Look what the nice man offered me!

.

.

From an email recently received;

.

from: Edwin Gichana <edwin@valsenfiduciaries.com>

to: “fmacskasy@gmail.com” <fmacskasy@gmail.com>

cc: David Morema <david@valsenfiduciaries.com>

date: 9 Jan 2019, 06:53

subject: Seychelles International Trust with Bank Account

mailed-by: valsenfiduciaries.com

Signed by: valsenfiduciaries.onmicrosoft.com.

Dear Esteemed professional,

We trust this email finds you well.

We are writing to you to inform you of the availability of a versatile wealth management structure in Seychelles. “The Seychelles International Trust”

We set up and administer Seychelles trusts at very competitive rates while providing you or your clients a highly personalized service.

Below are some of the landmark features of a Seychelles International Trust

a) Zero tax on Trusts

b) Pocket friendly prices – some of the lowest prices across all jurisdictions

c) Speedy formation

d) Light annual compliance

e) Re-domiciliation is permitted

f) No access to public records

g) It comes with a bank account to support operations

Popular Uses of a Seychelles International Trust:

ü Used for asset protection, tax planning and as a family and succession planning vehicle

ü Used for collective investments (Mutual Fund) structures

ü Can be used for the benefit of employees (ESOP)

ü Can do commercial transactions through Seychelles IBC

For more information Seychelles Trusts and other Estate Planning solutions please visit our website or contact us on the details below.

We look forward to hearing from you.

.

.

Firstly, it’s deeply and amusingly ironic that a dodgy outfit sending out random, spam solicitations to unknown people expects confidentiality and “legal privilege”. It’s a miracle they didn’t email an official at Interpol, FBI, or other law enforcement agency.

Secondly, me being a polite bloke, I emailed back, declining to participate, and offering certain observations;

.

from: Frank Macskasy <fmacskasy@gmail.com>

to: Edwin Gichana <edwin@valsenfiduciaries.com>

date: 9 Jan 2019, 14:43

subject: Re: Seychelles International Trust with Bank Account.

Kia ora Edwin,

Thank you very much for taking the time to email me regarding your offer of a tax-dodging Trust in the Seychelles.

No doubt you have many wealthy clients who partake of your services, thereby avoiding/escaping paying taxes in their own country.

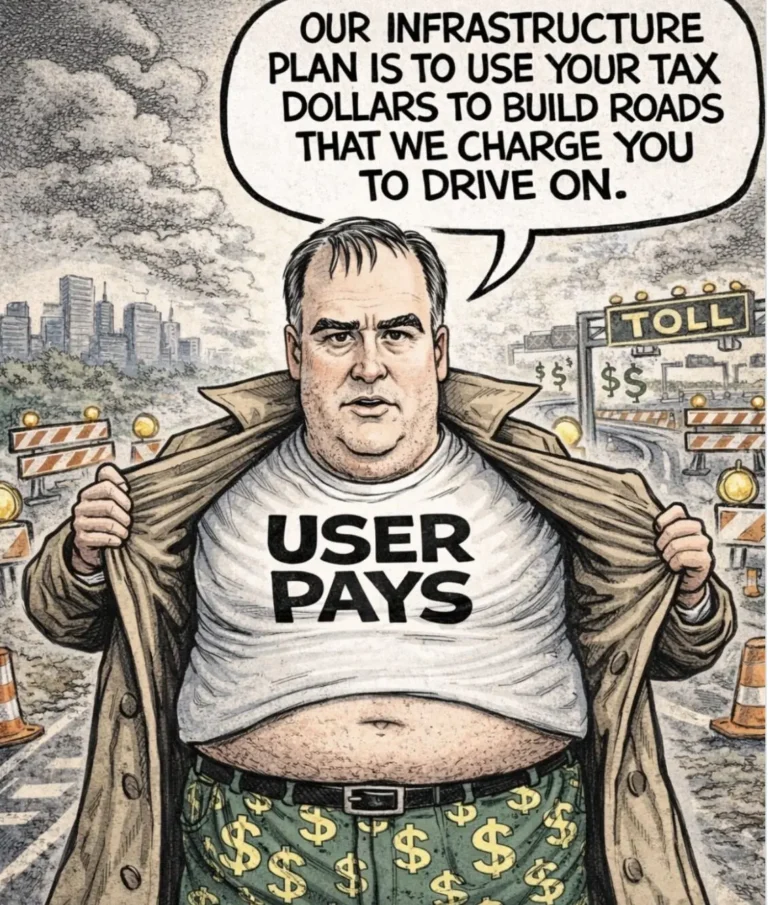

You may wish to ponder that the avoidance of paying tax is one of the leading causes of sovereign governments unable to provide basic health, education, housing, and transport services for their people. This creates poverty and a rising sense of hopelessness.

It also provides fuel for extremist right-wing and ultra-religious organisations as the powerless; the poor; the disaffected seek answers and solutions from outside the mainstream.

So the next time there is a riot or civil war or some other social upheaval – just ask yourself what part you and your colleagues played in the struggle between the Haves and the Have Nots. As with drug trafficking, cross-borders sex-slave trade, child-porn websites, and international arms industry, your profession is not one that I would encourage my own children to engage in.

I have dozens of dollars and will be investing them in ethical services and paying my fair share of tax on them.

I sincerely hope you find an honest job soon. (We have vacancies for fruit-picking here in New Zealand.)

Regards,

-Frank Macskasy

.

Ok, taking-the-piss out of tax-dodging companies, touting for business via spam-mail, is one thing.

Foreign companies touting for business that would erode our own country’s tax base by shifting company and personal wealth to secret tax havens – is another. In some ways, it should be considered a hostile economic act.

New Zealand has diplomatic as well as commercial dealings with the Republic of Seychelles since 1992. We also – apparently – have something called a “Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS” (Base Erosion and Profit Shifting) – which supposedly includes Seychelles.

The Multilateral Convention replaced a Tax Information Exchange Agreements (TIEA) that was being negotiated by MFAT (Ministry of Foreign Affairs and Trade) in 2010.

According to MFAT;

Double Tax Agreements (DTAs) reduce tax impediments to cross-border trade and investment and assist in the prevention of tax avoidance and tax evasion. Tax Information Exchange Agreements (TIEAs) are a limited form of DTA that are concerned only with assisting in the prevention of tax avoidance and tax evasion.

Those negotiations were never concluded, and the Multilateral Convention came into effect instead.

Organised through the OECD, the “Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS” stated in it’s opening paragraph;

The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the Convention) is one of the outcomes of the OECD/G20 Project to tackle Base Erosion and Profit Shifting (the “BEPS Project”) i.e. tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity, resulting in little or no overall corporate tax being paid.

In effect, the OECD Multilateral Convention was designed to close down (or restrict greatly) the activities of tax havens, as revealed in the millions of leaked documents from Panamanian law firm, and corporate tax-dodging service provider, Mossack Fonseca in 2015 (aka, the “Panama Papers“). Both New Zealand and Seychelles were revealed to be complicit in international tax evasion practices.

Seychelles signed the (OECD) Multilateral Convention on 7 June 2017;

.

![]()

.

However, as far as the author can ascertain, Seychelles has opted-out or reduced it’s obligations to the OECD Multilateral Convention through a raft of exclusionary clauses in it’s document, “Status of List of Reservations and Notifications at the Time of Signature“.

For example, amongst the many provisions Seychelles has exempted itself is the salient raison d’être for the very existence of the OECD Multilateral Convention – “Article 10 – Anti-abuse Rule for Permanent Establishments Situated in Third Jurisdictions“. This paragraph refers to income earned in one jurisdiction (Country “A”) being treated as non-taxable by a second jurisdiction (Country “B”) under a “Covered Tax Agreement” (a previous agreement between countries which allowed profits not to be “second taxed” – or taxed at all).

The OECD Multilateral Convention would have prevented an Income Earner (eg, a corporation) from using Country B, purely for low or nil taxation purposes, and insisted that said Income Earner pay tax in Country A;

“In such a case, any income to which the provisions of this paragraph apply shall remain taxable according to the domestic law of the other Contracting Jurisdiction, notwithstanding any other provisions of the Covered Tax Agreement.”

Seychelles declined to bound by that simple statement.

The language of the Convention and the Seychelles document are framed in legalese, and are difficult for the lay person to interpret. But the upshot is that Seychelles remains a tax haven – despite being a supposed signatory to the OECD Multilateral Convention.

Indeed, Seychelles’ status as a tax haven is currently touted by several firms specialising in tax dodging activities:-

From Offshore Protection.com;

Seychelles diligently encourages local and foreign investment; thus it offers:

- Low government fees

- Tax-resident low-tax and non-resident tax free structures

- A growing matrix of tax treaties used for investment into other countries

- An international trade zone

[…]

If you are looking for a tax haven with a solid secrecy policy, attractive offshore business laws, Seychelles may be the perfect choice for your next offshore company formation.

From Taxhavens.biz;

Seychelles as a tax haven is one of the most desired tax havens available to date. The government of Seychelles has invested a lot in the country in order to make it the tax haven that it is today. Seychelles as a tax haven has seen the modification of legislation which led to a modern but very strict offshore sector in the islands. The laws which govern the offshore tax haven of Seychelles provide asset protection, reduction of tax liabilities, privacy and confidentiality for individuals and corporations.

Disturbingly, Taxhavens.biz also promotes our own country on it’s website;

Although New Zealand is said not to be a tax haven there are certain features which make people associate the jurisdiction with tax havens. The fact that the country has offshore services which includes offshore business entities and offshore trust formation tend to qualify New Zealand as a tax haven.

No wonder New Zealand featured in the Panama Papers with links to tax dodging. Economist Shamubeel Eaqub condemned our secrective Trust laws as “firmly in a moral grey zone” and that “we have a moral duty to ensure our rules and regulations do not facilitate dishonest practices by others”.

From Fidelity Corporate Services Ltd;

Seychelles International Business Company (IBC)

Seychelles IBC – an International Business Company – is the most popular and versatile type of offshore corporation available in Seychelles. Similar to other classic offshore companies, Seychelles IBC is designed to engage in international business. Being an IBC, it is subject to minimum red-tape. While being obliged to keep internal records and registries in good order, a Seychelles IBC does not nave to submit any financial reports to public file. There is also no mandatory audit requirement.

[…]

Zero tax

A Seychelles IBC, by the definition of the law, is not subject to any tax or duty on income or profits. Article 361.(1) of the Seychelles International Business Companies Act, 2016, states as follows:

361.(1) A company, including all the income and profits of a company, is exempt from the Business Tax Act.

In a similar fashion, a Seychelles IBC is also also exempt from any stamp duties on all transactions relating to its business, in particular on any transfers of property to or by the company, and on any transactions in respect of the shares, debt obligations or other securities of the IBC.

Essentially, a Seychelles IBC is a completely tax-free offshore corporation, insofar as it complies with a few simple rules of operation. The main requirement is that a Seychelles IBC should not pursue business within the territory of the Seychelles (except, of course, it may enter into business with any other Seychelles IBC`s). The law provides that all exemptions for a Seychelles IBC shall remain in force for a period of twenty years from the date of incorporation of the IBC.

These provisions are enshrined into PART XXI of the Seychelles IBC Act (Articles 361, 362 and 363).

To strengthen secrecy, “virtual offices” are offered to companies utilising Seychelles as a tax haven;

In standard configuration, a Seychelles IBC would only have a Registered Address and Registered Agent in Seychelles, thus meeting the mandatory minimum domestic presence requirements. However, the usage of the Registered Address for routine business purposes is usually very limited. An additional functionality can be provided to an IBC by choosing some of the optional virtual office services.

A virtual office facility may include mail and fax forwarding service, shared or dedicated telephone and fax numbers, telephone call handling service, document preparation and re-mailing service. Using one or more of these optional services will contribute a more substantial “bricks and mortar” appearance for Your Seychelles IBC.

“Virtual offices” are a hallmark of tax-havens, giving the appearance of a company or individual being based in a jurisdiction, but often it is little more than “mail and fax forwarding service, shared or dedicated telephone and fax numbers, telephone call handling service, document preparation and re-mailing service” to create the illusion of a “substantial “bricks and mortar” appearance for Your Seychelles IBC”.

And if the above weren’t enough, Seychelles compounds secrecy using “International Trusts”, which can further obscure companies, individuals, and their income;

Seychelles International Trusts are commonly used in conjunction with the Seychelles International Business Companies. By using a trust to hold shares in the IBC, an additional layer of legal protection is provided for the owner. Moreover, this can enable beneficiaries to defer or avoid any possible tax on the profits of the IBC for an indefinite period.

One promoter of laissez faire tax-free jurisdictions, “Nomad Capitalist” has gone so far as to warn of the extreme nature of Seychelles as a tax haven;

I’m all for the creation of new tax havens. It’s refreshing to see governments coming to the realization that their bread is best buttered by business being conducted in their country…

[…]

…I’ve seen a number of small business owners set up shop in the Seychelles, often with disastrous results. Just recently, I advised an internet marketer get almost $100,000 from a frozen merchant account because the company refused to pay offshore companies in shady places like the Seychelles.

[…]

Any jurisdiction that doesn’t require you to keep books, maintain records, undergo any type of audit, pay any type of tax, or report your activities in any way is either on everyone’s blacklist or about to be on it. Seychelles falls into that category, which is why I get quite a few emails each year from people who have a mess to clean up there.

When even a free-marketeer, low-tax capitalist looks askance at a tax haven like Seychelles, it should ring alarm bells.

Seychelles has not taken it’s obligations seriously under the OECD “Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS”.

Seychelles continues to operate internationally as a Privateer-Pirate, seeking to loot other countries of their tax revenue (ie, “Base Erosion and Profit Shifting”).

Seychelles tax-dodging firms are touting for business in countries like ours.

So why do we still maintain diplomatic as well as commercial ties with Seychelles? What possible gain do we get from ties to another country – albeit a fellow Commonwealth member – that is practically waging covert economic war against our our tax base?

I put that question to Finance Minister, Grant Robertson;

.

from: Frank Macskasy <fmacskasy@gmail.com>

to: Grant Robertson <g.robertson@ministers.govt.nz>

date: 12 Jan 2019

subject: Tax havens.

Kia ora Mr Robertson,

Would you be able to comment on the following story regarding Seychelles’ ongoing activites as a tax haven (see [above] ).

A recent email to me touted for business, offering to set up a tax-dodging trust in the Seychelles. Naturally, I declined the offer.

However, that raises serious questions why we continue to have links with Seychelles when they remain a tax haven and are not fulfilling international commitments under the OECD’s “Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS”.

Specifically, why do we continue to have diplomatic links with a country that actively undermines our tax base by offering it’s services to New Zealand citizens as a tax haven?

What benefit do we gain by continuing diplomatic and commercial links with Seychelles?

Will your Coalition Government undertake specific measures to combat Seychelles’ ongoing tax haven activities, especially as they relate to our country?

Will your government lodge a protest with the Seychelles’ government for their country’s tax-haven companies approaching New Zealand citizens to engage in tax dodging activities?

I look forward to your response at your earliest convenience.

.

Regards,

-Frank Macskasy.

If there is no possible benefit to maintaining contact with Seychelles, and if that nation continues to actively allow it’s citizens to undermine our tax-base, then we should cut ties immediately. A country that threatens our economic activity is not a friend – it is a hostile force.

The letter to Grant Robertson was forwarded to Minister of Revenue, Stuart Nash. Five weeks later, Minister Nash responded.

He began by stating;

The OECD, and its monitoring agency the Global Forum on Transparency and Exchange of Information for Tax Purposes (the Global Forum), are working to implement a global standard for transparency and exchange of tax information. I can assure you that New Zealand continues to be a strong voice in what has become a significant international effort to ensure all Global Forum member jurisdictions comply with these standards.

In 2009, the Global Forum was commissioned to undertake comprehensive peer reviews and other monitoring, to assess compliance with the new international standards. The G20 stepped in after the global financial crisis to asist the OECD and establish oversight. The Global Forum now reports directly to the G20, which is positioned to apply sanctions if necessary to ensure compliance. This development has resulted in a significant change in international attitudes, with jurisdictions typically now making stringent efforts to address identified deficiencies to avoid being treated as non-compliant.

Note that Minister Nash claims there has been “a significant change in international attitudes“.

It is unclear how “significant” that “change” has been when – as pointed out above – Seychelles’ law specifically allows for any International Business Company to “not [be] subject to any tax or duty on income or profits” and furthermore is clear in that IBCs are “a completely tax-free offshore corporation, insofar as it complies with a few simple rules of operation”.

Furthermore, Minister Nash then claimed;

The breakdown of secrecy has marked the end of tax havens, given that the key feature protecting tax havens was secrecy. Schemes will no doubt continue to be developed and promoted with the intention of facilitating tax avoidance and evasion, but in the current international environment these will become more difficult, costly and risky for the taxpayers to use.

Minister Nash’s insistence that there has been a “breakdown of secrecy” which has “marked the end of tax havens” appears to be premature. These are not just random “schemes” being promoted. They are carefully planned business structures supported by Seychelles’ law. The legal use of “virtual offices” under Seychelles’ law does not “breakdown” secrecy – it facilitates it.

Whatever sanctions might apply from the OECD or G20 has not deterred Seychelles officially promoting itself as a tax haven.

The point I made above remains unanswered: Why do we still maintain diplomatic as well as commercial ties with Seychelles – a country that is practically waging covert economic war against our our tax base?

The government appears pre-occupied with other matters. Like China.

Postscript

Seychelles has a listing on both Wikipedia and Encyclopaedia Britannica. Curiously, neither make any reference to Seychelles’ notorious reputation as a tax haven. If any such references have ever been made on those entries, they have been ‘scrubbed’ clean.

.

.

.

References

Seychelles News Agency: Blue economy, climate change top the agenda between Seychelles, New Zealand.

IRD: Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (the MLI)

IRD: Tax treaties – recent changes

MFAT: Double Tax Agreements

OECD: Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS

Wikipedia: Panama Papers

Wikipedia: Panama Papers – New Zealand

Wikipedia: Wikipedia: Panama Papers – Seychelles

OECD: BEPS – MLI Position – Status of List of Reservations and Notifications at the Time of Signature

Offshore-Protection.com: Seychelles Offshore

Tax Havens: Seychelles

Tax Havens: New Zealand

Fairfax media: Panama Papers – More New Zealand links to come

Fairfax media: Shamubeel Eaqub – Panama Papers show NZ is complicit in criminal behaviour

Fidelity Corporate Services: Seychelles International Business Company (IBC)

Fidelity Corporate Services: Virtual Office Facility Service Description And General Conditions

Fidelity Corporate Services: Seychelles International Trusts

Nomad Capitalist: Four offshore company jurisdictions to avoid in 2018

Wikipedia: Seychelles

Encyclopaedia Britannica: Seychelles

Additional

NZ Herald: IRD rubbishes Oxfam claims of tax evasion by big drug companies

Business Insider: How the super-wealthy hide billions using tax havens and shell companies

The Guardian: We’re losing $240bn a year to tax avoidance. Who really ends up paying?

The Guardian: Tax havens shielding companies responsible for deforestation and overfishing

TV1 News: Panama Papers investigation – ‘NZ absolutely, conclusively is a tax haven’

International Consortium of Investigative Journalists: The Revolution Will Be Digitized

Other blogs

The Standard: Why was John Key singled out by Panama Papers hacker?

Previous related blogposts

Panama Papers: Matthew Hooton’s Alternate Universes on Twitter and Radio NZ

Dodgy tax havens and even dodgier Peter Dunne’s memory

.

.

.

.

.

= fs =

It’s amazing the lengths we will go to as a trading natyion to put up with unacceptable behaviour. Shame on Labour for tolerating Seycellian rorting of our tax base!!

Dear Edwin,

Your innovative tax rationalisation scheme looks like it might be just the thing I’m after since my own country changed its laws for offshore trusts. I look forward to corresponding with you further on this matter.

Yours,

“Sir” John Key

P.S. I know a great law firm in Panama that can help with all the paperwork.

LOL…

Key is probably on their board of directors… LOL

As well as the unethical aspects highlighted here, there is the matter of scammers who either scam by email or by phoning.

Some, such as those who claim to be agents for gold shipments or agents for transfer of overseas funds, are obvious scammers, but others can be extremely convincing, especially if you have an old computer that is playing up a bit.

BEWARE ANYONE who claims to be ringing from an Internet provider or customer support of Microsoft etc. Do not respond.

Nashy’s claim yhat all is now hunky dory kinda flies in the face of Seychellian law which condones andvlegislates to be a tax haven.

It’s a good question though, why ARE we maintaining relations with a country that continues to operate as a tax haven?? I can’t see any benefit to us whatsoever.

Interesting investigation, Frank. Especially Minister Nash’s response which seems to fly in the face of Seychelles current tax laws. Meanwhile our government is looking the other way, preoccupied, as you point out, at China. I betcha Huawei pays its taxes!