More Childcare, Bank review and Wealth Tax – why are Labour more conservative than what people are calling for?

This is going to be a weird election.

National are making inroads on Early Childcare and a demand to review Banks while tax surveys show people wanting wealth taxes to rebuild the country…

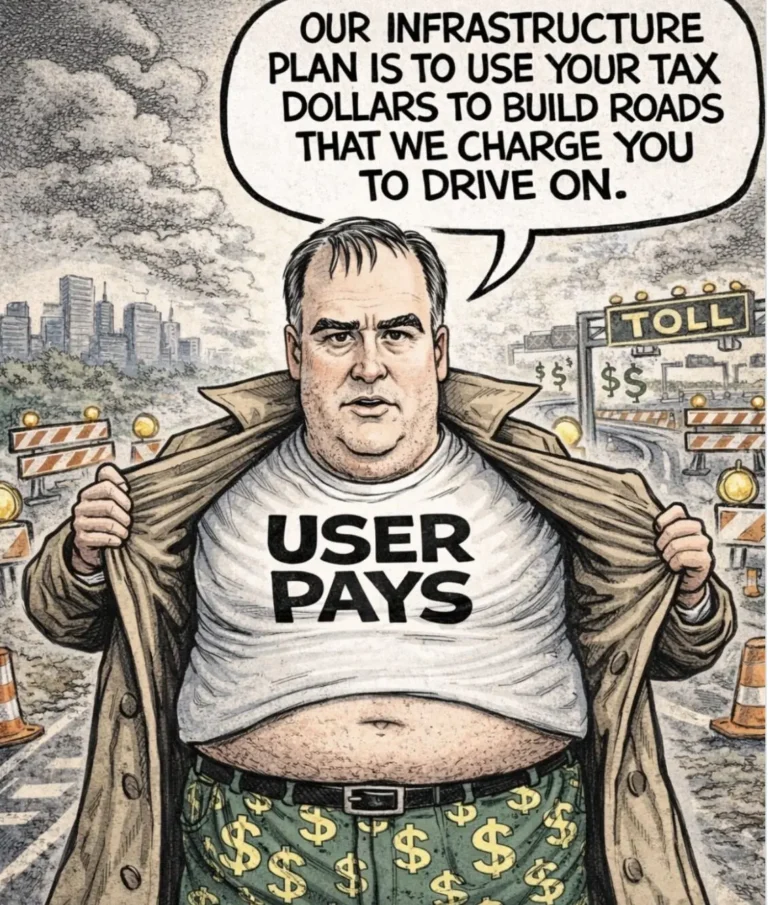

Government-commissioned survey suggests replacing fuel tax with wealth tax – and people love it

A Government-commissioned paper into replacing petrol taxes and road user charges has thrown up some politically awkward suggestions: wealth taxes, pollution levies, and charging malls and airports.

The reason for this awkwardness is that the Government has ruled out nearly all of these new taxes to various extents – and the Opposition doesn’t want to implement them either.

More awkward still is that the research paper shows that those new taxes, even the wealth tax, were widely supported by people questioned – although the sample used for the survey is small (436) and is not representative of the wider population like a poll, making it less useful as a measure of what the country thinks.

…you can’t call it ‘Socialism by Stealth’ if the whole country is screaming for it!

It’s this weird situation where the Labour Government is again flat footed because their own achievements in Welfare amount to nothing more than ‘it’s-a-first-great-step’ level press release from a Wellington Union.

Now let’s be clear, National’s child support and Banking inquiry won’t provide any off the real solutions the problems demand, but they are gaining political traction because Labour has done sweet fuck all in being transformative.

If Labour are to win this election, they also have to be pushing against the status quo they have managed for half a decade.

Jacinda and Grant were great in a crisis, but politically cautious domestically and that cation has seen us not live up to the promise of being transformative.

Chippy dumped the ideology for delivery, but he can’t ignore vision, and right now, Labour has very little vision and that is why they are open to attack on issues that are brand and butter Labour.

Increasingly having independent opinion in a mainstream media environment which mostly echo one another has become more important than ever, so if you value having an independent voice – please donate here.

If you can’t contribute but want to help, please always feel free to share our blogs on social media

Bank Profit Export Tax

Financial Transaction Tax

Alphabet Revenue Tax

CGT. CGT. CGT

Labout are against a review into banking despite all other parties wanting one.

Labour are against a review on forestry despite most party wanting one .NZF have been quite on this

Labour do not want to go to deep into the fishing industry along with NZF

Labour took power from children’s commissioner despite all other parties and NGO wanting him to have power to check Oranga Tamariki.

Labour has vested interest in all these areas and with the polls so close do not want to ruffle any feathers

CGT – on all but the family home and possibly bach. Labour chickened out of this and the need for it couldn’t be clearer – let’s ping these multiple property owners who, let’s face it, are in it for the capital gain. People only need one home to live in and property should not be a source of speculative “wealth”. What’s not to understand. A socalled wealth tax will just mean that the wealthy will continue to hide their wealth in various ways.

Not everyone wants to be a home owner so if people are penalized for having a rental property ere are going to live . The tate are not building enough and even if they did they have proven to be a poor landlord as they are slow to over on anti social clients due to fear of a backlash.

I am not against CGT on those that turn over their property in less than 2 years as they are speculators and can factor in the tax into their business.

A wealth tax would be better since it would be levied on a regular basis – annually, half yearly or quarterly. The trouble with CGT is that it doesn’t seem to discourage property price increases. This is probably because it is a bit like “slamming the stable door after the horse has bolted”.