Christchurch Council Housing Changes Not All We Were Led To Believe. Did Government Change Terms Or Was Council Wilfully Blind?

The Christchurch City Council (CCC) is the second biggest landlord in NZ (after the State). So, any changes with the city’s publicly-owned housing portfolio are a big deal.

Just such a major change is about to take effect from July. And it is not as benevolent as we have been led to believe.

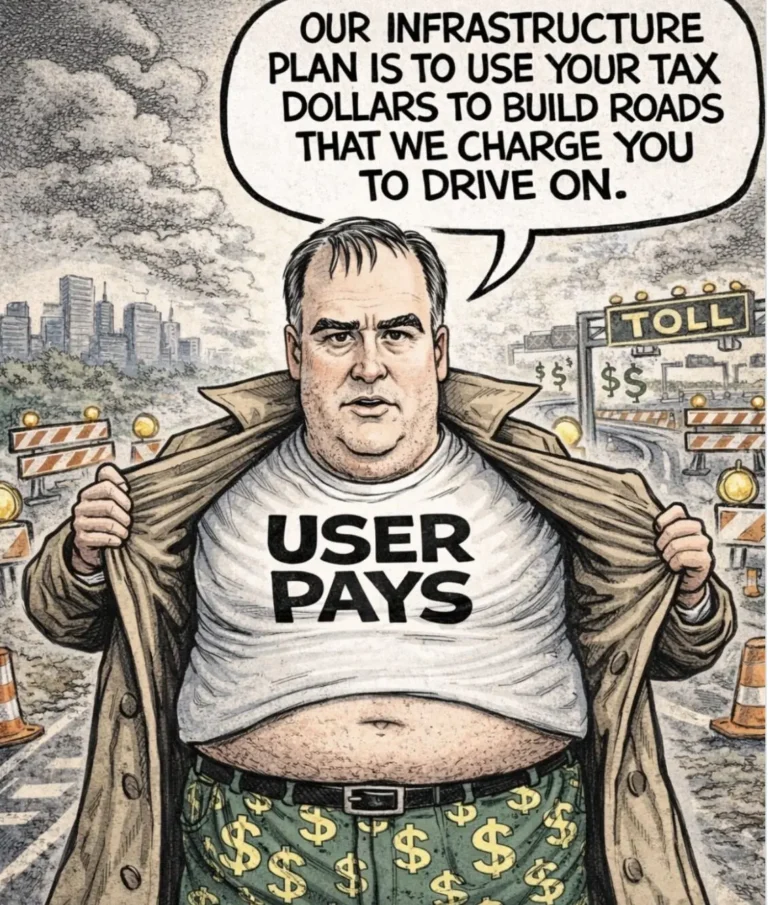

The decision to become a Community Housing Provider (i.e. transfer the City Council’s social housing to a Trust of which CCC is a 49% shareholder) was sold to the public as a method to increase income and assist tenants in attracting higher subsidies

“Under this new structure, the Council would lease its social housing to the new entity. For each social housing tenant who qualifies for the IRRS, the new company would receive from the Government the difference between the actual market rent and the rent paid by the tenant.

This would be substantial revenue and would be enough to enable us to continue, rebuild and repair our social housing without any charge on rates. It also provides a great base to keep building on the provision of housing for those in need. And at the moment that’s a lot.”

Deputy Mayor Vicki Buck, May 30, 2014

The actuality is somewhat different: only new tenants will attract the IRRS (Income Related Rent Subsidy) and only if they have been referred by the Ministry of Social Development to the new trust.

“The Government confirmed to Council that only new tenants referred to the proposed Community Housing Provider by the Ministry of Social Development will be eligible for an Income Related Rent Subsidy (IRRS).”

Christchurch Housing Accord Monitoring Report, December 2014

In political terms, such a major unpalatable change is called “swallowing a dead rat”.

But this particular dead rat was sold to the people of Christchurch (the owners of this extensive public housing portfolio, built up over generations) as if the Government subsidy would apply to all Council tenants, not just new ones.

As it stands, this is going to bring in a lot less by way of Government subsidies than what the public (and media) have been led to believe.

And, in the process, the City Council is losing 51% ownership of its own housing.

How’s that for a “win win” deal!

So, did the Government – ideologically committed to privatisation, including of State housing – change the terms of the deal or was the Council wilfully blind?

Probably a combination of both. But the Council can’t pretend it didn’t know.

That same December 2014 Christchurch Housing Accord Monitoring Report says, under “Priority Actions”:

“Council to consider how best to proceed with establishing the CHP given current Council tenants will not be eligible for IRRS”

http://www.ccc.govt.nz/assets/Documents/Services/Social-Housing/Christchurch-Housing-Accord-Monitoring-Report-Dec-2014.pdf

So the Council, willingly or otherwise, has swallowed a dead rat. And the people of Christchurch have been sold a pig in a poke.

This does not augur well for any other pending privatisations, such as City Care.

Christchurch has to pay its way after their earthquakes, so any way that expensive assets can be privatised to fund this, the better.

It is no surprise to ACT that this is happening and tenants and the taxpayer will be better off as a results. ACT’s mantra for success for the last 33 years has always been for the state and local councils to get out of expensive ventures that private sector can do better.

Expect more of the same after the next election from ACT as the last elements of the plan – 20% GST and 20% flat tax rate for taxpayers and business are implemented.

Only then will we see real growth in NZ under ACT and its coalition parties of National, Maori Party and United Future.

Here, David, have a Tui. It’s on me and 800,000 children living in poverty.

By the way, that’s offered to the real David Seymour who made a bit of a twat of himself this morning on TV3’s ‘The Nation’. Only a man with a poorly developed intellect or human empathy could possibly think that perpetuating higher and higher house prices is a good thing. https://www.beehive.govt.nz/release/radical-changes-child-protection-and-care

Who owns the 51% of the CHP & what guarantee is there that they will not asset strip the properties? What is to stop the CHP changing the numbering of the units then saying the tenants are new tenants so they can get the IRRS? It would cost for a lawyer & new contracts but might be cost effective.

Tenants who qualify for IRRS are better off than with the accommodation supplement.

It’s time the two different subsidies were made equal.