pre-Budget blog – Prioritising Public Debt?

Bill English has said that his fiscal policy priority is to reduce gross public debt to 20 percent of GDP. Is public debt really our number one economic problem?

I took a quick look at the IMF’s biannual ‘World Economic Outlook Database’ (April 2016 edition). I found that New Zealand’s gross public debt is 30.4 percent of GDP, and net public debt is 7.5 percent of GDP. Too high, many might say. How do these statistics compare with other countries’ public sectors?

For gross public debt, data is given for 186 countries. New Zealand comes in at 149th in the public debt league. (For net public debt, New Zealand ranks 73 out of 94 countries for which this data exists.)

Significant countries with less gross public debt than New Zealand are few: Norway (ranked 151), Indonesia (152), Bulgaria (154), Peru (161), United Arab Emirates (166), Democratic Republic of the Congo (168), Russia (171), Iran (173), Chile (174), Nigeria (176), Saudi Arabia (183).

Countries New Zealanders relate to that have higher gross public debt than NZ include: Japan (ranked 1; 248 percent of GDP), Italy (4th highest), happy Bhutan (9), unhappy USA (10), Spain (15), France (17), Ireland (18), Canada (22), UK (23), Brazil (39), Germany (44), India (67), Finland (65), Malaysia (75), Argentina (78), Mexico (82), South Africa (90), Fiji (99), Denmark (101), Switzerland (102), Sweden (104), China (106), Papua New Guinea (115), Panama (121), Philippines (126), Australia (127), South Korea (130), Qatar (132), Bangladesh (140), Turkey (144). Are these all economic ‘basket cases’, as the Roger-gnomes claimed the New Zealand economy was in 1984? Many of these countries have significantly higher living standards than New Zealand does.

Do we really need to beat Norway, Indonesia, Bulgaria and Peru in the low debt stakes? If we achieve the 20 percent goal, we’ll be 165th in the world for gross public debt instead of 149th. Whoop-de-doo!

Beating Norway would be a hollow victory. It has a net public debt of minus 278 percent of GDP. Don’t think we could match that.

Greece has the highest net public debt, at plus 177 percent of its GDP. Japan sits in third place on 128 percent. The UK and the USA both have net public debt at 81 percent of GDP. Canada has 27% and Australia 18%. Our 7.5% is puny. Do we really need to reduce that figure further?

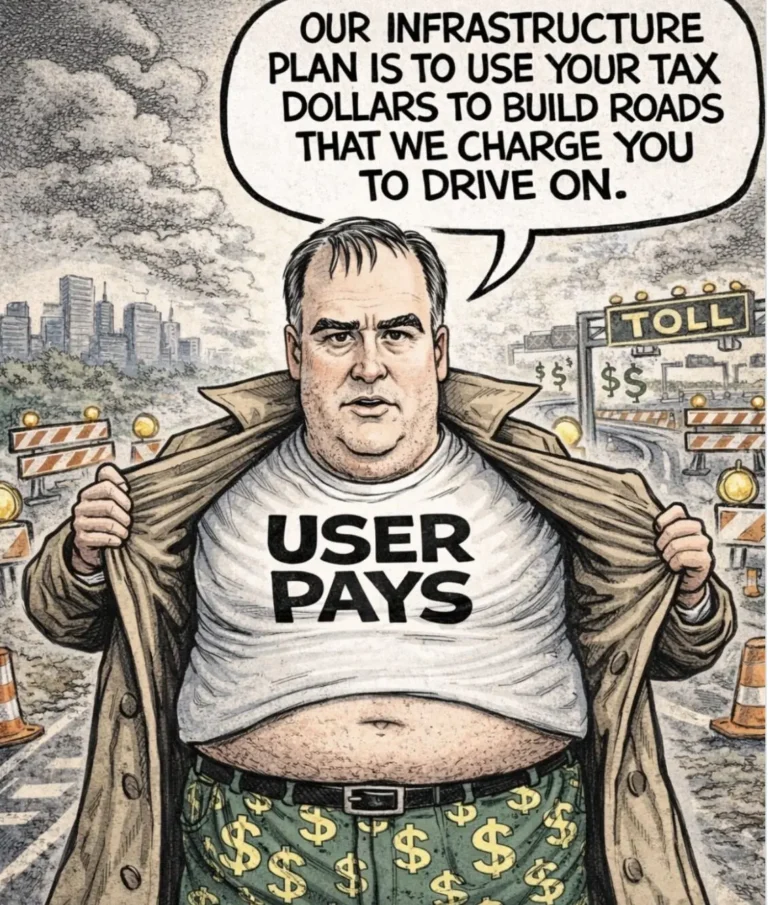

Let’s address the economic problems that we do have. There are plenty, such as housing. We could start by paying Statistics New Zealand a couple of million dollars to find out how many ‘rental’ properties are not actually being rented. (The withdrawal by ‘investors’ of houses from the rental stock is the proverbial ‘elephant in the room’ on this matter.) While we do not have a public debt problem, we do have very serious housing challenges that could be resolved by substantially taxing the owners of metropolitan baches and unrented rentals, thereby returning a substantial stock of existing houses to a state of habitation.

“Hang em high”!

Yes Country boy is right,

This Benglish – bull is just robbing again from the poor to feed the 1% who own all our common wealth they have stolen from us!!!

All under the administration of this criminal enterprise government!!!

So we need to “hang em high” due to their treason against the people!!!!.

So youve finally come around to my style of punishment.

Some times you have to be ruthless in crushing corruption. Sends the bejezus up scheming little punks

Srylands; ” The fact that much of the private debt is for housing which generates no income makes the need for public savings even more compelling ”

>>>the taxpayer is expected to bail out business people who don’t know how to save, how pathetic.

Meanwhile Nitrium thinks we are in a world where inflation is a problem and that we’re going to end up like Argentina or Venezuela.

Why don’t these people just stay at the Whaleoil site?

No offence but with a name like farmer guy you should know that small business owners like farmers are pretty good at paying of there debts and knuckling down in crises.

And when we talk about jailing bankers or the greedy ones that destroy capitalism. We are only talking about 200 New Zealanders that use different types of accounting. The Telly brothers use some shockingly old styles of capitalism that lowers there workers quality of life and manipulation of fishing quotas that destroy fish stocks and the environment.

People who financialise there profits and work force and socialise there external liabilities like that company that skived off on paying the full amount for thier ship the Rena that missed up the east coast. People like that are few and far between. So jail a few really won’t harm the economy, it will better it.

I’m a fiscal conservative personally. You’re literally arguing that just because other countries have ridiculous amounts of debt we can (and should) add to ours? If so, you’re failing to recognise that EVERY dollar of debt issued into the economy is, by definition, IMMEDIATELY spent into said economy (obviously no one takes debt that isn’t used). This by necessity increases the total money supply by that amount and therefore must directly result in inflation (regardless of how it’s spent). For those that are most vulnerable in today’s NZ (e.g. beneficiaries), ANY inflationary pressures will be immediately felt and definitely not in a “good” way. If said new debt is used for infrastructure projects that would result in economic growth down the road I can kinda see your point, but otherwise you’re effectively just advocating effective monetary inflation (i.e. “money printing”, even if it is by stealth).

Fiscal conservative can also mean jail bankers.

So New Zealand can borrow about 600 billion if we wanted to. And people like Warren Buffet actually do borrow that much. So it is a ligitimate investment strategy. It’s just every one isn’t a Buffet with 80 years experience in investing billions.

Borrowing that much dosnt scare me. How we spend it does scare me. Keith has good ideas about how to spend.

The problem remains that borrowed money isn’t ever “free”, as much as we might want it to be. Look at Argentina. Look at Venezuela, a formerly rich country, where the poor are literally eating cats, dogs and pigeons.

http://www.usatoday.com/story/news/world/2016/05/18/venezuela-food-shortages-cause-some-hunt-dogs-cats-pigeons/84547888/

Once an economy starts to unravel (as NZ will when the Auckland housing bubble imo inevitably collapses), you want to be in a solid fiscal position so you son’t end up forcing abject poverty on your population. Being up to your eyeballs in public debt when the shit hits the fan surely isn’t a prudent strategy.

Two things.

1) As I have said many times before. If it can be proven that Argentinian or Venezuela government officials snort more Coke while running an economy than Wallstreet execs you may have a point.

2) If and when a correction happens it will force people to engage with the political process. And depoliticise important issues. Aucklands unitary plan comes out in a couple of weeks. After that there will be no excuses. It will be act or get out of the way for some one more capable to lead this country.

I suspect that we should pass legislation to provide for the compulsory purchase of untenanted properties. It seems to be generally accepted that compulsory purchase is justified where land is needed for public works. I feel sure that the purchase of properties and their replacement with higher density housing would be justice in the present circumstances.

Banks require nations, communities and individuals to get into debt and remain in debt.

This planet is ruled by bankers.

Everything else is a puppet show.

Really? This post fails to mention private debt. Our gross debt/GDP ratio is around 100% of GDP. Or net debt/GDP ratio is about 55%. I can provide links if you wish but it is easy to look up.

So at the risk of stating the obvious, all that high private debt means the Government needs to run low public debt, otherwise we would be in the shit. The fact that much of the private debt is for housing which generates no income makes the need for public savings even more compelling.

I can’t believe you wrote this.

I agree, its as if all that borrowed billions for speculating on property doesnt really matter.

The chap from Business NZ was on RNZ this morning pointing out the massive private debt held by New Zealanders. He said when interest rates start to rise, there will be a day of reckoning for those owing $160 billion in mortgage debts.

God help us then.

Honestly. Who cares about stupid people who borrow more than there ability to repay. I believe the far right slogan is “choices.” We all have choices. Let feel the full power of a correction