Recycling – National Party style. Something embarrassing about Mr Bridges conference speech uncovered

.

.

Current Leader of the National Party, Simon Bridges gave the usual rah-rah speech to the Loyal & Faithful in Christchurch today (27 July). With National’s party polling and his own personal popularity sliding steadily in the polls, Mr Bridges has not much left to reverse his fortunes.

.

.

The entire Conference was geared toward promoting Simon Bridges to the public.

Even his wife, Natalie Bridges, was pressganged to put in a good word for her husband;

.

.

However, it was Mr Bridges’ speech that really stood out – though not for the right reasons.

When this blogger heard certain parts to it, there was a sense of deja vu. It was as if I had heard the speech before. In fact, listening to other parts of it, I was sure I had. From eleven years ago.

On 30 January 2008, then leader of the National Party, John Key gave his own “State of the Nation” speech, whilst still in Opposition. Mr Key said;

“So the question I’m asking Kiwi voters is this: Do you really believe this is as good as it gets for New Zealand? Or are you prepared to back yourselves and this country to be greater still? National certainly is.”

On Saturday, Simon Bridges said;

“We cannot and will not sit back and think this is as good as it gets. You deserve better, you deserve and are entitled to expect a government that delivers.”

In 2008, John Key said;

“Why are grocery and petrol prices going through the roof? […] We know you cringe at the thought of filling up the car, paying for the groceries, or trying to pay off your credit card. “

Simon Bridges said;

“I feel a deep sense of urgency as I watch this country that I love falter, as I see middle New Zealanders struggling to pay increasing rents and to put petrol in their car.”

In 2008, John Key said;

“Why can’t our hardworking kids afford to buy their own house?”

Simon Bridges said;

“A housing market that builds houses.”

In 2008, John Key said;

“Why hasn’t the health system improved when billions of extra dollars have been poured into it?”

Simon Bridges said;

“The New Zealand that I want to lead will not have a two class health system that provides care for those who can pay and leaves others suffering because they can’t.”

In 2008, John Key said;

“We will be unrelenting in our quest to lift our economic growth rate and raise wage rates”

Simon Bridges said;

“A strong economy means confident thriving businesses that create more jobs and increase incomes.”

In 2008, John Key said;

“It matters because at number 22 your income is lower, you have to work harder…”

Simon Bridges said;

“We know it’s the men and women of New Zealand that work hard…”

In 2008, John Key said;

“The National Party has an economic plan that will build the foundations for a better future.”

Simon Bridges said;

“National has a plan and a track record of getting things done. We are the ones that can manage the economy to ensure it is delivering for you.”

In 2008, John Key said;

“We will focus on lifting medium-term economic performance and managing taxpayers’ money effectively.”

Simon Bridges said;

“We are the ones that can manage the economy to ensure it is delivering for you.”

In 2008, John Key said;

“This year, signs are emerging that the winds of global growth have not only stopped but are turning into a head wind.”

Simon Bridges said;

“All that platitudes and hope have given us is a weakening economy that’s not delivering for anyone.”

In 2008, John Key said;

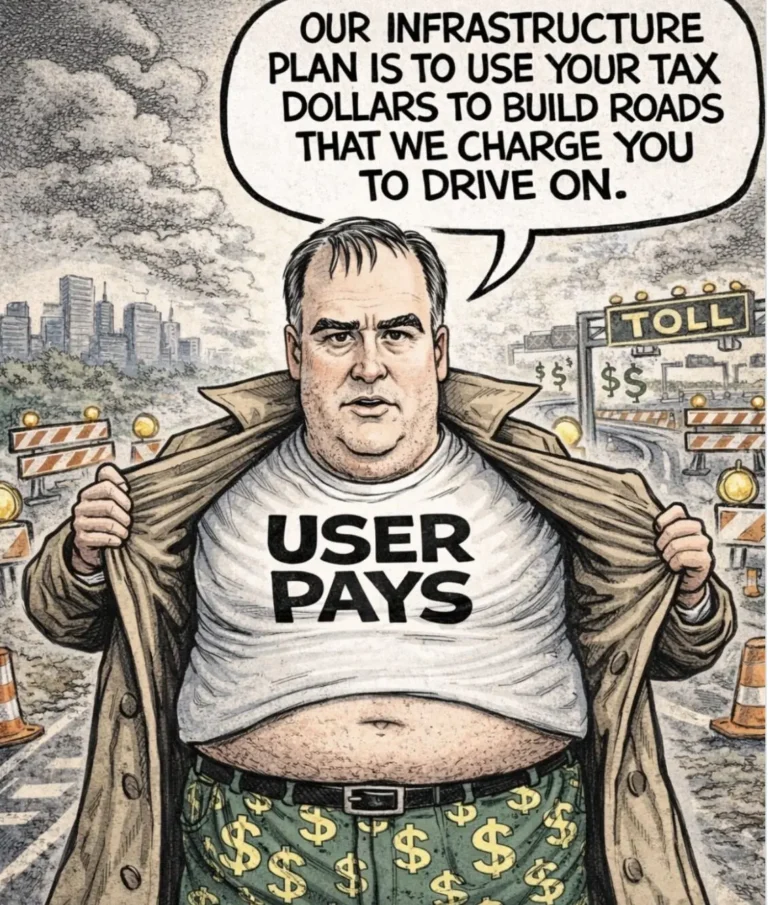

“We will invest in the infrastructure this country needs for productivity growth.”

Simon Bridges said;

“We are the party of infrastructure.”

And there’s more. Read both speeches and the repetition is startling and humourous. As if someone had dusted off past speeches; re-ordered a few words, and then handed it over to Mr Bridges.

Different decade, same bovine excrement. Political manure at it’s best.

This is recycling, done National-style.

Expect more of the same last nine years of National should that party find a coalition partner to propel it over the 50% party vote line.

Which, all humour aside, is a dangerous prospect. With New Zealand – and the entire planet – is facing unprecedented challenges (ie; crises) such as worsening climate change, and resurgent nationalism, growing from social stresses and dislocation. There are war drums on the horizon.

National has not demonstrated it is a forward-looking political party. It’s “more-of-the-same, business-as-usual” philosophy, as demonstrated by Mr Bridges’ recycled speech, is simply not tenable.

National’s contempt and constant undermining of policies to mitigate greenhouse gas emissions is a cynical ploy to win votes. It is short-term self-interest, done at the expense of our climate and future generations.

If National can re-cycle a speech from eleven years ago, it clearly demonstrates it has no new ideas.

Check out Simon Bridges’ speech. He does not mention climate change at all. The word “environment” is barely mentioned once, in passing. Even then it is in the context of growing the economy.

National is a relic of a by-gone age. For the 21st Century, it is simply not fit for purpose.

.

.

.

References

Radio NZ: Simon Bridges: ‘NZ can’t afford another three years of this government’

National Party: Speech to National Party Conference. Our bottom line – You (alt.link)

NZ Herald: John Key – State of the Nation speech

Other blogposts

The Standard: The weasel accurately dissects National

.

.

.

.

.

= fs =

Literally same bullshit, different day!!

Keep going, Simon, you will help keep National in opposition.

Maybe people in NZ were not paying record profits to banks then they would not be struggling…

Let’s have a look at this astonishing case

https://www.newsroom.co.nz/2019/07/29/701587/take-my-kiwisaver-and-cant-we-call-it-quits

In spite of report profits apparently nobody in either the National government or the Labour government is prepared to tackle why and how banks are making such huge profits as the expense of everybody in this country who needs financial profits!

As usual nothing to see here, even when some very odd goings on from ANZ bank for example…

At last count I seem to remember for example the commerce commission is desperatly investigating with much publicity a little kiwi booking company whose crime was apparently they deleted a bad review, (have to make sure that 1st world problems like reviews from a website for taking a holiday bookings for tourists is of VITAL importance to the commerce commission these days), but $580,000 in New Zealand every hour of banking profits is not an issue for them, https://www.newshub.co.nz/home/money/2019/03/the-astounding-profit-australian-banks-make-in-new-zealand-every-hour.html

Not to mention another travesty (sarcasm) investigated by the commerce commissions of another Kiwi company committing the serious crime of using a meatless pattie in a burger for a publicity stunt.

Great to see our taxpayers money is going to good use, with these cases being taken up, by government officials and sending Kiwi companies out of business while ignoring issue like the Westpac and ANZ examples as ‘too hard’ – they might have to do real work for their wages and we can’t have that!

No wonder nobody can get ahead in NZ, with the commerce commission ignoring the big business in preference to trying to scalp local business with some minor transgression that they can get their toothless teeth into without breaking a sweat!

Now banks ‘dob themselves in’ occasionally to save the commerce commission the trouble, you know works a treat for both parties, the banks don’t want the commerce commission digging around too deep, and the commerce commission has even less work to do and they pretend to be looking at banking practises with a quick fine…

https://www.newshub.co.nz/home/money/2019/07/commerce-commission-takes-westpac-to-court.html

You have to wonder what is going on!

Dangerous toys get a $45k fine, banks do their own policing, and the commerce commission are sending out press about burgers and website reviews, not dangerous goods like toys that could kill people, monstrous profiteering from banks and disgusting service levels like telecoms…

Nobody bothers complaining in NZ anymore about big business, everyone knows that our commerce commission is more a friend to them than an enforcer of any sort of service or stopping despicable behaviour such as the cancer sufferer’s 0% consolidation loans, she can never pay back!

The other weird thing about that case, is why would the commerce commission take a company to court with all the wasted time and resources of lawyers (bad use of taxpayer money) when the bank have already not only pleaded guilty but also helpfully they themselves bought it to the commerce commissions attention!

More money for lawyers perhaps and to get a ‘light’ penalty for that crime to be set into precedent?

Also wouldn’t it be more useful for the commerce commission to do more cases by just fining companies for pleading guilty and get more companies investigated instead of their current ‘show trial’ approach that just sends the message they are out of touch, lazy wankers, who like to see themselves in the court room a few times a year with easy prey to justify their existence, while 99% of consumer issues are ignored as someone else problem?

@Frank – do you happen to know who did the makeup? It obviously wasn’t someone Paula rustled up at the last moment although I did notice the transition from leopard skin in a Westie sort of context to it now being a suit-designer’s orgasm – so maybe it was, at least on her recommendation.

“Why are grocery and petrol prices going through the roof? […] We know you cringe at the thought of filling up the car, paying for the groceries, or trying to pay off your credit card. “

…certainly isn’t because of the labour costs that seem to be sliding down or maybe stuck in that time lock from 2008…

“A Glen Innes Pak’nSave owner, worth an estimated $65m, was paying one of the lowest rates as far as collective agreements go in Auckland supermarkets, FIRST Union’s Mandeep Bela said.

The union is in the process of bargaining at Hastings Pak’nSave where workers recently resorted to strike action. At mediation, the owner offered a 0 per cent pay rise for the 2018 year, Bela said.”

https://www.nzherald.co.nz/hawkes-bay-today/news/article.cfm?c_id=1503462&objectid=12108780

Meanwhile…

Supermarket owners banking super profits, NBR Rich List shows

https://www.stuff.co.nz/business/money/106288425/supermarket-owners-banking-super-profits-nbr-rich-list-shows

“Pak ‘n Save owner, and former director of its parent company Foodstuffs, Glenn Cotterill is worth an estimated $65m, NBR says.

Cotterill joined Foodstuffs in 1992 when he bought New World Te Puke. He went on to buy Pak ‘n Save Whakatane and another in Tauranga.

Fellow Pak ‘n Save owner and rich Lister Rob Redwood also has a long history with Foodstuffs having started as a Four Square delivery boy as a teenager.

In 1987 he bought his first supermarket – the Cut Price Store in Taumarunui – followed by the purchases of New world in Hillcrest, Hamilton, Eastridge, Auckland and Glenn Innes, Auckland.

Redwood is worth an estimated $65m, NBR says.

Garry Baker and Ian Hong, the owners of New World in Wellington have an estimated combined worth of $75m, NBR says.

While not on the Rich List, retired Black Caps pace bowler Chris Martin saw the value in the grocery trade and entered the mini-market business by buying the Hokowhitu Four Square on Albert St in 2014.”

They’re really going after the blue dragons aren’t they, immigrants (probably Chinese) property speculators and milk powder, good old classic Keyisms. I mean all is fair in love and war. For me. If our reaction does not respect the power of the blue dragons then Bridges consolidates his position because the largest party doesn’t necessarily have to be the winner anymore. We don’t just have to fend off the blue dragons, we have to keep NZFirst and the Greens on Labours side. Sure the game can be an academic one if you don’t mined losing.