.

.

Context

.

On 25 January, as Radio NZ returned to it’s normal broadcasting schedule (and putting away it’s dumbed-down “summer programming” until next December/January), John Campbell had his first interview with John Key’s replacement, Bill English.

Campbell raised several issues with English; the US withdrawal from the TPPA; the Pike River mine disaster; and the housing crisis. At this point, English made this staggering claim;

@ 5.58

“We’ve got a government actually with a good record on addressing, in fact, some of the toughest social issues. There may be disagreement over means by which we’re doing it, ah, but our direction is pretty clear. And you know over, certainly heading into election year we think that the approach the government’s developed around social investment, around increasing incomes is the right kind of mix – “

English’s bland assertion that “government actually with a good record on addressing, in fact, some of the toughest social issues” is at variance with actual, real, mounting socio-economic problems in this country.

.

Key indicator #1: Unemployment

.

The latest HLFS unemployment stats show an increase from 4.9% to 5.2% in the December 2016 Quarter. However, in all likelihood, the unemployment numbers are actually much, much, higher since Statistics NZ arbitrarily altered the way it calculated what constituted unemployment.

On 29 June 2016, Statistics NZ announced that it would be changing the manner in which it defined a jobseeker;

Change: Looking at job advertisements on the internet is correctly classified as not actively seeking work. This change brings the classification in line with international standards and will make international comparability possible.

Improvement: Fewer people will be classified as actively seeking work, therefore the counts of people unemployed will be more accurate.

The statement went on to explain;

Change in key labour market estimates:

-

Decreases in the number of people unemployed and the unemployment rate

-

Changes to the seasonally adjusted unemployment rate range from 0.1 to 0.6 percentage points. In the most recent published quarter (March 2016), the unemployment rate is revised down from 5.7 percent to 5.2 percent

-

Increases in the number of people not in the labour force

-

Decreases in the size of the labour force and the labour force participation rate

The result of this change? At the stroke of a pen, unemployment fell from 5.7% to 5.2% for the March 2016 Quarter (and subsequent Quarters).

If the “current unemployment figures” from Stats NZ are reported as “5.2%’, they may well be back to the original March 2016 figure of 5.7%, before the government statistician re-jigged definitions.

.

Key indicator #2: Housing

.

– Home Ownership

According to the 1984 NZ Yearbook, in 1981 the number of rental dwellings numbered 25.4% of housing. 71.2% were owner-occupied. Nearly three quarters of New Zealanders owned their homes.

Home ownership reached it’s maximum height in 1991, when it stood at 73.8%. Since then, it has steadily declined.

By 2013 (the most recent census survey), the numbers of rental dwellings had increased to 35.2% (up 33.1% in 2006). Home ownership had decreased to 49.9% (down from from 54.5% in 2006). If you include housing held in Family Trusts, the figure rises to 64.8% of households owning their home in 2013, down from 66.9% in 2006.

Whether you include housing held in Family Trusts (which may or may not be owner-occupied or rented out), home ownership has fallen steady since the early 1980s.

Renting has increased from 25.4% to 35.2%.

More and more New Zealanders are losing out on the dream of home ownership. Conversely, more and more of us are becoming tenants in our own country.

As Bernard Hickey from Interest.co.nz said in December last year;

Nearly two thirds of the 430,000 households formed since 1991 are tenants.

Think about that for a moment. It is a stunning revelation of how the young and the poor have been hit the hardest by the changes in New Zealand since the mid-1980s, and on an enormous scale.

It means two thirds of the kids born in those families grew up in rental accommodation, and more than 80% of those are private rentals (although the Housing NZ homes are often no better). That means they often grew up in mouldy, damp, cold and insecure housing. It’s true that some homes occupied by their owners are also below par, but it’s a much lower proportion and owners have the option to improve their homes through insulation and ventilation.

The NZ$696 billion increase in the value of New Zealand’s houses to NZ$821 billion between 1991 and 2015 means the 64% of owners in live-in houses have also had plenty of financial flexibility to improve those houses. Renters have had no access to that wealth creation and are not allowed to put a pin in the wall, let alone put in a ventilation system or some batts in the ceiling. The take-up for the Government’s home insulation and heating subsidies were vastly higher among home-owners than they were for landlords.

Those 284,000 renting households formed since 1991 have also often been forced to move schools and communities and all the roots that build families because New Zealand’s rental market is so transient.

[…]

It illustrates the scale of the fallout from that collapse in home ownership from 1991. Not only has it handicapped the education, health and productivity of a entire generation of New Zealanders, but it is set to magnify the likely growth in pension and healthcare costs of our ageing population. And that’s before the wealth and income inequality effects.

.

– Affordability

In 2016, the 13th Annual International Demographia International Housing Affordability survey rated New Zealand as one of the most unaffordable housing markets in the world;

The most affordable major housing markets in 2015 are in the United States, with a moderately unaffordable Median Multiple of 3.9, followed by Japan (4.1), the United Kingdom (4.5), Canada (4.7), Ireland (4.7) and Singapore (4.8). Overall, the major housing markets of Australia (6.6), New Zealand (10.0) and China (18.1) are severely unaffordable. (p2)

[…]

In New Zealand, as in Australia, housing had been rated as affordable until approximately a quarter century ago. (p24)

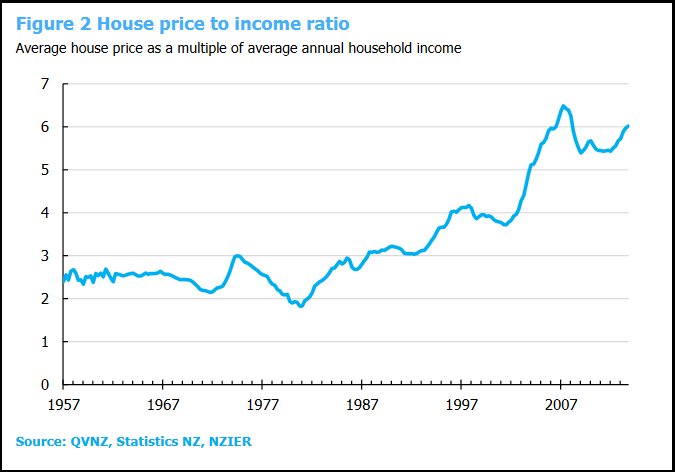

A 2014 report by the NZ Institute for Economic Research stated the “the average house price rose from the long-run benchmark of three times the average annual household income to six times“;

.

.

The NZIER report refers to several reasons for increasing housing prices; slow supply of land; demographic demand (from ‘Baby Boomers’); and investor demand caused by lack of a capital gains tax. Interestingly, the Report also refers to an “over-supply of finance”;

The loosening of financial standards and rising household debt relative to income has happened over a long period of time. The increase in indebtedness has coincided with rising house prices relative to incomes. This suggests that increased household indebtedness has at least partly contributed to the increasing price of homes. (p14)

Prior to Roger Douglas de-regulating the banking/finance sector, New Zealand banks could only lend depositor’s funds as mortgages.

As a result, mortgage money was “tight”, and scarcity helped keep house prices down. Vendor’s expectations were kept “in check” by scarcity of bank funds. Prior to the mid 1980s, Vendor’s Finance (by way of a Second Mortgage) were commonly-used financial tools to assist house-owners to sell and buyers to complete a purchase.

Once the banking sector was opened up, and monetary policy relaxed, cheap money flooded in from overseas for banks to on-lend to house-purchasers. As property investor, Ollie Newland vividly explained in the 1996 TV documentary, Revolution;

“I got a phone call from my bank manager to say some bigwigs were coming up from Wellington to have a chat with me. I thought it was just one public relations things they do. I had a very small office, it wasn’t much bigger than a toilet cubicle, and those five big fellows crowded in with their briefcases and books and they sat on the floor and the arms of the chairs – I only had one chair in the place – and stood against the walls. Their first words to me were, we’re here to lend you money. As much as you want. For somebody like me, and I’m sure it’s the same for everybody else, to suddenly be told by the bank manager that you could have as much money as you want, help yourself, that was a revelation. We thought we had died and gone to heaven.”

Unfortunately, the side affect of this was to increase vendor’s expectations to gain higher and higher prices for their properties. Combined with recent high immigration, and a lack of a comprehensive capital gains tax, and the results have been troubling for this country;

.

.

As well as increasingly unaffordable housing, we – as a nation – are sitting on a trillion-dollar fiscal bomb.

Think about that for a moment.

Little wonder that in September last year, the Reserve Bank issued the sternest warning yet that we were headed for impending economic mayhem;

A sharp correction in house prices represents a key risk to the financial system, and one that is increasing the longer the current boom in house prices persists. A severe downturn in house prices could have major implications for the banking system, with over 55 percent of bank loans secured against residential property. Moreover, elevated household debt levels and a growing exposure of the banking system to investor loans could reinforce a housing downturn and extend reductions in economic activity, as highly indebted households are forced to reduce consumption and sell property.

As with many other individuals, institutions, organisations, business leaders, left-wing commentators, media, political pundits, political parties, the NZIER was (and still is) calling for a comprehensive capital gains tax to be implemented.

Even then, this blogger suspects we may be too late. National (and it’s predecessor, to be fair) have left it far to late and the economic horse has well and truly bolted.

Even a Capital Gains Tax at 28% – New Zealand’s current corporate tax rate – may be insufficient to dampen speculative demand for properties.

Meanwhile, the dream of Kiwis owning their own homes continues to slip away.

Depressingly, New Zealanders themselves have permitted this to happen.

.

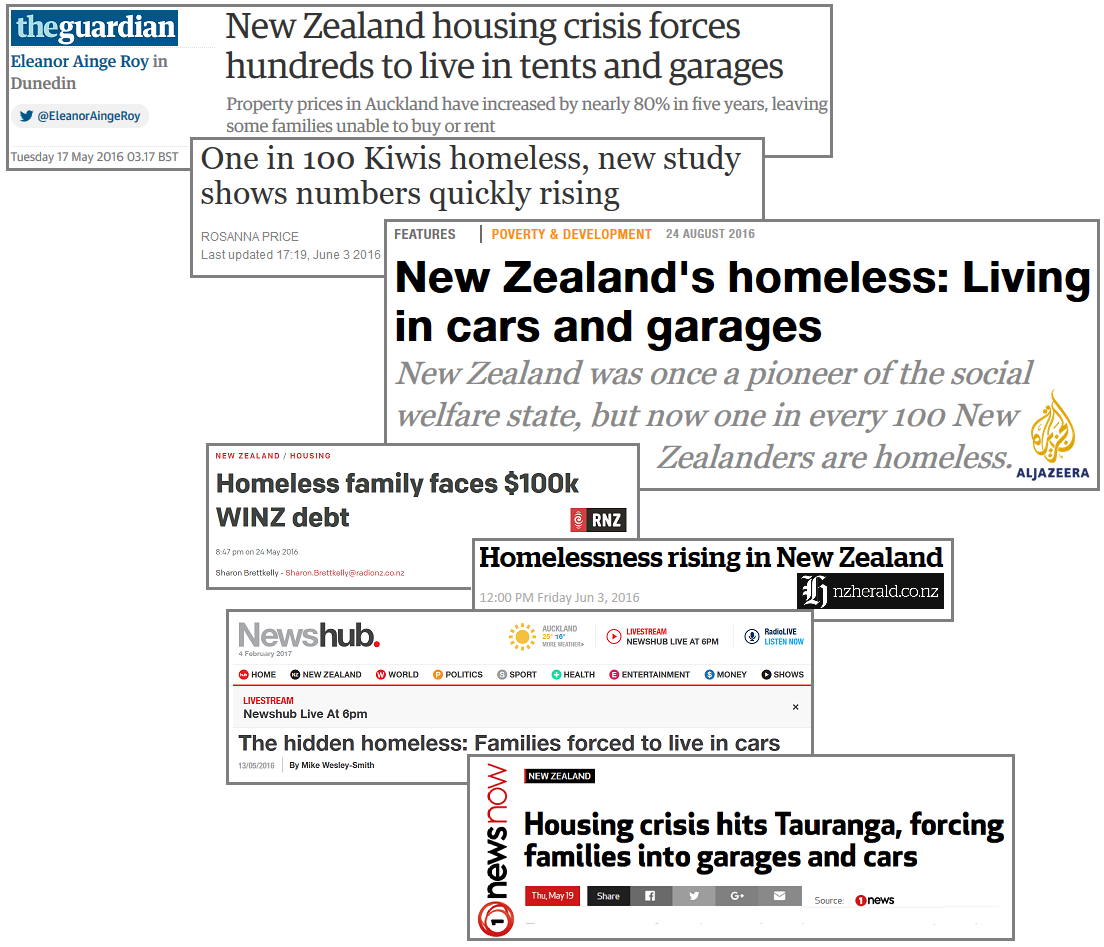

– State Housing

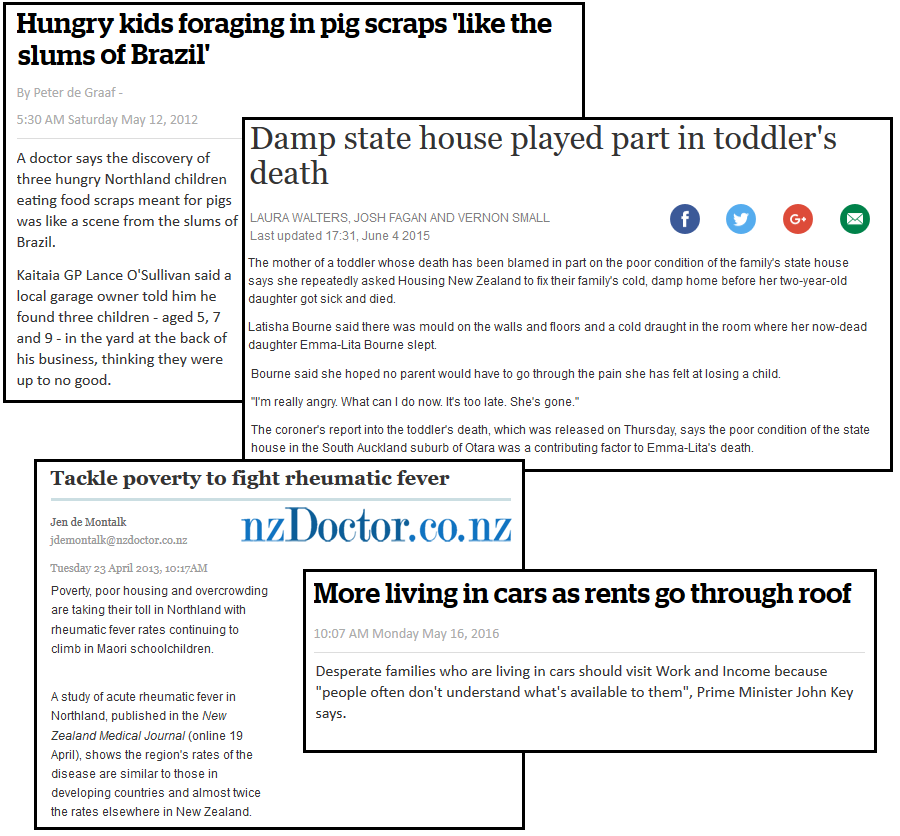

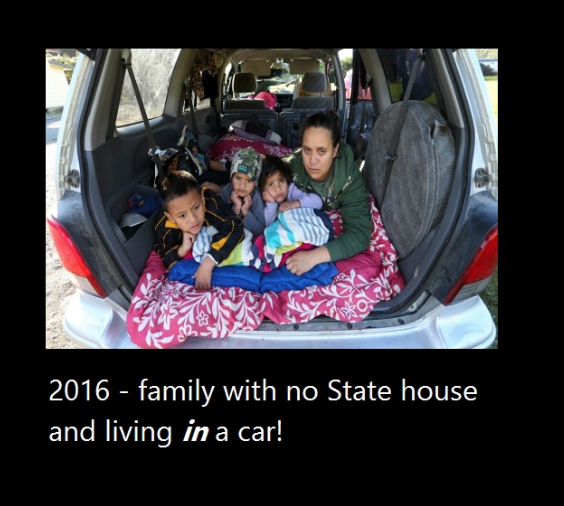

If the Middle Classes and their Millenial Offspring are finding it hard to buy their first home, think of the poorest families and individuals in our communities. For them, social housing consists of packing multiple families into a single house; living in an uninsulated, drafty, garage; or in cars.

Last year, the story of mass homelessness exploded onto our media and our “radar” as New Zealanders woke up to the reality of persistent poverty in our cities;

.

.

Although on occassion, the mainstream media found them themselves in embarrassingly ‘schizophrenic’ situations as they attempted to reconcile reporting on our growing housing crisis – whilst raising advertising revenue by promoting “reality” TV programmes that were far, far removed from many people’s own disturbing reality;

.

.

According to UNICEF;

295,000 New Zealand kids are living beneath the poverty line, which means they are living in households where income is less than 60% of the median household income after housing costs are taken into consideration.

One way to alleviate poverty is to provide state housing, at minimal rental, to families suffering deprivation. Not only does this make housing affordable, but also strengthens a sense of community and reduces transience.

Transience can have deletarious effects on families – especially on children – who then struggle with the stresses of losing friends; adjusting to new neighbourhoods, and new schools.

A government report states that transience for children can have extreme, negative impact on their learning;

Nearly 3,700 students were recognised as transient during the 2014 year. Māori students were more likely to be transient than students in other ethnic groups.

[…]

Students need stability in their schooling in order to experience continuity, belonging and support so that they stay interested and engaged in learning.

All schools face the constant challenge of ensuring that students feel they belong and are encouraged to participate at school. When students arrive at a school part-way through a term or school year, having been at another school with different routines, this challenge may become greater.

Students have better outcomes if they do not move school regularly. There is good evidence that student transience has a negative impact on student outcomes, both in New Zealand and overseas. Research suggests that students who move home or school frequently are more likely to underachieve in formal education when compared with students that have a more stable school life. A recent study found that school movement had an even stronger effect on educational success than residential movement.

There is also evidence that transience can have negative effects on student behaviour, and on short term social and health experience

Writing for The Dominion Post, in April 2014, Elinor Chisholm and Philippa Howden-Chapman pointed out the blindingly obvious;

Continuity of education and supportive relationships with teachers are critical for children’s educational performance.

“Churn” is not good for educational performance or enrolment in primary health care, where staff can ensure children are properly immunised and chronic health problems can be followed up.

It was for this reason that, in our submission on the Social Housing Reform Bill late last year, we strongly recommended that families with school- age children should be excluded from tenancy review.

Secure tenure and stability at one school would allow children the best chance of flourishing. In high- performing countries such as the Netherlands, children are explicitly discouraged from changing schools in the middle of the school year.

The bill had announced the extension of reviewable tenancies to all state tenants (new state tenants had been subject to tenancy review since mid- 2011). However, the housing minister, as well as the Ministry of Business, Innovation and Employment, had made clear that the disabled and the elderly were to be excluded from tenancy reviews.

In our submission, we acknowledged the Government for recognising the importance of secure tenure.

People who are compelled to move house involuntarily can experience stress, loss, grief and poorer mental health. Housing insecurity is also associated with poorer physical health.

National’s policy of ending a state “house for life”; increased tenancy reviews for state house tenants, coupled with the sale of state houses, is inimical to the stabilisation of vulnerable families; the well-being of children in those families; and to communities.

In 2008, Housing NZ owned 69,000 rental properties.

By 2016, that number had dropped significantly to 61,600 (plus a further 2,700 leased). National had disposed of some 7,400 properties.

Between 2014 and 2016, at least 600 state house tenants lost their homes after “reviews”.

This, despite our growing population.

This, despite John Key’s own family having been provided with the security of a state house, and Key enjoying a near-free University education.

This, despite John Key, ex-currency trader, and multi-millionaire, admitting in 2011 that New Zealand’s under-class was growing.

.

Key indicator #3: Incomes & Inequality

.

In June 2014, Oxfam reported on New Zealand’s growing dire child poverty crisis;

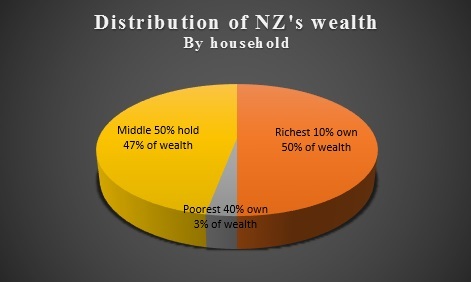

The richest ten per cent of New Zealanders are wealthier than the rest of the population combined as the gap between rich and poor continues to widen.

Oxfam New Zealand’s Executive Director Rachael Le Mesurier said the numbers are a staggering illustration that the wealth gap in New Zealand is stark and mirrors a global trend that needs to be addressed by governments in New Zealand, and around the world, in order to win the fight against poverty.

“Extreme wealth inequality is deeply worrying. Our nation is becoming more divided, with an elite who are seeing their bank balances go up, whilst hundreds of thousands of New Zealanders struggle to make ends meet,” said Le Mesurier.

Figures for the top one per cent are even more striking. According to the most recent data, taken from the 2013 Credit Suisse Global Wealth Databook, 44,000 Kiwis – who could comfortably fit into Eden Park with thousands of empty seats to spare – hold more wealth than three million New Zealanders. Put differently, this lists the share of wealth owned by the top one per cent of Kiwis as 25.1 per cent, meaning they control more than the bottom 70 per cent of the population.

Oxfam New Zealand’s Executive Director, Rachael Le Mesurier, was blunt in her condemnation;

“Extreme inequality is a sign of economic failure. New Zealand can and must do better. It’s time for our leaders to move past the rhetoric. By concentrating wealth and power in the hands of the few, inequality robs the poorest people of the support they need to improve their lives, and means that their voices go unheard. If the global community fails to curb widening inequality, we can expect more economic and social problems.”

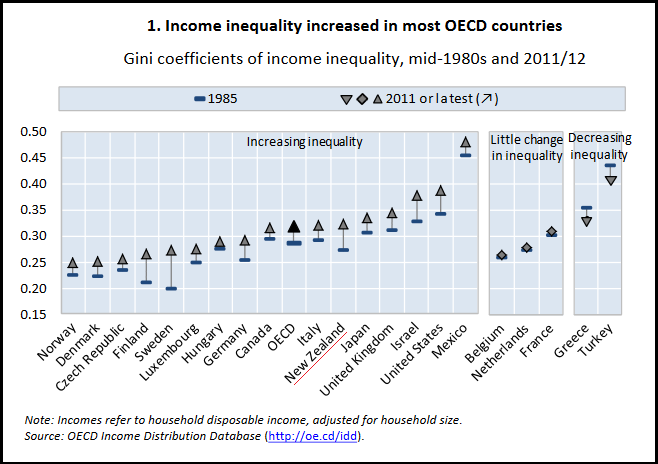

A 2014 OECD report placed New Zealand as one of the worst for growing inequality;

.

.

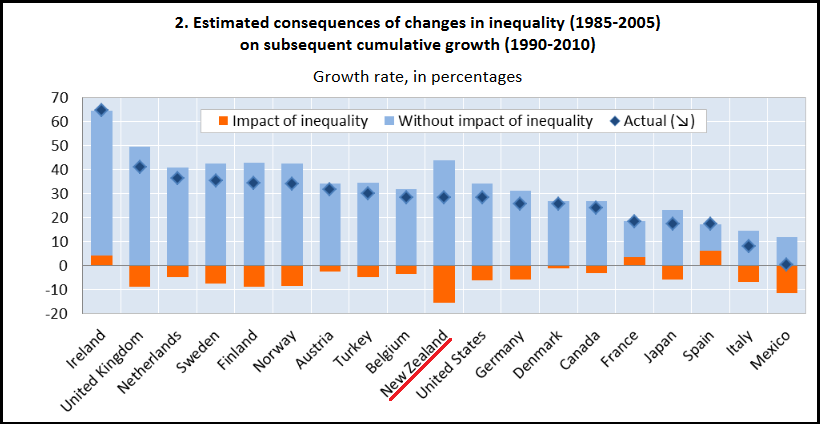

Not only was inequality a social blight, but according to the report it impacted negatively on economic growth;

Rising inequality is estimated to have knocked more than 4 percentage points off growth in half of the countries over two decades. On the other hand, greater equality prior to the crisis helped increase GDP per capita in a few countries, notably Spain.

According to the OECD assessment, income inequality had impacted the most on New Zealand, with only Mexico a close second;

.

.

The OECD Report went further, making this “radical” observation;

The most direct policy tool to reduce inequality is redistribution through taxes and benefits. The analysis shows that redistribution per se does not lower economic growth.

The statement went on to “qualify” any suggestion of socialism with a caveat. But the declaration that “analysis shows that redistribution per se does not lower economic growth” remained, constituting a direct contradiction and challenge to current neo-liberal othodoxy.

In August 2015, former City Voice editor, and now NZ Herald social issues reporter, Simon Collins revealed the growing level of child poverty in this country;

The Ministry of Social Development’s annual household incomes report shows that the numbers below a European standard measure of absolute hardship, based on measures such as not having a warm home or two pairs of shoes, fell from 165,000 in 2013 to 145,000 (14 per cent of all children) last year, the lowest number since 2007.

Children in benefit-dependent families also dwindled from a recent peak of 235,000 (22 per cent) in 2011, and 202,000 (19 per cent) in 2013, to just 180,000 (17 per cent) last year – the lowest proportion of children living on benefits since the late 1980s.

But inequality worsened because average incomes for working families increased much faster at high and middle-income levels than for lower-paid workers.

The net result was that the number of children living in households earning below 60 per cent of the median income after housing costs jumped from a five-year low of 260,000 in 2013 to 305,000 last year, the highest since a peak of 315,000 at the worst point of the global financial crisis in 2010.

In percentage terms, 29 per cent of Kiwi children are now in relative poverty, up from 24 per cent in 2013 and only a fraction below the 2010 peak of 30 per cent.

In September 2016, Statistics NZ confirmed the widening of income inequality from 1988 to 2015, between households with high and low incomes;

- In 2015, the disposable income of a high-income household was over two-and-a-half times larger than that of a low-income household.

- Between 1988 and 2015, the income inequality ratio increased from 2.24 to 2.61.

.

.

The neo-liberal “revolution” took place from the mid-to-late 1980s. Hardly surprisingly, the rise in income inequality takes place at the same time.

Income inequality dipped from 2004 when Labour’s “Working for Families” was introduced.

However, income inequality worsened after 2009 and 2010, when National cut taxes for the rich; increased GST (which impacts most harshly on low-income families and individuals); and increased user-charges on essential services such as prescription fees, ACC levies, court fees, etc. Increasingly complicated WINZ requirements for annual re-applications for benefits and complex paperwork may also have worsened the plight of the country’s poorest.

Despite all the promises made by the Lange government; the Bolger government; and every government since, our neo-liberal “reforms” have not been kind to those on low and middle incomes.

.

Key indicator #4: Child poverty

.

According to Otago University’s Child Poverty Monitor in 2014;

Child poverty has not always been this bad – the child poverty rate in the New Zealand many of us grew up in 30 years ago was 14%, compared to current levels of 24%.

Thirty years prior to 2014 was the year 1984. David Lange’s Labour Party had been elected to power.

Roger Douglas was appointed Minister of Finance. The Member for Selwyn, Ruth Richardson, was also in Parliament, taking notes.

The term “trickle down” entered our consciousness and vocabulary. It promised that, with tax cuts; privatisation; winding back state services; and economic de-regulation, wealth would trickle down to those at the bottom of the socio-economic ladder.

How is that working out for us so far?

.

.

So much for the “aspirational dream” offered to us by “trickle down” economics.

.

Key indicator #5: The Real Beneficiaries

.

In June last year, Radio NZ reported the latest survey of household wealth by Statistics NZ. It found;

“…the country’s richest individuals – those in the top 10 percent – held 60 percent of all wealth by the end of July 2015. Between 2003 and 2010, those individuals had held 55 percent. The richest 10 percent of households held half of New Zealand’s wealth, while the poorest 40 percent held just 3 percent of total wealth.”

.

.

Following hard on the heels of the Stats NZ report, Oxfam NZ made a disturbing revelation;

.

.

Three years after her previous public warning, Oxfam New Zealand’s, Rachael Le Mesurier, was no less scathing. Her exasperation was clear;

“The gap between the extremely wealthy and the rest of us is greater than we thought, both in New Zealand and around the world. It is trapping huge numbers of people in poverty and fracturing our societies, as seen in New Zealand in the changing profile of home ownership.”

National minister, Steven Joyce responded. He was his usual mealy-mouthed self when interviewed on Radio NZ about the Oxfam report;

“There’s always inequality but again you have got to look at those reports carefully because in that report a young medical graduate who has just come out of university would be listed as somebody who is in the poorest 20 per cent because they have a student loan.They’ll pay that student loan off in about four years and they’ll be earning incomes of over $100,000 very quickly.

So although they’re in those figures today, they won’t be in those figures in five years’ time.”

Which appears to sum up the National government’s head-in-sand attitude on child poverty and income inequality.

Economist, Shamubeel Eaqub, though, had a different “take” on the issue and warned;

“Every time we see a new statistic on inequality, whether it’s in terms of income, opportunities or wealth, it shows very clearly that New Zealand is being ripped apart by our class system.”

When economists begin to issue dire social warnings, you know that matters have taken a turn for the worse.

So where does that leave our New Dear Leader Bill English with his insistence that “we’ve got a government actually with a good record on addressing, in fact, some of the toughest social issues”?

English’s assertion to John Campbell on Radio NZ, on 25 January, (outlined at the beginning of this story) makes sense only if it it is re-phrased;

“We’ve got a government actually with a good record on addressing, in fact, some of the toughest wealth-accumulation issues. There may be disagreement over means by which we’re doing it, ah, but our direction is pretty clear. And you know over, certainly heading into election year we think that the approach the government’s developed around private investment, around increasing incomes for the wealthiest ten percent is the right kind of mix – “

Not a very palatable message – but vastly more truthful as income inequality continues to wreak appalling consequences throughout our communities and economy.

Otherwise, English appears to reside not so much in the Land of the Long White Cloud, but in the Realm of Wishful Thinking.

.

.

.

References

Radio NZ: Checkpoint – Bill English on the challenges of his first month as PM

Scoop media: Unemployment rate rises to 5.2 percent as labour force grows

Statistics NZ: Household Labour Force Survey – Revisions to labour market estimates

NZ 1984 Yearbook: 3A – General Summary – Census of population and dwellings 1981 (see “Tenure of Dwelling”)

Statistics NZ: Owner-Occupied Households

Statistics NZ: 2013 Census QuickStats about national highlights – Home Ownership

International Demographia: 13th Annual International Housing Affordability

NZ Institute for Economic Research: The home affordability challenge

Monetary Meg: What is vendor finance?

Radio NZ: NZ immigration returns to record level

NZ On Screen: Revolution

NZ Herald: New Zealand residential property hits $1 trillion mark

Reserve Bank: Regulatory Impact Assessment of revised LVR restriction proposals September 2016 – Adequacy Statement

The Guardian: New Zealand housing crisis forces hundreds to live in tents and garages

Fairfax media: One in 100 Kiwis homeless, new study shows numbers quickly rising

Al Jazeera: New Zealand’s homeless: Living in cars and garages

NZ Herald: Homelessness rising in New Zealand

Radio NZ: Homeless family faces $100k WINZ debt

TV3 News: The hidden homeless – Families forced to live in cars

TV1 News: Housing crisis hits Tauranga, forcing families into garages and cars

UNICEF: Let’s Talk about child poverty

Education Counts: Transient students

Dominion Post: Housing policy will destabilise life for children

NZ Herald: State housing shake-up – Lease up on idea of ‘house for life’

Radio NZ: Thousands of state houses up for sale

Housing NZ: Annual Report 2008/09

Housing NZ: Annual Report 2015/16

Fairfax media: Nearly 600 state house tenants removed after end of ‘house for life’ policy

NZ Herald: Key admits underclass still growing

Oxfam: Richest 10% of Kiwis control more wealth than remaining 90%

NZ Herald: 300,000+ Kiwi kids now in relative poverty

Statistics NZ: Income inequality

Law Society: Civil court fee changes commence

Fairfax media: Prescription price rise hits vulnerable

Salaries.co.nz: ACC levies to increase in April 2010

Radio NZ: Thousands losing benefits due to paperwork

Scoop media: Health Issues Highlighted in Child Poverty Monitor

NZ Herald: Hungry kids foraging in pig scraps ‘like the slums of Brazil’

Fairfax media: Damp state house played part in toddler’s death

NZ Herald: More living in cars as rents go through roof

NZ Doctor: Tackle poverty to fight rheumatic fever

Radio NZ: 10% richest Kiwis own 60% of NZ’s wealth

Fairfax media: Wealth inequality in NZ worse than Australia

Radio NZ: Steven Joyce responds to Oxfam wealth inequality report

Additional

Dominion Post: Kids dragged from school to school

Other Blogs

The Standard: John Key used to be ambitious about dealing with poverty in New Zealand

Previous related blogposts

Lies, Damned lies and Statistical Lies

Lies, Damned lies and Statistical Lies – ** UPDATE **

National exploits fudged Statistics NZ unemployment figures

2016 – Ongoing jobless tally and why unemployment statistics will no longer be used

CYF – The Hollowing Out of a State Agency

The Mendacities of Mr Key # 18: “No question – NZ is better off!”

Foot in mouth award – Bill English, for his recent “Flat Earth” comment in Parliament

The Mendacities of Mr English – Fibbing from Finance Minister confirmed

Rebuilding the Country we grew up in – Little’s Big Task ahead

.

.

.

.

.

= fs =

There is nothing mendacious in this statement:

“We’ve got a government actually with a good record on addressing, in fact, some of the toughest social issues. There may be disagreement over means by which we’re doing it, ah, but our direction is pretty clear. And you know over, certainly heading into election year we think that the approach the government’s developed around social investment, around increasing incomes is the right kind of mix – “

The National government is a government of self-serving cheats and liars concerned with transferring wealth upwards, and they have ‘addressed’ social issues….ensuring a bigger slice of the cake goes to those who already have more than too much. No inconsistency there.

Social investment means private hospitals (corporate-owned) and private (corporate-owned) retirement villages, road to satisfy the road transport lobby groups and oil companies, and plenty of fast-food outlets and Lotto shops. Oh, I nearly forgot the tattoo parlours. Again, businesses sucking money out of the system and into the pockets of corporations and opportunists.

‘increasing incomes is the right kind of mix’ Yes, more for the wealthy and less for the rest. Isn’t that exactly the kind of ‘mix’ that Bill English stands for?

‘our direction is pretty clear’ That is true too. More of the same, with a focus on extracting the last the land and waters will deliver and transferring the fiat money acquired into the bank accounts of looters and polluters before collapse occurs.

If Bill English wants to emulate his predecessor he should exercise caution. Key could get away with his lies and “alternative facts” because he was teflon coated. English does not share that and any lies he tells will stick.

Excellent investigation, Frank.

As usual, you succeed in holding truth to power, a fact that many paid journalists should be aware of.

Wow! National’s “new” old policy…

Pusillanimous Mendacity.

Chris Trotter would love it… 🙂

Frank

Appreciate this detail. I agree the horse has bolted for capital gains tax. We need new thinking urgently.

Taxing total net equity with an exemption of a base amount will pick up untaxed gain. It is time to have this debated if disaster is to be averted.

And clearly those that believe in “the trickle down effect” need only read this statement:

“no millionaire becomes a billionaire by giving away his/her money”

The trickle down effect does not exist, the rich just get richer, mostly by smart investment and not working hard at all. The right and hard right are about money whilst the left are about social consciousness. This is why there has been a collapse of many social subjects over the past 8 years, as Frank has given evidence too.

Another excellent summary of important indicators and reports on the true state of affairs in New Zealand Aotearoa.

I have often traveled between various suburbs in Auckland, that is on the bus, and I always get the same impressions. What I noticed over the years since 2008 is the following: Never before have I seen so many imported, flash European, Japanese and the odd US vehicles drive around the roads and streets of Epsom, Newmarket, Parnell, Kohimarama, St Heliers, parts of the North Shore.

There are also plenty of nice new yachts moored in the marinas around the Waitemata Harbour, some so top range luxury ones, it takes away your breath, looking at such wealth.

At the same time, the houses in places like much of Avondale, in Ranui, in much of South Auckland, in Glen Innes, Pt England and so, look as depressing, or more derelict than they ever have. Cars with taped up holes in the body, with poor paint jobs, and evident patch up repairs are found there, some must be without a warrant.

I see the same or worse poverty there, in the malls and in the streets and on the roads as there has been since the early 1990s, and I bet it looks even worse up North, in parts of Hawke’s Bay, Gisborne and areas around the Bay of Plenty and in Whanganui.

We have riches and poverty, the ones that are doing well are the property owners, some multiple owners of course, the buyers and sellers, the speculators, also the professionals in safe jobs, and those running businesses selling stuff that goes above the ordinary cheap wares such as pies, two dollar shop goods and cheap clothing.

Division is everywhere, that is social division, but given the appalling media we have, the desert like media, void of investigative journalism, where the so called 4th Estate no longer exists, and rather pays lip service to government Ministers, we have insufficient information, no education of the wider public, we have much swept under the carpet, and we live light years behind much of the other developing world, living a life of consumerism and endless wasting, like there is no tomorrow.

I have met people from Brazil, telling me how appalled they are, that we do not recycle stuff here, which is now totally normal in the more developed centres there. They no longer sell old style light bulbs as we still do, they are heavily investing in public transport and alternative energy use there, in much else, despite of the economic crisis.

Here we are living in the dark ages, as if we still have the 1950s lifestyle of the USA, sprawling cities, vast suburbs, people driving everywhere, few only walking, cycling and using buses or trains.

This country sadly is BACKWARD and falling further behind, while at least some in other countries have woken up to what needs to be done.

We have a PM, who took over from a careless little opportunistic rascal and snake oil salesman, who now tells us we are in “good hands” and have “great growth”. Wow, growth we have, only because we fill the country with endless rows of new migrants, with tourists that come here with airplanes, polluting the world only more, students that only pay high fees to get a foot in the door to get PR, and with that first cheap minimum wage or lower paid jobs.

What a miracle that is, I say, that we have not yet had a social and economic collapse, e.g. due to the housing affordability crisis. It is a miracle we have not had riots here. But as someone told me long ago on the beach: “We do not do politics here, in New Zealand, we just get on with life”, whatever that means?!

That says it all, people lulled into indifference, ignorance, even cowardice, and getting on with destroying this place, living it up today, those that can afford to, and not caring about tomorrow, and also not about their worse off fellow countrymen and women.

Shame on New Zealanders who still consider voting for the status quo.

Mike, that deserved to be a blogpost in it’s own right. It compliments Frank’s piece perfectly. You’ve made pertinent observations and it should be shared widely.

+1

I’ll echo that, Priss. That’s an excellent commentary by Mike and merits its own blogpost status.

Martyn? Scarlet mod?

In order to augment change @ Frank you must engage the masses. Not the odd one or two intellecshuls who would bother to wade through the above.

The masses have better things to do. Like listen to ZM while they chow down on Carl Jnrs.

The intellecshuls from both sides; the dark side and the light side, know all about what’s ‘going on’. The ‘going’s on’ you so eloquently highlight above.

It’s the masses, they’re the ones to galvanise into positive action. Take a page out of Trump’s Pussy Grabbers Guide to the ascension to the Presidency of the U$A.

My feeling is, that, even if the masses were constantly indoctrinated by Pro Light Side propaganda? They’d still eat each other alive while fawning over their abusers.

Is the reason why the Earth’s melting’s because we fucked it up and someone, or some thing, has hit the reset button?

We’re all outa here. We seemed like a good idea at the time.

Mike in Auckland you are so right about the right thank you for your honest comments

When Bill English recently announced an increase to police funding he was reported as saying:

“Real achievement is reducing welfare dependency, getting better results for our kids at school, preventing rheumatic fever, and reducing waiting times at hospital emergency departments.

“We call our new approach Social Investment and its showing promising results in a number of areas, but the recent rise in the prison population confirms we’ve got more work to do.

“That is why we are investing more in Police. The extra investment will enable police to devote more resources to addressing the causes of social problems, not just respond to the symptoms.”

That is confusing. Our country’s political leader seems to recognise

• the need for support for the disadvantaged,

• the role schooling plays in improving people’s choices, and

• the importance of addressing health needs.

And yet his answer is to give money to the police. who do not work in those areas.

Wasn’t it he who said ‘prisons are a moral and fiscal failure’? Surely, he lies when he says police will ‘address the causes of social problems, not just respond to the symptoms’. Police respond to crime. Police put people before the courts, where judges sentence them according to the laws made by politicians. When inequality, poverty, homelessness, and unfairness, are deliberately fostered, respect for law-makers is lost, powerlessness increases, and the resulting frustration is expressed in ways which increase unease. Hence the need for more police.

When politicians recognise their role in supporting the development of the infinite potential of each human life, we will have people worth voting for. So long as they only see people from an economic perspective, that is, they only see the part of the human that works, that produces, then we maintain the distorted society you discussed.

Frank, I am grateful for the research-based articles you provide.

Plenty of money to throw at aluminium smelters, Skycity, and Saudi businessmen with farms in the middle of the desert. Or to pay big profits to billionaires –

“A scheme funded by New Zealand taxpayers netted billionaire Peter Thiel tens of millions of dollars while his publicly funded investment partner barely broke even.

The partnering of Thiel’s Valar Ventures and the Government-owned New Zealand Venture Investment Fund (NZVIF) was launched by minister Steven Joyce in March 2012, nine months after Thiel took his oath of citizenship at the New Zealand consulate in Santa Monica.

Joyce said at the time the venture was “part of the Government’s comprehensive business growth agenda”, but a Herald investigation has discovered the arrangement was quietly ended in October when Thiel activated a generous buyback option allowing him and his private partners to claim all profits from the venture by cheaply buying out his public co-investor.” http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11794020

[…] blogpost was first published on The Daily Blog on 7 February […]

Comments are closed.