the good of society! It is when it’s a tax cut, that’s a blatant election bribe, more money for the social infrastructure that we are all reliant on for the very progressive democracy that we live in is not a ‘lolly scramble’.What that narrative demands is that there is no changing the neoliberal free market economy settings that the Right benefit from. Why on earth should we accept the gatekeeper definitions when it comes to deciding if the market should appease and benefit the few rather than benefit the many?

- 2: That’s it?

The message from Treasury was clear, that’s it. The last 9 years were as good as it gets economically. Turns out the Rock Star Economy is packing up and leaving after 20 minutes and the majority of people haven’t even been allowed into the stadium yet because they don’t own property.

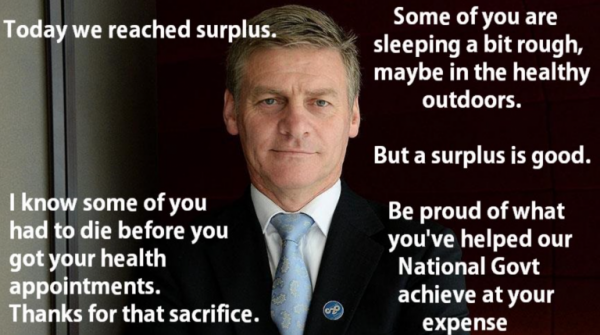

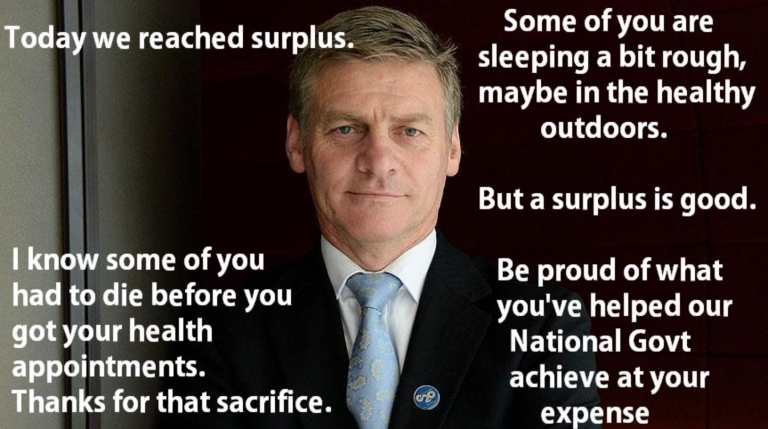

- 3: We made a surplus by cutting from the poorest, weakest and most vulnerable

The 1.7billion surplus ($2billion of it was a one off) was built on cutting benefits, underfunding health, low funded mental health, throwing people out onto the street, finding excuses to cut benefits off and state housing privatisation. Building a surplus when 41 000 are homeless, 300 000 kids are in poverty, 550 000 NZers are suffering severe hardship annually, 1500 are unofficially dying from suicide annually, 1600 are dying from cold houses annually, entire generations are being locked out of home ownership while our health and education systems are in desperate need of money just seems incredibly fucking cruel.

- 4: An economy built on rebuilding from earthquakes and immigration

So how has this amazing growth rate come about? Mass immigration and rebuilding from earthquakes. The total fraud of the illusion that is NZs growth hides that all National have done is open up NZ to mass immigration. This cheap neoliberal growth mechanism props up the property bubble and keeps the ratings agencies from hitting our credit rating.

- 5: Things are going to get worse

If the falseness of our growth rate is a serious problem, the reality that things are going to get worse means something is gong to have to radically change. Despite a predicted surge in ex-pat NZers coming back from Australia in the next few years, the economy will falter with the rebuild over and no other firm economic drivers. We’ve peaked out the level of growth where we can get a gain with the zero approach to infrastructure investment National has shown over 9 years. We will start getting a lower rate of productive economic growth for every extra person entering.

Our economy is built upon a counter productive growth model that is causing extreme economic dislocation and the mainstream media’s refusal to critically examine what the PREFU really tells us about that growth model while they’re yelling that Labour aren’t showing enough policy detail would be a sad joke if it wasn’t so damaging to our democracy.

Zombie conservatives having problems with wealth redistribution.

Me, points to cow: BBQ

And NO plans for long term changes due to climate and resource scarcity.

The crash will be a lot harder and faster than what it could be if we followed common sense and used today to plan for tomorrow.

Consumerism and convenience are both diabolical traps yet we are encourages to measure our success by how fast we are being trapped.

NZ, Give BOTH VOTES to ** NZ First ** __ Give WINSTON and TEAM the POWER to MODERATE ** Moral-LESS-National _&_ jacinda’s helenGrad**

Good one, dickhead. The moment you said “helenGrad” your already poor argument went down the toilet.

Seriously. Drop the stupid appellation. Labour are not Communists. Applying the ~Grad suffix does nothing except highlight your ignorance.

Perhaps let us get real, the housing price inflation has and is sucking billions out of people’s pockets that are desperately needed elsewhere.

http://www.stuff.co.nz/business/92748825/growing-evidence-that-housing-inflation-is-now-the-main-reason-for-inequality

Get this:

“Inflated house prices don’t just affect home owners and house-hunters.

They affect businesses too, increasing costs of business accommodation and making it harder for employees to live near their place of work.

Higher accommodation costs take resources away from productive enterprises, making business itself less productive and efficient.

They incentivise investors to put capital into non-productive assets, worsening the situation.

We need a housing market that can respond rapidly to increased demand, allowing more houses to be built quickly. ”

Economics 101, I reckon.

Even the merchant banksters are worried:

http://www.stuff.co.nz/business/92642259/goldman-sachs-new-zealand-houses-most-overvalued

A report only addressing some issues, the market way:

http://www.beaconpathway.co.nz/images/uploads/Affordable_housing_at_scale_v9.pdf

When we look back though, it has always been the state intervening that ensured enough affordable housing was being built:

https://www.nzgeo.com/stories/state-housing/

https://en.wikipedia.org/wiki/Affordable_housing

This is a damned complex issue, but without state involvement, it will never be solved in New Zealand.

The foreign owned banks in NZ are the winners and mortgage money by way of loans is all pure profit for those bankers.

A bonanza driven by National not protecting NZ soil from foreign ownership, importing labour and other migrants so driving up the bankers profitability through soaring land and house prices.

We are open house for transnational profiteering.

How many tens of billion has the mortgage portfolio held by banks increased each year.

We pay and the money goes of shore.

But why is this allowed to happen you may well ask yourself.

Second question ” Who runs the Govt”. Look to who profits and you may well have a clearer picture.

House prices have doubled in the last 8 years and the household debt has also doubled in the past 8 years, talking with my Bank Manager he says people are using their houses as ATM Machines. It would have been better to build twice as may houses over the past 8 years ?

The PREFU is only as good as government money managers may take an interest, they need a greater focus here now, in NZ, given the housing affordability crisis. Perhaps read this:

http://www.beaconpathway.co.nz/images/uploads/Affordable_housing_at_scale_v9.pdf

“Delivering affordable housing at scale:

Lessons from Europe: NEW2016/1

4.2 Alternative pathways to deliver social and affordable

housing

4.2.1 Housing associations and municipal companies / enterprises

Unlike New Zealand, most European states have sizeable, non-state providers of social housing. Most cities meet their statutory obligations to provide social housing through independent, not

for profit organisations (housing associations or municipal housing companies/enterprises)..

These organisations do not necessarily get direct capital fundi

ng grants, although they benefit from housing support, and rental income covers building maintenance. Housing Associations

(in Netherlands and UK), Municipal Housing Companies (Sweden),

and Municipal Enterprises (Germany) are private, non-profit organisations with a public purpose.

They work alongside local and state government to provide social housing, a role that is often mandated by legislation. However, they are able to act independently. These organisations have continued to invest in additional housing / housing refurbishment since the Global Financial Crisis but their levels of investment are low relative to demand. In the Netherlands, where there are three million rental homes, 75% of these homes are owned by Housing Associations 42 (31% total housing stock and all homes are social rental).

Dutch housing associations function without receiving any direct government subsidies. They do however benefit from the Social House-building guarantee fund, which guarantees the repayment of housing association loans, with interest rates significantly below market rates.

Income from letting and selling covers investment in new affordable homes and Housing Associations also invest in neighbourhood regenerations, public purpose buildings and social

programmes.

In Germany, municipal enterprises (an operating subsidiary of councils with a priority to provide housing for low income families) provide 2.4 million units (around 10% total rentals) In Sweden, housing policy is implemented through the authority and activities of the Municipal Housing Companies. These not-for-profit, municipally-owned associations are responsible for finding houses of a reasonable standard for all residents and for their welfare. The association’s income comes solely from the rents it collects from tenants, which cover building maintenance costs.

Housing associations are the only providers of new social and shared ownership homes in Northern Ireland. There are 1700

Housing Associations in the UK with an annual spend of £13bn (2013).”

Just some info worth looking at, but NZ is screwed with a government that does not believe in this, that rather sells stock of housing, and that wants outsourced providers take over all responsibility, so they can wash their hands in innocence.

Labour can do more than what their policy says, but they are scared of taking too great risks, we deserve better.

Comments are closed.