Let me ask you a very simple question: If you had a lot of money, would you invest in an industry that is growing substantially, has public acceptance and is sustainable? Or one that is finite, destructive and regularly incites protest?

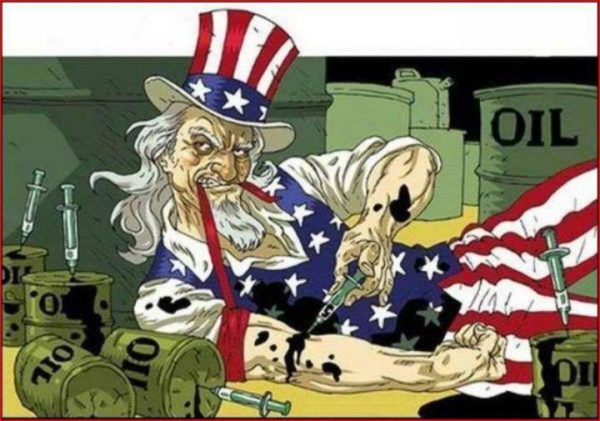

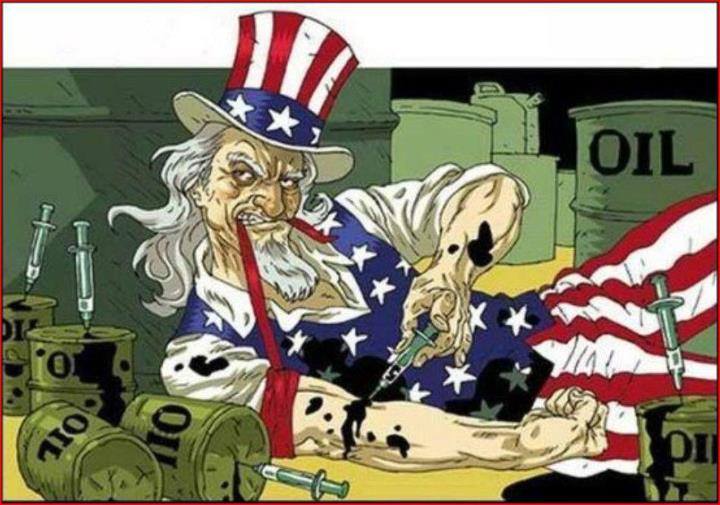

It seems logical to choose the former. However, that isn’t what is happening. Our extraction culture has created a dependency on oil and gas, one which our elected leaders seem happy to continue to base our entire economic system on. They gamble as shareholders of our wealth, the consolidated fund. Our taxpayer money has gone to subsidising oil exploration and companies, setting up legal branches as part of MBIE to prosecute protesters (laws made via oil lobbyists) and even paying millions for deconstruction once they have sucked the reserves dry. We have one of the lowest tax rates for oil companies (and fourth lowest royalty payments in oil in the world), pay to aid their research and upgrade vessels and even exempt them from paying any tax on their rigs.

Not to mentioning the oil data packages paid and supplied by National, the conferences and the wining and dining. Estimates of clear-cut lost revenue by tax breaks is in the hundreds of millions over the last few years, and the Greens plus other NGOs have estimated a clear-cut $46 million in tax breaks. What is abundantly clear is that these perks have increased substantially since National came into office.

Subsidies take many shapes and sizes. There are many different mechanisms and incentives, and also clear favouritism. But what is clear, more than anything else, is that we have a leadership whose sole drive is for more profit in the short term so that they look good, while being happy to leave a wasteland behind them that my generation will have to clean up. Why else would they be happy to set up coal mines in conservation land on the Denniston Plateau?

We need to stop fidgeting with numbers, allowing oil companies to funnel massive profits over seas and pay little royalties in comparison to their gross profit. But that requires a change of government, and almost all of the literature agrees we need to act now if we want to stop the worst effects of climate change. Nearly one third of our imports are fossil fuels. If we cut this, we could use the money spent to incentivise a modern green economy, ranging from video games to robotics. I’ll leave it to your imagination to think of other emerging industries. Think of any sci-fi film really, and we’re working on it.

Until the day comes when the Greens are in government and showing bold leadership in cutting our dependency on scarce and dangerous resources, it is up to us as a community to take action.

What is most frightening is the large-sale “block offer” that is soon to be on the coast of Hawke’s Bay. When Tag Oil was here, the only reason they left was because of the transparency that community meetings gave the farmers who were prepared to sell their land for drilling. It was collective action, communication and a sharing of values that unearthed the duplicity of Tag Oil, rallied the community and forced them to leave.

And now, the oil companies are back.

This is why I support the Regional Council in their decision to place a moratorium on oil and gas exploration. It cuts the head off the snake, and it is also good economic sense. Royalties from oil and gas have dropped continuously since 2005, and there were very few companies who tendered for the recent block sale. We should invest in the productive sectors of our regions, not the dying ones. Economically, the basic law of diminishing returns (we’re putting in more and getting less) dictates we should abandon this industry. Yet, we still have to fight for the shore. While Hawke Bay (not a typo, it’s actually the name of the coastal land) is still in the Regional Council’s legal parameters, central government is running roughshod over local democracy. And when this fails to pass legislation, Judith Collins sends personalised letters equating to bullying. They’ve also decreased the zoning of our moratorium, for this very reason.

In the Greens charter, we have the principle of responsible decision making. Continuing to invest and subsidising a failing, ecological destructive industry is not responsible. Penalising protesters explicitly for that industry is not responsible. Disregarding local democracy is not responsible. The logical answer is to put our money towards a clean economy, and a productive economy. In Hawkes Bay, we have a thriving horticulture industry. Our organic produce is renowned and valuable. We have great capacity for solar and marine energy with our beautiful weather – we should harness it.

Clean, green energy has the potential to create four times as many jobs as oil. This is where we should be putting our resources, and the Green party promises to do exactly that.”

Damon Rusden is a chef, journalist and law student with an avid belief in civic education and accountability. He is also a Green Party candidate.

Radical man, so god to see someone with balls.

Next broadcast this bad deal with the English/SS Joyce NATZ signing us up to the criminal enterprise group called TPPA Damon.

http://isds.bilaterals.org/?62-new-investor-state-disputes-in&lang=en

62 new investor-state disputes in 2016

AddThis Sharing Buttons

Share to FacebookShare to TwitterShare to Google+Share to More

Financial Express (Dhaka) | 27 May 2017

62 new investor-state disputes in 2016

In the past year, some 62 Investor-State Dispute Settlement (ISDS) cases were initiated by the investors against 41 countries.

The cases were initiated in pursuant to the international investment agreements (IIAs), according to a review report of the United Nations Conference on Trade and Development (UNCTAD).

Thus, total number of such arbitrations stood at 767 at the end of 2016. Most of the new cases were filed by the investors from developed countries.

UNCTAD report showed that about two thirds of ISDS cases in the past year were based on bilateral investment treaties, most of them dating back to the 1980s and 1990s.

The remaining arbitrations were based on treaties with investment provisions.

In 2016, ISDS tribunals made 57 substantive decisions, 41 of which are in the public domain.

Tribunals considered many issues that touch upon policy options identified in UNCTAD’s Road Map for IIA Reform and its Investment Policy Framework for Sustainable Development.

UNCTAD’s World Investment Report 2017, scheduled to unveil the next month, presents and analyses the pros and cons of 10 policy options that countries can take to reform their old-generation treaties.

Hmm. Timeous heading. (Out of the box – sorry TDB)

https://www.youtube.com/watch?v=PY0-huRW4ec&t=1s

Comments are closed.