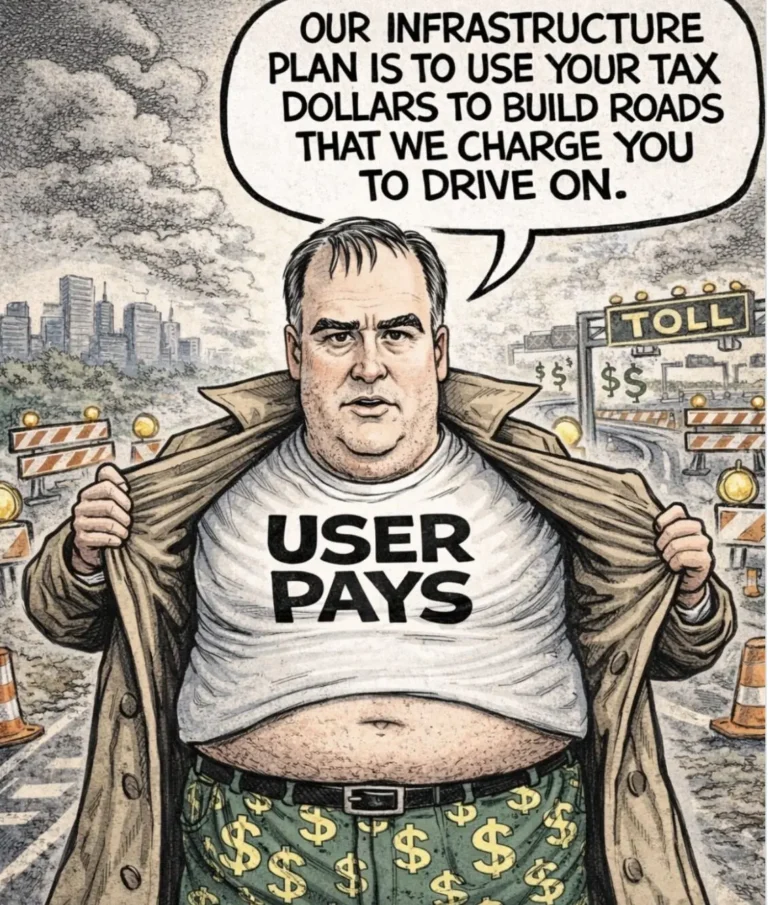

Is the orgy of capitalism about to end?

While the NZ media hyperventilate over Clare Curran’s coffee date, the next looming global financial crash looms.

Ever since Central Banks around the world turned to quantitive easing to get out of the 2007/2008 GFC, the moment of correction simply built and built.

It never dissipated.

This mornings shock crash on the Dow Jones is just the latest warning signal of a stroke that will rupture the heart of the global financial markets…

Over the last three months the measure has slumped to an annual rate of 2 per cent in the US and 1.2 per cent in Japan. Broad money is often a powerful predictor of economic activity a year or so later.

Professor Tim Congdon, from the Institute of International Monetary Research said the US Federal Reserve has misjudged the full impact of reversing QE and may be making a serious policy error by withdrawing stimulus too quickly.

“I don’t think there will be a recession because the Fed will change course, but there may well be a ‘growth recession’, and it is a big threat to asset prices,” he said.

The Fed has been cutting its balance sheet by US$20 billion ($27.8b) a month.

What worries monetarists is that the institution is already pre-committed to stepping up the pace to US$50b by September and seems determined to carry out its plan regardless of the monetary effects.

The Fed’s bond sales automatically slow the growth of bank deposits and curtail money creation. Some evidence is already visible in the rate of loan growth in the US, which has slumped to zero over the last five months.

The eurozone is at a different stage of the cycle but the money data are nevertheless disturbing. Simon Ward, from Janus Henderson, says the growth rate of non-financial M3 has dropped to 2.3 per cent over the last three months, the slowest since the eurozone debt crisis.

“They are clearly going to be in a lot of trouble by next year,” said Prof Congdon.

The central bank is running out of options. It has already pushed its balance sheet to 42 per cent of GDP and is near the technical and political limits of QE.

Ward said “narrow” M1 money in the eurozone has been plummeting since last September, with a sharp fall in real M1 deposits in France and Spain that has attracted little notice so far.

With the usual delay, the slowdown is starting to become visible in the hard data.

Eurozone industrial output fell 1.1 per cent in February. The IHS Markit survey of manufacturing has slowed for two months in a row, with a marked slide in new orders.

Britain seems to be slowing in lockstep. In a recent note, Janus Henderson went as a far as warning that “monetary alarm bells” are ringing ever louder in the UK.

Its favourite gauge – six-month real M1 – has slumped to almost zero, with an outright contraction in household deposits.

This points to a sharp economic downturn by the end of this year, coinciding with the final talks over Brexit. The group said it would be a serious mistake for the Bank of England to press ahead with further rises in interest rates into this storm.

Nor is there any comfort from China. Its explosive credit and fiscal stimulus in 2015 and 2016 is largely exhausted. Janus Henderson says the growth rate of China’s “real true M1” (six-month annualised) has dropped to 1.6 per cent, down from double-digit levels in 2016.

Underlying economic growth has dropped to 5 per cent – using proxy measures – and this is showing up in rising inventories of iron ore and raw materials. China is again on the cusp of a “stop-go” mini-slump.

The global monetary slowdown is hard to separate from the effects of rising US interest rates.

The Fed’s main rate has risen six times to 1.75 per cent, constricting a global financial system that has never been so leveraged to US borrowing costs.

The Bank for International Settlements estimates that offshore dollar debt in loans or equivalent derivatives has ballooned to US$25 trillion.

Three-month dollar Libor rates have risen 62 basis points to a nine-year high of 2.31 per cent since the start of the year. A report last week by the New York Fed said that US$200t of derivatives are priced off Libor – 10 times US GDP. The rates reset rapidly. The spike amounts to a global credit shock.

The Libor squeeze is gaining worldwide attention. The parallel monetary squeeze has so far gone largely unnoticed. It may be just as significant.

…$30Trillion has been printed and pumped into the global economy falsely creating the lowest inflation rates for 5000 years, these distortions are now ripe for AI trading programs to nanosecond trade the stock market into depression.

Globally this could spark a trade war into a real war between America and China while Russia starts pushing back in Europe. At home NZ will become swamped by mass migration from people fleeing the turmoil while Kiwisaver accounts get slashed from market collapse and interest rates cripple home owners.

This economic meltdown has been building for a decade, we can’t pretend to not know it was due. Unfortunately the stock market would need have a coffee date with Clare Curran for the NZ media to take any notice.

But don’t worry, according to Liam Dann from the NZ Herald, there’s no need to panic.

“This economic meltdown has been building for a decade, we can’t pretend to not know it was due. ”

They couldn’t fix it then except temporarily by QE as they did and kick the can (snowball rather) down the road and hope some genius would come up with a way to correct it.

It can’t be corrected. It seems it should still work because it’s taken a lifetime for the inherent self perpetuating terminal flaws in our monetry system to work through to catastrophe.

I had a story when I was a kid about a little monkey trapped in a swamp and gradually sinking; the more he struggled the faster sank, till he decided to pull himself out by his own whiskers. The last picture was of his fists full of hair sticking out of the swamp and some bubbles coming up between them. That’s where the world’s finance system is now.

D J S

Do you suppose that our sweet government will do anything sort of permanent to protect depositors’ funds in our delightful foreign-owned banks?

Or will ‘too big to fail’ happen here, too – and the depositors get a neck level haircut each?

Will anyone think of the bonuses? And remind banks that poor management is not eligible for performance rewards this time?

Can we count on the wee Smiling Assassin, there in the comfy stratosphere of the ANZ, to do something for the good of all, regardless of which bank is involved? Or not?

Maybe we can invent something less Lotto-ish than stock markets for bulking up the funds for pensions-later. Or not.

I think gold was still trading above $US1300. Might make the mattress lumpy but it is slightly sweeter than hog belly futures.

Jog on, kitties. Bring the popcorn.

Key has passed regs to allow banks to canabilise out deposits to bail them selves out.

Not the sort on news given out.

Protect out funds and defy the banks – never!

https://www.rbnz.govt.nz/faqs/open-bank-resolution-policy-faqs

”

What happens to depositors funds during the OBR process?

The first stage of the process is to freeze all access channels to the bank and establish the balance of each account at the point at which the bank was placed under statutory management. A high-level assessment of the bank’s losses will then be undertaken, and a conservative portion of account balances frozen.

The frozen funds are then set aside to cover any losses beyond what the bank’s capital position could absorb. The frozen funds are not cancelled or written off, and the depositors and creditors continue to hold a legal claim to these funds. To the extent that all or some of these funds remain available after all losses have been covered, they will be returned to depositors and creditors.”

AND

“How soon will depositors be able to access their funds?

The bank will re-open for ordinary transaction business on the next business day after it is placed under statutory management. At this point, depositors will have full access to the unfrozen portion of their accounts. These funds will be subject to a government guarantee.

The full assessment of the condition of the bank and the identification of the appropriate long-term solution to the failure are likely to take a number of days or even months to work through. Additional frozen funds may be periodically released to depositors during this time, to the extent that it becomes clear that they will not be required to cover the losses that have been incurred.”

So after the statutory manager is appointed by the Reserve Bank who are closely aligned with private banks through a revolving door practice,

then she/he decides how your deposits are used and how much may be held as a residue for you. Guidelines are fluid but your deposit can be stripped to a basal figure depending on how much the banks needs to recover from its wealth stripping activity.

No guarantees for you as a depositor, but you bail out the bank effectively.

Kiwis remain silent and seemingly ignorant.

Labour has to act.

https://www.interest.co.nz/personal-finance/63660/labour-leaps-bank-deposit-protection-bandwagon-calls-1st-nz30k-deposits-be

Don’t panic: they’ll bail it all out again. Expect interest rates to go negative, bank accounts to be raided (i.e. forced bail-ins), and prices to soar Venezuela/Zimbabwe style. I fail to see why any economist is predicting a repeat of 1929’s The Great Depression deflation when 1918’s Weimar Germany’s inflation is far more likely in a post-Keynesian “borrow and hope” debt-addicted world where unlimited quantities of fiat currency can be printed “out of thin air” at literally zero cost (except for the poor and vulnerable of course, who won’t be able to afford a loaf of bread – but since when did those people ever matter to elites with off-shore bank accounts?).

Word on the street was ethical funds were selling tech aggressively. Ethically looking after after their investors interests. Good on them. Tough job that. Ethical funds were and are in Facebook because Facebook have some carbon abatement policy in place- Thats so bubbleicious.

When you look at the Price and Volume profile of all big tech names last week it seems pretty obvious there were one or two big VWAP (volume weighted average price) work all day sell programs across the board triggering stop lose levels all day. Its actual been a very orderly sell off.

Its the New World Economy attempted propaganda, virtue signalling gone wrong. New Facebook and Amazon ads will be fronted by coloured woman with blatant crazy eyes projecting the possible mental health of woman. Very quickly you’ll see where the New World Economics went wrong.

Nice one Martyn, your articles are always the best, straight to the point just how we like it. This financial mess has been cooking for 3, 4 ,5 decades, take yer pick. Shut the borders, hunker down and ride it out. UNLESS Donald Trumps got some brilliant idea on how to kick it some more. Capitalism gonna die, mother fu****. Yiha.

https://www.forbes.com/forbes/welcome/?toURL=https://www.forbes.com/sites/markhughes/2018/03/30/review-the-china-hustle/&refURL=https://www.google.com/&referrer=https://www.google.com/

watch the china hustle if you can another massive fraud by wall street

https://www.youtube.com/watc

h?v=55892jT06aI