Headline: Billions of dollars stolen from the unemployed

By Mike Treen

(Reprinted from the Daily Blog)

The combined efforts of both National and Labour governments’ punitive policies towards the unemployed seems to have removed over 100,000 people from rightful access to an unemployment benefit.

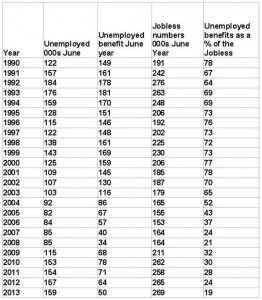

Until the mid-2000s there was a broad correlation between the number officially counted as unemployed through the Household Labour Force Survey (HLFS) and the number getting an unemployment benefit at the same time even though they were being measured in different ways.

In fact, the number on benefits exceeded the number as recorded by the HLFS by an average of about 30,000 in the late 1990s and early 2000s. The economic recovery that had set in by that time saw both numbers drop significantly.

However, around the mid 2000s the Labour government introduced a severe case management regime that seemed designed to prevent people accessing their entitlements rather than encouraging them to. The numbers on the unemployment benefit began to fall dramatically faster than the HLFS unemployment number until the gap hit 50,000 in 2008.

The international crisis and recession of 2008-10 sent the HLFS unemployment numbers soaring but the new National government’s even more punitive regime managed to keep the numbers on a benefit from increasing anywhere near as fast. The number of those on average receiving a benefit compared to the number of unemployed in the household survey is now about 130,000 fewer than it was in the late 1990s.

The missing 130,000 are the reason why so many social agencies are being inundated for help for food, clothing, shelter despite the so-called recovery in the economy over the last year.

There was also no significant increase in other working age benefits like sickness, invalid or sole parent benefits to account for the missing number of those receiving the unemployment benefit.

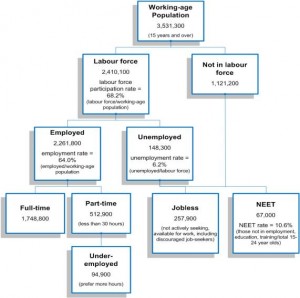

To make matters worse the HLFS is actually a very narrow measure of unemployment. To be counted you have to be physically able and ready for work, not be enrolled in a education course, and to have actively sought work in the last 4 weeks other than looking in a newspaper. You are also disqualified if you have worked one hour in the survey week – even if unpaid in your family dairy.

The broader measure of “jobless” which is also collected in the HLFS is actually a more useful figure. This number includes those actively seeking work but unable to start immediately, those available and only seeking work through newspaper advertisements or not actively seeking work for some other reason, and those discouraged from looking for work at all.

Graph of the September 2013 HLFS shows 148,000 Unemployed, 258,000 Jobless, and 95,000 Underemployed.

Using this number we find that those on benefits as a percentage of the broader jobless category went from around 70% in the late 1990s to less than 20% today. There is no scientific explanation for this to happen except for the policies of the government making it happen. But there is a price that is paid – and it is one of human misery on a wide scale.

These numbers need to be given a human face. The unemployed are not just numbers. They are working people trying to survive in an unjust capitalist system that is happy to use us when the capitalists need us but want to discard us when they don’t and not even provide the minimal emergency support we are legally entitled to.

The demonising of the unemployed as bludgers is a lie and has always been a lie. Welfare fraud is minuscule compared to tax fraud by the rich but prosecuted much more vigorously. There has been a massive denial of entitlements to the unemployed over then last decade that is probably worth billions of dollars. The tax cuts for the rich have been paid for by denying entitlements to the poorest and most vulnerable is theft from working people of about a billion dollars a year. It is time to get angry.

NB: The numbers used in this article compare the number of unemployed, jobless and beneficiaries are taken from the Department of Statistics available on their Infoshare website. I use annual figures for the June year to remove seasonal or other factors. The one figure not available was the 2013 number for beneficiaries which I have done an estimate for.

After I wrote the article on the daily blog some right wingers took exception to the wealthy being denigrated in my article. A pretty furious argument ensued in the comments section which readers can look at here. I replied to one commentator with some additional facts that may also be of interest to Unite Blog readers in the following exchange:

“Intrinsic Value” wrote:

“The tax cuts for the rich have been paid for by denying entitlements to the poorest and most vulnerable is theft from working people of about a billion dollars a year. It is time to get angry.”

No, it’s time for some facts: In 2009:

1. The top 10 per cent of income earners paid 44 per cent of all personal income tax in New Zealand.

2. If Working for Families and other benefits are taken into account, the top 10 per cent of income earners pay 76 per cent of all net personal tax.

They’re paying more than their share.

I replied:

This is a tired right wing mantra that completely distorts the tax picture by only looking at income taxes.

Obvious points to note:

– 40 of tax is from non income sources – GST being the main one.

– These non income taxes tend to consume a significantly larger proportion of a low income workers income as they spend a larger proportion of their income.

– A significant proportion of wealthy peoples income is not taxed at all – ie capital gains – Workers have no choice but to pay their tax up front.

– the wealthy are allowed to fiddle their tax to limit their payments.

“A Statistics NZ survey found that couples earning around $50,000 between them spend on average 76 per cent of their gross incomes on items attracting GST, whereas couples earning around $150,000 spend only about 41 per cent of their income on such items. (The rest goes on income tax, savings, mortgages, overseas trips and other items not subject to GST). Dr Salmond says the result is that the total tax rate, combining income tax and GST, actually falls slightly from about 29 per cent on those with the lowest incomes to about 24 per cent on those like the Bradleys on around $50,000, then rises slowly to about 34 per cent around $150,000.” See “Divided Auckland: NZ tax on rich among lowest in the world” http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10783837

“Intrinsic Value” responded:

You’re talking about the % of a persons income spent in tax, I’m talking about the proportion of the total tax take. Including all taxes, the wealthy pay their fair share. The % of a persons income spent on total taxes is irrelevant.

I replied again:

The proportion of the total tax take obtained from the top 10% is only a bit above their percentage of total income – as would be expected in even our slightly progressive tax system. Since the top 1% earn about 9% of total pre tax income according to Brian Easton and have about 16% of total wealth.

The top 10% (whose income in nine times the bottom 10%) get get about 30% of total income (excluding capital gains) and have 50% of total wealth and pay about 43% of total tax – one of the lowest shares in relation to income of any wealthy country. The top 10% got $2.2b a year in tax cuts in 2010 which they clearly did not need.

(Unite National Director Mike Treen has a blog hosted on the TheDailyBlog website. The site is sponsored by several unions and hosts some of New Zealand’s leading progressive commentators. Mike’s blog will be covering union news and general political comment but the views expressed are his own and not necessarily those of Unite Union.)

—