The combined efforts of both National and Labour governments’ punitive policies towards the unemployed seems to have removed over 100,000 people from rightful access to an unemployment benefit.

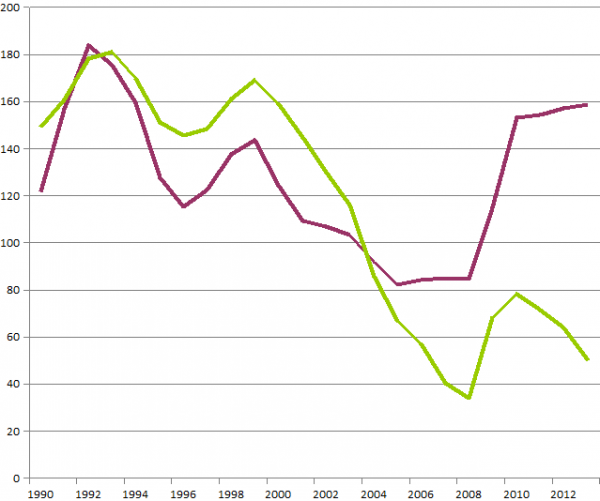

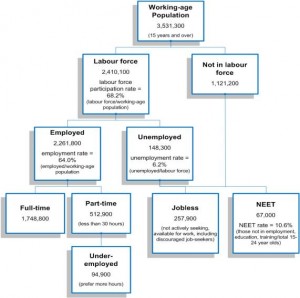

Until the mid-2000s there was a broad correlation between the number officially counted as unemployed through the Household Labour Force Survey (HLFS) and the number getting an unemployment benefit at the same time even though they were being measured in different ways.

In fact, the number on benefits exceeded the number as recorded by the HLFS by an average of about 30,000 in the late 1990s and early 2000s. The economic recovery that had set in by that time saw both numbers drop significantly.

However, around the mid 2000s the Labour government introduced a severe case management regime that seemed designed to prevent people accessing their entitlements rather than encouraging them to. The numbers on the unemployment benefit began to fall dramatically faster than the HLFS unemployment number until the gap hit 50,000 in 2008.

The international crisis and recession of 2008-10 sent the HLFS unemployment numbers soaring but the new National government’s even more punitive regime managed to keep the numbers on a benefit from increasing anywhere near as fast. The number of those on average receiving a benefit compared to the number of unemployed in the household survey is now about 130,000 fewer than it was in the late 1990s.

The missing 130,000 are the reason why so many social agencies are being inundated for help for food, clothing, shelter despite the so-called recovery in the economy over the last year.

There was also no significant increase in other working age benefits like sickness, invalid or sole parent benefits to account for the missing number of those receiving the unemployment benefit.

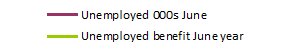

To make matters worse the HLFS is actually a very narrow measure of unemployment. To be counted you have to be physically able and ready for work, not be enrolled in a education course, and to have actively sought work in the last 4 weeks other than looking in a newspaper. You are also disqualified if you have worked one hour in the survey week – even if unpaid in your family dairy.

The broader measure of “jobless” which is also collected in the HLFS is actually a more useful figure. This number includes those actively seeking work but unable to start immediately, those available and only seeking work through newspaper advertisements or not actively seeking work for some other reason, and those discouraged from looking for work at all.

Graph of the September 2013 HLFS

Using this number we find that those on benefits as a percentage of the broader jobless category went from around 70% in the late 1990s to less than 20% today. There is no scientific explanation for this to happen except for the policies of the government making it happen. But there is a price that is paid – and it is one of human misery on a wide scale.

These numbers need to be given a human face. The unemployed are not just numbers. They are working people trying to survive in an unjust capitalist system that is happy to use us when the capitalists need us but want to discard us when they don’t and not even provide the minimal emergency support we are legally entitled to.

The demonising of the unemployed as bludgers is a lie and has always been a lie. Welfare fraud is minuscule compared to tax fraud by the rich but prosecuted much more vigorously. There has been a massive denial of entitlements to the unemployed over then last decade that is probably worth billions of dollars. The tax cuts for the rich have been paid for by denying entitlements to the poorest and most vulnerable is theft from working people of about a billion dollars a year. It is time to get angry.

NB: The numbers used in this article compare the number of unemployed, jobless and beneficiaries are taken from the Department of Statistics available on their Infoshare website. I use annual figures for the June year to remove seasonal or other factors. The one figure not available was the 2013 number for beneficiaries which I have done an estimate for.

Mike no-one who qualifies for a benefit is being denied one. Successive Governments have placed a greater level of responsibility on those applying for a benefit to justify their qualification for one. An unemployment benefit is not a right, it is a privilege afforded by taking money from those who are working. There have to be qualification rules, and Governments are right to adequately police these.

As for your claim:

“Using this number we find that those on benefits as a percentage of the broader jobless category went from around 70% in the late 1990s to less than 20% today. There is no scientific explanation for this to happen except for the policies of the government making it happen. ”

this is just not correct. The answer is found in your own definition of jobless:

“This number includes those actively seeking work but unable to start immediately, those available and only seeking work through newspaper advertisements or not actively seeking work for some other reason, and those discouraged from looking for work at all.”

There are many reasons why people may be unemployed but not actively seeking work, and I would suggest that, particularly during a recession, this category is likely to be the primary difference you are looking for.

Finally, if a person is not looking for work, and if they are not seeking work through every possible channel available, then they are not involuntarily jobless, and therefore, in my opinion, should not be eligible for the unemployment benefit.

Disingenuous crap. Everything National has done in the last five years has been to made access to social welfare harder – whilst corporate welfare is sprayed around like a demented fire-hose.

This has been all the more vile because people like Key and Bennett benefitted from social welfare and fully funded tertiary education that they are denying others. Christ almighty, Bennett even managed to buy a house through the system.

Actually, it is a right. And it is paid to those who were working, before the GFC destroyed 95,000 jobs from 2008 onwards.

Everything this government has done has been a victimisation and shameless appeasement of it’s rightwing constituency. You included, because you know no better.

You’re pathetic, IV. You spend so much time on this blog defending your wealthy masters. Do you really think they give a snot about you?! 😀

Name one person who qualifies for a benefit and isn’t getting one.

Unemployment benefit is no more a right than internet access. The unemployment benefit is paid out of the generosity of taxes paid by those who are working, and is a part of maintaining social order. Nothing more, nothing less.

That is the whole point of the article! Let me explain.. The way a person qualifies for a benefit has been steadily restricted over the past 20 years to such an extent now that people who in the past would have been entitled now cannot get them.

The article asserts that, but gives no examples of mechanisms that have been adopted to achieve this. Further the article asserts that based on a ‘missing’ number the author cannot otherwise explain.

I have no problem with it getting tougher to get a benefit. That is simply prudent management of taxpayers money.

You have obviously been asleep for the past 20 years.

No, I’m discussing the article. When you make assertions, they need to be supported by facts, not presuppositions.

Ok! you obviously haven’t a clue what your talking about so lets give you a few facts shall we…

Nah! I’ll only give you one you could find many more like them yourself if you took the time to go looking. This is a recent example of a restriction – drug testing.. Actually it has been an absolute fail from the numbers tested positive – who can afford drugs when you rely on the pittance begrudgingly given. All it has done is to discourage people even applying whether or not they have been using drugs. There are many more examples like this that have the effect of discouraging people from applying. Meaningless training sessions, hoops and rings to jump through, endless bureaucracy, changing caseworkers, – In the end it becomes easier to sleep on a friends couch, and hope something comes along. This is the reality for 25% of young people under the age of 25..

As I said Macro, I was discussing the article. Please provide the paragraph where the article mentions drug testing.

Also, you said earlier “The way a person qualifies for a benefit has been steadily restricted over the past 20 years”. How is requiring a drug test restricting a persons access to a benefit? Are you seriously suggesting that attending to a drug test somehow magically makes a person not want to draw a benefit? What level of motivation do you ascribe to the unemployed Macro?

““The way a person qualifies for a benefit has been steadily restricted over the past 20 years”. How is requiring a drug test restricting a persons access to a benefit? ”

Let me turn that question around, IV – how is that new drug testing policy relevant to benefits being restricted over the last 20 years?

You’re describing events twenty years apart!

Or, quite simply, the jobs aren’t there in the first place. As this person remarked, on 29 April 2012;

TVNZ Q+A: Transcript of interview

http://tvnz.co.nz/q-and-a-news/transcript-paula-bennett-interview-4856860

Assuming that there’s plenty of jobs is your first mistake.

Blaming the unemployed for being unemployed, is your second.

“Or, quite simply, the jobs aren’t there in the first place.”

And if they aren’t, but the person is taking every possible steps to become employed, they qualify for a benefit. But how will a person know there is no job if they are not taking all possible steps to find one? I’m not letting my taxes (and they are MY taxes) pay for people to sit on a benefit and do nothing about getting of it. Pure and simple.

There are lots of other ways my taxes are used and spent on things I would rather they weren’t; corporate welfare, spying on innocent people, paying for the cop bullyboys to run around chasing after innocent people and destroying their families because they represent some threat only known to them, arresting, charging and jailing innocent people, exorbitant charges on ministerial credit cards. No one seems to be too bothered about these things, or is it that the generally people don’t know that this is where their tax dollars are going. Ok, if there are people getting the unemployment benefit that shouldn’t be – yes I could feel hard done by but due to the officiousness of the powers that be I would think this would never happen. But for those who do not have a job, are looking for work or there are no jobs, the benefit is a Right. What has happened to our society that we would suggest we leave them with nothing and what are the spin offs from this if we don’t care for those in need. Is the right to my tax dollar only for those whose greed and ‘genius’ can trickle down (yeah right) or who have been so reckless that their fall will impact severely on the economy?

Win, what is ‘corporate welfare’? I’ll tell you, it’s left wing sloganism. I’d also be interested to know why you are so anti the police. Seems to me they do a damn good job.

At WINZ this week, I was told by my assigned “case manager” (fyi – they don’t case manage anymore) that I need to call IRD and get proof that I have not been receiving money/working. I responded that I’d be on the phone for hours, which is “a pointless waste of time as your systems cross check everything”, her response was, “Oh no they don’t… that would take way too long and we only do that rarely if someone is under suspicion.”

Funny, when I received one weeks benefit at the same time as my student loan finally kicked in, they were demanding payment (via letter) within a week.

My experience of applying for a benefit now, is it’s all about stalling tactics and farcical hoop jumping. Any mention of money comes right at the end of their sentences and even then it’s suggested that YOU MAY NOT QUALIFY.

Fun fact: I’ve had no job/income now for five months and have resisted going into WINZ until this point. If it were not for my family I’d be literally starving. I’ve lost 15 kilos.

HOOP JUMPER –

as SAM CARROLL describes below, the difficulties people applying for benefits and being on benefits have increased dramatically. Much of it is due to very tight and rigid (unreasonable) “pre benefit activity” expectations. They expect people to do all possible to first get another job, to seek other help and to use up “savings” like redundancy or holiday pay (which under law they can only legally do in some rare cases), before even accepting an application for a benefit. Thousands of people get fobbed off by call centre and front desk staff.

Even when people have a clear enough reason to make an application, they now expect people to deliver all kinds of proof that they need benefit support. For sick this means getting medical certificates, for unemployed a notice terminating employment and what else there may be.

But to expect people to get a letter from IRD, that is new to me. I think that someone at WINZ just wants to make it extra difficult for you. Their staff do often breach their own rules and guidelines.

You can find some of these via their manuals and procedures page:

http://www.workandincome.govt.nz/manuals-and-procedures.html

Often enough they breach the Social Security Act and other law, like natural justice, when making decisions or expecting things off their “customers”.

There is a lot of crap going on with the “designated doctors” they use, who are all even regularly “trained” and “mentored” by WINZ Health and Disability Advisors, all again “managed” and instructed by Dr David Bratt, a highly anti beneficiary “doctor”.

See my comment further below for links to some information.

E.g. this one:

http://accforum.org/forums/index.php?/topic/15463-designated-doctors-%e2%80%93-used-by-work-and-income-some-also-used-by-acc/

What is going on now is absolutely inhumane in many cases! They do not really care, as all they want is to keep people from applying, from claiming and from staying on benefits, and the pressure is RELENTLESS, as Bennett proudly announced, when already in 2010 announcing the Future Focus policies, that led to more sick and disabled being pressured to look for at least part time work, same like sole parents.

I am absolutely astonished about how many Kiwis are so long suffering. In many other countries we would have mass protests outside WINZ kinds of offices.

“The tax cuts for the rich have been paid for by denying entitlements to the poorest and most vulnerable is theft from working people of about a billion dollars a year. It is time to get angry.”

No, it’s time for some facts: In 2009:

1. The top 10 per cent of income earners paid 44 per cent of all personal income tax in New Zealand.

2. If Working for Families and other benefits are taken into account, the top 10 per cent of income earners pay 76 per cent of all net personal tax.

They’re paying more than their share.

This is a tired right wing mantra that completely distorts the tax picture by only looking at income taxes. Obvious points to note:

– 40 of tax is from non income sources – GST being the main one.

– These non income taxes tend to consume a significantly larger proportion of a low income workers income as they spend a larger proportion of their income.

– A significant proportion of wealthy peoples income is not taxed at all – ie capital gains

– Workers have no choice but to pay their tax up front.

– the wealthy are allowed to fiddle their tax to limit their payments.

“A Statistics NZ survey found that couples earning around $50,000 between them spend on average 76 per cent of their gross incomes on items attracting GST, whereas couples earning around $150,000 spend only about 41 per cent of their income on such items. (The rest goes on income tax, savings, mortgages, overseas trips and other items not subject to GST). Dr Salmond says the result is that the total tax rate, combining income tax and GST, actually falls slightly from about 29 per cent on those with the lowest incomes to about 24 per cent on those like the Bradleys on around $50,000, then rises slowly to about 34 per cent around $150,000.”

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10783837

Johnnie Sparkles wants to make sure he looks good to all his adoring Tory voters the harder he smashes the lazy unemployed bludgers who can’t be bothered getting a job the better he looks in the eyes of his supporters.

You’re talking about the % of a persons income spent in tax, I’m talking about the proportion of the total tax take. Including all taxes, the wealthy pay their fair share. The % of a persons income spent on total taxes is irrelevant.

The proportion of the total tax take obtained from the top 10% is only a bit above their percentage of total income – as would be expected in even our slightly progressive tax system. Since the top 1% earn about 9% of total pre tax income according to Brian Easton and have about 16% of total wealth. The top 10% (whose income in nine times the bottom 10%) get get about 30% of total income (excluding capital gains) and have 50% of total wealth and pay about 43% of total tax – one of the lowest shares in relation to income of any wealthy country. The top 10% got $2.2b a year in tax cuts in 2010 which they clearly did not need.

Now you are conflating income and wealth. We don’t pay taxes on wealth (at least not directly), so stick to the point. And comparisons with other countries, with vastly different tax systems, are irrelevant. Your figures say that 10% of the tax payers earn 30% of the total income and pay 43% of the total tax. That shows just how much of share they are carrying.

IV – has it ever occurred to you that if the rich earn more, it’s logical that they should pay more tax?!

What else would you base it on?

But it’s not quite as simple, as Mike is trying to point out to you. Because overall taxation is paid in many forms – including indirect taxation – and, yes, low income earnerrs do pay more than their fair share because – and I emphasise this for your attention-span – they cannot escape paying it.

I also wonder why you’re so concerned for “the wealthy pay[ing] their fair share” of taxation. You do realise they don’t give a rats about you?

It would be like a peasant in medieval England being highly concerned for the health and wellbeing of his feudal overlord.

Your concern for your rich masters is touching. But sadly misguided.

“has it ever occurred to you that if the rich earn more, it’s logical that they should pay more tax?! ”

Yes. And they do. They earn 30% of the total income and pay 43% of the total tax.

You’re still cherry-picking figures to suit your own agenda.

Dishonest.

No it’s not cherry picking Frank. Any amount any individual pays over and above the lowest tax rate is disproportionate, and represents a higher contribution to public services. Higher income earners pay for more, yet they get the same. It is as simple as that.

…and this is what you said:

“has it ever occurred to you that if the rich earn more, it’s logical that they should pay more tax?! ”

What you don’t seem willing to accept is that they do. They earn more, and therefore pay more personal income tax, and they spend more, and therefore pay more GST.

It’s really very simple.

These arguments all get quite tiresome IV. The top earners often get there through privelege and good fortune rather than hard work or personal virtue. I.e Mum and Dad give them the leg up to where they are today. It is their duty to share their good fortune if they want to live in our society. After all if inequality continues the way it is our society will be a hell of a place for everyone to be. I wonder what happened to the idea that as worksaving technology increased we would all have to work less. Oh I forgot, the wealthy entrepreneurs took controll of it all, kept the wealth to themselves, made some people work harder for less and kept the rest unemployed. We need a major social correction.

That is complete rubbish. On all counts. I know dozens of wealthy people, and none, I repeat NONE came from moneyed families. You can repeat this left wing mantra if you wish, but don’t expect those of us ho live in the real world to swallow it. Also…income inequality is actually on the decline (albeit only very slight), and since 2004 has certainly not increased.

Facts please.

There is considerable truth in that, Dawn.

That “leg up” doesn’t have to be in the form of direct cash hand outs (though $100,000 for a new Aston wouldn’t go astray).

“Eg ups” can be in the form of private schooling; support for business adventures; paying for overseas experience; goof clothes; decent food; the latest technological consumer goods – all things which create an environment for Future Top Earners where they can’t fail.

Of course, there are certain exceptions; Key and Bennett amongst them.

But ironically, despite not having wealthy parents, both Key and Bennett had the benefit of considerable state assistance. Chief amongst them; subsidised State housing and a fully-funded free tertiary education.

How could they not fail?

But then, successive New Right regimes ended free tertiary education by 1992, and Bennett scrapped the Training Incentive Allowance in 2009.

Of course, a few RWNJs may jump up and down and scream that their masters got their wealth through “hard work”. Which kind of implies that only the rich work whilst the rest of us are slackers.

Put things into some kind of context and it all seems so obvious…

Since you think that requiring tertiary students to pay for part of the costs of their education has been so detrimental can you actually provide evidence to support this view?

The sort of evidence that would be beneficial to your argument would be say the trend of the proportion of the population attending and completing a Tertiary qualification since an element of user pays was introduced.

What would also be beneficial to your argument would be the trend in the numbers of people from lower socio-economic communities attending Tertiary institutions.

Do you have any of these figures Frank?

So let me get this straight… are you suggesting that more people took up tertiary education because it suddenly cost them to do so?!

Is that what you’re implying?

No. Spending hours on research for your inane questions is a monumental waste of time. I’ve done it in the past, only to have you ignore it.

So, short answer; no.

If, however, I come across the info in my “travels” upon the interweb, I’ll happily share it with you.

Then you can duly ignore it, as per usual.

This might help you find the answers to those questions Frank

http://www.fulbright.org.nz/wp-content/uploads/2011/12/axford2002_mclaughlin.pdf

Please note the following quote:

“Due to increased private contributions coupled with a demand-driven system of public subsidies to institutions, the competitive policies of the late 1980s and 1990s resulted in significantly higher participation in tertiary education. New Zealand moved from more or less free tertiary education and relatively universal student allowances to a situation where fees are charged to students, student allowances are highly targeted by income and student loans are widely used. Government policy moved from subsidising a smaller number of students at a higher rate—often referred to as an elite system—to subsidising a larger number of

students at a lower amount per student—often referred to as a mass system of tertiary education.”

…

An American, telling us how we should conduct our education system, when the US ranks even lower than we do, on the OECD PISA system?! http://www.oecd.org/pisa/keyfindings/PISA-2012-results-US.pdf

Oh yeah. That works. *note: sarcasm*

Couple of points to consider Frank.

First off PISA results have nothing to do with Tertiary results and/or participation rates. They are related to non Tertiary educational achievement.

Secondly whether or not you have an issue with the source of the article, (although I suggest you look in to what Fulbright organisation actually does. You might be surprised), the data that was used to make the claim is easily verifiable. That data, if you bothered to check, would show that participation rates in Tertiary education has increased and not decreased since the introduction of partial user pays.

You are not suggesting surely that the increase is due to students having to pay more for their tertiary education?

I have worked most of my life, and when the work has run out, until recently found a benefit helpful in getting me back into work. However my most recent experience has left me flabbergasted.

Having recently had a baby the lack of support has hit even harder, and on numerous occasions my partner has wished we had simply broken up, as this would have immediately eased her financial stress, entitling her to the domestic purposes benefit. My most recent job could only find me 14-16 hours work weekly, which fell under the 20 hour threshold for decent family support. To try to make things better for us, I applied for and was accepted into a live-in 7 week intensive course leading to a full time salaried position.

In late September last year, six weeks before the course was to commence I arranged an appointment with WINZ, and attended a meeting with all the necessary paperwork detailing the good news, and asking for some assistance until my first salary is paid in mid February. The course did not qualify for any Studylink assistance, and so I could see no other option, and figured that as someone who has paid their taxes over twenty years of employment in NZ I deserved some help, especially as it was clear that I had work to go to.

The first response was that I should come back closer to the time, which is hardly reassuring. I made another appointment a few weeks later, and was told that I may qualify for temporary assistance, and that I needed to complete an online form. I found the form I had been recommended online and spent over an hour filling in the online form, only for the website to crash, and when I went back to do it again, none of the information had been saved, ironic from a government that has introduced the GCSB bill, hell bent on saving everything that hits the internet… (when it is in their interest to do so.) As I repeated the process, as someone with a University degree, and capable with computers, I couldn’t help but think of those less fortunate, and how this very form would be beyond many people, and could easily take three times as long.

I expected with such a considerable amount of detail requested that it was being processed, but with no reply my partner arranged a meeting to check what was happening. As I was attending the course she attended without me, and with our baby. She was there for an hour as the inexperienced case manager made calls to the head office, asking about our progress, and what could be done. After another hour, our baby was tired, hungry, beginning to cry, and we still had no answer. Eventually she simply had to leave, with one small food grant to show for two months of trying.

Numerous phone calls later we were eventually told that we had applied for the wrong benefit, and that it was in fact a job seekers allowance we should have applied for, and this was a different online form. (Another hour long process, essentially repeating all the questions we had already answered, but with a different heading, and a couple of other bits)

Upon submitting it just before Christmas we were unable to get an appointment until the new year, and so needless to say a humble Christmas lunch was had at the homestead we wondered how long we could remain living in.

when we could eventually make an appointment on the phone I was told that I had to attend a search for work seminar. I repeatedly explained to the call centre operator that I had a job starting in a few weeks, and I would be paid in 5 weeks, so really didn’t need to search for work, as the full time intensive nature of the course didn’t allow any time for work, it barely allowed any time to duck away for the seminar.

She insisted that everyone needed to attend to qualify for the job seekers benefit, so I booked it, and arranged the time off the course to attend. Upon attending I showed the course operator the signed contract I had commencing shortly, and he said that the call centre operator had got it wrong, and I should arrange a meeting with a case manager.

I did so, and he said to me that as I had a signed contract I didn’t qualify for the job-seekers allowance, and so not seeing any way I could get through the next month or more until my first paycheck I simply stated that I am seriously considering ripping up the contract, quitting the course and doing everything I could to comply with their requirements for some form of assistance. My baby had to travel to Auckland for an operation, we had missed rent, and stress was causing both of her parents ill-health too.

Basically if the contract was standing in the way of us eating and being housed over the next month it had to go. Desperation causes some rash decisions, but I couldn’t see any other way.

He said that I should call him back, arrange another meeting, and he will talk to some people about my situation to see if they could make a special case.

I called his direct dial, and left a message with my return number. Three times. He has still not given me the courtesy of a return call. I have now given up.

I am sure I am just one of many that can testify first hand to exactly what this blog speaks about.

Sam, I’ve heard stories similar to yours.

It’s a crazy system that is now so complex; so unwieldy; with so many barriers; that if it were a private company, it would’ve collapsed a long time ago.

There are people I’ve accompanied to WINZ, and advocated for, that would not have had a clue how to navigate the system.

Many would have given up and sought “alternative” sources of income (illegal sources).

Unfortunately, most New Zealanders (IV, Gosman, being clear examples) who are naive and haven’t a clue what’s going on within the WINZ system.

Your experience is a reflection of what might laughably be called current “best practice” for WINZ as defined by the Minister. There’ll be a performance review system that covers everybody working for WINZ, in which performance is assessed based on minimisation of the amount given out in benefits. If you’re a WINZ worker and your boss has to sit down every year with their superior and be rated on how well they’ve done at minimising payments to beneficiaries, you will either develop a lack of conscience about creating an impenetrable labyrinth for benefit applicants or find another line of work – or be made to suffer in all the different ways that your boss can make you suffer.

Several people I’m very close to work as Case Managers for MSD, they tell me their performance is never judged by the “minimisation of the amount given out in payments”,however, their performance is judged on their ability to return people to the work force.

The MSD staff I know mostly empathise with their clients as they know how easy it could be for them to be sitting on the other side of the desk.

The idea that performance of the department isn’t being measured in terms of minimising benefit liability would be more believable if the Minister wasn’t issuing press statements in which that’s exactly the measure of performance used.

Indeed. Referring to this, Milt? http://www.msd.govt.nz/about-msd-and-our-work/newsroom/media-releases/2014/taylor-fry-welfare-valuation.html

Milt,

I haven’t seen the press release you refer to, however, I suspect “minimising benifits liability” is probably the minister’s phse for returning more people to the work force.

Remember this minister also thinks it’s perfectly OK for her to release a client’s details to the media, something that would call for instant dismissal of any of her MSD staff. I would suggest that most of her case managers are better informed than she is about MSD protocol.

I also except that some case managers and CSRs manning the phones will many mistakes at times, some caused by the myriad of nefarious changes this government has made to welfare system.

Sorry to hear about your stressful dealings with WINZ. Having had to deal with them when my husband was made redundant we did find out about a Returning to work Grant. You can claim up to $1500 for returning to work expenses which you do not have to pay back. This is what WINZ staff should be advising you of.

Yes, Mike, you are onto it, and it will get worse, we will have outsourced “service providers” start assessing sick and disabled on benefits next month, “independently” MSD say, but that is a smoke screen and misinformation, they are going to do all to drive sick and disabled into “job seekers”!

It all comes from the UK, and the ideal helper to drive for the “work will set you free” agenda is Professor Mansel Aylward, former Chief Medical Officer for DWP in the UK, then a voluntary mercenary “doctor” and “researcher” to develop the perfect “scientific” proof, that work will “set you free”, no matter how sick and disabled you are. He and his department were paid by UNUM Provident, part of the UNUM insurance group from the UK, that were convicted and banned to do business in 13 US states!

It was the same corporation that was allowed to “consult” and “advise” even the UK governments on welfare “reforms”. Now we have the same “experts” do the same crap here, and sell it as “supportive”, same as the government, for whom this is the ideal solution.

A Dr David Beaumont is part of the plan, who worked for ATOS in the UK, then advised MSD and ACC, and he runs his own private “rehab” business called “Pathways to Work” here in NZ! And we also have a “Principal Health Advisor” Dr David Bratt, comparing benefit dependence to “drug dependence” right here, working as top advisor for MSD and WINZ, also lecturing their supposedly “independent” designated doctors!

There are many into the money here, and it is bizarre, how this government can make contracts to outsource “mental health employment services” to Workwise, because they had Helen Lockett, their policy advisor, sit on the Health and Disability Panel, that “advised” Bennett and the government on “welfare reform”, suggesting outsourcing. Talk about conflicts of interest, corruption, perhaps, it is all here, right in NZ!

Read up and study up on this, and it summarises the whole stuff and agenda, you will not believe what goes on, dear folks, but it needs study, I am afraid, as the headlines will not tell you all:

http://accforum.org/forums/index.php?/topic/15188-medical-and-work-capability-assessments-based-on-the-bps-model-aimed-at-disentiteling-affected-from-welfare-benefits-and-acc-compo/

http://accforum.org/forums/index.php?/topic/15463-designated-doctors-%e2%80%93-used-by-work-and-income-some-also-used-by-acc/

http://accforum.org/forums/index.php?/topic/15264-welfare-reform-the-health-and-disability-panel-msd-the-truth-behind-the-agenda/

Read especially the last bits in those posts, which have been updated and tell about the outsourcing that goes on, that sick and disabled are now facing, close to modern forms of eugenics.

The drive is to force unemployed off benefits, even sick and diseabled now, and they will lose entitlements in their thousands soon.

If you care for a humane society, take a stand please!!!

[…] numbers officially unemployed and those getting a benefit are highlighted in Mike Treen’s blog Billions of Dollars Stolen From The Unemployed . Worryingly the evidence around us suggests that a high price is being paid by those who have […]

Billions of dollars were / are stolen from NZ farmers and the unemployed are as a consequence of that . And before you throw yourselves off your feet with a violent attack of the eye rollings , do your research .

148,300 unemployed at September 2013

126,470 on Jobseeker Support at September 2013

see data tables

http://www.msd.govt.nz/about-msd-and-our-work/publications-resources/statistics/benefit/index.html

These are not comparable. Half the jobseeker support category have an illness or disability as it includes people previously on the sickness benefit. In fact the new benefit includes those previously receiving the Unemployment Benefit; Sickness Benefit; Domestic Purposes Benefit – Women Alone; Domestic Purposes Benefit – Sole Parent if youngest child is aged 14 and over; Widow’s Benefit – without children, or if youngest child is aged 14 and over.

They are all work-tested even if only part-time (eg with a HCD). Therefore they would describe themselves (for HLFS purposes) as actively looking for and available to work.

“There was also no significant increase in other working age benefits like sickness, invalid or sole parent benefits to account for the missing number of those receiving the unemployment benefit. ”

“Billions of dollars stolen”.

Your post implies there are around 110,000 people who are unemployed with no access to a benefit. That’s incorrect.

Just because this current shabby government is re-writing the rulebook to suit it’s own agenda, doesn’t necessarily make it so, Lindsay. You know this. As a member of the Libertarianz and then Act, you railed against the previous Labour government enough times.

Frank, I have always “railed against” welfare dependency. Currently not a member of any political party, I try to keep to the facts. Bottom line is 85 percent of those officially unemployed were supported by a benefit at September 2013. And I am glad they were. I’ll be even gladder if and when they can find work, Lindsay

So, Lindsay, do you know how how many of those 85%, relying on a benefit, were “welfare dependent”?

It’s never been answered when I’ve asked that question.

“As at the end of June 2013, 74,559 clients were receiving a JS equivalent benefit for more than 12 months. This was made up of:

39,776 (approximately 53%) receiving Sickness Benefit

20,985 (approximately 28%) receiving Unemployment Related Benefits

10,560 (approximately 14%) receiving DPB sole parent whose youngest children are over 14 or DPB Women Alone

3,238 (approximately 4%) receiving Widow’s Benefit with no children or whose youngest children are over 14.”

http://www.ssc.govt.nz/bps-reducing-dependence

Reading the cite above, the Govt’s focus seems to be on reducing long term (defined as 12 months or more) welfare dependency. There are some excellent social and economic reasons outlined for achieving this.

For people unable to support themselves for genuine reasons (a life changing injury or illness being one example) I believe we are morally obligated to provide assistance, possibly for the life of that individual. But those who are able to work must be available to work, or there should be no benefit. Plain and simple.

Further, the policy is working. Since June 2012 numbers on JSS have decreased by 3,595, including a 14% drop in numbers claiming the DPB, and a 16% drop in numbers claiming the Widows benefit. These are real people who have been placed into real jobs. This has to be good news for them and for society as a whole.

“But those who are able to work must be available to work, or there should be no benefit. Plain and simple. – ”

Yeahhhh, nah.

You forgot one part of your little black&white statement; jobs.

Where. Are. The. Jobs?

By making your statement, you are casually implying that jobs are available, and the unemployed are deliberately ignoring them.

Rubbish.

Without that vital little ingredient (jobs), you’re simply engaging in pointless judgementalism (as usual) and parroting cliches (as usual).

I refer your attention to this; http://fmacskasy.wordpress.com/employment-unemployment-fact-sheet-1-queues-for-vacancies/

When 2,700 people turn up for 150 vacancies, what does that tell you?

You are totally missing the point Frank. At any one moment in time, even during the recession, there are jobs available. Maybe not enough, but who’s to know what’s available if you aren’t looking?

If your actively looking, and can’t find something, you get a benefit. If you aren’t actively looking, tough.

So you concur, IV, that there AREN’T enough jobs?

IV – if that post at 10.13 was supposed to answer my question, it failed.

Being supported by a benefit is not the same as “welfare dependency”.

The vast majority want to get off welfare and into a job that pays significantly more money.

So, for the second time, I repeat; do you know how how many of those 85%, relying on a benefit, were “welfare dependent”?

Based on the definition of welfare dependency used in the cite, the data answered the question.

The reality though is that anyone on a benefit at all is ‘welfare dependent’. The real issue is how many are in a long term cycle of welfare dependency, and that is what this Govt. is trying to resolve, and quite successfully I might add.

You’ve now avoided answering the question for a second (or third – I lost count) time.

The answer is, of course, there are no stats relating to the number of people who are “long term welfare dependent”. You, Lindsay, and other rightwingers simply parrot these cliches without a single thought given to their accuracy.

Congratulations for assisting me in showng up the mendacities which the Right uses.

The problem is the left cannot point to any country where job creation by government is very successful in any meaningful way. Most of the European countries following a government led approach on this issue have higher rates of unemployment than those the let the private sector take the lead. As this article points out the best way of dealing with unemployment is to encourage the private sector to employ more people by allowing more flexibility in the labour market, a policy the left around the world is loath to follow.

http://www.telegraph.co.uk/finance/economics/9914644/Unemployment-in-France-hits-14-year-high.html

[…] in my article. A pretty furious argument ensued in the comments section which readers can look at here. I replied to one commentator with some additional facts that may also be of interest to Unite Blog […]

[…] in my article. A pretty furious argument ensued in the comments section which readers can look at here. I replied to one commentator with some additional facts that may also be of interest to Unite Blog […]

@ IV;

And just how do you know “they aren’t looking”?

What do you base that on , except blind, wilfull ignorance and prejudice?

When 2,700 people turn up for 150 job vacancies, what the f**k does that tell you? Or are you blind to that as well. (You have to be blind, IV, otherwise your worldview – naive as it is – would collapse.)

Even Paula Bennett – your political mistress – admitted on national television that there weren’t enough jobs to go around or we wouldn’t have the high (7.2%!) unemployment we currently do.

If a member of this right wing, incompetent government can admit that salient point why can’t you?!

So far you’ve made many assumptions about the unemployed, IV, and when requested to back up with facts and figures, you duck behind more parroted, redneck cliches and stereotyping.

Well guess what, sunshine, that don’t cut the mustard. You’ve brought scissors to a gun-fight, intellectually speaking, and with each post, the reader can determine that you have nothing to base your beliefs on.

I’ve answered that Frank with respect to my tenant. (Assuming that post hasn’t been removed?) I personally know a number of people who are on the benefit and are not looking for work. It is totally irrelevant whether there are enough jobs for everyone looking. If you aren’t looking, you won’t get a job, an if you aren’t looking, you shouldn’t be getting a benefit.

Here it is…

“Because I know of many such people.

Two such people live a rental property I own. They have two children, neither work, neither are in any way incapacitated. The family receives substantial support from the taxpayer, including an accommodation supplement to contribute towards their housing costs.

For the past twelve months I have been working with them to help them get back on track after they got behind in their rent. During that time the man of the house has not, to my knowledge, attended a single job interview. When I organised some labouring work for him, he failed to show up.

On Thursday of last week, this delightful couple did a runner, leaving behind most of their earthly belongings, and thousands of dollars in debt.

I can’t even enter my own property until I get the eviction notice that I have applied for, likely to be this Tuesday.

These people are bludgers, living off the taxes you and I pay. How many more examples would you like?”

Previously posted at https://thedailyblog.co.nz/2014/01/30/60-a-start-but-welfare-reforms-must-go-too/#comment-184827

@ IV:

Oh?

So the unemployed ARE looking for jobs then?!

But, up till now you’ve been saying that they have been lazy slackers?!

Now you’re using the drop in welfare stats to show that the jobless are jobseeking and (some) are finding work?

So really, they are looking for work then?

Or maybe, what you are actually implying is that the drop in welfare recipients is because the National Government, wielding a f*****g big stick, forced them into work?

So really, you’re trying to have it both ways, IV. You’re implying that the unemployed are long-term welfare dependent and not looking for jobs – but when they did find work, it was due to Paula Bennett finding them jobs and forcing them back to work.

Have I missed anything out?

Your worldview of the life of the unemployed, solo-mothers (but never solo-dads, I notice), widows, invalids, et al, is a sad and sorry one, IV.

It borders on a kind of socio-economic paranoia where you see anyone/everyone receiving welfare as a potential parasite.

Yet, as the same time, you wilfully turn your back on the real parasites in life; corporate welfare and the exploitation of human beings by a small oligarchy of business, political, and bureacrat “elites” (the 1%, in common parlance).

Your role in this life, IV, while you draw breath, is to serve their interests and parrot their cliched rhetoric without thought or question. You are their loyal servant until the day you die.

God, I pity you, and others like you.

“So the unemployed ARE looking for jobs then?!”

Yep, they are now.

“But, up till now you’ve been saying that they have been lazy slackers?!”

Oh certainly some have. The stats are clear on that.

“…you’re trying to have it both ways, IV. You’re implying that the unemployed are long-term welfare dependent and not looking for jobs – but when they did find work, it was due to Paula Bennett finding them jobs and forcing them back to work.”

In some cases, absolutely.

It’s good to see your coming around Frank.

What stats?!

Please share with us.

No answer. As usual.

The stats on the numbers of people who have come off benefits since the welfare reforms began. It’s not difficult Frank.

@ Gosman,

Jesus, Gosman! Who the f**k do you think built the roads, bridges, hospitals, schools, tewlevision and phone networks; dams; transmission lines; rail network; airlines; etc, etc, etc in this country?!

The construction of that infra-structure was done by the State. employing thousands of people!

Christ man, you’re using the internet, based on the old copper wires laid down by the New Zealand Post Office, a State entity!!! Oh good lord, the irony… A libertarian promoting free market ideology on a communications system based on State-built infra-structure!!!

Is that “meaningful” enough for you?

Those are all short term boosts to job creation and are not effective long term. Most of the old commercial enterprises in NZ pre the SOE model lost millions of dollars. If you want to go back to that model then accept that the NZ taxpayer and.or consumer will have to subsidise them. Just look at Greece to see where that leads.

” Just look at Greece to see where that leads” – is not a rational response to everything in politics and economics, Gosman. Just thought I’d point that out to you.

The rest of your post is nonsense.

Especially when it was the very neoliberal free market methods that Gosman loves so much that actually wrecked Greece – he NEVER mentions how Goldman Sachs collaborated with the Greek Government to hide the levels of debt that were being manipulated and built up.

Indeed, Martyn.

Perhaps Gosman should inform himself with these two articles,

Wall St. Helped to Mask Debt Fueling Europe’s Crisis

http://www.nytimes.com/2010/02/14/business/global/14debt.html?pagewanted=all&_r=0

Goldman Secret Greece Loan Shows Two Sinners as Client Unravels

http://www.bloomberg.com/news/2012-03-06/goldman-secret-greece-loan-shows-two-sinners-as-client-unravels.html

Hmmm, no doubt it was Labour’s fault. 😉

Gosman is incapable of informing himself of anything that may run counter to his ideology.

He can’t even grasp the implications of a exponential, economical growth model, no matter how many times it’s explained to him. Maybe I should have tried an even simpler example for him…namely…if a lily growing in the middle of a pond doubles in size every day, it will be some time before the pond is half covered but only one day for the pond to go from half to fully covered.

What a load of nonsense.

The fact is Greece is in a mess because they couldn’t control their government spending. They couldn’t control their government spending because they had too many loss making public entities such as the Greek railways.

Whether or not Goldman Sachs once lent them some money so they could continue spending money on loss making parastatals and white elephant projects is irrelevant.

Once again left wingers failing to accept responsibility for the failure of left wing economic policies.

I think there might be a blog post in that…

That’s great Gosman, when you reach TDB stat levels on that tiny blog of yours I’ll get worried, until then http://www.spiegel.de/international/europe/greek-debt-crisis-how-goldman-sachs-helped-greece-to-mask-its-true-debt-a-676634.html

So what is your point Martyn? Are you suggesting that because TDB’s readership is far less than WOBH’s that you are less credible that Slater?

There are many reasons for Greece’s financial problems and your pointing to not controlling their spending is, as usual for you, a gross over-simplification.

Part of Greece’s over-spending was because of their SECOND HIGHEST military expenditure in NATO. Source: http://www.nytimes.com/2013/01/08/world/europe/08iht-letter08.html?_r=1&

Another was their chronic tax avoidance which lost an estimated $20 billion per year. Source: http://www.businessweek.com/ap/financialnews/D9FF7K681.htm

And as any good leftist will tell you, you can’t begin to have decent public services unless they are paid for. Tax cuts or evasion will inevitably lead to a cut in public spending on public services.

Hopefully this is a lesson not lost on people in this country who want both tax cuts AND a good public service sector. You can’t have both (unless we are Norway).

There are other reasons as well for Greece’s financial woes and referring simply to “loss making parastatals and white elephant projects” simplifies a complex problem.

Indulging yourself in wishful thinking about “bloated State” fantasies is simply fooling yourself. The rest of us find your burblings amusing, but not very helpful.

Matt McCarten wrote a NZ Herald article based on Mike Treen’s research into this subject, so I thought it would be useful for Herald readers to have a link to this original post. Matt’s article is the “most commented” with 191 people responding, however, my comment is not amongst them. Oversight or censorship?

[…] read Mike Treen’s excellent analysis on The Daily Blog, on 30 […]

[…] wing blogger has made a fool of themselves trying to dispute figures first revealed by me in the Dailyblog about how a huge gap had grown up between the number on benefits and the number being recorded as […]

[…] wing blogger has made a fool of themselves trying to dispute figures first revealed by me in the Dailyblog about how a huge gap had grown up between the number on benefits and the number being recorded as […]

Comments are closed.