Reserve Bank Interest rates rise to force a recession on NZ

The Reserve Bank raised the Official Cash Rate (OCR) by 0.5% to 5.25% saying: “Inflation is still too high and persistent, and employment is beyond its maximum sustainable level.” this is simply a declaration of war on working people.

The OCR is the rate that all other rates are based on. That means your mortgage and credit card payments are also going to go, along with rates for loans to businesses. Risks of business failures will increase. Credit will be tightened and the economy will be tipped into a recession. The December quarter recorded a decline of 0.5% in GDP and if the March Quarter also records a decline this will mean two-quarters of a decline in a row which is the official measure for a recession, so we may already be in one.

But that did not deter the Reserve Bank in NZ from doubling the rate of increase compared to Australia, the US, and the UK which increased their rates by only 0.25% over the last few weeks. The NZ Reserve Bank is absolutely determined the use a recession to put tens of thousands of workers out of work in their claimed drive to deter inflation.

In addition, the Reserve Bank Governor warned in February that if the government didn’t slash spending or raise taxes the Reserve Bank would increase the OCR higher and faster than planned to induce a recession.

The NZ Reserve Bank says this is needed because a wage-price spiral threatens. But this is simply a lie. Prices surged much earlier and faster than wages have. This means that real wages are being cut. The inflation we have in NZ today is the product of the government and Reserve Bank adopting money printing policies to save the capitalist system during the pandemic-induced economic decline in 2020. Now they try and blame workers for the problem and refuse to accept any responsibility themselves.

But the solutions being enforced by the Reserve Bank today are against the interests of the vast majority of people in this country. They are serving the interests of only the top 1% in society who hate inflation because it depreciates their wealth and threatens to undermine faith in their monetary system which they need to continue to extract wealth from the labour of the rest of us.

The relentless increase in interest rates that Central Banks across the world are imposing will in the end result in businesses failing or slashing staff, with more and more banking and financial crises. Deutsche Bank strategist Jim Reid conducted a study in April 2021 that found that over 25% of U.S. companies were zombies in 2020. For comparison, in the year 2000, only about 6% of U.S. firms were in the same situation, according to Reid’s findings. The recessions that are coming across Europe, and the US will inevitably take down more companies with the weakest links going first. More banks and financial institutions will follow.

The pro-capitalist economists say that the New Zealand banks are sound and we shouldn’t worry.

But nearly every international study identifies a major problem with the banking system in this country which is their over-exposure to the massively over-inflated property market. If this market crashes, it could take the banks with them. The International Monetary Fund (IMF) last year warned for example, that: “New Zealand’s high levels of household debt, borrowers’ vulnerability to rising interest rates and banks’ high exposure to housing loans could be a risk for the economy.” That exposure has got much worse over the past year because of the relentless rise in interest rates.

Bank greed and Reserve Bank enabling created that massive housing market price boom over the past decade or so. Reckless Covid spending and Reserve Bank money printing resulted in a final burst of prices of 45.6% in property prices over 18 months between May 2020 to November 2021.

This year housing prices are already down 13.9% and will crash much further once the recession is in full swing later this year or early next.

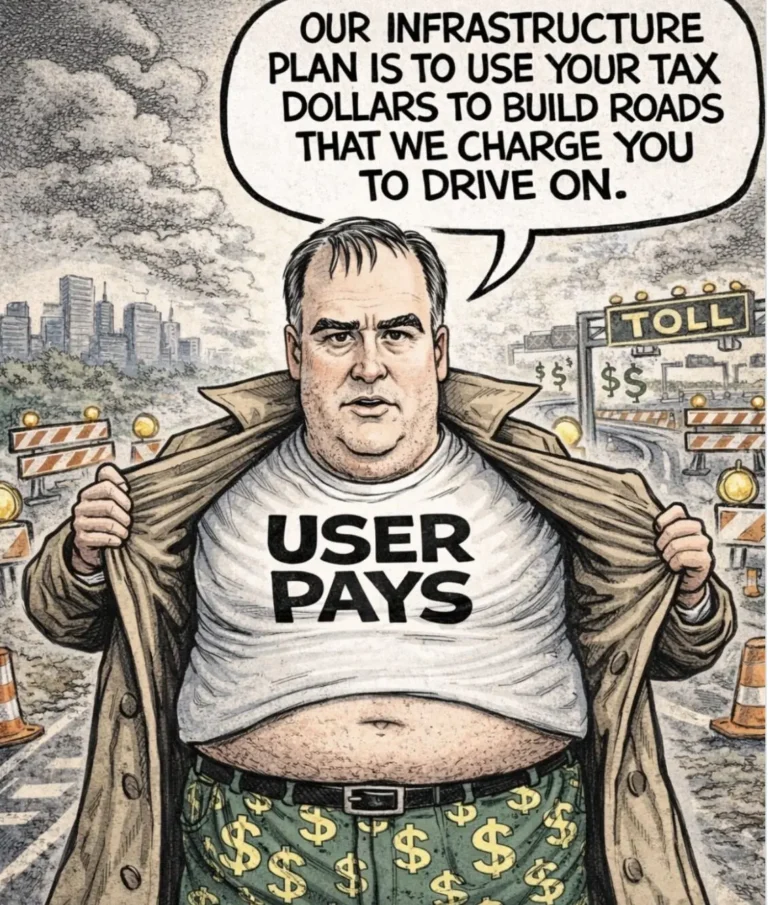

The free-market madness that gripped New Zealand in the late 1980s meant that banks were given the freedom to do as they wished. The Reserve Bank was made “independent” meaning under no democratic accountability. In New Zealand, there is no insurance for bank deposits. This was considered against free-market principles. This “principle” was abandoned by the National Government temporarily in 2008 when a financial crisis threatened and a temporary insurance system was established to stabilise the financial system.

I assume the government paid the cost of the bailout at that time of the financial companies that were wound up. A permanent law for $100,000 deposit insurance is being considered by the current government. I assume the banks will have to pay for this like in the US. I would advise the government to speed up the passage of this law and make sure the banks themselves are paying enough into the system to save themselves when a crisis happens rather than running to the government to save them as happened across the globe in 2008.

When three banks failed recently in the US, the federal government had to guarantee the deposits above the bank’s insured limit of $250,000. The Silicon Valley Bank (SVB) bank which failed on March 10, had not been recklessly criminal like many banks in 2008 which marketed product they knew was likely to fail. The SVB had become cash rich in the tech boom with deposits going from $60 to $200 billion over the two years to the beginning of 2022 because they catered to that clientele. They then bought lots of long-term government bonds as a traditionally safe investment. When interest rates rise the value of the bond automatically goes down.

A year ago interest rates were close to zero. Inflation has then induced the US Federal Reserve to increase rates 9 times to 5% in March this year. This has devalued long-term bonds because the price of a bond moves in the inverse direction to the interest rates. Now short-term rates are above long-term rates which has significantly devalued the bonds they hold. Unrealised losses on the bonds they hold now exceed $620 billion. Bloomberg notes: “They’re paying more for deposits, and their earnings on bonds are fixed,” said Stan August, a retired bank examiner for the Federal Reserve Bank of Richmond and a former bond analyst at Bank of America. “That’s where the squeeze is.”

Nouriel Roubini who got dubbed Dr Doom for correctly predicting the 2008 crash commented on what this means: “Official data of the FDIC [U.S. Federal Deposit Insurance Corporation] said there are $620 billion of unrealized losses on securities and the capital of banks in the U.S. is $2.2 trillion, so the average U.S. bank has about a third of its tier one capital at risk,” referring to a metric that indicates how easily a bank can absorb losses on its financials.

“Over in Europe, unrealized losses on bond portfolios could be much graver, Roubini said. Europe, and specifically Switzerland, were among the first places in the world to push ahead with negative interest rates, meaning the sensitivity of local bond portfolios to rising interest rates was likely to be much larger. Bank profitability on the continent has also been much lower, putting further strain on capital buffers and, by extension, the value of bank shares.”

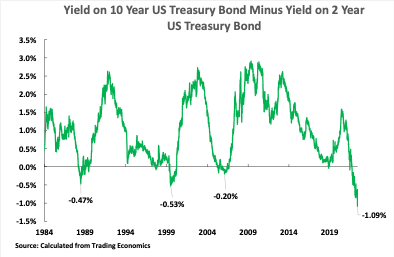

Higher short-term interest rates are also a signal of an approaching recession. This is true in New Zealand also. As John Ross in the US Monthly Review notes:

“Figure 1 shows over the long run the relation between U.S. long term, 10 year, and short term, two-year bond interest rates – that is, how much the two interest rates differ. As can be seen, almost always U.S. long term interest rates are higher than short-term ones. This is logical because the risk of lending money over a long period is greater than over a short period – so a greater reward, a higher interest rate, has to be paid to get someone to lend money for a longer period. But, as can be seen, on four occasions this normal relation has changed and short-term interest rates became higher than long term ones. On each of the three previous occasions this event, the inversion of the yield curve, was followed by very serious problems in the U.S. economy.”

The tech industry suffered a downturn over the last year as well which meant some of the deposits of SVB were being withdrawn. To cover these withdrawals the SVB decided to sell $21 billion in securities for a loss of $1.8b. That triggered a run on the bank. The problem today is that a bank run can be orchestrated from a smartphone rather than queueing outside banks like in the 1930s. $50 billion was withdrawn in one day and $100 billion was scheduled the next. The US government and Federal Reserve Bank were forced to take over SVB and two other banks and guarantee all deposits.

The US government also allowed hundreds of other banks threatened with a similar run to borrow hundreds of billions of dollars to cover deposit withdrawals. They were allowed to use bonds as collateral “at par” or purchase value rather than the current actual value which is significantly lower than that because of the recent interest rate rises there. Again “free-market” principles are abandoned when it comes to protecting the wealthy and powerful.

The international banking system is actually a giant criminal conspiracy against ordinary people. They routinely engage in fraud, money laundering, and enabling kleptocrats and oligarchs. We shouldn’t get surprised when they fail.

I have an alternative to the deposit insurance scheme or any other tinkering with the system. Why don’t we nationalise the banking system with no compensation to shareholders and run it as a democratically controlled public service? We’ll probably have to do it in a couple of years anyway when the next big crash happens, why not get in first and limit the damage?

OCR hike: Do 74,000 people really have to lose their jobs to save economy?

Susan Edmunds

05:00, Apr 09 2023

https://www.stuff.co.nz/business/money/300849075/ocr-hike-do-74000-people-really-have-to-lose-their-jobs-to-save-economy

It’s not our economy.

Gosh MT, sounds like governmental inexperience and incompetence?

Reserve Bank incompetence to boot?

In order for us people to get what we want we have to first realize that government works for them (the moneyed crowd) not for us. Best example of this are reserve banks which are all private entities separate to government, and yet government pays fealty to these private entities and most people are none the wiser. Talk about a microcosm of the world today.

You want to make a plan, then acknowledge the real world we live in and make plans (or wishes) with that in mind, otherwise you are just leading everyone here on a merry dance to nowhere!

High inflation and a big recession is how the people at the bottom oay for the Ukraine Conflict

House pricing can be controlled by:

1. Investors can only loan money based on their “Cash Savings”, not the equity of current Houses they have.

2. since Banks will only Loan up to “X times the amount of a Borrower’s Wage”, then the Average Home price in that Area, can be no more than that Area’s Average Wage times “X factor” value.

3. The Reserve Bank, should be the Loaner of Morgages, not the Trading Bank.

The irony of inducing economic hardship and higher unemployment to onto a population already enduring economic hardship is summed up by the brilliant John Stewart in this clip https://www.youtube.com/watch?v=SHUUTpxmzxA

Inflation has been running rampant in assets for years but only when workers gain leverage to increase wages do we hear from the economic warrior class that something must be done to stop it.

Totally onto it Mike. There is no actual reason to keep hiking rates apart from neo liberal dogma and protecting the profits of private capital. The RB is meant to take “employment” into account not impose unemployment.

“What the”…is so many peoples reaction to the RB’s 5.25%. The NZCTU gave its usual piss weak response to this blatant attack on working class people…

https://union.org.nz/reserve-bank-should-pause-before-further-interest-rate-increase/

The twisted thing is that without an opposing ideology and political movement–NZ Labour are obviously not going to provide that–as they are welded to the monetarism that set up the Reserve Bank in the first place!

People are going to start losing homes in numbers very shortly. Some serious suffering is going to occur among middle class people who typically Bennie bash and look down on food banks and Marae assistance–well cancel those gym memberships folks and meet your MSD case manager! Maybe stand up for yourselves for once rather than expect it to be handed to you like WWF and the Govt. second tier COVID benefit.

The significant worry is that right opportunism will kick in and Natzos will gain office on fake populist empathy for those affected, and then like Trump will do absolutely nothing about it, in fact make things much worse by freezing minimum wage, shrinking the state, etc. etc.