We can help solve child poverty – here is one crucial way how

Good on the Tax Working Group (TWG)for wading its way through endless submissions on future tax reform from the public. Will they have enough time left over to do the needed work?

CPAG and Oxfam co-presented last Friday in the spectacular offices of PWC overlooking the sparkling Waitemata. We were assured by the chair Sir Michael Cullen that the TWG appreciated that our submissions were clear and to the point and the TWG had actually read them. Whew. Tax can be a turgid topic.

The room was large and the acoustics poor. Around 15 or more members, advisors and officials clustered around a large boardroom table. The process was running well behind time, so we could only answer specific questions. So much to say, so little time. How are they going to assimilate all the views from all the submissions? Will justice be done to this daunting task?

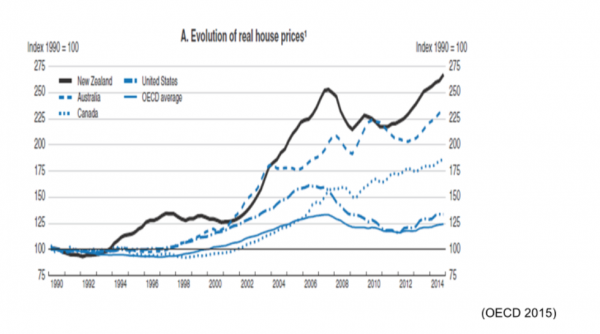

I wanted to really drive home from CPAG’s submission that New Zealand has been in the grips of an extraordinary speculative housing bubble. We are the new Ireland.

There is an ample supply of housing overall, but it is poorly distributed in terms of size and price. Increasingly large gains in house values are accruing for the already wealthy while the poorest households suffer excessive rents or lose housing access to housing altogether.

The inevitable divide between children who thrive and those who don’t is now strikingly along housing lines.

Taking the balance sheet approach required by a social capital lens suggests a grave deficit especially from the child’s perceptive. CPAG submits that the lack of a principled-based approach to the taxation of housing has been a prime driver of the now precipitous state of our housing market which has in turn perpetuated rising inequality and deep child poverty.

Our latest analysis: Will children get the help they need? shows families on full core benefits paying typical rents in Auckland and getting the maximum accommodation assistance, fall well below, not just the 60% poverty line, nor the 50% nor even the impossibly low 40%, but they fall below the 30% line. At these subsistence levels, with no housing security and nothing in reserve, families drift to the outer margins of society. In the meantime, the median housing price has risen to over $2 million in several suburbs and mansions of $5-$20m plus are more common.

A radical rethink of the taxation of housing is needed if the situation is not to devolve into irreversible calamity in the next ten years.

We argue that horse has bolted, and it is too late for capital gains tax. In any case, the history of taskforces trying to design a capital gains tax suggests that the 2018 TWG too will revisit all the old arguments and problems and, in the end, government will walk away from it as happened 1990, 2000 and 2010. It is simply, too hard.

In the meantime, the wealth accumulation of the wealthiest households continues exponentially, and the accruing income is untaxed, apart from easy-to-avoid bright line rules around truly speculative property investment. This growing imbalance will worsen poverty and further undermine the efficiency of the economy and social stability.

Currently landlords can deduct costs including full nominal mortgage interest costs against other income for tax purposes. The present Government’s proposal to ring fence-losses from rental property investment is a very partial and inadequate response. Losses from one property are still able to be offset against others that make profits, or carried forward and written off eventually. There is a five-year ‘bright line’ test that captures short-term capital gains but it is not enough on its own.

CPAG urges that a net housing equity tax is developed.

A person would be assessed on total housing owned, less registered mortgages. This net equity would be treated as if it had been put into a deposit at the bank at say 3-4%. This deemed income would be added to other income and taxed at the person’s marginal tax rate.

The present Government has taken the owner-occupied home off the TWG’s table. The danger is that elaborate owner-occupied housing becomes even more attractive as a result. It would be better to allow a generous exemption for a home, say up to say $1 million net equity per person but to still include owner-occupied housing in the tax net. The young with high mortgages on their own home are protected and modest freehold owner-occupied homes fall outside this net, but very high value owner-occupied mansions are captured.

A net equity housing tax is simpler than the current messy tax situation for landlords. Under the net equity approach any incentive for landlords and property investors to engage in intricate tax avoidance is removed. Moreover, as past capital gains are captured in the net equity base as they accrue with each new valuation, the wealth gap may narrow at last rather than continue to grow exponentially.

Landlords will no longer be subsidised through tax concessions to invest for capital gains, and some may withdraw from this market. While that leaves more houses for genuine first home buyers, a price correction is not to be avoided if the biggest housing bubble in the western world is to be contained. The best to hope for is gradual adjustment, not a precipitous fall such as experienced in Ireland after their strong bubble 10 years ago.

A high degree of political and public acceptability can be expected because of the widespread concern over growing intergenerational housing inequity and an appreciation of the need for radical action. The TWG should delegate the fine details to an expert subgroup, including a plan for immediate implementation post-election 2019.

The big problem is with rents escalating, the poor people can not afford to buy food after they have paid the rent.

Yep, and the meagre increase in Accommodation Supplement did NOT help those most in need, as the ones getting Temporary Additional Support had that ‘increase’ taken off them at the next review, as the abatement regime kicked in.

Those on benefits are kept poor as they are meant to be kept poor, it is part of the flawed, but so designed system:

https://nzsocialjusticeblog2013.wordpress.com/2018/05/23/social-security-benefit-rates-in-new-zealand-set-at-will-by-governments-ignoring-socio-economic-realities-and-evidence/

(published 23 May 2018)

https://nzsocialjusticeblog2013.files.wordpress.com/2018/05/social-security-benefit-rates-in-n-z-set-at-will-by-govt-ignoring-evidence-nzsjb-23-05-18.pdf

(as on 23 May 2018)

Hi Susan, this is really important to solve Child poverty issue, this things needs to be noticed by large or say whole population and they needs to be aware of it. I believe you solution can wok in solving this issue. Liked it a lot. Hope others too.

Labour’s house CGT proposals for a main residence tax exemption have always been fatally flawed in as much as a person with a $1m house in Auckland (a very humble abode to be fair) will net a tax free $500,000 if the house is held for some time and increases by 50%, whereas a person with a $200,000 house in Tokoroa will only get a $100,000 tax free gain if their property were to increase by the same 50% over the same timeframes. Gains is gains but Aucklanders and those in Central Otago get bigger tax free ones.

So I see some merit in your “equity tax”. But if I had a couple of domestic rentals, in your tax world, I would load them up with debt shortly before the regime started to reduce my “equity”.

I am unsure whether your proposal would still have me paying income tax on my rents. I would presume that my “equity tax” would be all the State would want from mr. Is this xcorreect?

If you aren’t buying, selling, or borrowing – how are you really ‘becoming wealthy’ in an overheated property market?

It’s only a few with the will and skill to join this speculation. It’s not Tulip Mania which was engaged in by many.

I don’t know this as a fact – I do know that most people in my street have been there for upward of ten years and more. The rates keep going up. No new amenities have been added. The roads are still as potholed as they ever were.

Has anyone got the mental capacity to truly investigate this peculiar speculation form – and identify all the ticket clippers who use the winnings of a few to inflict imposts on the many? Before rethinking the interconnetedness and how it reaches into the guts of ‘the Kiwi way of life’.

Or have agencies step in to buy up properties and allow widespread rent to buy – no ghettos of State housing, low decile schools, colonies of low income people stuck without access to decent and affordable public transport, reasonable commute times to work and the amenities – such as affordable shopping – that others can take for granted.

Or would that rock the boat too much?

Read this, and you will have part of the reasons what has been behind it, the other part is immigration and well cashed up Kiwis coming back from overseas, who wanted to buy a new home:

https://www.stuff.co.nz/business/75376876/more-intensified-housing-zones-will-inflate-auckland-property-prices

“”Those that now fall into those areas that are defined for intensification are seizing the opportunity to leverage that in the sale of their homes,” Gray said.”

There was rezoning proposed with the Proposed Auckland Unitary Plan, and in the end, most rezoning was passed and accepted by Council, upon a developer friendly ‘independent’ hearing panel.

Intensified residential land is a safe bet for gains in value for many years to come, as more people will need more homes, and building up and more intensively means more returns on the same piece of land.

Net housing equity would encourage irresponsible borrowing.

Furthermore it is the equivalent of negative interest rate policy – almost guaranteed to cause less investment in the sector.

Its the worst of both worlds.

Z

at the moment it is the tax treatment of mortgages that encourages irresponsible borrowing because nominal interest is fully deductible. Of course a property bought with a large loan under a net equity approach would end up taxing a small net equity. This would eliminate the current ability to offset losses against other income. Also as net equity increases each year in a housing boom so there is some capture of capital gains

“Our latest analysis: Will children get the help they need? shows families on full core benefits paying typical rents in Auckland and getting the maximum accommodation assistance, fall well below, not just the 60% poverty line, nor the 50% nor even the impossibly low 40%, but they fall below the 30% line. At these subsistence levels, with no housing security and nothing in reserve, families drift to the outer margins of society. In the meantime, the median housing price has risen to over $2 million in several suburbs and mansions of $5-$20m plus are more common.”

Re this analysis, it is also important to note, that recent increases in the Accommodation Supplement will not necessarily end up in the accounts of those on benefits, who would use it to pay part of the actual market rents they may face.

With and ABATEMENT REGIME in place, that takes any such increase straight out of the total benefits again, by reducing accordingly the Temporary Additional Support (TAS) or Special Benefit (SB), only few people on benefits are better off after the 1 April ‘increases’.

I know a number of persons who had their supplements like TAS and SB cut when their reviews of them were due after 1 April, and a case manager at WINZ even told me, that is how these supplements are affected for persons on benefits. So the government does not even seem to understand how the benefit system works, as the ABATEMENT REGIME does neutralise any increase in other components of total benefit.

As for the tax regime, the present regime may appear unfair to some, but landlords who have a few properties do at times show some consideration to those tenants not that well off, whether temporarily or for longer, as long as they are considered good tenants. So they do not charge them the market rent for the hard times they may face, while they may charge market rents for other properties, occupied by better off tenants.

An equity based tax would dictate equal taxation for all residential homes, thus take out that opportunity to diversify rental charges, leading to landlords having to pass on their costs for every property equally, it would seem.

How will this help those less well off in tenancies, when they may presently pay less than market rent, but may after introduction of an equity based tax be confronted with higher rents.

What I am saying is, it is never so clear cut and easy as it may seem.

Also given the abysmal market failure in places like Auckland, Tauranga, Wellington and so, we need more housing, especially state and social housing, that is affordable, that will lead to needed market adjustment.

If the market would function correctly, we would sooner or later have a housing price crash, but like the Nats, Labour is scared stiff to let that happen, as it will affect many property owning middle class voters, who would vote them out.

“CPAG urges that a net housing equity tax is developed.

A person would be assessed on total housing owned, less registered mortgages. This net equity would be treated as if it had been put into a deposit at the bank at say 3-4%. This deemed income would be added to other income and taxed at the person’s marginal tax rate.”

Having read this again, it seems fair enough.

But taxing property is just one measure, to raise more taxes and to have the state take a share on property value increases.

It may or rather will dis-incentivise people buying or even building more residential properties.

Whatever is done and changed, it will have some unwanted consequences.

Meanwhile we urgently need affordable housing to be built where it is needed.

The rich will find ways to get around so many proposed new taxation changes. It may be better to re-introduce a more graded progressive tax regime, and tax the high income earners and wealthy more than they are now, and to do away with exemptions.

Of course we need more housing, preferably state housing at the same time. Landlords would also still be free to cross subsidise rents- more for rich and less for poor without requiring a tax funded subsidy to do so.