National and the Reserve Bank – at War!

.

.

Open warfare has broken out between the National regime and the Reserve Bank. Recent media statements indicate that we are seeing an increasingly bitter war-of-words; a battle of wills, taking place over the growing housing crisis.

National is demanding that the Reserve Bank implement policies to “get on with it” to rein-in ballooning Auckland housing prices. The Reserve Bank is resisting, in an almost Churchillian-way.

In April this year, Key denied flatly that there was any “housing crisis” in this country;

“No, I don’t think you can call it a crisis. What you can say though is that Auckland house prices have been rising, and rising too quickly actually.”

But a year ago, on 15 April 2015, Reserve Bank deputy governor Grant Spencer warned that investors/speculators were becoming a major problem in the housing market;

“Investors are often setting the marginal market prices that are then applied to the full housing stock within a regional market.”

Spencer went on to issue what must be the most prescient statement ever uttered by a senior civil servant;

“Indicators point to an increasing presence of investors in the Auckland market and this trend is no doubt being reinforced by the expectation of high rates of return based on untaxed capital gains.”

Predictably, Key rejected taxing capital gains as an instrument to control rampant speculation;

“I remember when everyone said to [introduce] the equivalent of a [capital gains] bright line test, it will solve the issues. Well, it really didn’t.”

Key also rejected calls by the Reserve Bank to curb high levels of immigration which was exacerbating demand for housing. Key was blunt;

“We’re going to stick with the plan we’ve got.”

Of course Key is not prepared to reduce immigration . It is one of the few drivers for current economic growth that is stimulating the economy. Curb migration and the economy stalls. Stall the economy and National would have nothing to take to the election next year.

As National’s own minister, Jonathan Coleman stated in 2011;

“It’s important to highlight the economic value of Immigration here…

[…]

…New migrants add an estimated $1.9 billion to the New Zealand economy every year.

Immigration recognises the strategic importance of the tourism and export education sectors and the direct links they provide to employers.

Given these compelling figures, my number one priority has been to ensure Immigration is contributing to the Government’s economic growth agenda.”

Coleman’s 6 May 2011 press release was entitled, “Immigration New Zealand’s contribution to growing the economy”.

Key deflected criticism and instead blamed the Auckland Council. In a blustering attack reminiscent of the late Robert Muldoon, Key threatened the Auckland Council with over-riding it’s Unitary Plan;

“The effect of the [government] National Policy Statement would vary around the country, but in essence it linked the price of land to demand in the economy. If the land price is going up too quickly (councils) have to amend their plans to release enough land, and if they don’t do that they’ll breach the law. If the Unitary Plan doesn’t meet the demands of Auckland, the National Policy Statement because of the way it works will drive it, mark my words.”

His solution? Build more;

“Look, in the end, we’ve been saying for some time it is not sustainable for house prices to rise at 10, 12, 13 percent a year. The only answer to that is do what we’re doing: allocate more land and build more houses. It certainly will stop it, there’s no question about that, because if you build enough supply, you eventually satisfy demand.

The mantra to ‘build more, build more‘ overlooks recent statistics which showed that nearly fifty percent of housing in Auckland was being purchased by investors/speculators;

The Reserve Bank has for the first time unveiled official figures that break out the Auckland market from the rest of the country’s mortgage lending figures. The figures confirm what some previous research and anecdotal evidence has pointed to. Investors are huge in the Auckland market.

The figures show that in April, investors committed to $1.623 billion of the $3.536 billion worth of mortgages advanced in Auckland. That’s just a tick under 46% of the total.

Labour’s Phil Twyford said that in some areas of Auckland, up to 75% of housing was being grabbed by investors/speculators. Twyford said;

“They should start immediately by banning non-resident foreign buys from speculating in New Zealand property, unless they build a new dwelling. That’s the Australian Government policy and we think it makes a lot of sense.”

So unless National is prepared to ban foreigner and local investors/speculators from purchasing around half of all new housing in Auckland, building new homes will not address the growing crisis.

On the issue of foreign-ownership of residential property, Key was adamant that his open-door, free-market policy of foreign ownership of housing would be unchanged. Even if it meant New Zealander’s would find it harder and harder to buy their own home, in their own country. As he said to Corin Dann on TVNZ’s Q+A last year;

“But the point here is simply this – I don’t want to ban foreigners from buying residential property.”

But Deputy Mayor, Penny Hulse, was having none of Key’s bullying tactics. She responded with her own tough message;

“We’ve got six and half years of land planned for, infrastructure in the ground and ready to go. Government themselves have got more than 20 special housing areas that belong to Housing New Zealand that are ready to go. There’s no shortage of places to build. Our question to government would be, perhaps you just need to get on with it.”

The reality is that National is unwilling to implement any policy that might lower property prices. As Key has said previously;

“If it is left unchecked, some buyers could find themselves substantially overexposed in an overvalued market, and we all know what happens if those values start to fall.” – John Key, 23 July 2013

“Let’s just take the counter-factual for a moment. Would you want your house price going down? And what most Aucklanders say to me is ‘I’d rather my house price went up, but I’d rather it went up a little more slowly than this’.” – John Key, 6 August 2015

So Key is in a bind. His government’s continuing popularity is at the pleasure of property-owners with bloated housing values.

Build too many houses or implement too many restrictions (including new taxes), and property values in Auckland and elsewhere in New Zealand might begin to fall, as they did in the late 1990s. That would be a financial shock for many New Zealanders who, through rising property values, are feeling like “millionaires”, albeit on paper.

If that happens, National’s popularity – riding high on 47% – would finally crash and burn, paving way for a Labour-Green(-NZ First?) coalition government next year.

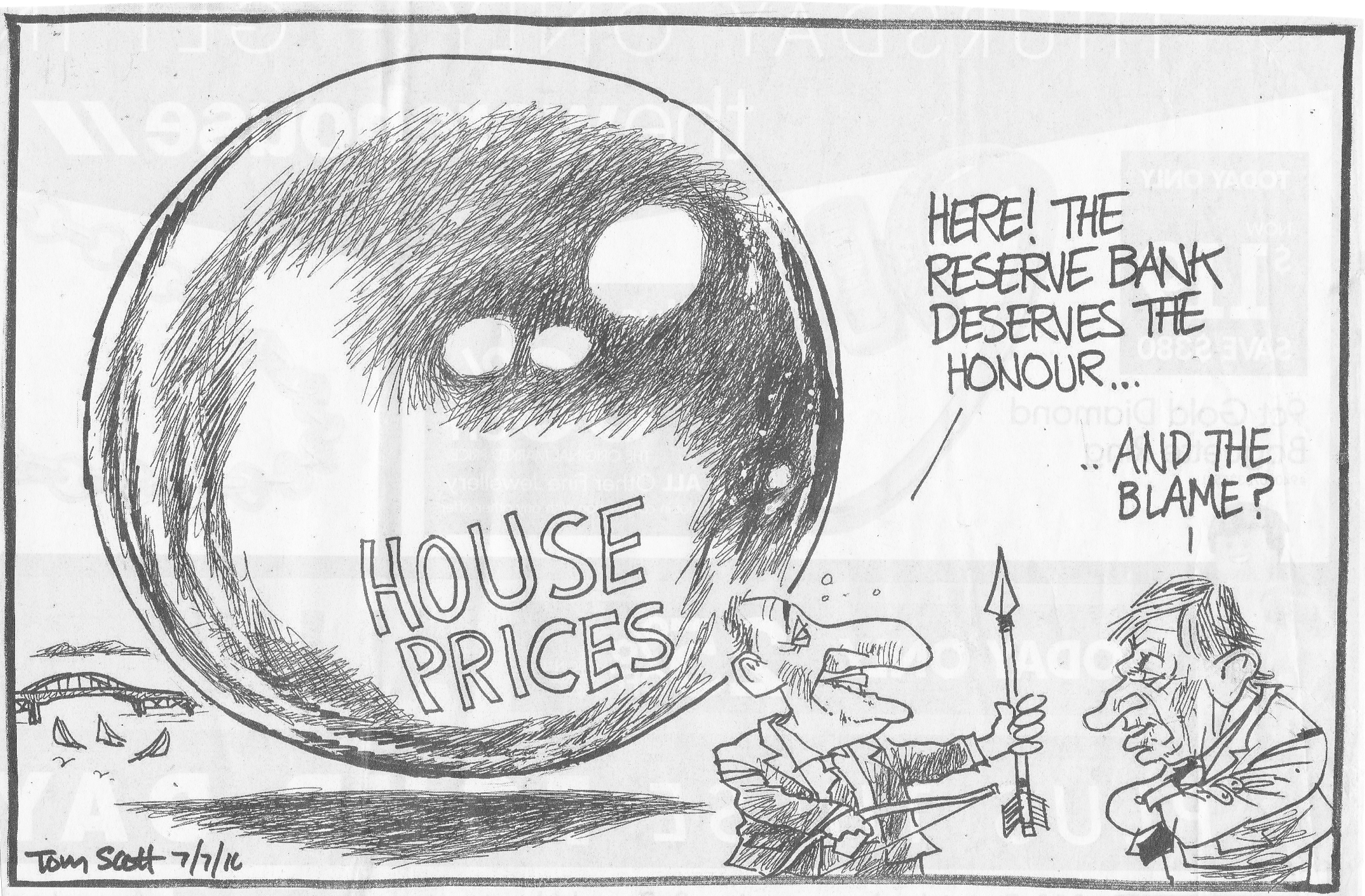

However, National’s desperation to resolve what has become a major public crisis has apparently found a new scape-goat – the Reserve Bank.

National’s cunning plan is for the Reserve Bank to do their “dirty work” for them. If the RBNZ were to implement policies that would result in property values levelling off – or even dropping – then Key and English would have “plausible deniability”. They could point to the Reserve Bank as an independent body and wash their hands of its actions.

Recent demands from John Key for the RBNZ to “get on with it” are not the first time that National has interfered with the independence of the bank.

In April last year, in a classic example of nepotistic cronyism, Bill English’s brother was appointed to the RBNZ as an “advisor”;

.

.

A year later, in April this year, Bill English took an unprecedented step in demanding greater over-sight of Graeme Wheeler, the RBNZ’s Governor;

.

.

According to the Fairfax report, English said;

“The duties of the board include keeping under review the performance of the governor. I would expect to discuss your assessment of the governor’s performance from time to time.”

On National’s* own website, English went further;

“Ministers typically send letters of expectation to the Boards of entities in their portfolio. This letter was prepared after The Treasury identified an opportunity to bring the accountability framework into line with other Crown agencies.”

This is naked interference in an institution that, since 1989, was to be protected from partisan-political interference. The RBNZ supposedly acts according to legislation – not the demands of the Finance Minister. Not since the Muldoon era has the RBNZ been controlled directly by a government minister.

It can only be assumed that National is meeting stiff resistance from the bank’s Governor, Graeme Wheeler, as English attempts to assert direct ministerial “over-sight” (ie, control) over the institution.

The fact that a recent war-of-words has erupted over the RBNZ’s involvement in Auckland’s housing crisis suggests that English’s Very Kiwi Coup may not have been successful.

In fact, the Cold War has become a Hot Conflict.

In the last week, the ‘battleground’ between National and the Bank became more public, as government minister and chief Head-Kicker, Steven Joyce and Grant Spence continued their war-of wills.

6 July, 1.10 AM

“But my sense is potentially one of the risks is you have got people buying rental properties at the moment, borrowing more money but fearful that the Reserve Bank is going to move. If they are going to make changes, probably they should just get on with it.”

7 July

Grant Spencer (RBNZ);

“Increased housing demand has been driven by record net immigration, low mortgage interest rates and increasing investor participation. Net migration flows continue to hit new records, with annual net PLT migration now approaching 70,000 persons…

[…]

A dominant feature of the housing market resurgence has been an increase in investor activity. In recent months, investors have accounted for around 43 percent of sales in Auckland and 38 percent in other regions […] The prospect of capital gains appears to remain a key driver for investors in the face of declining rental yields.

The declining affordability of New Zealand housing and increasing investor presence have seen a downward trend in the share of households owning their own home. This ratio has fallen steadily since the early 1990s, reaching 64.8 percent at the 2013 Census. The recent increase in investor housing activity suggests that the home-ownership rate may have declined further since 2013.

The Reserve Bank considers that rising investor participation tends to increase the financial stability risks relating to the household sector in severe downturn conditions.

[…]

…However, we cannot ignore that the 160,000 net inflow of permanent and long-term migrants over the last 3 years has generated an unprecedented increase in the population and a significant boost to housing demand. Given the strong influence of departing and returning New Zealanders in the total numbers, it will never be possible to fine-tune the overall level of migration or smooth out the migration cycle. However, there may be merit in reviewing whether migration policy is securing the number and composition of skills intended. While any adjustments would operate at the margin, they could over time help to moderate the housing market imbalance.”

8 July, 7.46am

Don Brash (Former Reserve Bank governor);

“The Reserve bank has no statutory responsibility for Auckland house prices or indeed house prices anywhere else…

[…]

The Prime Minister wants to pretend this is somebody else’s responsibility. I think the Reserve bank is absolutely right, that this responsibility for Auckland house prices lies first and foremost with local government Auckland and central government in Wellington.

Central government, because it controls the rate of migration, which is by any international standards a very high level, that pushes demand for housing. And of course the Auckland Council, not just now, but for the last couple of decades has restrained the availability of land on which to build Auckland houses...”

8 July, 7.51am

Steven Joyce (Minister for Economic Development);

“Migration is a contributing factor to housing demand…

[…]

The prime minister’s comment was entirely fair, which is to to suggest to the Reserve Bank [that] if you’re going to these things then, then do move on them quickly…

[…]

The Prime Minister’s comments on Tuesday were just to highlight the fact that actually if you’re going to make these sorts of changes, do make them reasonably quickly…“

8 July, 7.57am

Grant Spencer (RBNZ);

“What we’re saying is that the, what we’re seeing in the last three years is 160,000 net in-flow is unprecedented and it’s an important driver of the current housing situation and therefore it can’t be ignored….

[…]

“You can’t manage or fine tune the migration cycle, we know that, but all we’re saying is that given it’s an important driver that we should be taking a look at that policy – making sure that we’re getting the numbers and the skills that government’s really targeting.”

It’s an important driver in the housing market, yes. There’s no doubt about that. But we’re also saying there’s no easy solution. You can’t manage or fine tune the migration cycle, we know that, but all we’re saying is that given it’s an important driver that we should be taking a look at that policy – making sure that we’re getting the numbers and the skills that government’s really targeting.”

[…]

We’re running at a rate of 60,000 at present, but how many years can we continue running at a rate of 60,000 and continue to absorb that rate. It get’s more and more difficulty when the country doesn’t have that absorbtive capacity.”

Current battle-status: stalemate.

Controlling house prices, as former Reserve Bank governor, Don Brash said, is beyond the bank’s statutory responsibility. On top of which, the RBNZ is unwilling to be the “patsy” for implementing policies (even if it could) that might crash house prices, and make them the Bad Guys in this worsening crisis.

Only a government can act decisively in such matters – but to do so would be political suicide for Key and his fellow ministers.

Fran O’Sullivan is usually sympathetic to the National government, but her column on 6 July was damning of Key’s inaction;

Most National Cabinet ministers and MPs are well invested in “real property”. So are many of their counterparts from other political parties.

Like most of us who are “established” – that is those of us who bought into the housing market a decade or more ago – the MPs have seen their own on-paper wealth double.

Having rejoiced at the wealth effect, neither the MPs nor the rest of us want to take a financial haircut. Key is right on that score.

But it is a pretty crap society that pulls the ladder up on younger people or those less well off just because they want to preserve their new unearned wealth.

[…]

Key again duck-shoved the issue, suggesting it was the Reserve Bank’s responsibility to “have a look at the question around investors”.

What’s notable is his Government will not slap investors with an effective capital gains tax, preferring a “bright line” test which is easily avoided by holding a housing investment for more than two years; refuses to introduce specific taxes to punish land bankers; and will not introduce rules to preserve the acquisition of existing residential housing for citizens or curb migration.

Key could pass special legislation to do this.

The question is why won’t he.

“Why”? Because Key doesn’t want to lose the 2017 election.

This is National’s Achille’s Heel, and it is fully exposed.

.

.

.

Addendum1

In May this year, a TV3/Reid Research Poll was scathing of National’s inaction on the housing crisis. Even National voters were getting ‘grumpy’;

.

.

Addendum2

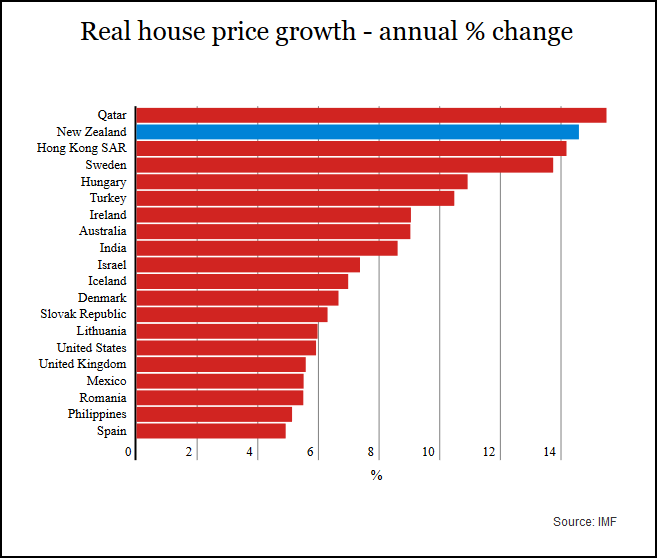

Current ballooning property prices are the highest in the developed world;

.

Ad

Addendem3

• $975,087- Auckland: Average house price, up 4.7% in past three months and 16.1% since June last year

• $492,403- Hamilton: Average house price, up 6.9% in past three months and 29% since June last year

• $599,915- Tauranga: Average house price, up 4.9% in past three months and 23.6% since June last year

Inflation is currently at 0.4%, according to Statistics NZ.

Notes

* I have downloaded and retained a copy of the National Party webpage. In the past, National Party webpages tend to “disappear”, and are no longer searchable, making referencing and verification of quotes problematic. If this webpage disappears, English’s comments can still be verified to anyone requesting it. – Frank Macskasy

.

.

.

References

Radio NZ: Key denies Auckland housing crisis

Fairfax media: Reserve Bank call to look at untaxed property gains

NZ Herald: John Key to Reserve Bank – Housing measures ‘not terribly effective’

Radio NZ: No change on immigration, says John Key

NZ Herald: Housing crisis – Reserve Bank calls on Government to curb immigration

Beehive.govt.nz: Immigration New Zealand’s contribution to growing the economy

Fairfax media: Key gets tough on Auckland with new policy forcing councils to release land

Interest.co.nz: Investors accounted for nearly 46% of all mortgage monies in Auckland

Radio NZ: Auckland’s home ownership rates ‘collapsing’ – Labour

Scoop media: PM – I don’t want to ban foreign buyers from buying

Radio NZ: Get on with it – Auckland Council tells govt

Fairfax media: Key expects LVRs to go ahead

Interest.co.nz: Key says non-Aucklanders tell him they would love it when house prices are rising

QV.co.nz: How fast is the current property market rising compared to the past? (2013)

TV3: Newshub poll – Key’s popularity plummets to lowest level

Fairfax media: Finance Minister Bill English’s brother to advise Reserve Bank on interest rates

Fairfax media: Bill English seeks talks on Reserve Bank governor’s performance ‘from time to time’

National.co.nz: English releases RB Board letter of expectations

NZ Herald: Auckland property: $400k deposit please

Reserve Bank: Housing risks require a broad policy response

Radio NZ: RBNZ wants immigration review to rein in house prices

Radio NZ: Government responds to RBNZ housing speech

Radio NZ: Reserve Bank – Housing risks require a broad policy response

NZ Herald: Fran O’Sullivan – Why won’t Key act on housing?

Fairfax media: Why MPs may want house prices in New Zealand to keep rising

TV3 News: Government gets thumbs down on housing

NZ Herald: Auckland property – $400k deposit please

Statistics NZ: Consumers Price Index: March 2016 quarter

Additional

Radio NZ: Reserve Bank refuses to play housing ball with government

Previous related blogposts

Can we do it? Bloody oath we can!

Budget 2013: State Housing and the War on Poor

National recycles Housing Policy and produces good manure!

National Housing propaganda – McGehan Close Revisited

Housing; broken promises, families in cars, and ideological idiocy (Part Tahi)

Housing; broken promises, families in cars, and ideological idiocy (Part Rua)

Housing; broken promises, families in cars, and ideological idiocy (Part Toru)

Another ‘Claytons’ Solution to our Housing Problem? When will NZers ever learn?

Government Minister sees history repeat – responsible for death

Housing Minister Paula Bennett continues National’s spin on rundown State Houses

Letter to the Editor – How many more children must die, Mr Key?!

National under attack – defaults to Deflection #1

National’s blatant lies on Housing NZ dividends – The truth uncovered!

State house sell-off in Tauranga unravelling?

Upper Hutt residents mobilise to fight State House sell-off

Park-up in Wellington – People speaking against the scourge of homelessness

.

.

.

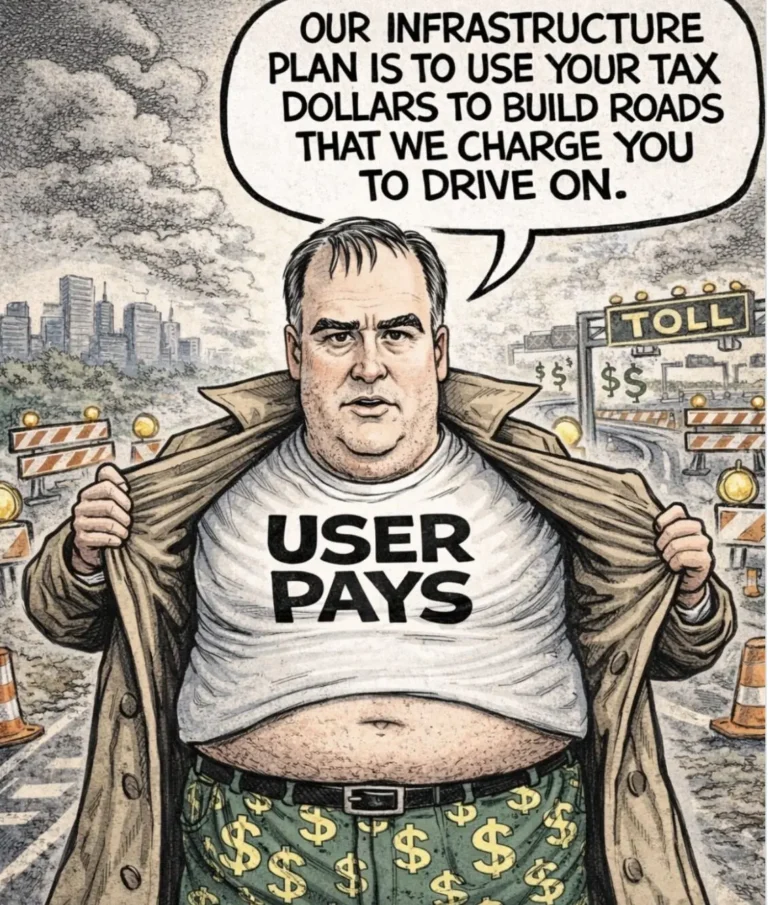

Cartoon acknowledgement: Tom Scott, Dominion Post

.

.

= fs =

I love that name, the “Bright Line Test”. How cool is it? They can’t say it often enough for mine. Roll it round on your tongue. Sounds like a superhighway to the future. I don’t even have to know what it means to know it’s great. (I certainly don’t want it to be called a capital-gains wet bus-ticket).It’s almost as good as that $25.00 bail-out of my responsibility towards people who are struggling.

If Labour wins in 2017, and house prices crash during its first term, they will probably lose in 2020. Therefore they should be thinking now, not only about how to halt price increases, but also about what to do in the event of a crash.

It seems to me necessary to, not only stabilise house prices, but greatly reduce them.

Frank – very nice work – much appreciated.

Our housing crisis will not change much with this govt.

Of course the Reserve Bank will do not much either as they are owned and controlled by the — ROTHSCHILD’S ILLUMINATI.

Their priorities and agenda are clear and needs the attention of folks that want to wake up and see the truths.

Jonkey Donkey is heavily entrenched in this same group that wants to privatize everything and cut social service spending.

Their whole banking and corporate plan is profit – profit and more profit. That is why these unethical and greedy families are worth many

trillions meanwhile the world suffers and refugee numbers grow and the homeless problem remains.

To count on National or the reserve bank to help the poor and help curb this housing crisis is a

very futile effort and waste of time and energy. THEY are the problem.

http://beforeitsnews.com/alternative/2015/10/complete-list-of-banks-owned-by-illuminati-rothschild-family-3235204.html

https://www.youtube.com/watch?v=r97Z94xNYsk

I remember watching something on TV years ago, where the Reserve Bank was the topic of discussion. Basically, the implication was that the Reserve Bank governor could do whatever he liked, so long as he remembered that if he did, he would never see his wife and kids again. (They being in a cabin in the woods, so to speak).

While it DID appear to be that way back then, today there are signs of rebellion, as has been pointed out. Perhaps the present governor is not a paid-up member of the Natzkey Party. (OMG-how did THAT happen?)

At least now we know what the economy is based on. Migrant investors buying up large in Auckland.

It MIGHT work for a while, but it cannot longterm. And, as usual, the pollies have failed to notice that the natives are getting restless.

So I presume only Qataris will consider NZ housing cheap by comparisons.

Watch Blinglish at the end of this excellent ‘Sunday’ program from tonight, how he is desperate to explain away the housing crisis, shy of the word crisis to come over his lips:

https://www.tvnz.co.nz/ondemand/sunday/10-07-2016/series-2016-episode-23

“John Key MP

Leader of the National Party

20 August 2007

Speech to Auckland branch

New Zealand Contractors Federation

Conclusion

Over the past few years a consensus has developed in New Zealand. We are facing a severe home affordability and ownership crisis. The crisis has reached dangerous levels in recent years and looks set to get worse.

This is an issue that should concern all New Zealanders. It threatens a fundamental part of our culture, it threatens our communities and, ultimately, it threatens our economy.

The good news is that we can turn the situation around. We can deal with the fundamental issues driving the home affordability crisis. Not just with rinky-dink schemes, but with sound long-term solutions to an issue that has long-term implications for New Zealand’s economy and society.

National has a plan for doing this and we will be resolute in our commitment to the goal of ensuring more young Kiwis can aspire to buy their own home.

It’s a worthy goal and one I hope you will support us in achieving. Thank-you.”

So if in 2007 it was a crisis ,in John Key’s words, why is just a challenge now? Surely Key has turned the housing issue into a catastrophe?

His inaction clearly defines his lack of leadership and should resign now or is he lust a hypocrite.

Bert, here’s the link to that piece: http://www.scoop.co.nz/stories/PA0708/S00336.htm

And thank you for bringing it to my attention. It fits perfectly with a story I’m working on tonight.

100% Bert that statement will come around & bite him in the arse come election time.

Well, the good/bad news is that this government isn’t going to do anything substantial so we can expect the average house price to be well over $1 million by the next election.

Well done Frank. You have outdone all of your previous efforts in both volume and depth of drivel. The only sad part is I bothered to read it all!

You haven’t commented on any aspect of it, so I doubt you read it, maninthemiddle. Otherwise you’d be more specific in what part is “drivel”.

Give us some examples.

“Drivel”? The only “drivel” is your rather asinine comment, Man In The middle. Frank has referenced every point he’s made and drawn some fairly reasonable conclusions.

In fact, the MSM have come to the same conclusion, that there is conflict between the Nats (who you so slavishly support) and the Reserve Bank.

You didn’t address a single point raised in Frank’s report, because you can’t.

Maninthemiddle . . .

So full of piddle

Comments that show

He has much to grow

In order to see

that most disagree

with your drivel and nonsense.

Frank is light years ahead

of your intellect so

drivel on middleman

and then bury you head in the sand.

Heh heh heh… thank you, Blake. I think I can say in all honesty that that is the first poem ever dedicated to one of my works…

I might have to print it off and frame it for my office wall…

Spent some time tonight on your blog, for the first time, and I agree with each item on your list of how to heal New Zealand.

I knew we were kindred spirits and I am honoured that you like the quickly put together poem cuz I enjoy questioning and exposing those who dwell in untruths and biased ignorance and just plain ole Tom Foolery ==>> myself included sometimes ! !

I heard from a birdie that these trolls get $15 to $20 every blog response so we shouldn’t give it any money for the dribble.

I thought I’d be worth more, Cleangreen… 😉

As usual, maninthemiddle, you’re not much more than a mouthpiece for National and Act.

As usual you can’t address a single point Frank has raised and documented.

As usual, your pro-National ignorance shines through.

http://www.nationaldebtclocks.org/debtclock/newzealand

We have manipulators masquerading as a government that doesn’t know what it’s doing until it’s told. The Reserve Bank is the National Government and the National Government is the Reserve Bank. All for one and that one being NZ Inc run out of The City of London.

I’d be awfully happy if someone could correct me if this is wrong thinking.

Awesome thanks Helena.

Borrowed from the Golden Bay Weekly:

http://thecontrail.com/forum/topics/printed-in-the-golden-bay-weekly-this-week-national-party-s-10-do?xg_source=activity

Of course the Reserve Bank can (but won’t) do something about the housing bubble: increase interest rates. Doing that would both make saving for a house easier and make borrowing to the hilt more expensive. Naturally they won’t do this, because it would instantly expose the underlying recession this country is undergoing under the National government. The whole GFC has been a race to the bottom, and once you hit bottom there is nowhere left to go.

The facts are simple folks, house PRICES are largely irrelevant to the buyer. The ONLY thing they care about is how much it COSTS to “own” (i.e. service the debt on) a house which is ENTIRELY dependent on the interest you have to pay on the mortgage.

A $400,000 debt at 8% costs EXACTLY the same ($32,000/year) as $800,000 at 4%. Until people wake up and realise this whole housing bubble is predicated on the cost of “ownership” (i.e. debt servicing) NOT price, nothing is going to change. Indeed the Reserve Bank is going to keep DECREASING rates to prop up the bubble which will all but guarantee increasing prices until they hit zero.

Capitalism officially failed in 2008, but clearly the apparatchiks haven’t gotten memo yet.

I guess you covered it with the “underlying recession this country is undergoing” part of your comment but increased interest rates would up our dollar value & decrease exports & tourism income. While your maths about interests cost is reasonable you need to factor in income as well before you can say the house price is irrelevant. While property investors can rely on capital gain & leverage during the good times to cover the high purchase price the low to middle income families that should be able to afford their own home are still denied that ability by high house prices. In many other parts of the world property prices have dropped & I expect the same drop here eventually.

August is a-coming in.

We can hope the OCR rises.

(Have we punished the country’s few savers enough? Or is saving ‘un-Kiwi’? Everytime I check my account there’s a bit more in it and the interest rate is fading, fading fading. Save more – get less.)

PANIC FRANK! – As monetary cracks appear!!!!

Frank! You are like a rare French wine “keep getting better with age”

PARTLY DUE TO NATIONALS “SPEND BIG” ON ROADING AS ANOTHER $30 BILLION IS GIVEN TO ROADING IN THE NEXT THREE YEARS!!!

WITH NO RETURN ON THAT INVESMENT, UNLIKE WHAT THEY PLACE ON OUR PUBLICALLY OWNED RAIL, – THAT FACES AN 8% PREMIUM ON GOVERNMENT’s FLIMSY ONE BILLION INVESMENT IN RAIL?????

THIS IS ONLY ONE SUCH FOOLISH ISSUE GOVERNMENT HAVE SCREWED UP WITH THEIR BUSTED FLAWED ECONOMIC POLICIES.

“The fact that a recent war-of-words has erupted over the RBNZ’s involvement in Auckland’s housing crisis suggests that English’s Very Kiwi Coup may not have been successful.

In fact, the Cold War has become a Hot Conflict.

In the last week, the ‘battleground’ between National and the Bank became more public, as government minister and chief Head-Kicker, Steven Joyce and Grant Spence continued their war-of wills.”

The crazy thing is that all those people who own property in NZ, and particularly in Auckland, who feel richer when their property values go up, aren’t actually richer at all.

It’s all theoretical increases. Paper wealth only.

It’s only actually an increase in your real equity if you sell your property and exit the market, then enter a different market.

If you sell and buy in the same market, you’re selling and buying at the same inflated prices. You will have no real gain until you cash up and exit the market.

So what do these people really get out of rising prices? The feeling of being rich. And the ability to borrow more. Which they are doing. Our level of household debt is now higher than it was in 2007. Thats a huge risk for the NZ economy.

IMO it’s horribly selfish for those owning property to resist all attempts at bringing prices down, because of their feels. Too high prices have the effect of reducing home ownership, young people find it so much harder to buy.

You are right, it leaves the whole country at huge risk. A drop in prices will leave many with debt they will struggle to pay off.

If they stopped corrupt money, rich immigrants and our speculators blowing money into the Auckland property bubble ….. the thing would go pop….

Like Ireland where key used to work with merill Lynch ….

Ireland:

all of Ireland had become subprime. Otherwise sound Irish borrowers had been rendered unsound by the size of the loans they had taken out to buy inflated Irish property. That had been the strangest consequence of the Irish bubble: to throw a nation which had finally clawed its way out of centuries of indentured servitude back into it.”

_______________________________________________________

Perhaps the only detailed academic examination of Ireland’s regulatory laxity comes from Professor Jim Stewart of Trinity College, Dublin. The IFSC, he reveals, formed a core element in the toxic global “shadow banking” system that led to the global financial crisis. For example, hedge funds would typically be listed in Dublin, managed in London and domiciled in a classic tax haven like the Cayman Islands.

****************************************************

Simply put, the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly.

__________________________________________________________

Lastly is the area of offshore trusts, a means of avoiding tax so common that even the dogs on the street could tell you what they’re used for. The users of trusts enjoy relative anonymity which makes it difficult to ascertain who owns them, what assets they control and thus how to tax them.

************************************************

Merill Lynch” ………..

“Ken Lewis, the CEO of Bank of America, agreed to swallow one of the country’s most toxic investment houses.”

“Tucked into the press release was the news that Merrill Lynch had lost a staggering $15.3 billion in the fourth quarter.

Merrill’s losses were now $12 billion. (By the end of December, they reached $15.3 billion.) Lewis later said that what he mainly remembered from the conversation with Price was just the “staggering amount of deterioration” in Merrill’s financial performance.”

“provide protection against further losses” on $118 billion in toxic assets, primarily taken from the Merrill Lynch balance sheet.”