MUST READ: The fiscal stranglehold

Labour is getting a rough time over its fiscal rules from many commentators, but few question the underling accounting conventions.

Accounting may look objective but the fiscal caps are meaningless. To focus on net debt and government spending as a % of GDP without a view of the whole balance sheet is at best misleading, at worse dangerous.

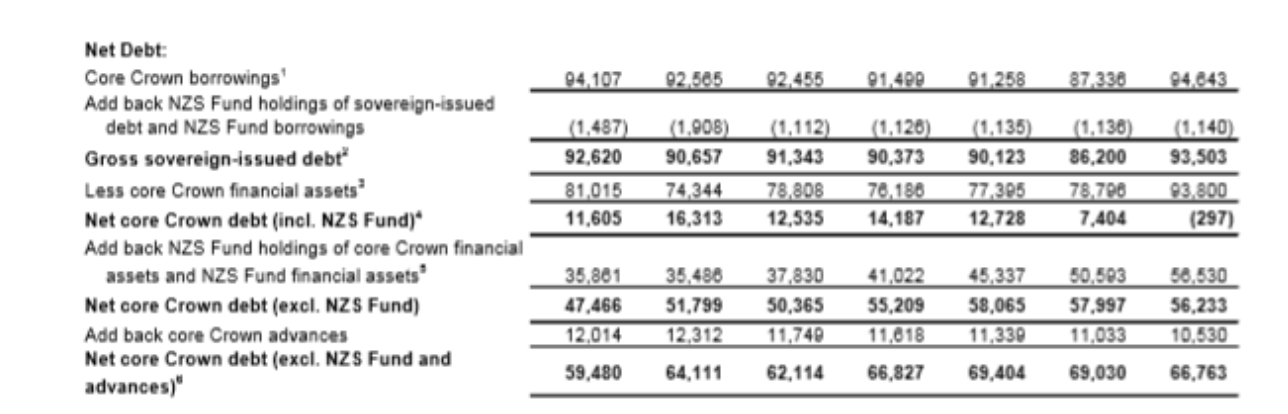

Let’s take the concept net debt as a measure of fiscal responsibility. The NZ government’s total net equity is total assets- total liabilities. Net debt is a selective subset of the balance sheet that starts with gross debt and nets off liquid financial assets such as shares and cash.

In 2009, a decision was made by Treasury to exclude the financial assets held in the NZ Super fund from the net debt calculation. The reason given was because the assets “are ring-fenced for long-term fiscal pressures and their time varying and volatile nature can complicate communication of a net debt target”.

In 2013 the Auditor-General noted “the exclusion of New Zealand Superannuation Fund’s assets from net debt was debatable and resulted in a higher projection of Crown net debt than if those assets were included”.

Thus while projections of government spending include NZS Super demographic pressures, the government gives itself no credit on the net debt side for preparing for this by stashing money away in the NZ Super Fund.

The Auditor-General was ignored but stated categorically again in 2016 “We note that the 2016 Statement also includes the measure of core Crown net debt after deducting the assets of the New Zealand Superannuation Fund. We remain of the view that the New Zealand Superannuation Fund’s assets should be deducted in the calculation of net debt to GDP when used as the main financial sustainability indicator in the 2016 Statement.”

Isn’t it time to take away the imaginary ring around NZ Super Fund assets on the Crown balance sheet? The ring-fenced fund gives a false sense of security re the future affordability of NZ Super. It cuts off discussion about the actual physical infrastructure investment we need to invest in to prepare for an ageing population. There is not much point in having money in shares when there is a creaking sewage/ transport/ care and health system and a poorly-trained, impoverished workforce.

Isn’t it also time to question the restarted contributions to the fund when there is so much deficit spending to address? Contributions to the fund come out of current workers’ taxes, which means they are being double taxed. First they are taxed to pay for current superannuitants, many of whom are a lot wealthier than they are themselves, and second they are taxed extra to help pay for their own New Zealand Superannuation. It’s called paying twice while letting the richer baby-boomers off scot-free. Why does the working age generation stand for it?

The Super fund doesn’t change the cost of New Zealand Superannuation. Taking money out of one pot rather than other doesn’t make it cheaper. It doesn’t guarantee NZ Super will stay the same for future generations. NZ Super is unsustainable in its current form and eventually changes will have to be made.

In the meantime the double taxation will result in shifting debt to today’s workers who may, for example, end up with bigger mortgages which will make it harder for them to save for their own retirement. Private debt is a far bigger problem than public debt for the NZ economy as the IMF have recently claimed.

When the Fund is included, New Zealand’s net debt level becomes extremely low. Treasury projections in the fiscal update December 2017 show net debt including the fund actually disappears by 2022! Time to stop the fiscal panic please.

p 109 fiscal forecasts Dec 2017

All monies are about credit and debit or black or white. National said the books were white, we are now discovering they were a very dark black.

“It’s called paying twice while letting the richer baby-boomers off scot-free. ”

And that’s called – I dunno. Must be a term somewhere for this.

EVERY ‘baby boomer’ and older PAYS TAX.

They pay it as GST, excises, resident withholding tax on interest.

They BUY goods and services BECAUSE thay have a bit of extra after the leeches have been by. You know – be customers and clients that help sustain j.o.b.s for employees. Some help their children and grandchildren in various ways cash or services – as families always have.

Some of those accursed boomers also help parents and other kin to meet such minor things as home repairs, transport, health costs.

Do you imagine they sit over hoards of gold like gormless dragons, neither spending nor sharing?!

And – may we have the numbers for: these jolly bands of slightly wealthier?

The number of older citizens who HAVE to work because they cannot make ends meet otherwise – ever-rising rates, medical costs, basic quality of life purchases;

the number of older citizens, boomer or older, who go without because their pittance is at least $10k below adult minimum, they owe money to WINZ, they’re renting because they missed being affluent boomers?

There is so much systemic incompetence and obsolescence that urgently needs addressing. So much change that needs careful shepherding through all its phases.

And yet there’s this everlasting myopic hooha about ‘baby boomers and other affluents’. Wrong game. Wrong focus.

PS Have you actually looked at the astonishing wealth that isn’t coming from savings to prudent people? It’s been that way for a decade now. Lucky savers. Not.

Bloody oath. I owe $40k+ on my student loan. I often bail some of my children out financially, not because I’m rich but because I’ve got a mortgage therefore have easy access to bank finance.

I too am damned sick of the pejorative ‘baby boomer’ implying immense wealth.

“There is not much point in having money in shares when there is a creaking sewage/ transport/ care and health system and a poorly-trained, impoverished workforce.”

Agree.

And you could equally say, there isn’t much point running surpluses at all right now, sucking demand out of the economy when we have high labour underutilisation, near deflation making the debt burden problematic, low wage growth and poor investment levels.

What matters for the future is that there is a more productive economy where fewer workers can support more oldies. And that we have enough hospitals and carers and retirement housing to support those oldies. That’s why we need investment now. To build that world. But with discretionary surpluses and debt-laden households where is the demand to stimulate that kind of investment?

As for the politics of cutting superannuation to redistribute to the poor – there are some rich boomers for sure but there are a lot of struggling pensioners – I’ve seen some shocking living conditions – and most are living just a decent respectable existence that we should aspire to for our elderly. A politics of taking from older generations to help the young will get nowhere right now.

Better to focus on countering the paranoid fear of deficits and the need for greater fiscal expansion.

category 2 fakenews

Finance types always hide money for there pet projects. ALWAYS. They’re never open about why savings have to be made or why every one has to work harder. For Steven Joyce it was for $11bln plus $20bln defence fund. For Bill Emglish it was for a surplus. For Sir Micheal Cullan it was for a global financial crises. If I was Grant Robertson I’d massively increase super contributions there by creating a new revenue stream for infrastructure and put it all on green and fund there renewables programme effectively creating Insta shareholders to shut every one up.

That’s a good idea Sam we need to start preparing now for our future without fossil fuels by investing. Imagine how much money we would have had for disasters, infrastructure and much needed social services if the national government continued to contribute to the Cullen fund. Too much short term thinking.

I know a guy that told his close buddies to go “All-in” Long the stock market last monday till close, because sell-off was 100% driven by volatility in Electronic traded funds unwind and pain trade. He wants to remain anonymous but he comments on TDB.