More user pays is not the solution to our infrastructure problems – Sovereign Credit is!

‘Many people will be quite shocked’ by the cost to fix NZ, minister says

The cost to fix New Zealand is so large, there’s no agreed price tag.

How on earth is the solution to free market infrastructure underinvestment more User Pays?

It’s like using cancer to cure syphilis!

It is utterly insane that we are allowing free market mythology over rule basic Keynesianism.

The State invests because it is in the national interest that the largest City in the country be able to provide the infrastructure to house so many, it doesn’t just shrug and say ‘not my problem, you pay for it’.

User Pays is the disease, it isn’t the cure!

We have to provide a Left Wing Economic response to this that makes the State work for the people, not the powerful!

Infrastructure is not a luxury — it is the foundation of economic productivity. The debate over Harbour Bridge tolls is ultimately about whether the state shoulders national growth costs, or whether individual commuters are left to carry them alone heading into Election 2026.

It’s time NZ did something radical, look back at our own history for solutions on how to fund NZ Infrastructure – Sovereign Credit!

The greatest mistake Labour did over Covid, was that they borrowed the money from private banking rather than do what Mickey Savage did, create Sovereign Credit!

In the 1930s–40s, the first Labour Government (Savage & Fraser) used the Reserve Bank to directly finance social housing, infrastructure, and employment schemes. This was sovereign credit creation — money issued into the economy for public purposes.

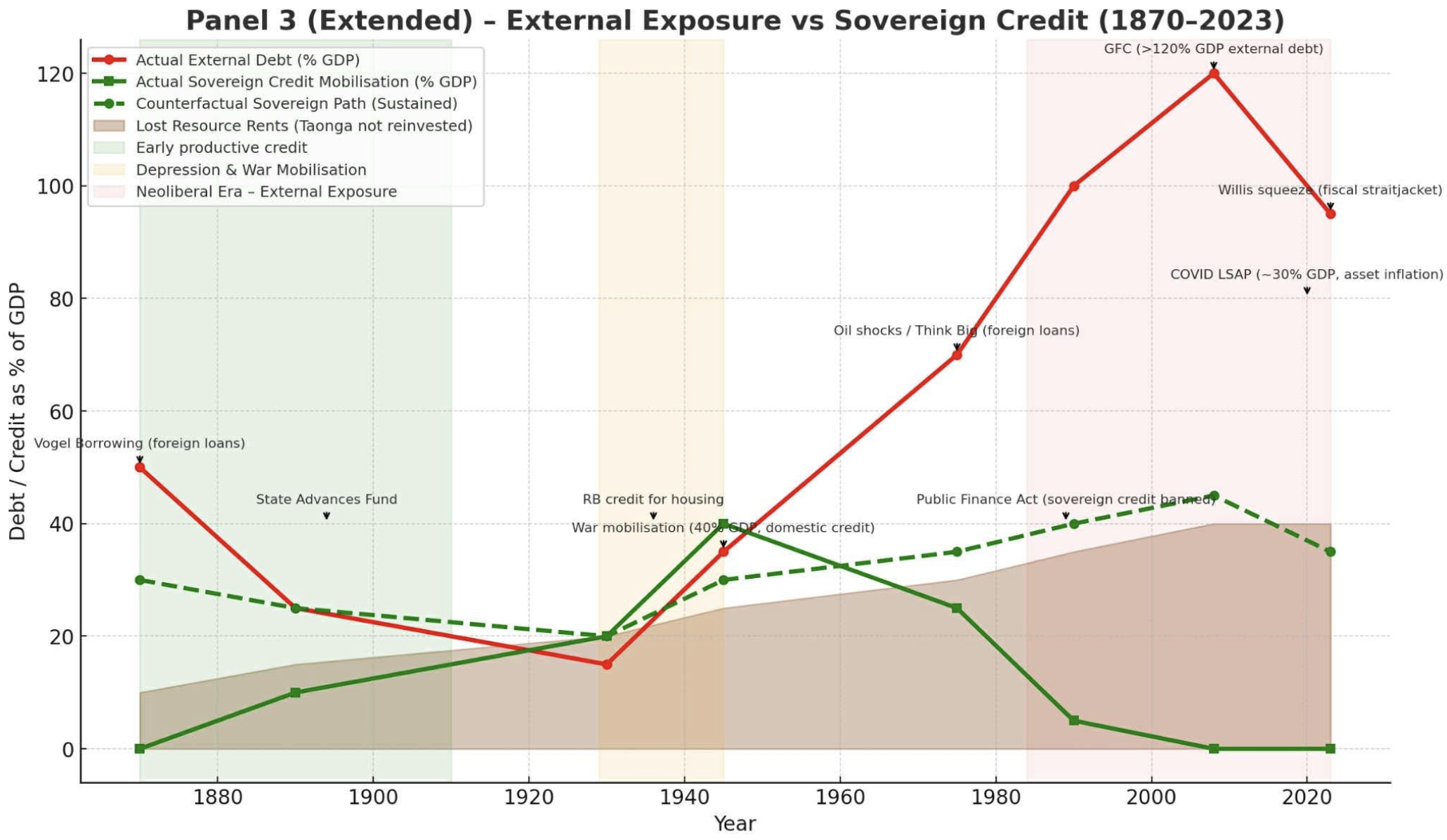

New Zealand used sovereign credit creation in the 1930s for housing and recovery. Since the late 20th century, reforms locked us into a bond-based system to satisfy global financial orthodoxy and inflation fears. The difference is simple: bonds create debt to outsiders, sovereign credit creates money internally.

Why borrow from private banks when we should be directly creating sovereign credit to build the vast infrastructure deficit and climate adaptation investment net we face.

Consider the actual borrowed debt vs sovereign credit…

…so what would happen if NZ created sovereign credit now?

-

If the Reserve Bank or Treasury created credit for targeted, productive investment(say, green infrastructure, affordable housing, climate resilience):

-

The economy could benefit from extra capacity and jobs.

-

Inflationary pressure would be limited if the spending matched real productive needs.

-

International markets might notice but wouldn’t necessarily “punish” NZ — especially if debt-to-GDP stayed stable.

-

If NZ created sovereign credit now for targeted, productive investment, markets might grumble but wouldn’t punish us severely — especially if inflation stayed under control.

We could back this Sovereign Credit using ACC and KiwiSaver:

-

ACC Fund: ~$50 billion+ investment portfolio to meet future injury compensation liabilities.

-

KiwiSaver funds: ~$100 billion+ in private retirement savings, invested across shares, bonds, property, etc.

None of what I am suggesting is new, Mickey Savage used it to build NZ and Positive Money has been making these points for a long time:

Positive Money NZ is the New Zealand branch of the international Positive Moneymovement (originally UK-based). Their core aim is to change who creates money in the economy.

At present:

-

About 97% of money in NZ is created by commercial banks when they issue loans (especially mortgages).

-

Only ~3% is physical cash issued by the Reserve Bank.

Positive Money argues this system:

-

Drives house price inflation (since most new money goes into property lending).

-

Makes the economy unstable (credit booms and busts).

-

Privatises the benefits of money creation (banks profit, not the public).

Labour, Greens and te Parti Maori need radical solutions to the many problems we have, investigating Sovereign Credit to build our infrastructure and climate adaptation is one of those radical solutions!