The Listener is manipulating NZers over retirement

The latest Listener (Nov 10) proclaims “Fresh moves to raise the age of super to 67”. I like the Listener but this article is at best misleading.

The Labour-led Government has given no indicaton that it is considering raising the qualifying age. In fact it has locked itself into promises not to raise the age. The Listener points to the NZ First’s private member’s bill just drawn from the ballot. Yet this bill has nothing to do with raising the age. It is about raising the residency threshold required for NZ Super to prevent people coming from overseas and getting the full age pension after only 10 years.

The Listener highlights the “growing number of pensioners who struggle to live on NZ Super alone” and in a non sequitur seems to suggest that the answer is to raise the age to 67. Many low income pensioners eke out NZ Super with part-time work, and cannot and probably should not work full-time. If there is no basic age pension income until 67, many more will reach the higher age even more impoverished.

In spite of the hype of the age going up already in selected countries, the OECD report cited actually says that by 2060 the average age will be 66. In Ireland, where the age is already 66, there is real anxiety about it going up to 67 in 2021 and 68 in 2028 as old age poverty is already a problem there and women are especially affected.

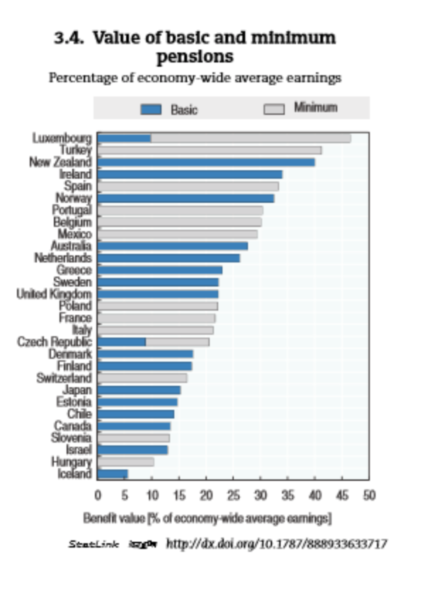

The Listener article claims that we have one of the most ungenerous pensions in relation to the average wage. To support this proposition the article cites the Netherlands as having a pension over 100% of the average wage. However, that happy outcome is for a person who has not only fulfilled the 50 years of residency for a full basic pension but has made contributions to an occupational scheme for a full-time, 40 year career at the average wage.

The OECD actually shows that New Zealand has one of the highest basic pensions (see Figure) at 43% of the average wage for a single living alone recipient. Because of low residency requirements and its universal character, NZ Super is one of the most generous basic pensions in the OECD.

There are very important social aspects to having a basic income for everyone at age 65. In this simple visionary idea New Zealand leads the world, allowing many of those over 65 to contribute to the critical voluntary unpaid activities such as caregiving, mentoring, and support of NGOs without which society would not function. Perhaps Labour’s well-being budgets will properly value this contribution?

People are quoted in the Listener article saying that they love working into older age as it gives them a sense of pupose. There is nothing intrinsically better about paid work and many people find a freedom and satisfaction in doing the work they love if they can do it without having to worry about not being paid.

The underlying issue the Listener raises is whether we can we afford New Zealand Super. As Michael Littlewood says, New Zealand spends only around 4% of GDP on NZ Super and while this will rise, at its peak it will be still well below the pension spending of many other countries today. We don’t spend very much in subsidising private provison either. KiwiSaver subsidies are very minor compared to other countries’ expensive tax breaks for private saving.

To think that raising the age is some kind of fiscal saviour overlooks so many qualifiers. Importantly, as National discovered when they tried to do this, it needs to occur gradually over a long time period for poltical accpetance and to give people enough time to adjust. National’s plans would have seen 67 years reached only by the year 2037. Fiscal savings would be miniscule for the first decade and even then the savings needs to be tempered by the additional spending in the welfare system for the many unable to work full-time.

What is the actual problem to be solved? Perhaps it is a simple one of social equity. Many of working age have little chance of accumulating a supplementary nest egg that will cover the needed extra $270 a week the article claims is needed for a good retirement. All the while, these same working age people are taxed to pay for NZ Super for today’s wealthy superannuitants who may also still be working in highly paid jobs. Today’s taxes also contribute to the New Zealand Super Fund for a pension that may be harder for todays’ working age to access especially if the age is raised.

For most wealthy superannuitants NZ Super is a drop in the bucket. They don’t notice it. They certainly didn’t need the expensive Winter Energy Payment. It is possible to devise a higher tax rate for the very well-off that could provide useful saving of at least 10% of the total NZ Super cost without causing anyone hardship. A Retirement Policy and Research Centre paper shows how NZ Super could be changed to a basic income, the same non taxable grant for each person over 65, with a separate tax scale for other income. Around $1 billion a year could be saved very easily. But this is just one potential option. First we need to agree what the problem is that we are trying to solve.

Raising the age a little is perhaps inevitable over the long term as people live longer, but it is no answer to actual problems ordinary people face. Let’s hope the promised retirement incomes review in 2019 does justice to examining all the options for sustainability, fairness and affordability without just relying on the chimera of raising the age of entitlement.

Absolutely right, Stephen. Sadly most people dont understand this.

For a start, the government is NOT like a household. It is NOT revenue constrained. It has its own bank RBNZ. It can NEVER run out of NZD. It spends NZD into existence via things like superannuation, then taxes some of those NZD back. Taxes are NOT required for spending. They do not fund spending. They are not the same NZD. Taxes DO create spending space for things like superannuation without creating substantial inflation. Deficits or government debt do not create a burden on future generations as long as they are denominated in NZD. Whether superannuation is 4% or 10% of GDP, the government can always fund it. The level of government spending, how it is allocated and the level of acceptable inflation, are political decisions, not hard fiscal rules

https://unframednz.wordpress.com/2018/06/13/modern-monetary-theory-part-3-deficit-spending-taxation/

Perhaps we could afford super had the Tories not cut taxes, benefitting the rich mostly, a few years back?? Tax cuts = slashed services and redistribution, QED.

What we urgently need is a tax reform, that taxes wealthy and high income earners more fairly at a higher rate, and perhaps also some form of a carbon tax, and also a capital gains tax, and a tax on some other so far un-taxed or too lowly taxed activities.

Then all will fall into place, no need to raise the retirement age.

Please refer to the graph on this page.

Superannuation pays considerably more than other core benefits. If you are on Super YOU GET MORE THAN EVERY OTHER BENEFICIARY SO STOP WHINING.

https://thestandard.org.nz/poverty-and-disability/amp/

Z

I am disabled and say to you Z go try live on super before you make such toxic statements as “YOU GET MORE THAN EVERY OTHER BENEFICIARY SO STOP WHINING.”

I paid taxes for all my years from when I was 15 to 65 for 50 yrs and expected support when I needed it, and now since I am still disabled I am going totally broke, as I have to pay my own way for disability treatments under your tory National Government:- and still do as your harsh toxic in-human system was sadly bedded in by deliberate insertion of your handpicked bureaucrats you helicoptered into place, to keep your blunt actions to kill off the old, weak, disabled, much like Hitler did during his purge of Germany’s ‘weak, disabled, and ethnic disadvantaged’.

You Z should hold your head in shame.

I hope you never have to suffer with a horrible disability as I have done to learn the cruel ‘REAL TRUTH’ here living on a “low retirement pension plan” such as NZ Super is today.

If all of the data is based on an average wage, the figures are meaningless because of the distortions created by the very rich. The correct figure should be ‘median wage’.

Three cheers for the support for a basic income! Zero cheers for totally ignoring the effect of robotics, which increases the total supply of goods and services without increasing the demand (since robots dont need to be fed). This will make all including superannuants, richer (with apologies to believers in Climate Change).

Lastly, dont be too upset about the “Listener” taking this stance, Susan, I like the “Listener” too but am aware that most of their columnists are right wing. You just have to grin and bear it.

I think we should actually be lowering the age to 60. We don’t have enough jobs anyway, and over time this will lead to huge positive flow on effects.

For instance, allowing people five of the best remaining years of their lives to do activities that are fulfilling to them and will benefit their communities.

couldnt agree more– people who can work and want to work in paid work are not doing better work than others who do the unpaid work

I’d add that, after a lifetime of reading it, even during my childhood, I gave up on the Listener some years ago. That was at the point where its diet of articles about self-improvement and to-which-school-should-I-send-my-child? became indigestible.

Nowadays, I note its headlines in passing at the supermarket checkout, and congratulate myself on the money I’ve saved. Which – being an OAP – I sorely need to do, of course.

Those who argue for raising the qualifying age for NZ Superannuation seem all to be white, wealthy and wallowing in a desk job. I haven’t encountered anyone in his sixties who’s spent a lifetime wielding pick and shovel eager to delay retirement.

If anything, the qualifying age for NZ super needs to be lowered for people broken by a lifetime of toil. Susan St John’s alternative in her Retirement Policy and Research Centre paper: a universal basic income topped up by a benefit constrained by a rigorous tax (don’t say surtax, or Winston’s lot will start their needyrich wardance) shows the way: it could be extended to include a needs-assessed invalid benefit.

John

you are absolutely right but there is a wilful blindness to examining options other than raising the age. I agree the basic income should be extended to other groups such as invalids and sole parents. It is important to signal to the Retirement Commission that the 2019 review should take a wide view of the issues. There is a problem of growing poverty among retirees but raising the age is not a solution for that problem

Official unemployment figures are 4% (so actually 5.5%) so why bother putting more old people back into the work force when there are too many workers to spare anyway?

Answer; maintaining labour-market flexibility – which is code for keeping workers desperate.

It makes no sense financially either since the economy contracts every time the government cuts it’s welfare budget, which is what will happen if they raise the retirement age.

To summarise; we’ll end up with more workers looking for less jobs in a contracting economy.

With a contracting economy the tax take will be reduced and then we’ll need to make more cuts in government spending…

I have seen that graph before we are fed this line and the more it is said the more people believe it is true that we cannot afford super. It really gets to me.

Wouldn’t trust Simon Bridges or Amy Adams with a jar of 10 cent pieces.

Congratulations, Susan, on a much-needed corrective to The Listener’s feature article.

You are much too kind in your use of the word “misleading” to describe the piece. It was just another example of the Right’s determination to mess about with NZ Super – along with every other working example of social-democracy in action.