GUEST BLOG: Pat O’Dea – The great Aussie Vampire Squid vs. the Kiwi lockdown

In 2009 Matt Taibbi wrote an article for Rolling Stone magazine entitled;

“The great vampire squid stuck on the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

He was of course writing about Goldman Sachs, But Taibbi’s essay could just have easily be written about the Aussie banks that suck $3.5 billion out of the New Zealand economy every year.

It is these Aussie owned banks that have profitted the most from New Zealand’s unafordable house prices and the usurious levels of mortgage and rental payments extracted from New Zealanders to pay for them.

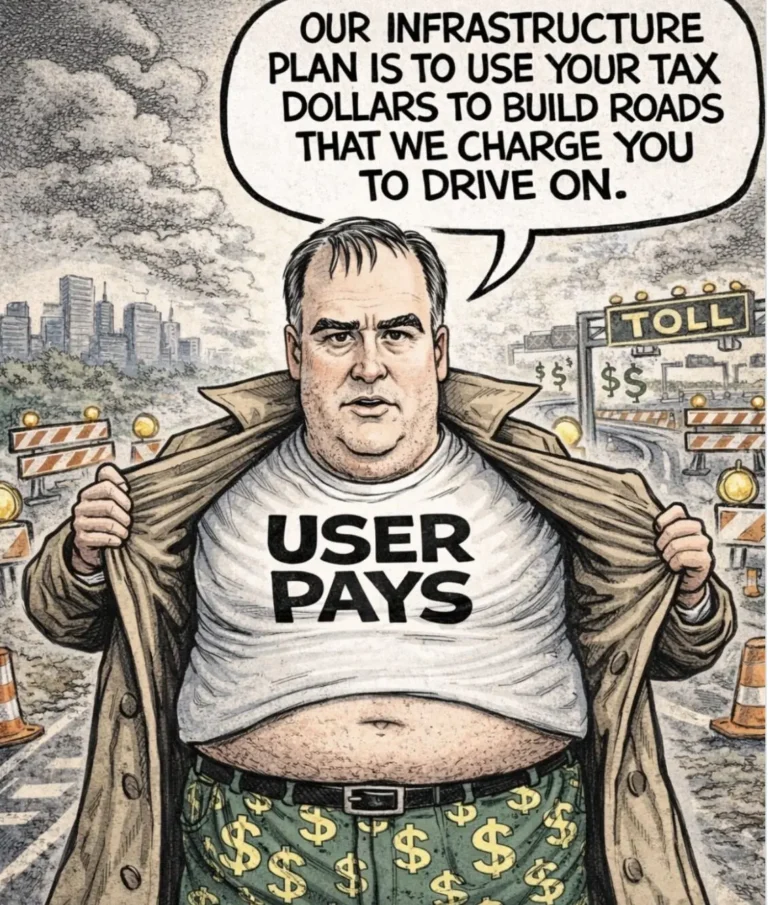

When the pandemic hit this country – to stop the spread of the virus the government put the whole country into lockdown, effectively putting New Zealand’s normal economic activity on hold, all except one part, the profit taking of the mostly foreign owned Aussie banks.

In the depths of lockdown, when everyone else’s livelyhoods were constrained, or even stopped, the Aussie banks blood funnel never missed a beat pumping out money from our pockets and out of the country.

It was not the Lockdown itself, rather it was this continued relentless extraction of mortgages and rents, when no income was coming in, that imposed the most misery and hardship on small businesses and families.

To halt the spread of the virus, non-essential economic activity was frozen, to share the burden equally, all non-essential economic activity should have been frozen, including mortgage and rent collection. To make lockdown more bearable this should have been done from the very First Level 4 Lockdown, and probably continued into Level 3 lockdown as well.

Such a move is not unprecedented:

…..by 1931, it was clear that further intervention was necessary to prevent widespread foreclosures and mortgagee sales…..

….Although mortgage relief was frequently discussed at some length by

contemporary commentators, and by some historians in the 1950s and

1960s, it has been relegated to a few lines at most in more recent works.’

…..This Act also extended to lessees [renters] the same protection

that had been granted to mortgagors,

The modification of mortgage conditions was not new in New Zealand. A ‘mortgage moratorium’ had been imposed as a war measure in 1914,

http://www.nzjh.auckland.ac.

But why is this still important?

Medical experts and epidemiologists have said that the government’s decision to take Auckland out of Level 4 lockdown when the virus was still circulating was, “a gamble”, “a line call”, “a risk”.

So why couldn’t we stay the course and eliminate the virus?

Because we have a parasite stuck on our face that won’t let us.

We are told that we can’t have any more lockdowns because the hardship on small busines and households is too great.

The last lockdown was lifted early before it had done its job for the same reason.

In a lockdown all our incomes are constrained, all except for the Vampire Squid.

Now imagine if the Vampire Squid’s income was put into lockdown too.

The hardship on the rest of us would not be so great, in fact for most of us, the lockdown wouldn’t be a hardship it would be a holiday, it would be something that we would look forward to, because for a short period the Vampire Squid would be lifted from our face and we could breathe freely for a little while,

Without the Vampire Squid’s suffocating embrace, we could see out another lockdown to the virus is eliminated again.

“The other great thing about a rent and mortgage moratorium, is that it won’t cost the tax-payers a cent.”

Pat O’Dea is a unionist and human rights activist.

To maintain our highly successful and globally admired ‘Elimination Strategy’ to protect our hospitals from being overwhelmed. To prevent working people and small business being ruined. Lockdown now with full rent and mortgage moratorium.

Level 3 not working if case spike continues

https://www.stuff.co.nz/national/politics/126530023/covid19-level-3-may-not-be-working-if-case-spike-continues-expert-warns

Just as forecast by the scientific modelers and epidemiologists the virus is on the verge of spreading exponentially.

Without a mortgage or rent moratorium another lockdown will visit massive hardship, on low income familes and small business.

The alternative is no lockdown and the spectre of our hospitals being overwhelmed. New Zeaalnd from being globally admired for our covid response becoming reviled and a disgrace on the world stage.

New Zealanders take on the Great Aussie Vampire squid to get it to regurgitate some of its ill gotten gains.

“Solicitor Scott Russell said that under New Zealand law the banks were not allowed to charge interest or fees on loans when they had not properly disclosed terms and conditions to customers.”

https://www.theguardian.com/australia-news/2021/sep/29/new-zealand-loan-holders-launch-legal-action-to-force-australian-owned-banks-to-refund-fees

This is only part of a bigger global action against the Big Australian Vampire Squid and other international Banksters for corrupt financial dealings and manipulation.

ANZ said it would be “vigorously defending the US class action complaint”.

“ANZ notes there has been no allegation by ASIC of collusion between it and other institutions,” the bank said in a statement.

Among the Australian and international banks being sued are ANZ, NAB, Westpac, Macquarie, Deutsche Bank, HSBC, JP Morgan, and Citi according to court filings.

Westpac has flagged it has not been formally served with any proceedings, but said it was aware of the class action filed in New York.

Westpac said it denies the “allegations in this claim and, if served with the claim, will defend those allegations vigorously”.

The court filings allege that the defendants broke the law from at least January 1, 2003.

In the documents, the banks and stockbrokers are accused of rigging the BBSW by “co-ordinating manipulative transactions” during the fixing window, the five-minute period during which the rate is set each day.

The defendants are also accused of manipulating the benchmark rate by “artificially increasing or decreasing the supply of prime bank bills” during the period when the BBSW was being set, of sharing information on their BBSW rate exposure and co-ordinating “manipulative trades to maximise their impact on BBSW rates”.

The plaintiffs have also accused the stockbrokers, Tullett Prebon and ICAP, of actively participating “in the conspiracy by facilitating manipulative trading for the bank defendants”.

https://www.abc.net.au/news/2016-08-18/anz-nab-bbsw-us-class-action/7763178

Kia ora Pat

You made a very good point, and as you suggest the person who calls himself John has no argument in rebuttal so responds with meaningless insults. The Daily Blog is over-run with types like “John”, none of whom will reveal their true identity, for obvious reasons.

The tone and quality of The Daily Blog could be vastly improved by (a) only allowing people to post comments under their real identity and (b) allowing free expression of political opinion by all commenters.

Keep up the good work, don’t be fazed by malicious, anonymous idiots, and see if you can influence your colleagues to make some positive changes to the tikanga.

On the TVNZ Breakfast Show this morning, the Prime Minister has just announced that the wage subsidy will not be continued for failing businesses.

ICU Nurses and Drs have just said that our health system will be overwhelmed with an outbreak of covid.

These two things are not unrelated.

The Prime Minister is right: Why should the taxpayers be screwed even more to support the private business sector, when the public health sector is failing us badly and should be the priority for tax payer investment?

But also, why should the mostly foreign owned mega banks be allowed to cream it, when small business is failing, and our health sector needs upgrading, and thousands of New Zealand families are queuing for food parcels?

Even with 90% vaccine coverage ICU will barely cope, resulting in 50 extra deaths a year.

https://www.stuff.co.nz/national/health/coronavirus/300414293/covid19-icu-staff-plead-for-kiwis-to-be-vaccinated-amid-bed-nurse-shortage

Dr Alex Psirides, a Wellington-based ICU doctor, says there are not enough ICU beds for “business as usual” care in New Zealand, even without the effects of a pandemic.

…..almost 80-90 per cent of ICU beds currently have patients in them.

“We need more ICU beds in New Zealand. Full stop.”

New Zealand has 4.6 ICU, beds per 100,000 people, to Australia’s 8.9 ICU beds per 100,000 people.

After years of neglect and underspending, the health system needs massive government investment, just to cope with their current workload.

Business people are screaming for government support, which will mean the government having to borrow even more from overseas, which will add even more to the nations indebtedness to the foreign owned mega banks, a debt for future generations of New Zealanders to pay off.

What is so special about these parasites that that taxpayers are expected to subsidise their profits far into the future?

I think it is very reasonable and fair to sheet some of the cost and burden of this pandemic to these foreign owned banks.

Makes perfect sense Pat, so why won’t they do it? It should be mandatory in L4 and L3 to have mortgage and rent holidays as par for the course. And you are right, everyone would look forward to it, except maybe the bank’s and the 1%.

Thanks Frank the Tank for rolling over and crushing our misconstructions – that word covers so much of what is going on in this country. I think we need your unwelcome truths.